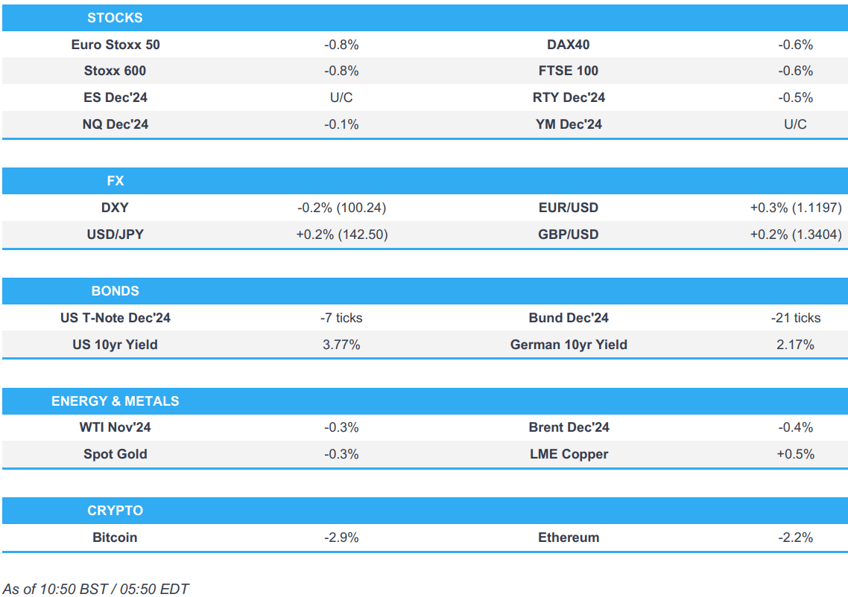

- European equities post losses to varying degrees, with autos hit after several guidance cuts; US equity futures are flat/subdued with the focus on Fed Chair Powell later.

- Dollar is slightly softer, Antipodeans benefit from the positivity surrounding China whilst the traditional havens CHF & JPY lag.

- Bonds are modestly softer to varying degrees; Bunds were not too reactive after the German Regional CPI metrics painted a picture of cooling Y/Y inflation ahead of the Nationwide figure at 13:00 BST / 08:00 EDT.

- Crude oil has pared initial gains and is now modestly lower as markets digest the recent geopolitical updates between Israel/Hezbollah; XAU is subdued whilst base metals benefit from the Chinese optimism.

- Looking ahead, German CPI, Chicago PMI, Speakers including ECB President Lagarde, Fed Chair Powell, Bowman, BoE’s Greene, Earnings from Carnival.

More Newsquawk in 3 steps:

1. Subscribe to the free premarket movers reports

2. Listen to this report in the market open podcast (available on Apple and Spotify)

3. Trial Newsquawk’s premium real-time audio news squawk box for 7 day

EUROPEAN TRADE

EQUITIES

- European bourses, Stoxx 600 (-0.7%) are modestly lower across the board and to varying degrees, with sentiment in the region failing to piggy-back off China's performance but instead focusing on escalating geopolitics, profit warnings, and upcoming risk events such as Friday's NFP.

- European sectors are mostly negative; Basic Resources remain aflaot, given the strength in metals prices. Autos is by far the clear laggard after a myriad of guidance cuts today; Stellantis (-12.9%), Aston Martin (-27.5%) and Volkswagen (-2.7%) all slip. As a reminder, Mercedes-Benz (-1.7%) and BMW (-1.9%) both lowered forecasts already earlier in the month.

- US Equity Futures (ES U/C, NQ -0.1%, RTY -0.3%) are flat/subdued on month end, with traders keeping an eye on this week's risk events including Fed Chair Powell today, US ISMs throughout the week, and US NFPs on Friday.

- Bytedance, the owner of TikTok, reportedly plans a new AI model built with Huawei's Ascend 910B chips, according to sources; Bytedance is NVIDIA's (NVDA) largest customer for H20 AI chips tailored for the Chinese market.

