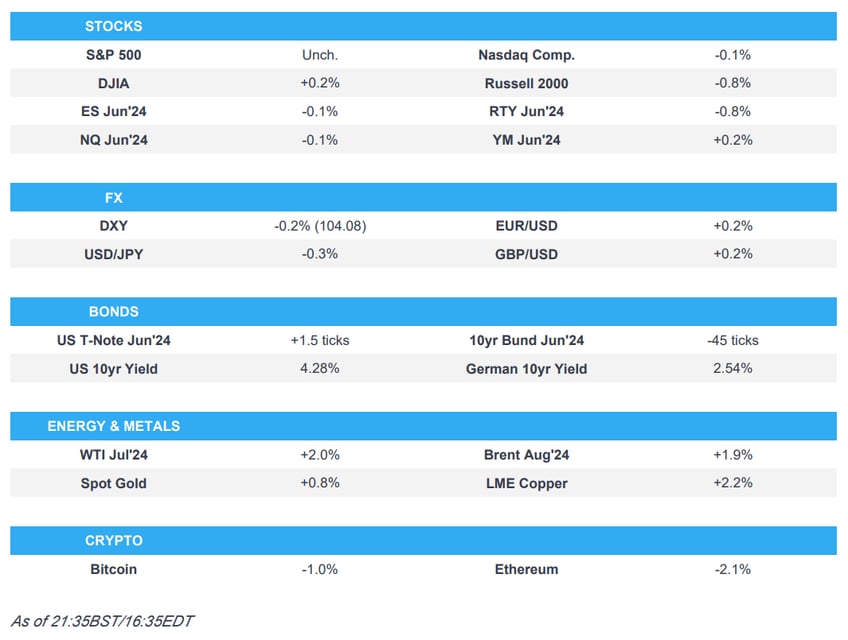

- US stocks were choppy and closed mixed as Wall Street looks ahead to Friday’s Non-Farm payrolls report for May ahead of the US CPI and FOMC next Wednesday.

- The Dollar saw some mild upside overnight and into the European session before taking a hit in reaction to the ECB rate decision and US data.

- As expected, the ECB cut rates for the first time since September 2019, lowering the deposit rate by 25bps to 3.75%. Within the accompanying statement, the main highlight was that the "Governing Council is not pre-committing to a particular rate path".

- WTI and Brent saw decent gains on Thursday in response to Saudi and Russia commentary as well as geopolitics.

- Looking ahead, highlights include New Zealand Manufacturing Sales, Japanese All Household Spending, Chinese Trade Balance, RBI Announcement, and a Speech from RBA's Hauser.

More Newsquawk in 2 steps:

1. Subscribe to the free premarket movers reports

2. Trial Newsquawk’s premium real-time audio news squawk box for 7 days

7th June 2024

SNAPSHOT

- Click here for the Newsquawk Week Ahead.

US TRADE

- US stocks were choppy and closed mixed as Wall Street looks ahead to Friday’s Non-Farm payrolls report for May ahead of the US CPI and FOMC next Wednesday.

- SPX flat at 5,353, NDX flat at 19,021, DJI +0.20% at 38,886, RUT -0.70% at 2,049.

- Click here for a detailed summary.

NORTH AMERICAN DATA

- US Challenger Layoffs (May) 63.816k (Prev. 64.789k)

- US Initial Jobless Claims w/e 229.0k vs. Exp. 220.0k (Prev. 219.0k, Rev. 221k); Continued Jobless Claims w/e 1.792M vs. Exp. 1.79M (Prev. 1.791M, Rev. 1.790M)

- US Unit Labor Costs Revised (Q1) 4.0% vs. Exp. 4.9% (Prev. 4.7%); Productivity Revised (Q1) 0.2% vs. Exp. 0.1% (Prev. 0.3%)

- Canadian Imports C$ (Apr) 65.5B CA (Prev. 64.84B CA, Rev. 64.80B CA); Exports 64.45B CA (Prev. 62.56B CA, Rev. 62.81B CA)

FX

- The Dollar saw some mild upside overnight and into the European session before taking a hit in reaction to the ECB rate decision and US data.

- The Euro was trading flat just before Thursday's ECB interest rate decision, initially reacting to the upside following the ECB's decision to cut rates by 25bps as widely expected, though trade did remain choppy thereafter for some time. Ultimately, the Euro is firmer following the rate decision and lack of clear guidance while there was also some hawkish dissent.

- Cyclical Currencies performance is mixed post-ECB rate cut and US data. The Aussie was the cyclical outperformer to see AUD/NZD rise above 1.0750 but both Aussie and Kiwi benefitted from the Dollar weakness while equity performance was ultimately flat with eyes turning to US NFP.

