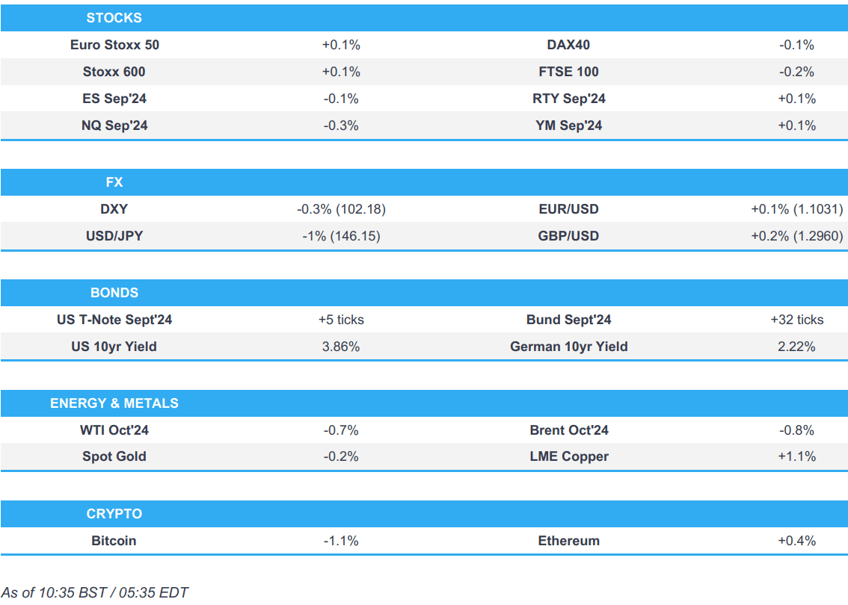

- Equities are mixed and struggling to find clear direction in catalyst thin trade

- Dollar is lower, JPY sees significant strength as USD/JPY holds around 146.00

- Bonds are firmer to varying degrees, Bunds lead as Germany reaches a deal regarding its 2025 budget

- Crude is lower and resides near session lows, XAU holds around USD 2500/oz, base metals benefit from the softer Dollar

- Looking ahead, BoC SLOOS, NZ Trade Balance, US Democratic Convention, Comments from Fed’s Waller, Earnings from Estee Lauder & Palo Alto Networks.

More Newsquawk in 3 steps:

1. Subscribe to the free premarket movers reports

2. Listen to this report in the market open podcast (available on Apple and Spotify)

3. Trial Newsquawk’s premium real-time audio news squawk box for 7 days

EUROPEAN TRADE

EQUITIES

- European bourses, Stoxx 600 (+0.1%) began the week on a mixed footing and generally traded on either side of the unchanged mark.

- European sectors are mixed with the breadth of the market fairly narrow. Basic Resources takes the top spot, in a paring to some of the hefty selling pressure seen in the prior session. Healthcare is found at the foot of the pile, joined by Tech.

- US Equity Futures (ES -0.1%, NQ -0.1%, RTY +0.1%) are mixed and also trade on either side of the unchanged mark, ahead of what will be a catalyst packed week.

- Click for the sessions European pre-market equity newsflow

- Click for the additional news

- Click for a detailed summary

FX

- DXY is on the backfoot, going as low as 102.00 predominantly amid gains in the JPY and EUR. From a macro perspective, Fed's Daly and Goolsbee have delivered dovish remarks ahead of Powell on Friday.

- EUR/USD has extended its rise on a 1.10 handle and printed a fresh YTD peak at 1.1050 with the pair now at levels not seen since December last year.

- GBP is firmer vs. the broadly softer USD with not much in the way of UK-specific newsflow ahead of flash PMI metrics on Wednesday. Cable has been as high as 1.2975 with attention on a test of 1.30.

- JPY is by far the best performer across the majors vs. the USD as traders continue to focus on the expected upcoming Fed cutting cycle in the run up to the Jackson Hole Symposium this week (note, a 25bps hike by the BoJ is now priced for September 2025).

- Antipodeans both gaining vs. the USD with AUD benefiting from some of the positivity surrounding China amid the revival of talk over the idea of China issuing shopping vouchers to boost consumption.

