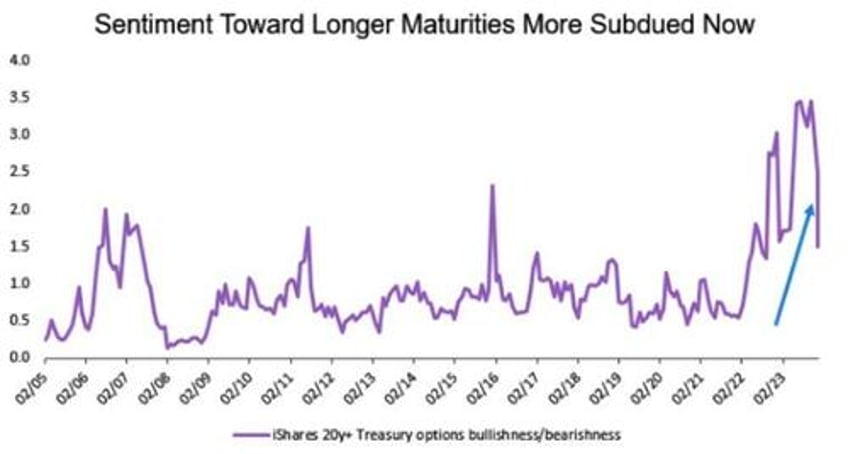

With the US economy still proving to be largely resilient, investors don’t seem to be as optimistic about a chase for duration as they were around the start of the year.

Open positions on Treasury options that measure optimism about longer maturities have fallen sharply, underscoring conviction that neither the labor market nor inflation will crumble quickly.

Data today is forecast to show that headline consumer prices climbed a notch higher to 0.4% in February from a month earlier, while core inflation is expected to show a moderation to 0.3%. The last mile of the disinflation narrative may yet prove frustratingly long. So we may stay in a world of 3%-something annual headline inflation and core inflation that is closer to 4% for a while longer.

Juxtaposed against that view, longer-dated yields that are modestly above 4% look reasonable — meaning there is little room to drive those rates materially lower from here in the absence of further progress on disinflation.

Meanwhile, two-year yields are bobbing around 4.50% of late, failing to make any headway, consistent with the observation made here. If the inflation readings come in above forecast, the rate can go higher by some 10 basis points, while a softer-than-estimated reading has the potential to send it toward 4.45%.

Of course, a more definitive direction for front-end maturities will come from next week’s policy review from the Fed, with the revised dot plot being the key.

The longer end, though, may be more inure to a radical shift until investors build conviction that they can assign a lower inflation premium going forward.