- Click for the sessions European pre-market equity newsflow

- Click for the additional news

- Click for a detailed summary

FX

- USD is softer vs. cyclically-exposed peers and firmer vs. havens. Incremental US developments have been lacking since Friday's PCE report with markets instead looking ahead to a slew of upcoming data releases, including the key NFP report. DXY is in a 100.17-48 range and within Friday's 100.15-88 parameters.

- EUR is marginally firmer vs. the USD but unable to reclaim 1.12 status which was lost late last week on account of soft inflation prints from Spain and France. Today's German Regional CPI figures have thus far painted a picture of cooling Y/Y inflation, but had little impact on the Single-Currency. EUR/USD is tucked within Friday's 1.1124-1.1203 range.

- GBP is firmer vs. the USD with Cable just about making its way back onto a 1.34 handle after venturing as high as 1.3433 last week. Downward revisions to Q2 GDP metrics had little follow-through into the market. BoE's Greene is due after-hours.

- JPY is a touch softer vs. the USD in the wake of mixed data from Japan overnight. Broader focus for the JPY is on the fallout from Friday's LDP leadership race, with the victory of Ishiba viewed as a hawkish outcome. USD/JPY is currently trading towards the bottom end of today's 141.66-142.95 range.

- Antipodes are top of the leaderboard as the positivity surrounding China continues to reverberate around the market. As such, AUD/USD has printed another YTD peak at 0.6941

- Click for a detailed summary

- Click for NY OpEx Details

FIXED INCOME

- USTs are currently scaling back some of the post-PCE upside seen on Friday with not a great deal of fresh US drivers over the weekend. NFP will likely be the highlight for the week given the Fed's increased focus on the employment side of its mandate. As it stands, markets currently see the November meeting as a near-enough coinflip between a 25 or 50bps reduction. Dec'24 USTs are currently contained within Friday's 114.08-25 range.

- Bunds showing similar price action to other global peers by scaling back some of the ground made on Friday, which was driven in part by soft regional inflation metrics from Spain and France ahead of the German release today and EZ-wide metric tomorrow. Regional CPIs for Germany have thus far painted a picture of cooling Y/Y inflation. Dec'24 Bunds have returned to a 135 handle but are contained within Friday's 134.31-135.19 range.

- Gilts are also on the backfoot with not much in the way of notable UK newsflow with downward revisions to Q2 GDP metrics having little follow-through into the market. BoE's Greene (voted for a hold in August and September) is due to speak afterhours.

- Click for a detailed summary

COMMODITIES

- Crude oil was initially on a firmer footing, but has since slipped since the European cash open and slowly drifted into negative territory. Price action today is focused on continued industrial commodities tailwinds from Chinese stimulus coupled with escalating geopolitics after Israel’s assassination of Hassan Nasrallah; on which, Bloomberg suggested Iran will try to transfer thousands of fighters to the border areas between Lebanon and Syria. Brent Dec trades in 71.24-72.79/bbl confines.

- Subdued trade in the precious metals complex despite the escalating geopolitical tensions, but still within contained parameters thus far in the run-up to risk events this week including Fed Chair Powell, ISM PMIs, and the US jobs reports. XAU resides within an USD 2,647.33-2,666.05/oz range.

- Base metals are firmer but off best levels as the optimism from Chinese stimulus is somewhat hampered by a broader cautious tone across markets.

- Russian Deputy PM Novak said Middle East geopolitical risks are already priced in, and global oil prices will not fluctuate significantly, via Ria

- BSEE estimated about 3% (prev. 12%) of oil production and 1% (prev. 6%) of natural gas production in the Gulf of Mexico was shut-in on Sunday. It was also reported that the death toll from Helene reached 89 and North Carolina’s Governor said that almost 464k customers in the state remain without power.

