By Newsquawk

OVERVIEW: The ECB is anticipated to raise its deposit rate by 25 basis points to 3.75%, according to market pricing and analysts' consensus. The decision will be driven by the Governing Council's concern that inflation is set to remain high for an extended period. Despite a slight cooling in headline inflation from 6.1% to 5.5%, the super-core metric has increased to 5.5% from 5.3%. With the rate hike widely expected, attention will turn to any future tightening measures from September onwards. Bloomberg reporting suggested a challenge for policymakers will be keeping options open for the September meeting, avoiding explicit signals for either another rate hike or a pause. Market pricing currently gives a 50% probability of another 25 basis points hike in September. ECB President Lagarde is expected to emphasize the Bank's reliance on data, given that July and August inflation reports and latest macro projections will be available by September.

PRIOR MEETING: The ECB delivered another 25bps hike to the Deposit Rate, taking it to 3.5%. The decision to raise rates was once again premised on the judgement that inflation “is projected to remain too high for too long”. Going forward, policy decisions will continue to follow a data-dependent approach and be taken on a meeting-by-meeting basis. Perhaps the main takeaway from the initial announcement came via the accompanying macro projections which saw upgrades to headline and core inflation for 2023 through 2025 with the core 2025 print expected above-target at 2.3%. Elsewhere, the GC confirmed that it will discontinue reinvestments under the asset purchase programme as of July 2023. At the follow-up press conference, when questioned on whether the GC expects to keep raising rates, Lagarde replied that there was still “more ground to cover” and that the ECB is not done on hikes.

RECENT ECONOMIC DEVELOPMENTS: Headline Y/Y HICP in the Eurozone fell to 5.5% from 6.1% in June, whilst the super-core metric rose from 5.3% to 5.5%. Oxford Economics notes that the uptick in core was driven by base effects from last June's temporary introduction of a public transport subsidy in Germany. The consultancy estimates that the core would have been lower if it hadn't been for the distortion from Germany. The latest ECB consumer inflation expectations survey for May saw the 12-month ahead metric fall to 3.9% from 4.1%, whilst the 3-year ahead print held steady at 2.5%. On the growth front, flash data for Q2 GDP is not released until July 31st. However, more timely survey data via July PMI metrics saw the manufacturing component slip further into contractionary territory, at 42.7 vs. prev. 43.4, services fall to 51.1 from 52.0, leaving the composite at 48.9 vs. prev. 49.9. The accompanying release noted "the eurozone economy will likely move further into contraction territory in the months ahead, as the services sector keeps losing steam". In the labour market, the unemployment rate remained at the historic low of 6.5% in May.

RECENT COMMUNICATIONS: President Lagarde followed up her remarks at the June policy meeting with an appearance at the Sintra Forum (28th Jun) whereby she reiterated her view that there was still further ground to cover for the ECB and if the Bank's baseline still stood, the ECB would likely hike again in July. On the September meeting, she noted that the decision would be data dependent. Chief Economist Lane (28th June) remarked that policy needs to continue to tighten and expects a sustained period of restrictive rates. He also (12th July) noted the considerable monetary tightening over the last year will only play out over the next couple of years. The influential Schnabel (19th Jun) of Germany suggested the "the fact that we underestimated inflation persistence last year raises the probability that we are underestimating inflation now" adding that the Bank should "err on the side of doing too much rather than too little". Known-hawk Knot (18th July) of the Netherlands drew attention when he remarked that a hike in July was a "necessity", adding that hikes beyond July are possible but "not a certainty". At the more dovish end of the spectrum, Greece's Stournaras (19th July) stated that more tightening could harm the economy, adding that another 25bps hike would be enough.

