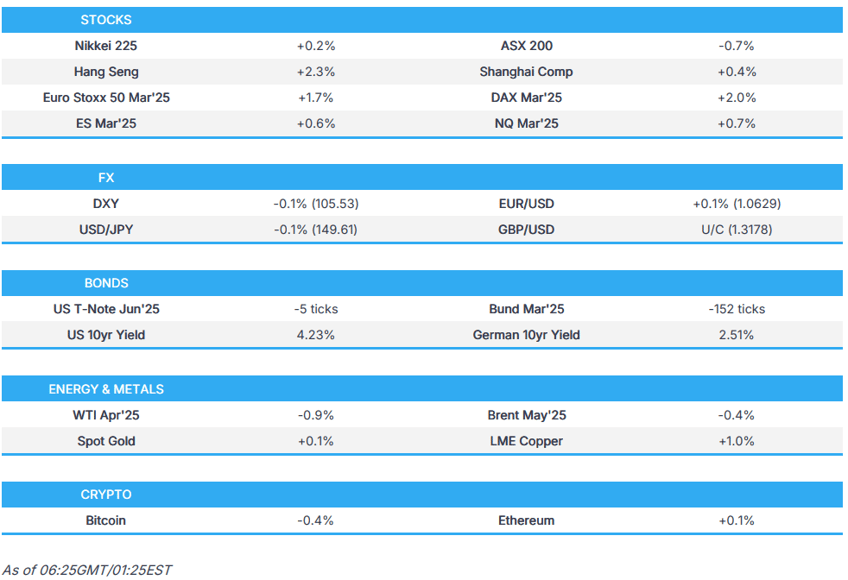

- US futures gained after the Wall St. close as Lutnick suggested Trump could potentially reduce tariffs on Canada and Mexico, perhaps as soon as Wednesday.

- APAC mixed but with strength in China after data and the Official Growth Report which maintained a growth target of around 5% and pledged measures to boost spending.

- EUR underpinned by German debt brake reform with the DXY under pressure as a result, Cable hit a YTD peak while NZD was unreactive to Orr resigning.

- Bunds weighed on by CDU's Merz saying the first results on debt brake reform have been reached with the SPD alongside proposing new instruments and defence exemptions.

- Fed's Williams said he does not see the need to change policy currently, and described it as "still restrictive" and with the right balance; highlighted UoM inflation data as one to watch.

- Crude subdued, XAU range bound and Copper gained on China's report; Trump said he received a letter from Zelensky who is ready to come back to the table.

- Looking ahead, highlights include Swiss CPI, US ADP National Employment, US Factory Orders, ISM Services, China NPC, Fed’s Beige Book, BoE Treasury Select Hearing, Speakers including BoE's Bailey, Pill, Taylor and Greene, Supply from UK, Earnings from Telecom Italia, Bayer, Adidas, Sandoz, Abercrombie & Fitch, Foot Locker & Marvell.

Newsquawk in 3 steps:

1. Subscribe to the free premarket movers reports

2. Listen to this report in the market open podcast (available on Apple and Spotify)

3. Trial Newsquawk’s premium real-time audio news squawk box for 7 days

US TRADE

EQUITIES

- US stocks closed largely in the red on what was a choppy session with a notable sell-off into the close amid a chunky market imbalance, while markets fluctuated during the session with initial significant risk-off sentiment amid US growth concerns which was further exacerbated by a poor RCM/TIPP economic optimism print and after the implementation of Trump tariffs on China, Mexico, Canada which spurred the announcement of retaliatory measures. Nonetheless, stocks then staged an intraday recovery before suffering another bout of selling heading into the close.

- SPX -1.22% at 5,778, NDX -0.36% at 20,353, DJI -1.55% at 42,521, RUT -1.08% at 2,080.

- Click here for a detailed summary.

TARIFFS/TRADE

- US President Trump posted on Truth "Please explain to Governor Trudeau, of Canada, that when he puts on a Retaliatory Tariff on the U.S., our Reciprocal Tariff will immediately increase by a like amount!". Trump separately commented that Canada does not allow American banks to do business in Canada but their banks flood the American market which does not seem fair.

- US Commerce Secretary Lutnick said he thinks US President Trump will meet Mexico and Canada in the middle on tariffs and they're probably going to be announcing that tomorrow (i.e. Wednesday 5th), while he added if USMCA rules are followed, Trump is considering relief, according to a Fox Business interview. Lutnick also said that President Trump is to move with Canada and Mexico but not all the way and that Trump may roll back Canada and Mexico tariffs on Wednesday.