- Click for a detailed summary

NOTABLE DATA RECAP

- German Baden-Wurttemberg State CPI MM (Sep) 0.1% (Prev. -0.3%); Baden-Wurttemberg State CPI YY (Sep) 1.4% (Prev. 1.5%)

- German Hesse State CPI YY (Sep) 1.2% (Prev. 1.5%); Hesse State CPI MM (Sep) 0.0% (Prev. -0.1%)

- German Saxony State CPI MM (Sep) 0.2% (Prev. -0.2%); Saxony State CPI YY (Sep) 2.4% (Prev. 2.6%)

- German North Rhine-Westphalia State CPI YY (Sep) 1.5% (Prev. 1.7%)

- German Bavaria State CPI MM (Sep) 0.1% (Prev. -0.1%); German Bavaria State CPI YY (Sep) 1.9% (Prev. 2.1%)

- German Brandenburg State CPI MM (Sep) 0.0% (Prev. -0.2%); Brandenburg State CPI YY (Sep) 1.4% (Prev. 1.7%)

- German Import Prices YY (Aug) 0.2% vs. Exp. 0.3% (Prev. 0.9%); Import Prices MM (Aug) -0.4% vs. Exp. -0.3% (Prev. -0.4%)

- UK GDP YY (Q2) 0.7% vs. Exp. 0.9% (Prev. 0.9%); GDP QQ (Q2) 0.5% vs. Exp. 0.6% (Prev. 0.6%)

- UK Business Invest QQ (Q2) 1.4% (Prev. -0.1%, Rev. 0.6%); Business invest YY (Q2) 0.2% (Prev. -1.1%, Rev. -1.8%)

- UK Nationwide house price YY (Sep) 3.2% vs. Exp. 2.7% (Prev. 2.4%); Nationwide house price MM (Sep) 0.7% vs. Exp. 0.2% (Prev. -0.2%)

- UK Current Acc GBP (Q2) -28.397B vs. Exp. -33.0B (Prev. -20.995B, Rev. -13.76B)

- UK Mortgage Lending (Aug) 2.861B GB vs. Exp. 2.8B GB (Prev. 2.786B GB, Rev. 2.796B GB) Mortgage Approvals (Aug) 64.858k vs. Exp. 64.0k (Prev. 61.985k, Rev. 62.496k); BOE Consumer Credit (Aug) 1.295B GB vs. Exp. 1.4B GB (Prev. 1.215B GB, Rev. 1.231B GB); M4 Money Supply (Aug) -0.1% (Prev. 0.3%)

- Swedish Retail Sales MM (Aug) 0.4% (Prev. 0.5%) Swedish Retail Sales YY (Aug) 0.5% (Prev. -0.5%)

- Swiss KOF Indicator (Sep) 105.5 vs. Exp. 101.0 (Prev. 101.6, Rev. 105.0)

- Italian Flash Trd Bal Non-EU (Aug) 2.69B (Prev. 6.04B)

- Italian Consumer Price Prelim MM (Sep) -0.2% vs. Exp. -0.1% (Prev. 0.2%); CPI (EU Norm) Prelim MM (Sep) 1.2% vs. Exp. 1.2% (Prev. -0.2%); CPI (EU Norm) Prelim YY (Sep) 0.8% vs. Exp. 1.0% (Prev. 1.2%); Consumer Price Prelim YY (Sep) 0.7% vs. Exp. 0.8% (Prev. 1.1%)

NOTABLE EUROPEAN HEADLINES

- Germany is reportedly poised to abandon forecasts for economic growth this year, according to Bloomberg sources; Germany forecasts economic stagnation this year at most

- Former UK PM Sunak urged for the Tories to unite behind who succeeds him as party leader and warned that the party risks marginalisation if divisions persist, according to FT.