- PBoC set USD/CNY mid-point at 7.1415 vs exp. 7.1548 (prev. 7.1464).

- Click for a detailed summary

- Click for NY OpEx Details

FIXED INCOME

- USTs are bid, but not quite performing as well as Bunds are; holding at 113-09+ highs with resistance from Friday & Thursday at 113-12 & 113-23 respectively.

- A firmer start to the week with Bunds leading the complex marginally after Germany came to a deal on its 2025 budget which will not fund any new Ukraine aid, as part of a measure to limit spending. Thus far, Bunds to a 134.58 peak, just shy of Friday's 134.65 best with little of note until 135.00.

- Gilts are in a very narrow 99.98-100.09 range, which is entirely within Thursday's 99.67-100.19 spread. UK-specific docket is light.

- Click for a detailed summary

COMMODITIES

- Crude is subdued intraday but largely in consolidation mode following Friday's losses. The Dollar weakness has done little to prop up the crude complex in recent sessions, whilst the geopolitical risks appear to be overshadowed by demand concerns. Brent sits near the lower bound of a USD 78.94-79.81/bbl parameter.

- A mixed picture across precious metals despite the softer Dollar and as catalysts over the weekend were light. Spot gold trades on either side of USD 2,500/oz.

- Mostly firmer trade across base metals, albeit largely as a function of the softer Dollar. Desks have cited the recent trimming of losses by copper on alleviating fears of a US recession amid recent economic data.

- Norway’s Equinor said production at Gullfaks C Platform in the North Sea is shut and it evacuated some workers from the platform as a precaution following a well incident, while it is unclear when production will restart but output at other Gullfaks platforms are running as normal.

- Algeria is to immediately supply Lebanon with fuel to operate electric power stations and return electricity to the country, according to Algerian state radio cited by Reuters.

- Iran said it is ready to tranship Russian gas through its territory, according to TASS.

- BHP Escondida workers union said it could relaunch a strike if the Co. does not rectify its position over contract talks as soon as possible.

- Click for a detailed summary

NOTABLE DATA RECAP

- UK Rightmove House Price Index YY (Aug) 0.8% (Prev. 0.4%); MM -1.5% (Prev. -0.4%)

NOTABLE US HEADLINES

- Fed’s Daly (voter) said recent data gave her more confidence that inflation is under control and it is time to consider adjusting rates from their current level, while she noted the Fed needs to take a gradual approach to reducing borrowing costs, according to FT.

- Fed's Goolsbee (non-voter) said on Friday that he has concerns for 2024 and that they have crosscurrents. Goolsbee added he is concerned that the Fed set this level of rates over a year ago and inflation and the labour market are cooling faster than expected, while he thinks the Fed should take a step back and think about it.

- Republicans warned Donald Trump to get serious on policy or he could lose and cautioned that his 'showman' tactics could cost him the chance of a second term in the White House, according to The Telegraph.

- Goldman Sachs cuts the probability of a US recession in the next 12 months to 20% from 25%; cites last week's Retail Sales and IJC metrics. Says could lower it to 15% in the event that the August jobs report "looks reasonably good".

GEOPOLITICS

MIDDLE EAST

- Israeli military said it conducted an airstrike in Lebanon’s Nabatieh which targeted a Hezbollah depot, while it was separately reported that Israel targeted the towns of Houla and Beit Leif in Lebanon during airstrikes on Sunday night, according to Al Jazeera. Furthermore, an Israeli airstrike targeted agricultural land northeast of the Nuseirat refugee camp in the central Gaza Strip and it was also reported that 10 people were killed in an Israeli strike on central Gaza’s Zawaida.

- IDF said it detected the launch of a number of suspicious air targets from Lebanon towards areas in the Western Galilee.

- Israeli PM Netanyahu’s office said the Israeli negotiating team expressed cautious optimism in advancing a Gaza hostage deal. PM Netanyahu's office also said Israel is in complex negotiations and there are things it can and cannot be flexible about, according to Reuters.

- Hamas on Sunday rejected an updated US proposal for a ceasefire and hostage deal in Gaza and blamed Israeli PM Netanyahu for moving the goalposts and the US for indulging him, according to Axios.