- US and Canadian officials are in talks to possibly roll back Trump’s tariffs, according to WSJ. However, it was separately reported that US President Trump signalled privately he will stick with tariffs, according to NYT.

- US Department of Commerce preliminarily determined Canadian softwood lumber is being dumped into the US.

- Canada's Foreign Minister Joly is set to speak with US Secretary of State Rubio on Wednesday, according to the BBC.

- Ontario Premier said if tariffs persist, they will immediately apply a 25% surcharge on the electricity they export to New York, Michigan, and Minnesota, while it was also reported that Quebec is to add a 25% penalty to US bids on government contracts.

- US President Trump's administration is readying an order to bolster US shipbuilders and punish China, while the draft order includes measures such as raising revenue from Chinese ships and tax credits and grants for shipyards, according to WSJ.

NOTABLE HEADLINES

- Fed's Williams (Vice Chair) said he doesn't see the need to change the policy rate right now and monetary policy is in a good position which can be adjusted as needed. Williams added that monetary policy is still restrictive and has the right balance right now and it is really hard to know what the Fed will do with rates this year, while it is worth watching UoM inflation expectations data.

- US President Trump said in his Address to the Joint Session of Congress that America is back and they have taken swift and relentless action and are just getting started. Trump announced he will create a new office of shipbuilding in the White House and will offer new tax incentives for shipbuilding, while he is fighting every day to make America affordable again and reiterated his call to drill for more oil. Furthermore, Trump said they will eliminate inflation by reducing all fraud, waste and theft of public money and stated that reciprocal tariffs will kick in on April 2nd.

APAC TRADE

EQUITIES

- APAC stocks traded mixed following the whipsawing stateside on Trump's tariffs, subsequent retaliation and Commerce Secretary Lutnick's suggestion of a potential rollback, while the region also digested a slew of commentary from China’s Official Work Report and President Trump’s Address to the Joint Session of Congress.

- ASX 200 was dragged lower by underperformance in the consumer and energy sectors, while better-than-expected Australian GDP data failed to inspire a recovery.

- Nikkei 225 price action was initially choppy but gradually edged higher amid a weaker currency.

- Hang Seng and Shanghai Comp were positive after better-than-expected Chinese Caixin Services PMI data and with the attention on the NPC and the Official Work Report in which China maintained its annual growth target of around 5% and pledged measures including a boost in spending, while there was notable outperformance in Hong Kong where CK Hutchison surged by more than 20% after agreeing to sell its Panama Canal Ports stake to BlackRock,

- US equity futures calmed down following yesterday’s whipsawing with upside seen post-Wall Street's closing bell after US Commerce Secretary Lutnick suggested that Trump could potentially reduce the tariffs on Canada and Mexico, while there was limited upside seen amid President Trump’s Address to the Joint Session of Congress.

- European equity futures indicate a higher cash market open with Euro Stoxx 50 futures up 1.8% after the cash market closed with losses of 2.8% on Tuesday.

FX

- DXY initially regained some composure after weakening yesterday amid continued US growth concerns, while the implementation of US tariffs on China, Mexico, and Canada failed to meaningfully support the greenback. However, the index is back to lows as the EUR strengthens.

- EUR/USD remains underpinned after recently surging on the back of a softer dollar and as European yields experienced a boost on German defence spending and debt brake reform plans; EUR/USD comfortably above 1.0600.

- GBP/USD was rangebound overnight after climbing to a fresh YTD peak just shy of the 1.2800 handle.

- USD/JPY continued to rebound and retested the 150.00 level to the upside amid light fresh catalysts from Japan.

- Antipodeans faded some of their recent gains as the greenback recouped lost ground and amid the mixed risk sentiment in Asia, while there was little reaction seen following better-than-expected Australian GDP data or from the announcement that RBNZ Governor Orr resigned.

- PBoC set USD/CNY mid-point at 7.1714 vs exp. 7.2575 (prev. 7.1739).

FIXED INCOME

- 10yr UST futures remained lacklustre after declining yesterday alongside an intraday rebound in stocks and with prices dragged lower in tandem with the heavy selling pressure seen in Bunds.

- Bund futures slumped after comments from Germany's CDU leader Merz who said Germany plans a reform of the debt brake and announced a credit-financed special fund worth EUR 500bln.

- 10yr JGB futures tracked the losses in global peers as Japanese yields marginally edged higher, while the latest comments from BoJ officials provided little in the way of fresh insight as Deputy Governor Uchida reiterated they will continue to adjust the degree of monetary accommodation if the outlook for economic activity and prices presented in the Outlook Report is realised.