- Far-right Freedom Party of Austria was projected to be first in the Austrian parliamentary election with 29.3%, while the ruling conservatives are seen at 25.3% and social democrats at 20%. Furthermore, Austria’s Chancellor and conservative leader Nehammer conceded that his party failed to catch up with the far-right freedom party in the election and said talks between the parties are important once the final election result is in, while the far-right party leader Kickl said they are ready to lead a government.

- ECB's Stournaras said that based on the most recent data for inflation and the real economy, he finds it reasonable to proceed with a 25bps cut in October, or risk inflation falling below target, according to an FT interview.

- EU is to continue China EV talks even after final vote on its proposal to impose final import tariffs on Chinese EVs, via Reuters citing sources.

GEOPOLITICS

MIDDLE EAST - EUROPEAN MORNING

- "Israeli Walla website: The Israeli army completes its preparations for the ground incursion into south Lebanon", according to Sky News Arabia.

- "Iran will try to transfer thousands of fighters to the border areas between Lebanon and Syria", via Al Jazeera citing Bloomberg.

- "Iranian Foreign Ministry said we will not send forces to help Hezbollah", via Al Arabiya.

- "Reports of explosions in the Syrian capital, Damascus", via Sky News Arabia

- Hezbollah Deputy chief said will confront any possibility and are ready if Israel decides to enter by land; Hezbollah forces are ready for a ground incursion; confident Israel will not achieve its aims

MIDDLE EAST

- "Israeli special forces have been carrying out small, targeted raids into southern Lebanon, gathering intelligence and probing ahead of a possible ground incursion that could come as soon as this week," according to WSJ sources

- Israel conducted strikes on Lebanon’s capital of Beirut on Friday and targeted the headquarters of Hezbollah which killed Hezbollah leader Nasrallah.

- Israeli military said it struck dozens of Hezbollah terror targets in Lebanon including launchers that were aimed at Israeli territory, while it also announced that it killed senior Hezbollah figure Nabil Kaouk and the commander of Hezbollah’s southern front Ali Karaki.

- Israeli Walla website reports that Israeli forces are concentrated on the northern front and preparing for a ground invasion of Lebanon.

- Israeli military said sirens sounded in an area of Jerusalem following a launch from Lebanon towards Israeli territory on Saturday and reports noted that Hezbollah launched a new rocket attack on Israel after announcing the death of its leader and said the group is to continue its battle against Israel.

- Israeli military announced sirens sounded after a missile was fired from Yemen which was intercepted and Yemen’s Houthis said they fired a ballistic missile at Israel’s Ben Gurion Airport upon Israeli PM Netanyahu’s arrival, while it was also reported that the Israeli military conducted strikes on Houthi targets in Yemen on Sunday including a power plant and sea import used to import oil.

- Israeli army said it bombed dozens of rocket launchers and Hezbollah weapons storage buildings in eastern Bekaa, while the Popular Front for the Liberation of Palestine said three of its leaders were killed in an Israeli strike on Beirut.

- Israeli PM Netanyahu said on Saturday that Hezbollah’s Nasrallah was the main engine of Iran’s axis of evil and Nasrallah’s elimination was a necessary step towards changing the balance of power in the Middle East, while he added that their work is not done and there are challenging days ahead.

- Israel’s Defence Minister was reported to be holding talks on the expansion of IDF activities in the northern arena.

- Israel warned Lebanese air control that it would use force if an Iranian plane landed at Beirut Airport, while the Lebanese Transport Ministry asked the Iranian plane to stay away from Lebanese airspace and the plane obliged.

- Lebanon’s caretaker PM said that they have no option but the diplomatic option, while the Lebanese Information Minister said following a cabinet meeting that diplomatic efforts for a ceasefire are continuing. It was also reported that the head of the Lebanese government crisis cell said around 1mln Lebanese people have been displaced by Israel attacks.

- Lebanon’s top Christian cleric said Lebanon’s patriarch calls for diplomacy because war means all sides lose, while the top Christian cleric added that Nasrallah’s killing opened a wound in the hearts of the Lebanese and that the international community must work to stop the cycle of war, killing and destruction.

