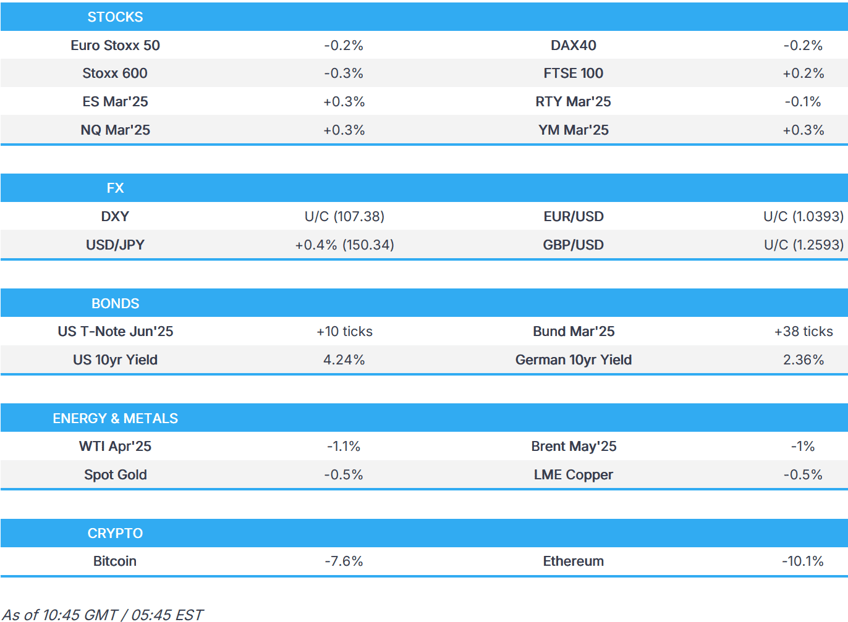

- European bourses are in the red, but with sentiment off lows; ES/NQ gain ahead of US PCE.

- USD remains underpinned by trade angst; Antipodeans lag given the risk-tone.

- Bonds bid after Trump's latest on tariffs & tech pressure, though benchmarks are off highs.

- Commodities lower on month end and ahead of weekend uncertainty.

- Looking ahead, German CPI US PCE & Dallas Fed, Canadian GDP. Credit Reviews for Germany & France.

More Newsquawk in 3 steps:

1. Subscribe to the free premarket movers reports

2. Listen to this report in the market open podcast (available on Apple and Spotify)

3. Trial Newsquawk’s premium real-time audio news squawk box for 7 days

TARIFFS/TRADE

- US Treasury Secretary Bessent said he's open to the idea that other countries' tariffs could come down or go away, while it was separately reported that South Korea’s Acting President Choi and US Treasury Secretary Bessent discussed tariffs, investment, and forex policy in a video call, according to South Korea’s finance ministry.

- China's MOFCOM said China opposes US President Trump's latest tariffs on Chinese goods and hopes the US will avoid making the same mistake again and return to the right track of properly resolving differences through dialogue as soon as possible. Furthermore, it stated if the US insists on its own path, China will take all necessary countermeasures to defend its legitimate rights and interests.

- China's Foreign Minister, on the remarks from US President Trump around an additional 10% tariff, says the US is once again using fentanyl as a pretext for threatening China. China opposes the tariff move. Will take all necessary measures to safeguard their legitimate interests. Rubio's speech was filled with "cold war mentality", adds the US coercion will backfire. China is willing to cooperate.

EUROPEAN TRADE

EQUITIES

- European bourses (STOXX 600 -0.4%) began the session entirely in the red, continuing the down-beat and risk-off mood seen in US and APAC hours. As the morning progressed, there has been an upward bias, attempting to pare back some of the early morning pressure; indices still generally reside in the red.

- European sectors hold a strong negative bias, given the risk-off sentiment. Construction & Materials tops the pile, lifted by post-earning strength in Holcim (+3.5%). Basic Resources is the underperformer today, given the risk-tone which has weighed on underlying metals prices. It is also no surprise that Tech is amongst the laggards, following the significant losses in NVIDIA (-8.5%) in the prior session; ASML (-2.5%)

- US equity futures are mixed, with the ES/NQ attempting to make back some of the hefty losses seen in the prior session and ahead of the US PCE later today.

- Click for the sessions European pre-market equity newsflow

- Click for the additional news

- Click for a detailed summary

FX

- USD remains underpinned by the Trump administration's trade policies. As a reminder, Trump clarified that there will be a "10+10" tariff on China for a total of 20% additional tariffs and that the proposed tariffs on Canada and Mexico are scheduled to go into effect on March 4th. On the data slate, the obvious highlight is monthly PCE data for January with core M/M expected to tick higher to 0.3% from 0.2%, and the Y/Y metric forecast at 2.6% vs. prev. 2.8%.