COMMODITIES

- Crude futures were subdued after yesterday’s choppy performance and failed to benefit from the latest private sector inventory data which showed a surprise draw in headline crude but the stockpiles of other products were mixed.

- Private inventory data (bbls): Crude -1.5mln (exp. +0.3mln), Distillate +1.1mln (exp. +0.2mln), Gasoline -1.2mln (exp. -0.4mln), Cushing +1.6mln.

- Spot gold took a breather and sat just north of the USD 2,900/oz level after gaining on a softer dollar.

- Copper futures initially traded rangebound amid the mixed and indecisive risk sentiment in Asia-Pac but then gained as stocks saw a mild uplift alongside US President Trump’s Address to the Joint Session of Congress and following China's latest support pledges in the Official Work Report.

CRYPTO

- Bitcoin traded indecisively and oscillated around the USD 87,000 level.

NOTABLE ASIA-PAC HEADLINES

- China targets 2025 GDP growth of around 5% and CPI at around 2%, while it sees the 2025 budget deficit at 4% of GDP and said it will adopt more proactive fiscal policy. China will re-capitalise major state banks with CNY 500bln from special treasury bonds and will issue CNY 1.3tln in ultra-long-term special treasury bonds in 2025 vs CNY 1tln in 2024, while it set the 2025 quota on local government special bonds at CNY 4.4tln vs. CNY 3.9tln in 2024, according to the Official Work Report.

- China's NDRC said it will boost domestic demand and will promote integrated advancements in technological and industrial innovation and will use monetary policy instruments to adjust both the monetary aggregate and structure, while it added that China will lower banks' reserve requirement ratios and interest rates at the right timing. NDRC said China will support the fundraising of micro and small businesses, well accelerate efforts to foster a complete system of domestic demand and make domestic demand the main engine and anchor of economic growth.

- China's financial regulator head said will support the property market, lengthen the white list, and ensure delivery of housing, while China will increase the supply of credit to more private enterprises and will reduce comprehensive financing costs of private enterprises. Furthermore, China approved an additional CNY 60bln of insurance funds for long-term investment in capital markets.

- China Cabinet Research Office head said fully confident in achieving the 2025 economic growth target and that China’s economy has shown steady improvement over 2025 so far, while the official added that macro policy measures will provide strong support to the economy.

- RBNZ Governor Orr resigned and Deputy Governor Hawkesby will be Acting Governor until March 31st, while RBNZ Chair Quigley said Governor Orr resigned for personal reasons and feels like 'he's done the job'.

DATA RECAP

- Chinese Caixin Services PMI (Feb) 51.4 vs. Exp. 50.8 (Prev. 51.0); Composite PMI (Feb) 51.5 (Prev. 51.1)

- Australian Real GDP QQ SA (Q4) 0.6% vs. Exp. 0.5% (Prev. 0.3%); YY SA (Q4) 1.3% vs. Exp. 1.2% (Prev. 0.8%)

GEOPOLITICS

MIDDLE EAST

- White House said the Gaza reconstruction plan adopted by Arab states does not address the reality that Gaza is 'currently uninhabitable' and that President Trump stands by his proposal to rebuild Gaza 'free from Hamas'.

- Russian President Putin agreed to act as a mediator between Iran and the US, according to Zvezda citing the Kremlin. It was also reported that a Kremlin aide said Iran was discussed at Russia-US talks in Riyadh and that Russia and the US agreed to hold separate talks on Iran, according to Interfax.

RUSSIA-UKRAINE

- US President Trump said in his Congress address that he received an important letter from Ukrainian President Zelensky who said he is ready to come back to the table and Ukraine is ready to sign a minerals deal.

- US and Ukraine plan to sign minerals deal and President Trump has told advisers he wanted to announce the Ukraine minerals deal during Tuesday's speech to Congress, according to sources cited by Reuters although they cautioned that the deal had yet to be signed and the situation could change.

Other

- China's Coast Guard said the Philippines sent a civilian boat to deliver supplies to its 'illegally grounded' warship at Second Thomas Shoal, while China urged the Philippines to honour its commitments and work with China to manage the maritime situation.

EU/UK

NOTABLE HEADLINES

- Germany's CDU leader Merz said Germany plans reform of the debt brake and the first results have been reached in talks with SPD and a special fund is to be presented next week. Merz also said they will propose a new instrument that will provide EUR 150bln of loans, while he added the economy must be brought back on the growth path with a credit-financed special fund worth EUR 500bln and all defence spending above 1% of GDP would be exempt from debt brake restrictions.