- Iran’s Supreme Leader Khamenei announced five days of mourning over the death of Hezbollah leader Nasrallah and said that Nasrallah’s blood will not go unavenged.

- Iran's President Pezeshkian said Lebanese fighters should not be left alone so that Israel does not attack countries of the axis of resistance one after the other.

- Iran’s Foreign Minister Araqchi said the killing of the IRGC deputy commander Nilforoushan in Lebanon will not go unanswered, according to a statement.

- Iran called for a UN Security Council meeting on Israel’s actions in Lebanon and across the region, while it warned against any attack on its diplomatic premises and representatives. Furthermore, it was stated that Iran will not hesitate to exercise its inherent rights under international law to take every measure in the defence of its vital national and security interests, according to Iran’s UN mission.

- Iran’s parliament speaker Qalibaf said the resistance will continue confronting Israel with the help of Iran, according to state media.

- US President Biden said it is time for a ceasefire now and replied that they are responding when asked if the US would respond to missile attacks on US warships in the Red Sea. It was also reported that President Biden is reviewing the status of the US military force posture in the region and directed continued diplomatic efforts to coordinate with allies and partners and de-escalate the ongoing conflicts.

- US Defense Secretary Austin spoke with Israeli Defence Minister Gallant and expressed support for Israel’s right to defend itself against Iranian-backed terrorist groups, while Austin stressed the US is determined to prevent Iran and Iranian-backed partners and proxies from exploiting the situation or expanding conflict.

- US is to reinforce defensive air support capabilities in the coming days in the Middle East and Defense Secretary Austin has put other US forces on a heightened readiness to deploy. US also ordered the departure of certain US Embassy direct hire employees and their eligible family members from Lebanon.

- US Central Command said it conducted targeted strikes in Syria which killed 37 terrorist operatives including senior leaders of ISIS and Hurras Al-Din.

- China’s Foreign Ministry said China opposes any violation of Lebanon’s sovereignty and urges the parties concerned, especially Israel, to immediately cool the situation.

OTHER

- UAE condemned a 'heinous attack' on UAE's mission in Sudan's Khartoum and said the attack was carried out by a Sudanese military aircraft.

- Russian forces took control over the settlement of Makiivka in eastern Ukraine’s Luhansk region, according to IFX.

- Russia’s Kremlin said amendments to Russia’s nuclear doctrine have been prepared and will now be formalised, according to RIA.

- Russian PM Mishustin will visit Iran on Monday and will meet with the Iranian President.

- China’s Foreign Minister Wang told the UN General Assembly that China is not throwing oil on fire or exploiting the situation for selfish gain by promoting Ukraine peace talks, while he also stated that the complete reunification of China will be achieved and that Taiwan will eventually return to the embrace of the motherland.

- North Korea said the US’s USD 8bln military aid to Ukraine is an incredible mistake, while it added that Ukrainian President Zelensky who called Pyongyang an accomplice in the Ukraine war is waging reckless political provocation, according to KCNA.

- South Korea’s Foreign Minister Cho said Russia is engaging in illegal arms trade with North Korea.

CRYPTO

- Bitcoin is softer and holds just above USD 64k; Ethereum posts losses to a similar magnitude.

APAC TRADE

- APAC stocks were mixed heading into month-end amid the backdrop of recent geopolitical escalation and as participants digested a slew of data releases, as well as China's latest support efforts and Japan's leadership transition.

- ASX 200 was led by outperformance in the commodity-related sectors as oil and metal prices benefitted from geopolitics and China's policy announcements.

- Nikkei 225 suffered heavy losses amid a firmer JPY following Ishiba's victory against Abe protege Takaichi in the LDP leadership race, while the data releases from Japan were mixed with a steeper-than-expected drop in Industrial Production but Retail Sales topped forecasts.

