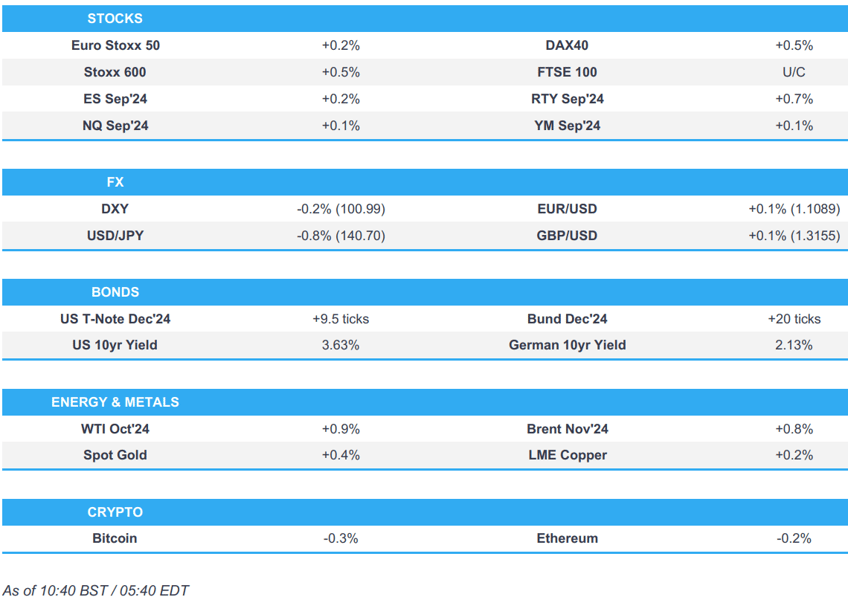

- European bourses are generally firmer; US equity futures remain steady and hold on to the prior day’s gains.

- Dollar is slightly lower amid a dovish repricing of Fed rate cut bets, and JPY outperforms as USD/JPY slips to a 140 handle.

- Bonds are generally firmer; Bunds trade around the 135.00 mark.

- Crude oil continues to edge higher given the risk tone, XAU is modestly firmer and base metals are mixed.

- Looking ahead, highlights include US import/export prices, UoM Prelim, credit ratings for Germany, Spain, and Greece.

More Newsquawk in 3 steps:

1. Subscribe to the free premarket movers reports

2. Listen to this report in the market open podcast (available on Apple and Spotify)

3. Trial Newsquawk’s premium real-time audio news squawk box for 7 days

EUROPEAN TRADE

EQUITIES

- European bourses, Stoxx 600 (+0.5%) hold a modest upward bias following on from a mixed APAC handover, but given the strong performance on Wall St. on Thursday.

- European sectors hold a strong positive bias; Autos top the chart, possibly as chances of a larger Fed rate cut increased after the European close. On the flip side, Optimised Personal Care Drug and Groceries sit at the bottom of the bunch.

- Flat/eventful trade across US futures (ES +0.1% NQ Unch. RTY +0.4%) this morning but with the contracts holding onto a lion's share of yesterday's gains.

- Click for the sessions European pre-market equity newsflow

- Click for the additional news

- Click for a detailed summary

FX

- DXY is trading around the 101.00 mark following a dovish repricing of Fed bets, attributed to an article by Fed-watcher Timiraos, where he noted that it could be a close call between 25 or 50bps, whilst former FOMC Member Dudley said he would push for a 50bps if he was stll on the committee.

- EUR/USD is on the rise after picking itself up from a 1.1005 base yesterday to a current peak at 1.1094, which has subsequently brought a test of 1.11 into view; upside stemming from a scaling back of dovish ECB bets at the October meeting.

- GBP is a touch firmer vs. the USD as the dovish repricing for next week's Fed meeting stands in contrast to a widely-expected hold by the BoE next week. Accordingly, Cable has picked itself up from a 1.3001 low earlier in the week to a current peak of 1.3150.

- JPY is the best performer across the majors as USD/JPY extends its move lower for a fourth consecutive session in what appears to be a Fed vs. BoJ play.

- AUD/USD is currently pausing for breath after gaining on Wednesday and Thursday; some notable Opex activity for the pair is in play today.

- PBoC set USD/CNY mid-point at 7.1030 vs exp. 7.1048 (prev. 7.1214).

- Peru Central Bank cut its reference rate by 25bps to 5.25%, as expected, but stated that the rate cut does not necessarily mean future rate cuts will follow. The pair has now moved as low as 140.64; its lowest level since December 28th 2023.

- Click for a detailed summary

- Click for NY OpEx Details

FIXED INCOME

- USTs are scaling back yesterday's losses with upside primarily attributed to an article by Fed-watcher Timiraos, where he noted that it could be a close call between 25 or 50bps. Comments from former FOMC member Dudley that he would be pushing for 50bps if he were on the committee is also a factor. The 10yr yield has slipped as low as 3.623% but is holding above Wednesday's 3.605% trough.

- Bunds are higher alongside gains in global counterparts and a reversal of Thursday's price action which saw the curve bear-flatten as odds of an October rate cut were scaled back. German 10yr yield is currently towards the middle of yesterday's 2.098-169% range.

- Upside in Gilts is more a by-product of price action elsewhere in the fixed income space, given the light UK-docket. The UK 10yr yield is currently towards the middle of yesterday's 3.744-798% range.

- Click for a detailed summary

COMMODITIES

- WTI and Brent continue the gains seen in the prior session, with upside facilitated by the broader risk-on sentiment coupled with the shut-ins amid Hurricane Francine (now a post-tropical cyclone). Brent Nov resides in a USD 72.17-52/bbl.

