- France’s far-right won the first round of the French parliamentary election, according to estimates. However, expectations are mixed over whether they will secure a majority.

- EUR is the best performing currency across the majors and OATS are firmer by circa 16 ticks and CAC 40 future +1.1%, with some citing relief over the potential lack of majority for Le Pen.

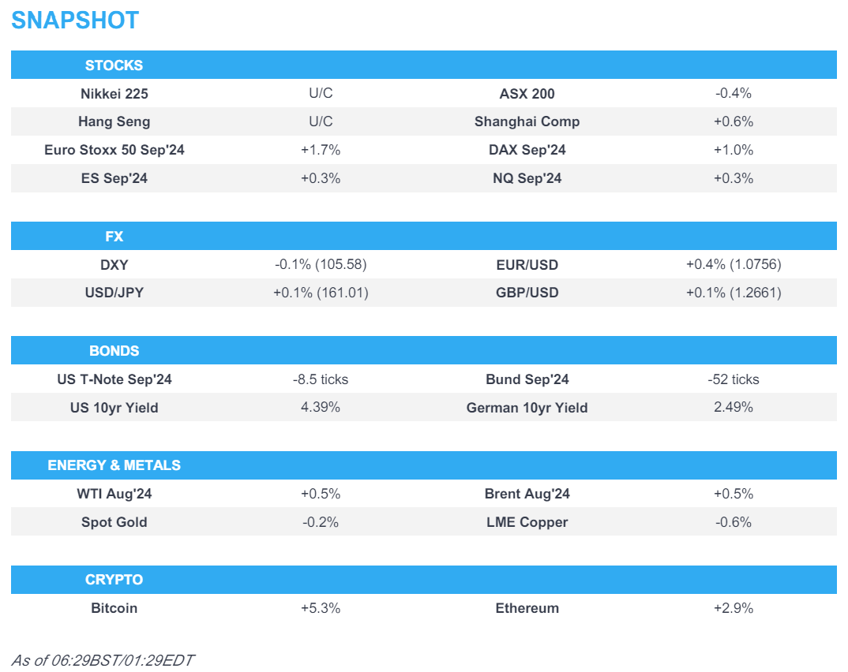

- European equity futures indicate a higher open with Euro Stoxx 50 future +1.4% after the first round of the French parliamentary election, while the cash market closed lower by 0.2% on Friday.

- APAC stocks began the new quarter somewhat varied as participants digested key data releases.

- Official Chinese Manufacturing PMI remained in contraction territory, Non-Manufacturing missed estimates, but Caixin Manufacturing PMI topped forecasts to print its highest in three years.

- Looking ahead, highlights include EZ, UK & US Manufacturing Final PMI (June), German Prelim. CPI, US ISM Manufacturing PMI, Comments from ECB’s Lagarde & Fed’s Williams

More Newsquawk in 3 steps:

1. Subscribe to the free premarket movers reports

2. Listen to this report in the market open podcast (available on Apple and Spotify)

3. Trial Newsquawk’s premium real-time audio news squawk box for 7 days

FRENCH ELECTION

- France’s far-right won the first round of the French parliamentary election, according to estimates. IFOP's initial estimate showed the far-right National Rally is seen leading after the first round with 34.2% of the popular vote, while left-wing New Popular Front is seen with 29.1% of votes and President Macron’s centrist bloc is seen with 21.5% of votes. Furthermore, IFOP noted that National Rally is expected to win 240-270 seats (vs. 289 seats needed for a majority) in the second round of voting on July 7th and Macron’s centrists are to win 60-90 seats, while Elabe initial estimates project 260-310 seats for the National Rally, 115-145 seats for New Popular Front and 90-120 seats for Macron’s centrist block, according to Reuters.

- Belgian public broadcaster RTBF reported that the far-right National Rally was seen leading the first round of the French parliamentary election with 34.5% of votes, while left-wing New Popular Front was seen with 28.5% of votes and President Macron’s centrist block was seen with 22.5% of votes.

- French Interior Ministry said voter turnout was at 59.4% around 17:00 local time in the first round of the French parliament election, while IPSOS France noted French voter turnout was estimated to be the highest since 1986.

- French President Macron called on a wide-ranging rally behind clearly Republican and Democratic candidates for the second round of the French election, while French PM Attal said the lesson from the first round is that the far-right are at the gates of power and said they will work to ensure the National Rally does not get an absolute majority, according to Reuters.