- EUR is flat vs. the USD and pivoting around the 1.04 mark. On the data front, CPI releases thus far today have seen a softer-than-expected outturn for French inflation, whilst German state CPIs have been broadly in-line with expectations of the national release at 13:00GMT; firmer on a M/M basis and steady Y/Y. Elsewhere on the inflation front, the ECB's survey of consumer expectations saw the 12-month forecast slip to 2.6% from 2.8% and the 3yr remain at 2.4%. Tariffs also remain on the mind of investors with the EU still in the firing line of the Trump admin, after President Trump reaffirmed his criticism of EU VAT taxes. EUR/USD briefly slipped below its 50DMA at 1.0387 before just about returning to a 1.04 handle.

- Overnight, USD/JPY saw mild downside amid haven flows into the Japanese currency but saw two-way price action with a brief surge triggered by softer-than-expected Tokyo inflation data. USD/JPY has gained a firmer footing on a 150 handle with a current session peak at 150.68 vs. the YTD low printed on 25th February at 148.55.

- GBP is flat vs. the USD after briefly slipping onto a 1.25 handle. GBP has been more resilient vs. the USD compared to other peers with the UK seen to have less exposure to US tariffs than peers. Furthermore, US President Trump said the US is going to have a deal done on trade with the UK "rather quickly" and that UK PM Starmer tried to convince him not to impose tariffs on the UK during their meeting. Elsewhere, BoE's Ramsden presented an even-handed speech in which he noted inflation risks "are two-sided. Cable, the earlier session low sits at 1.2574; if breached, last week's low kicks in at 1.2562.

- Antipodeans are softer alongside the risk-off tone triggered by the latest Trump tariff tirade and tech losses on Wall Street.

- PBoC set USD/CNY mid-point at 7.1738 vs exp. 7.2873 (prev. 7.1740).

- Click for a detailed summary

- Click for NY OpEx Details

FIXED INCOME

- USTs are bid, benefitting from the marked equity sell-off seen in the second half of Thursday’s US session which reverberated into APAC trade and the European open; driven by losses in Tech and Trump confirming that the 10% measure on China is in addition to the 10% tariff he had already announced. Action that took USTs to a 111-03+ peak in APAC trade which is a YTD high for the June contract and takes us back to the 111-08 and 111-20+ peaks from November and December respectively. Focus today is on US PCE.

- Bunds are trading in tandem with USTs for the first part of the session but has since experienced a marginal pullback from highs and while still comfortably in the green, the benchmark finds itself in the lower-half of a 132.94-133.46 band. A pullback which has occurred despite the cooler-than-expected French preliminary inflation measures and the broadly in-line, when compared to expectations for the nationwide figure, German State CPIs; though, while expected, the M/M German figures did see a marked move higher which may be weighing on EGBs. The ECB SCE saw 12-month inflation expectations ease a touch whilst 3yr remained steady.

- Gilts are following the above. UK specifics include Nationwide House Price figures which lifted from the prior and showed the sixth consecutive monthly gain. Alongside that, an extensive text release from BoE’s Ramsden in which he noted that uncertainty has increased and as such a data-dependent and meeting-by-meeting approach is warranted. Firmer but at the lower-end of 93.24 to 93.48 parameters. A further pullback brings into view the figure and then the 92.22 base from earlier in the week. While a pickup would first encounter resistance at 93.49 from mid-February and then the current WTD peak of 93.51.

- BoJ plans to buy bonds in March at same pace as February, according to a release.

- Click for a detailed summary

COMMODITIES

- Crude futures are lower on Friday, giving back some of the upside seen in the prior session. Some of the pressure today could be attributed to month-end profit-taking, and with traders mindful of US PCE later. Brent May sits in a USD 72.76-73.37/bbl range.

- Subdued trade across precious metals as European players reacted to the surge in the Dollar yesterday amid US President Trump's tariff rhetoric, with nothing new to add during European hours. Spot gold resides in a USD 2,851.11-2,885.24/oz range.

- Base metals are lower across the board amid the risk-off sentiment amid Trump's tariff rhetoric which seeks to impose an additional 10% tariff on China on top of the February 4th 10% levy. 3M LME copper fell further below USD 9,500/t and resides in a USD 9,331.90-9,405.65/t range at the time of writing.

- Oman crude OSP USD 77.63/bbl in April vs. March USD 80.26/bbl, according to GME data cited by Reuters.

- Iraq Oil Ministry says it will announce a resumption of oil exports in the next few hours; initial oil flows from Iraq's Kurdistan region through Turkey will be at 185k barrels, and will increase gradually.

- A group of eight oil firms operating in Iraqi Kurdistan and Apikur say there will be no resumption of oil exports through Iraq-Turkey pipeline on Friday, has not been any formal outreach to member companies with regards to resumption of oil exports yet

- Click for a detailed summary

NOTABLE DATA RECAP

- German State CPIs: Y/Y & M/M broadly in-line with German Mainland expectations of an unchanged Y/Y figure and a jump higher in M/M.

- German Retail Sales YY Real (Jan) 2.9% (Prev. 1.8%).