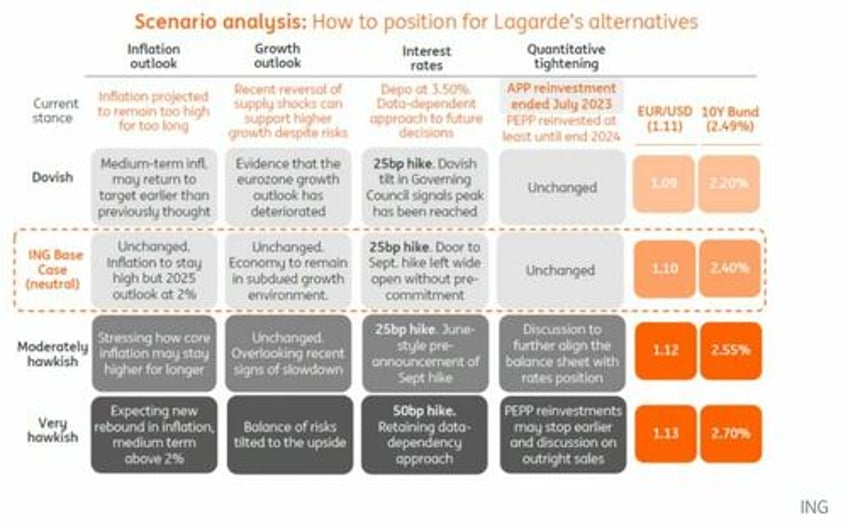

RATES/BALANCE SHEET: As judged by market pricing and surveyed analysts, the ECB is once again expected to deliver a 25bps hike which would take the deposit rate to 3.75%. The decision to move on rates again will be based on the GC’s view that inflation “is projected to remain too high for too long”, which prompted President Lagarde to declare at the June meeting that there was still “more ground to cover” and the ECB is “not done” on rate hikes. With a July hike a done deal, focus for the release will be on any accompanying guidance or hints about what tightening (if any) will be delivered from September onwards. On which, reporting from Bloomberg has suggested that the toughest challenge policymakers are set to face will be how to keep the September meeting an open one by avoiding “strong signals of either another hike or a pause”. As a guide, the policy statement currently includes the line “interest rates will be brought to levels sufficiently restrictive to achieve a timely return of inflation to the 2% medium-term target and will be kept at those levels for as long as necessary”. Market pricing for September puts the chance of another 25bps move at around 50/50 in the wake of comments from hawkish GC member Knot (and partly as a result of global rate pricing on the back of soft UK inflation data) who refrained from putting a September hike on the table by suggesting that rate increases beyond July are “possible” but “not a certainty”. President Lagarde’s best course of action will likely be to stress the Bank’ s data-dependence given that come September it will have seen the release of July and August inflation reports and will be armed with the latest macro projections. On the balance sheet, after confirming in June that it will discontinue reinvestments under the asset purchase programme as of July 2023, no more decisions are expected on this front. Going forward Croatia's Vujcic has noted that it is "not unimaginable to discuss bringing forward the end of PEPP reinvestment"; however, this is not expected to be a feature of the upcoming meeting.

And some additional thoughts from ING Economics

Another well-telegraphed hike from the European Central Bank brings another tough challenge for the Governing Council and Christine Lagarde: committing to another move in September or switching to full data dependency. We think the second scenario looks more likely, which may be read as a modestly dovish surprise and could weigh on EUR/USD

Stressing the "higher for longer" to counter market rate cut speculation

A 25bp hike is a done deal. More relevant is what the European Central Bank will signal as its next steps. Given the surprisingly dovish remarks by some of its most hawkish members, a renewed commitment to future hikes – as we have seen in past meetings – seems unlikely. Switching to greater data dependency for the meeting ahead will be viewed as mildly dovish and could see markets nudge down hike expectations, which are close to fully discounting a further 25bp hike before the end of the year.