- Hamas said the new ceasefire proposal presented by the US at talks in Doha responds to Israeli PM Netanyahu’s rejection of a permanent ceasefire and complete withdrawal from Gaza, while it added that the proposal placed new conditions in the issue of a hostages exchange and retracted other issues hindering a deal, according to Reuters.

- US President Biden said they will not give up and a Gaza ceasefire is still possible. It was separately reported that US Secretary of State Blinken arrived in Israel to renew the push for a Gaza ceasefire.

- US Secretary of State Blinken says "This is the best and perhaps the last chance to release the hostages and reach an agreement"; "We have decisive efforts to deploy troops and deter any attacks on Israel", via Sky News Arabia.

- Iranian Foreign Ministry says "we affirm our right to respond to the attack on our sovereignty and we will do so at the appropriate time", via Al Jazeera

OTHER

- Chinese Premier is to visit Russia from August 20th to August 22nd, according to Interfax; Premier Li will meet with Russian and Belarussian counterparts, and will hold in-depth exchanges on bilateral relations.

- Pipeline at oil and chemical plant in Russia's Bashkiria set on fire, via Tass

- IAEA said nuclear safety at Ukraine’s Zaporizhzhia nuclear power plant is deteriorating following a drone strike that hit the road around the plant site perimeter, while it stated there were no casualties and no impact to equipment, but there was an impact to the road between the two main gates of the plant.

- Russia captured the village of Svyrydonivka in Ukraine’s Donetsk, according to TASS.

- Belarusian President Lukashenko said troops were deployed along the entire border with Ukraine, according to RIA.

- North Korea condemned Ukraine’s attack against Russian territory as an act of terror and invasion backed by the US and the West. North Korea said the anti-Russia policy of the US is driving the global security environment to the brink of World War 3, while North Korea will stand with Russia as it seeks to protect its sovereignty and realise international justice, according to KCNA.

- US, South Korean and Japanese leaders pledged to consult on regional challenges, provocations and threats, while they said they are resolved to maintain peace and stability in the Indo-Pacific.

- China's Coast Guard said Philippine Coast Guard vessels illegally intruded into the waters adjacent to Sabina Shoal without permission from the Chinese government and one of the Philippine vessels ignored China's repeated solemn warnings and deliberately collided with the Chinese vessel in an 'unprofessional and dangerous' manner. The Philippines later commented that the Philippine Coast Guard encountered 'unlawful, aggressive manoeuvres' in the South China Sea from Chinese Coast Guard vessels which resulted in structural damage to both Philippine Coast Guard vessels.

CRYPTO

- Bitcoin is slightly softer and slips below USD 59k, whilst Ethereum manages to hold above USD 2.6k.

APAC TRADE

- APAC stocks were mixed with a somewhat cautious tone amid geopolitical uncertainty after Hamas rejected the latest ceasefire proposal and as participants await this week's key events including the Jackson Hole Symposium.

- ASX 200 traded rangebound as outperformance in gold miners and utilities was offset by weakness in consumer stocks.

- Nikkei 225 swung between gains and losses and traded on both sides of the 38,000 level after mixed Machinery Orders data, while the index was then pressured again later in the session alongside a firmer currency.

- Hang Seng and Shanghai Comp. gained amid stimulus hopes after Premier Li hinted on Friday at targeted measures to smooth the economic cycle and promote consumption, while a recent report noted weak Chinese data raised the pressure for Beijing to provide support and revived talk of regarding the idea of China issuing shopping vouchers.

NOTABLE ASIA-PAC HEADLINES

- China’s Vice Premier is to co-chair a regular meeting between Chinese and Russian leaders with Russia’s Deputy PM on August 19th-20th, according to Chinese state media.

- Singaporean PM Wong warned that increasing tensions between the US and China will have an impact on Singapore’s economy and the broader region, according to FT.

DATA RECAP

- Japanese Machinery Orders MM (Jun) 2.1% vs. Exp. 1.1% (Prev. -3.2%); YY (Jun) -1.7% vs. Exp. 1.8% (Prev. 10.8%)