- Hang Seng and Shanghai Comp rallied ahead of National Day Golden Week holiday closures despite mixed PMI data from China with advances led by strength in property developers after the PBoC instructed banks to lower interest rates on existing mortgages and lower downpayments, while some Chinese cities also eased home purchase restrictions. Furthermore, the mainland index is on course for its largest gain since 2015 and is set for a bull market after China's latest policy announcements and the PBoC's Monetary Policy Committee quarterly meeting where it pledged several supportive efforts.

NOTABLE ASIA-PAC HEADLINES

- PBoC’s Monetary Policy Committee held its third-quarter meeting and stated that China’s economy still faces challenges such as insufficient demand and weak social expectations, while it added that it must accurately and effectively implement prudent monetary policy, as well as pay more attention to counter-cyclical adjustments. PBoC said it must focus on expanding domestic demand, boosting confidence and promoting a sustained recovery in the economy. Furthermore, it is to maintain a reasonable abundance in liquidity, guide reasonable credit growth, support banks to supplement capital, support the reduction of interest rates on existing mortgages and promote the stable and healthy development of the real estate market, according to Reuters,

- PBoC said all commercial banks must in batches lower interest rates on all existing mortgages by October 31st to no less than 30bps below the PBoC’s Loan Prime Rate, while it said the adjusted mortgage rates in some Chinese cities including Beijing, Shanghai and Shenzhen must not be less than the floor of their existing rates. Furthermore, Guangzhou city announced to lift all restrictions on home purchases, while Shanghai and Shenzhen announced to ease restrictions on home purchases by non-local buyers and cut the minimum downpayment ratio to no less than 15%, according to Reuters.

- PBoC injected CNY 182bln via 7-day reverse repos on Sunday with the rate lowered to 1.50% (prev. 1.70%) and injected CNY 212.1bln via 7-day reverse repos on Monday with the rate kept at 1.50%.

- China's MOFCOM said it will further improve policy targetedness and effectiveness, as well as improve the consumption structure and focus on fostering new consumption business, while it will promote the steady growth of foreign trade business.

- China’s Finance Ministry said state-owned firms’ August YTD profits fell 2.1% Y/Y.

- Japan’s Finance Minister post is likely to go to former Chief Cabinet Secretary Kato and the Foreign Minister position is likely to go to former Defence Minister Iwaya, while the Defence Minister post in the new cabinet is likely to go to former Defence Minister General Nakatani, according to Japanese press. It was also reported that newly elected ruling LDP leader Ishiba is considering a plan to conduct a Lower House election on October 27th.

- Japanese ruling LDP executive said incoming PM Ishiba proposed lower house election to be held on October 27th and to dissolve parliament October 9th

DATA RECAP

- Chinese NBS Manufacturing PMI (Sep) 49.8 vs. Exp. 49.5 (Prev. 49.1)

- Chinese NBS Non-Manufacturing PMI (Sep) 50.0 vs. Exp. 50.4 (Prev. 50.3)

- Chinese NBS Composite PMI (Sep) 50.4 (Prev. 50.1)

- Chinese Caixin Manufacturing PMI (Sep) 49.3 vs. Exp. 50.5 (Prev. 50.4)

- Chinese Caixin Services PMI (Sep) 50.3 vs. Exp. 51.6 (Prev. 51.6)

- Chinese Caixin Composite PMI (Sep) 50.3 (Prev. 51.2)

- Japanese Industrial Production MM (Aug P) -3.3% vs. Exp. -0.9% (Prev. 3.1%)

- Japanese Retail Sales YY (Aug) 2.8% vs. Exp. 2.3% (Prev. 2.6%, Rev. 2.7%)

- New Zealand ANZ Business Confidence (Sep) 60.9% (Prev. 50.6%)

- New Zealand ANZ Activity Outlook (Sep) 45.3% (Prev. 37.1%)