- Precious metals are mostly firmer, with modest gains seen in spot gold and silver whilst spot palladium is subdued, following the prior day's outperformance. The complex will be mindful of a meeting between US and UK governments, where it will decide on allowing Ukraine to use long-range missiles to hit targets in Russian territory. Spot gold trades in a USD 2,566-2,571.12/oz range.

- Mixed trade across base metals and reflective of the tentative tone across the market.

- US Coast Guard said the New Orleans Port condition is normal following waterway assessments, with vessel movement and cargo operations authorised within the COTP New Orleans Zone.

- Macquarie said global oil market faces heavy surplus in 2025. Oil may drop into low USD 50s/bbl, outside base case.

- Click for a detailed summary

NOTABLE DATA RECAP

- French CPI (EU Norm) Final YY (Aug) 2.2% vs. Exp. 2.2% (Prev. 2.2%); CPI (EU Norm) Final MM (Aug) 0.6% vs. Exp. 0.6% (Prev. 0.6%)

- EU Industrial Production MM (Jul) -0.3% vs. Exp. -0.5% (Prev. -0.1%); Industrial Production YY (Jul) -2.2% vs. Exp. -2.7% (Prev. -3.9%, Rev. -4.1%)

NOTABLE EUROPEAN HEADLINES

- German Economy Ministry said economic recovery is only likely to occur towards the end of the year; German export economy not expected to see significant impetus in coming months.

- The Bank of England/Ipsos Inflation Attitudes Survey: Median expectations of the rate of inflation over the coming year were 2.7%, down from 2.8% in May 2024. Asked about expected inflation in the twelve months after that, respondents gave a median answer of 2.6%, unchanged from 2.6% in May 2024. Asked about expectations of inflation in the longer term, say in five years’ time, respondents gave a median answer of 3.2%, up from 3.1% in May 2024.

ECB SPEAK

- ECB's Nagel said expect to reach inflation goal at the end of next year and core inflation is also going in the right direction, according to German radio.

- ECB's Simkus discussed monetary policy in interview on Radio LRT, while he stated that additional reductions will rely on information and speed of rate cuts will depend on data.

- ECB's Rehn said the ECB's rate cuts support growth but Europe should get on the road to better productivity. Current uncertainties further emphasise the dependence on fresh data and analysis about the economy. Council will continue to base monpol on the inflation outlook, the dynamics of core inflation net of energy and food prices and strength of monpol transmission.

- ECB's Vasle said inflation is to be largely steered by core and services; not committing to a pre-determined path.

- ECB's Villeroy said that recent activity data has been somewhat disappointing. Should gradually reduce the degree of monetary restriction as appropriate.

- ECB's Rehn said EZ GDP growth is projected to gradually pick up; disinflation in the EZ is on the right track; downside risks to growth increased over the summer; have full freedom of action and flexibility at all meetings.

NOTABLE US HEADLINES

- Turkey seeks US approval to buy GE aerospace (GE) engines for military jets, via Bloomberg

GEOPOLITICS

MIDDLE EAST

- Lebanese media reported that rockets were fired from southern Lebanon towards Safad in northern Israel, according to Sky News Arabia.

- Sirens sounded in the Israeli settlement of Alemon in the West Bank warning of an infiltration of militants, according to Al Jazeera.

OTHER

- Russian President Putin warned the UK and the US that they will be "at war" with Russia if they allow Ukraine to use long-range missiles to strike targets inside Russia, according to The Times.

- US Ambassador to Ukraine strongly condemned Russia's attack on a vessel carrying grain from Ukraine.

- Russian Deputy Defence Minister said the China-Russia relationship is a model of nation-to-nation collaboration and is a peace guarantee, while their two defence ministries have continuously expanded cooperation and interactions such as drills and exchanges, including more than 100 projects this year. The official added that the US is trying to suppress any technological development centre that is not obedient to it which is double containment and suppression of China and Russia. Furthermore, the Russian Deputy Defence Minister said Russia has unique experience of fighting against various Western weapons and is ready to share it with partners, according to RIA.

- China's Defence Ministry said major countries must the take lead in safeguarding global security and should never interfere in other countries' internal affairs. China's Defence Ministry also stated it is important to uphold fairness, justice, international rule of law, and enhance the authority of the UN, while it added that peace talks and political settlement are the only solutions for the Ukraine crisis and Israeli-Palestinian conflict.

- North Korean leader Kim oversaw a test-fire for the new 600MM multiple rocket launcher, while he inspected a training base for special operations armed forces and guided combatants drills, as well as inspected the nuclear weapons institute and production base of weapons-grade nuclear materials, according to KCNA. It was later reported that South Korea condemned North Korea's unveiling of a uranium enrichment facility and said it will never accept North Korea's possession of nuclear weapons, according to the Unification Ministry.

CRYPTO

- Bitcoin is slightly lower and holds just beneath USD 58k, whilst Ethereum holds flat around USD 2.3k.

APAC TRADE

- APAC stocks were ultimately mixed and initially took their cues from the gains in the US, but with upside capped by a lack of fresh drivers ahead of a long weekend.

- ASX 200 was led by outperformance in mining stocks with gold miners boosted after the precious metal hit a fresh record high.

- Nikkei 225 underperformed owing to currency strength and as participants headed towards the extended weekend in Japan.

- Hang Seng and Shanghai Comp were mixed as the former spearheaded the advances in the region with the help of developers, energy stocks and financials, while the mainland was lacklustre ahead of the latest Chinese activity data on Saturday and the four-day weekend closure.

NOTABLE ASIA-PAC HEADLINES

- China's top legislative body approves draft proposal to raise retirement age, via Xinhua; China will raise retirement age of men to 63 (prev. 60) and female to 55-58 (prev. 50-55)