- Marine Le Pen said the French people have put the far-right National Rally in front and have practically wiped out Macron’s camp, while she is hoping to have things in place so that Bardella will become PM. It was also reported that French far-right leader Bardella said next Sunday’s vote will be one of the most important in the history of the French Fifth Republic and he is hoping to be a PM for all citizens if they get an absolute majority, while he added that he would be a PM who would be respectful of the President in cohabitation but ready to stand his ground, according to Reuters.

US TRADE

EQUITIES

- US stocks finished mostly lower on Friday with two-way price action at month and quarter-end, while markets digested US PCE data which ultimately printed in line with expectations across the board, while Chicago PMI printed firmer-than-expected and the Final UoM survey for June was revised up but inflation expectations were revised down.

- SPX -0.41% at 5,460, NDX -0.54% at 19,683, DJI -0.12% at 39,118, RUT +0.46% at 2,048.

- Click here for a detailed summary.

NOTABLE HEADLINES

- Fed's Bowman (voter) said on Friday that they have strong employment but have not quite reached the inflation goal and will continue to work towards the inflation goal at their pace.

- US President Biden’s family is urging him to stay in the race and keep fighting despite last week’s disastrous debate performance, according to NYT.

APAC TRADE

EQUITIES

- APAC stocks began the new quarter somewhat varied as participants digested key data releases and markets braced for a busy week ahead culminating in the latest NFP report on Friday.

- ASX 200 was led lower by underperformance in tech amid headwinds from firmer yields although the index was off worst levels owing to resilience in mining stocks.

- Nikkei 225 gained at the open amid initial currency weakness although some of the gains were then faded as participants digested a mixed BoJ Tankan survey.

- Shanghai Comp. swung between gains and losses with price action choppy in early trade after mixed PMI data from China which showed official Manufacturing PMI remained in contraction territory and Non-Manufacturing PMI missed estimates, but Chinese Caixin Manufacturing PMI topped forecasts to print its highest in three years. Meanwhile, Hong Kong markets were shut for a holiday which also meant the absence of Stock Connect flows.

- US equity futures (ES +0.3%) were slightly higher as they attempted to nurse some of Friday's weakness.

- European equity futures indicate a higher open with Euro Stoxx 50 future +1.4% after the first round of the French parliamentary election, while the cash market closed lower by 0.2% on Friday.

FX

- DXY marginally softened in quiet trade amid light news flow stateside, while US Manufacturing PMI and ISM data are scheduled later to begin this week's slew of economic releases culminating in Friday's NFP report.

- EUR/USD strengthened following the exit polls from the first round of the French parliamentary election which showed the far-right National Rally won the most votes although an IFOP poll estimated the number of seats it will win in the second round of voting on July 7th was below what some had feared.

- GBP/USD remained afloat just above its 50- and 100-DMA levels as the UK election day draws closer.

- USD/JPY just about reclaimed the 161.00 level but with further gains capped amid mixed Tankan data.

- Antipodeans held on to recent gains against the dollar with price action contained amid the mixed risk appetite and divergence between China's official and Caixin Manufacturing PMI releases.

- PBoC set USD/CNY mid-point at 7.1265 vs exp. 7.2558 (prev. 7.1268).

- South African President Ramaphosa reappointed Enoch Godongwana as Finance Minister, while he appointed John Steenhuisien as Agriculture Minister and Ronald Lamola as Minister of International Relations and Cooperation, according to Reuters.

FIXED INCOME

- 10-year UST futures remained subdued after last week's selling pressure although were off Friday's post-settlement lows, while attention in the US this week turns to FOMC Minutes, a slew of data releases heading into the Independence Day holiday and with the latest NFP report due on Friday.

- Bund futures gapped lower at the open and briefly dipped beneath the 131.00 level before clawing back some of the losses with participants looking ahead to German CPI data scheduled later today, while OAT futures were firmer overnight following the first round of the French parliamentary election.

- 10-year JGB futures conformed to the recent losses in global counterparts with demand not helped by a mixed Tankan survey and the absence of the BoJ from the market.

COMMODITIES

- Crude futures eked marginal gains in quiet trade amid a lack of energy catalysts or geopolitical escalation.

