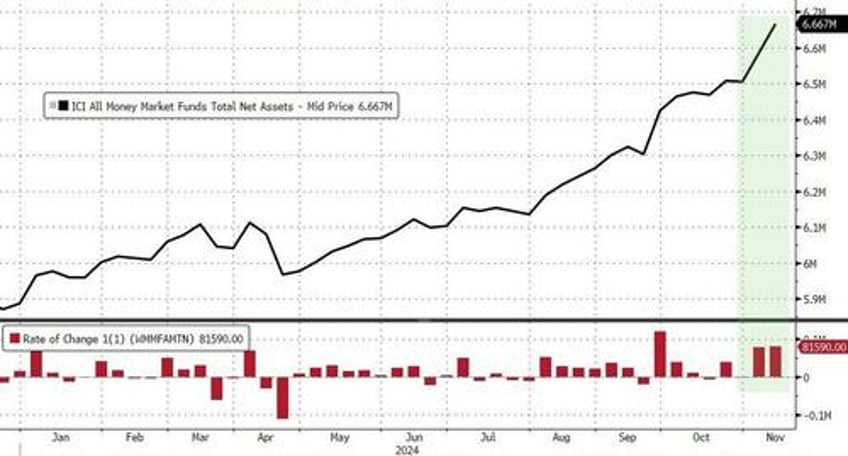

Money market funds saw massive inflows for the second straight week (+$81.6BN), pushing the total assets under management to a new record high of $6.66TN...

Source: Bloomberg

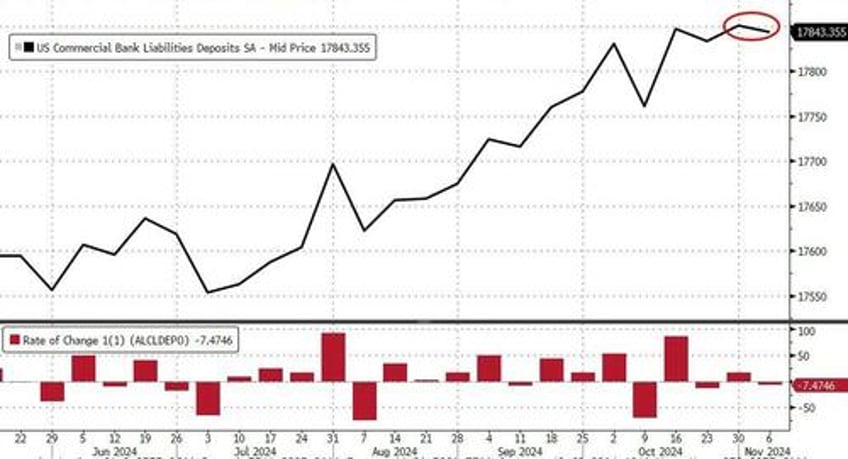

And while MM funds surged, total US bank deposits dropped modestly (-$7.5BN on a seasonally-adjusted basis)...

Source: Bloomberg

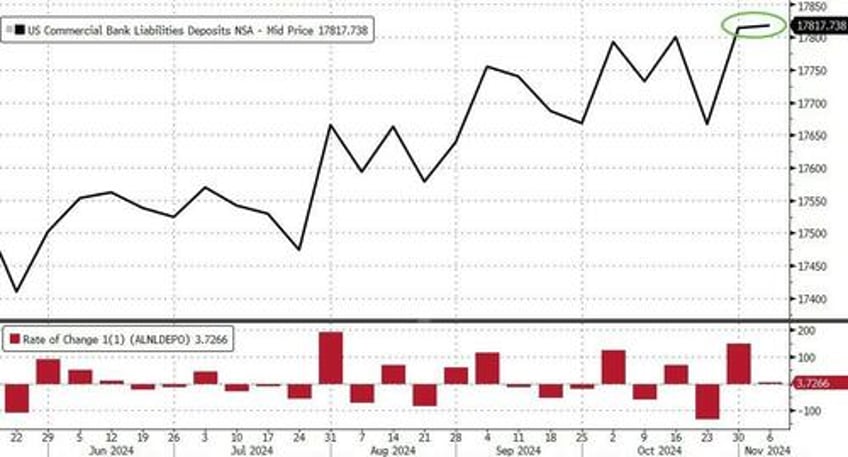

Though interestingly, on a non-seasonally-adjusted basis, total deposits rose by a modest $3.7BN during the week ending 11/6 (which included the election)...

Source: Bloomberg

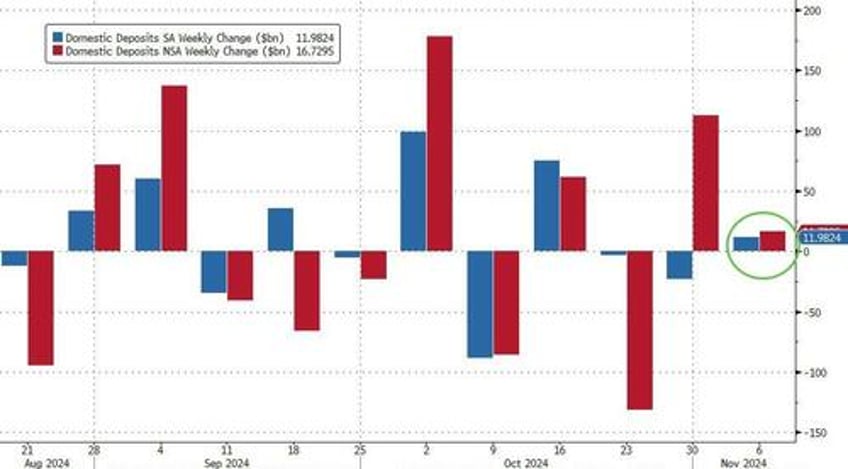

Excluding foreign deposits, US banks saw domestic deposits rise on both an SA (+$12BN) and NSA (+$16.7BN) basis...

Source: Bloomberg

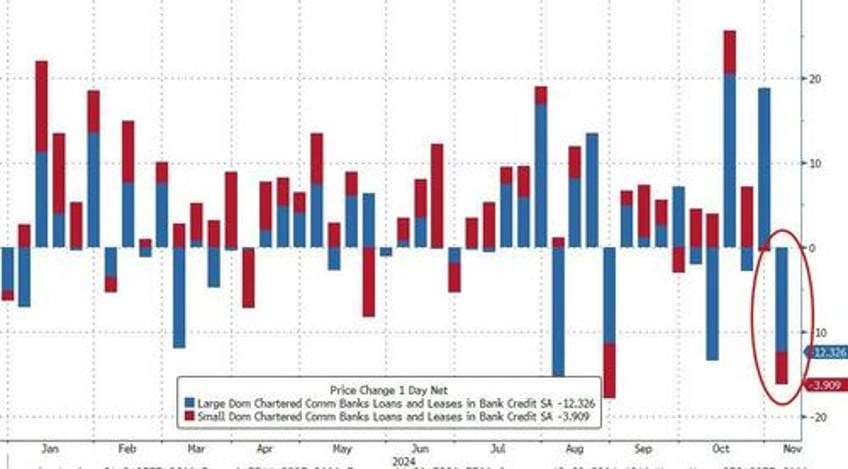

Loan volumes shrank significantly during election week...

Source: Bloomberg

Finally, the decoupling between bank reserves at The Fed and the total US equity market capitalization has reached an extreme...

Source: Bloomberg

With liquidity being drawn down from The Fed's reverse repo facility at a pace, we wonder how long that spread can be maintained.