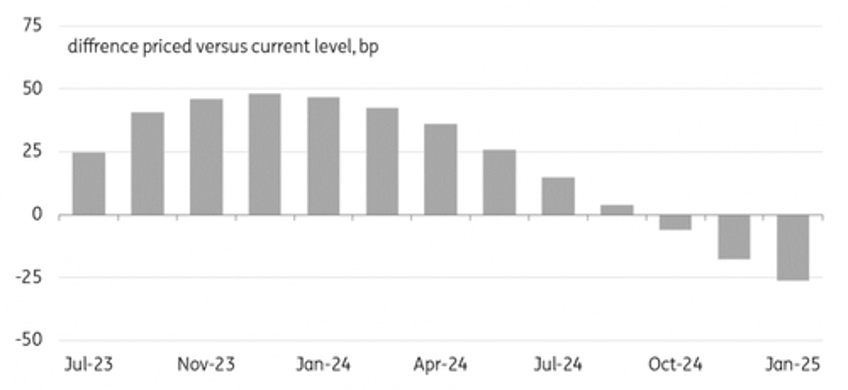

The ECB will be aware of that dilemma, and the risk is that it will seek to influence rate expectations further out, thereby manufacturing a (bearish) steepening of the front end. Currently, markets see the ECB cutting rates by around 75bp over the course of 2024. The challenge will be to overcome indications of a further softening macro backdrop as conveyed by today’s flash PMIs.

Markets see the ECB cutting rates 75bp over next year

One way to show determination would be to revive talk of quantitative tightening. Given that reinvestments from the Asset Purchase Programme have already ended, this would mean hinting at the possibility of outright sales. The obstacle to changing the guidance for reinvestments in the Pandemic Emergency Purchase Programme might be higher since they also serve as a backstop for sovereign spreads. Hints of quantitative tightening do not necessarily have to come at the press conference – but should the market reaction be deemed too dovish, the topic could be picked up in the typically active post-meeting commentary by officials.

Both the Federal Reserve and the ECB will not want to take any chances on inflation this week. They will both be wary of not giving the markets a premature bull steepening signal for broader yield curves just yet. Overall re-steepening of curves could be more gradual alongside evolving data this time around – that is, if nothing breaks before.

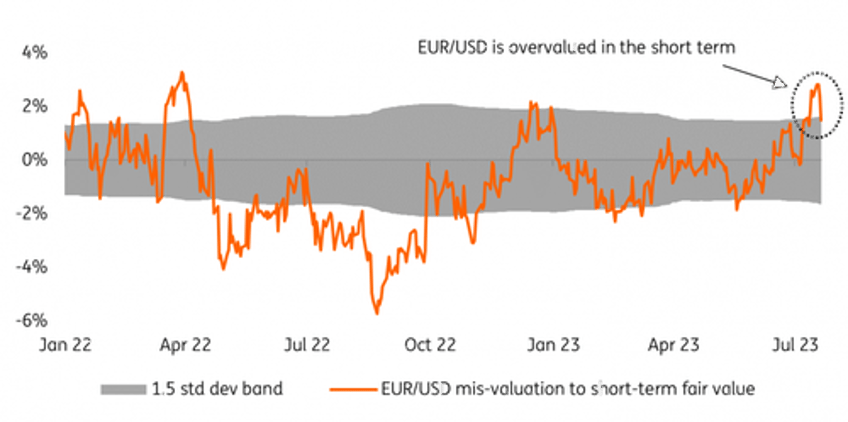

EUR/USD: Short-term valuation still offers room for correction

In the days following the large post-US CPI dollar drop, we had stressed how the short-term valuation picture for EUR/USD was looking quite stretched on the bullish side, having peaked above 3.0% at one point. One key input to our short-term fair value model is the 2-year USD-EUR swap rate gap, which at the time of writing has rewidened to near 130bp after a temporary contraction to 100bp after the US inflation report.

The latest bearish adjustment in EUR/USD has signalled a re-linking with that wider rate gap and allowed the short-term overvaluation to return to more sustainable levels of around 1.50%. That still leaves some room for another moderate EUR/USD correction this week, and we think the combined central bank messaging across the Atlantic is more likely to put some additional pressure on the pair than trigger a new rally.