- Saudi Aramco’s strategic gas expansion reportedly progresses with USD 25bln of contract awards.

- Spot gold traded rangebound in tandem with an uneventful greenback.

- Copper futures were subdued as participants digested the latest Chinese PMI data which showed the official headline Manufacturing PMI remained in contraction territory but Caixin Manufacturing PMI rose to the highest in three years.

CRYPTO

- Bitcoin extended on the gradual gains seen over the weekend and briefly climbed above the USD 63,500 level.

NOTABLE ASIA-PAC HEADLINES

- Indonesia is to impose safeguard duties of 100% to 200% on imports ranging from footwear to ceramics, while it mainly imports apparel and clothing accessories from China, Vietnam and Bangladesh, according to Nikkei.

- India’s government source said it is monitoring cheap Chinese imports, while India’s steel ministry is in talks with the commerce ministry over rising imports and the industry has sought a probe.

DATA RECAP

- Chinese Manufacturing PMI (Jun) 49.5 vs Exp. 49.5 (Prev. 49.5)

- Chinese Non-Manufacturing PMI (Jun) 50.5 vs Exp. 51.0 (Prev. 51.1)

- Chinese Composite PMI (Jun) 50.5 (Prev. 51.0)

- Chinese Caixin Manufacturing PMI Final (Jun) 51.8 vs. Exp. 51.2 (Prev. 51.7)

- Japanese Tankan Large Manufacturing Index (Q2) 13.0 vs. Exp. 12.0 (Prev. 11.0)

- Japanese Tankan Large Manufacturing Outlook (Q2) 14.0 vs. Exp. 13.0 (Prev. 10.0)

- Japanese Tankan Large Non-Manufacturing Index (Q2) 33.0 vs. Exp. 33.0 (Prev. 34.0)

- Japanese Tankan Large Non-Manufacturing Outlook (Q2) 27.0 vs. Exp. 31.0 (Prev. 27.0)

- Japanese Tankan Large All Industry Capex Estimate (Q2) 11.1% vs. Exp. 13.9% (Prev. 4.0%)

GEOPOLITICAL

MIDDLE EAST

- US proposed new language in an effort to reach a Gaza hostage-ceasefire deal, according to Reuters.

- Hamas officials said there is no progress in ceasefire talks with Israel but it is still ready to deal positively with any ceasefire proposal that ends the war in Gaza, according to Reuters.

- Iraq's Islamic Resistance reportedly hit an Israeli port with a drone, according to IRNA.

- Israel’s Finance Minister extended the waiver allowing cooperation between Israeli and Palestinian banks in the West Bank for four months, according to a spokesperson cited by Reuters.

- Iran’s UN mission said an obliterating war will ensue if Israel attacks Lebanon and that all options including the full involvement of resistance fronts are on the table.

- Iran will hold a presidential election run-off on July 5th as no candidate secured 50% of votes.

OTHER

- Russian President Putin held a Russian security council meeting on the moratorium on the deployment of intermediate-range missiles and said Russia needs to resume production of short and medium-range missiles, according to reports on Friday.

- Russia took control of the settlement of Shumy in Ukraine, while Russian forces also took over Spirne and Novooleksandrivka in Ukraine’s Donetsk region, according to RIA citing the Defence Ministry. It was separately reported that a Ukrainian drone attack killed five people in Russia’s borderline Kursk region, while Russia’s Emergency Ministry said four of its employees were injured in Ukraine’s shelling of Donetsk.

- North Korea condemned ‘Freedom Edge’ joint military drills by the US, South Korea and Japan as provocation, while it said it will make an important announcement and will protect regional peace with an aggressive and overwhelming response, according to KCNA. It was also reported that North Korea conducted a missile launch of a short-range ballistic missile and another ballistic missile, according to Yonhap citing the South Korean military.

- US military raised the alert level of several bases in Europe to its second-highest level, according to the Times of Israel citing multiple American media outlets.

EU/UK

NOTABLE HEADLINES

- European Commission President von der Leyen said European companies are signing deals or MOUs worth over EUR 40bln at the Egypt-EU investment conference, according to Reuters.

- Austria’s far-right Freedom Party chief Kickl said they are forming a new political alliance with Orban’s Fidesz in Hungary and Babis’s Czech ANO party, according to Reuters.

- The Sunday Times newspaper endorsed the Labour Party for the upcoming UK election.