- German Import Prices MM (Jan) 1.1% vs. Exp. 0.7% (Prev. 0.4%); YY (Jan) 3.1% vs. Exp. 2.7% (Prev. 2.0%)

- German Unemployment Rate SA (Feb) 6.2% vs. Exp. 6.2% (Prev. 6.2%); Unemployment Change SA (Feb) 5.0k vs. Exp. 15.0k (Prev. 11.0k); Unemployment Total SA (Feb) 2.886M (Prev. 2.88M) ; Unemployment Total NSA (Feb) 2.989M (Prev. 2.993M)

- UK Nationwide House Price MM (Feb) 0.4% vs. Exp. 0.2% (Prev. 0.1%); YY (Feb) 3.9% vs. Exp. 3.4% (Prev. 4.1%)

- French CPI (EU Norm) Prelim MM (Feb) 0.0% vs. Exp. 0.30% (Prev. -0.20%); YY (Feb) 0.9% vs. Exp. 1.2% (Prev. 1.8%)

- Italian CPI (EU Norm) Prelim MM (Feb) 0.1% vs. Exp. 0.1% (Prev. -0.8%); CPI (EU Norm) Prelim YY * (Feb) 1.7% vs. Exp. 1.8% (Prev. 1.7%); Consumer Price Prelim YY (Feb) 1.7% vs. Exp. 1.7% (Prev. 1.5%); Consumer Price Prelim MM (Feb) 0.2% (Prev. 0.6%)

NOTABLE EUROPEAN HEADLINES

- BoE's Ramsden says his conclusion from the "current elevated degree of uncertainty is that it increases the range of plausible states that the UK economy might end up in in the medium term". "I no longer think that risks to hitting the 2% inflation target sustainably in the medium term are to the downside. Instead, I think they are two sided, reflecting the potential for more inflationary as well as disinflationary scenarios." & On descending the Table Mountain "There may be circumstances when a slower than expected descent is justified but there will also be times when conditions require that the pace has to quicken."

NOTABLE US HEADLINES

- Fed's Harker (2026 voter) said the policy rate remains restrictive enough to continue putting downward pressure on inflation. Harker also commented that he was on the fence in December between thinking one or two rate cuts were appropriate this year and right now, there is a lot of uncertainty and he's in the let's stay where they are for now camp.

- US President Trump said on Truth that they are working very hard with the House and Senate to pass a clean, temporary government funding bill. Trump also announced he nominated Paul Dabbar to be the US Deputy Secretary of Commerce.

GEOPOLITICS

- Israeli army storms the West Bank city of Nablus, via Sky news Arabia citing Palestinian News Agency

CRYPTO

- Bitcoin is on the backfoot and has slipped below USD 80k; Ethereum now down to USD 2.1K.

APAC TRADE

- APAC stocks declined with heavy pressure seen at month-end following the sell-off on Wall St with global risk sentiment hit by tariff threats and following a slump in NVIDIA shares post-earnings.

- ASX 200 was pressured with nearly all sectors in the red and the declines led by underperformance in miners and tech.

- Nikkei 225 slumped from the open and briefly dipped below the 37,000 level with the index down by more than a thousand points amid tech-related selling, while there were mixed data releases from Japan including softer-than-expected Tokyo CPI, a miss on Retail Sales and a slightly narrower-than-feared contraction in Industrial Production.

- Hang Seng and Shanghai Comp conformed to the broad downbeat mood amid trade-related frictions after US President Trump announced that an additional 10% of tariffs on China is set to take effect on March 4th which is on top of the 10% tariffs the US had previously imposed earlier this month. Nonetheless, the losses in the mainland were somewhat cushioned ahead of next week’s annual ”Two Sessions” in Beijing, where markets will be hoping for fiscal stimulus.

NOTABLE ASIA-PAC HEADLINES

- China's Politburo said it will implement a more proactive macro policy, expand domestic demand and will stabilise the housing market and stock market. Furthermore, it will also prevent and resolve risks and external shocks in key areas, as well as promote the sustained recovery of the economy.

- China's state planner issued measures on promoting high-quality inclusive elderly care services and will leverage central budget investment to boost the construction of affordable elderly care facilities.

- BoJ Deputy Governor Uchida said there is no change to the stance on short-term policy rate or JGB taper despite recent yield moves, and JGB yields fluctuate depending on market views on the economy, prices, and overseas developments. Uchida added the BoJ guides monetary policy towards achieving price stability not to monetise government debt.

- Japan is to crack down on the booming market for JGB-backed loans, according to Bloomberg.

- Chinese banks are reducing US dollar deposit rates following guidance from the PBoC, according to sources cited by Reuters.

- PBoC did not conduct purchase or sale of Chinese sovereign bonds from primary dealers in Feb.

DATA RECAP

- Tokyo CPI YY (Feb) 2.9% vs. Exp. 3.3% (Prev. 3.4%)

- Tokyo CPI Ex. Fresh Food YY (Feb) 2.2% vs. Exp. 2.3% (Prev. 2.5%); Ex. Fresh Food & Energy YY (Feb) 1.9% vs. Exp. 2.0% (Prev. 1.9%)

- Japanese Industrial Production MM SA (Jan P) -1.1% vs. Exp. -1.2% (Prev. -0.2%)

- Japanese Retail Sales YY (Jan) 3.9% vs. Exp. 4.0% (Prev. 3.7%, Rev. 3.5%)