- The Franc and Yen saw decent strength, similar to the Aussie, further continuing their weekly overperformance upon more dovish US data with upside in US Jobless Claims and downward revisions to Unit Labour Costs in Q1.

FIXED INCOME

- T-notes ultimately little-changed despite choppy action to US data and ECB as eyes turn to NFP.

COMMODITIES

- WTI and Brent saw decent gains on Thursday in response to Saudi and Russia commentary as well as geopolitics.

GEOPOLITICAL

- Qatari Foreign Ministry spokesperson says Hamas has not yet handed to mediators its response to the latest ceasefire proposal and is still studying the proposal, according to Reuters.

- Israel's Gantz's State Camp party met to discuss leaving Netanyahu's coalition; Gantz is expected to announce he will leave the government unless there is a surprise, according to Israel Broadcasting Corp. The US administration asked Gantz to reconsider his expected withdrawal from the emergency government.

- China, Russia and Iran call on the West to take the necessary steps to revive the Iranian nuclear agreement, and we are ready for that, according to a statement cited by Al Jazeera.

- The Biden administration has cautioned Israel in recent weeks against the notion of "a limited war" in Lebanon and warned it could push Iran to intervene, according to Axios citing officials.

ASIA-PAC

NOTABLE HEADLINES

- Some large Chinese firms have been renting the most advanced AI chips made by Nvidia (NVDA) from Oracle (ORCL) for use in AI computing, via The Information citing sources; the article mentions ByteDance as one of the firms. China Telecom, Alibaba (BABA) and Tencent (TCEHY) have reportedly also held talks about renting the chips for use in data centres within the US.

EU/UK

NOTABLE HEADLINES

ECB

- ECB Statement: Deposit, Refi MLF rates cut by 25bps to 3.75%, 4.25%, and 4.50% respectively; will keep policy rates sufficiently restrictive for as long as necessary, will continue to follow a data-dependent and meeting-by-meeting approach. Snap Analysis: Overall, the decision was largely as expected with the ECB cutting by 25bp and not committing to any rate path with the decision ahead to be data-dependent and meeting-by-meeting. The details from the statement err on the hawkish side and as such, thus far, the ECB can be described as a hawkish cut with data dependence taking centre stage.

- ECB Staff Projections: Lifts 2024 and 2025 headline and core inflation forecasts, leaves 2026 unchanged; 2024 GDP forecast raised by more than expected, 2025 lowered in line with forecast, 2026 unchanged.

- ECB's Lagarde: Would not say that the ECB is 'dialling back phase', but there is a strong likelihood that the ECB is dialling back. Confidence in the path ahead has increased in the last month. If the neutral rate has increased, we're far away from the neutral rate at this stage.

- ECB's Holzmann was the lone dissenter in Thursday's policy meeting, via Reuters citing sources; argued for unchanged given the increase in inflation projections.

- Click here for the ECB review.

- Some ECB hawks reportedly argued that committing to the June rate cut too early was a mistake, a few hawks said they might have supported holding rates if there had not been a commitment, according to Reuters citing sources. "The sources, all with direct knowledge of the discussion, said that around a half dozen conservatives noted that this recent run of data may not be consistent with a rate cut, so the move was more a judgment." "A smaller number even said that their final decision might have been different without the pre-commitment." "But other than Holzmann, all agreed that backing out of the commitment would be a mistake and deeply divisive."

- ECB governors see a further interest-rate cut in July as unlikely after some stronger-than-expected economic data, with the focus now on their September meeting, according to sources via Reuters. "One source said a rate cut would be warranted in September if the ECB's inflation forecast for the last quarter of 2025 remained where it has been for some time, that is at 1.9%-2.0%."

- ECB officials all but rule out a cut in July with a move in September unclear, according to Bloomberg.

CENTRAL BANKS

- BoE Monthly Decision Maker Panel: 1-year ahead CPI inflation expectations remained unchanged at 2.9% in May. 3-year ahead CPI inflation expectations remained unchanged at 2.6% in May. Expected year-ahead wage growth fell by 0.3ppts to 4.5% on a three-month moving-average basis in May.

- BCB Chief Neto says the last inflation print was good and better than expected, recognising that CPI is converging, pointing out concerns ahead.

- CNB cuts countercyclical buffer rate by 50bps to 1.25%; effective July 1; To set systemic risk buffer rate at 0.5%; effective Jan 1 2025.

- NBP Governor Glapinski says "We cannot cut rates before the end of the year if changes in energy price cap are implemented as planned".

LATAM

- Mexican assets tumble on reports that the Morena leader in Congress has confirmed the 18 constitutional reforms proposed by AMLO will be voted on in September under the new configuration of Congress.