After the BoJ's malarkey overnight, it was Europe's turn to make economic headlines this morning and sure enough it did not disappoint (well it did, but vol traders were excited).

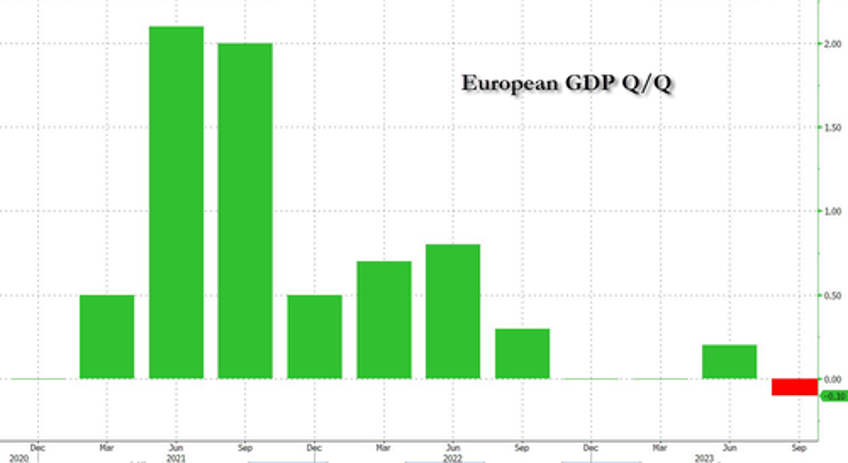

In the third quarter the Eurozone economy contracted by 0.1% compared to the second quarter, below expectations of 0.0%. This is the first decline since Q2 2020 (amid the COVID lockdowns).

There is wide dispersion in the growth figures published so far for individual member states, ranging from -2.5% q/q in Lithuania to +0.5% q/q in Belgium.

Among the largest member states, Spain (+0.3% q/q) and France (+0.1 q/q) managed to grow, while Europe’s biggest weak spot is also its largest economy, Germany, which revealed Monday that output shrank by 0.1% in the third quarter.

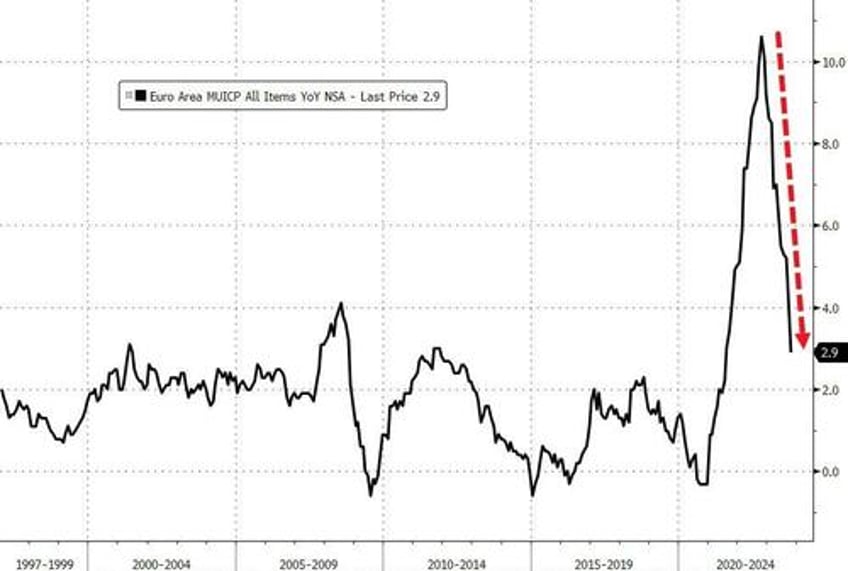

Additionally, Euro-area inflation eased to its lowest level in more than two years as the bloc’s economy shrank following an unprecedented ramp-up in interest rates.

Consumer prices rose 2.9% in October - down from the previous month’s 4.3% and better than the 3.1% median estimate in a Bloomberg survey analysts.

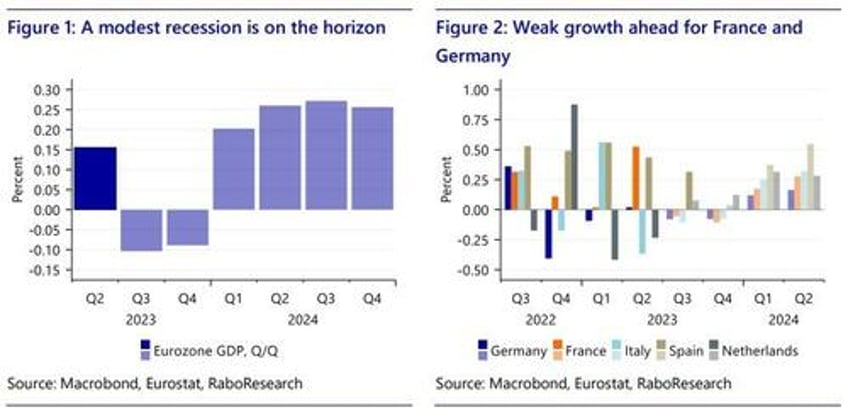

Rabobank economists wrote in a note this morning after the data that they believe the Eurozone will enter a mild recession, followed by a period of sluggish growth.

Although it is rather difficult to precisely estimate the exact effect, undoubtedly, higher interest costs should put a lid on growth. Meanwhile, the labour market will likely loosen somewhat, but we expect that it remains structurally tight.

This both puts a floor under an economic contraction (since consumers can uphold their consumption) and a lid on economic growth as companies struggle to find qualified workers.

Foreign demand is unlikely to be able to substantially lift the Eurozone growth figure, as we expect a struggling Chinese economy and a US recession in 23Q4-24Q1.

However, they warn that there are some serious risks to this rather benign outlook :

The most obvious one being a further escalation of the war in the Middle-East, which could lead to seriously higher energy prices.

The economic impact of higher energy prices could be bigger than it was last time around. Governments no longer have the same fiscal firepower to cushion the blow, due to the increased cost of borrowing, whilst at the same time most consumers can’t rely anymore on a glut of pandemic savings. Indeed, in most countries, household savings adjusted for inflation are close to their pre-pandemic level.

Meanwhile, companies are also in a worse position to handle a new energy price shock. They already face (or are about to face) significantly higher financing costs and increasing labour costs, whilst the slowing economy likely means that they can’t fully charge those higher costs to their customers.

The economic price of a renewed energy shock could therefore be larger.

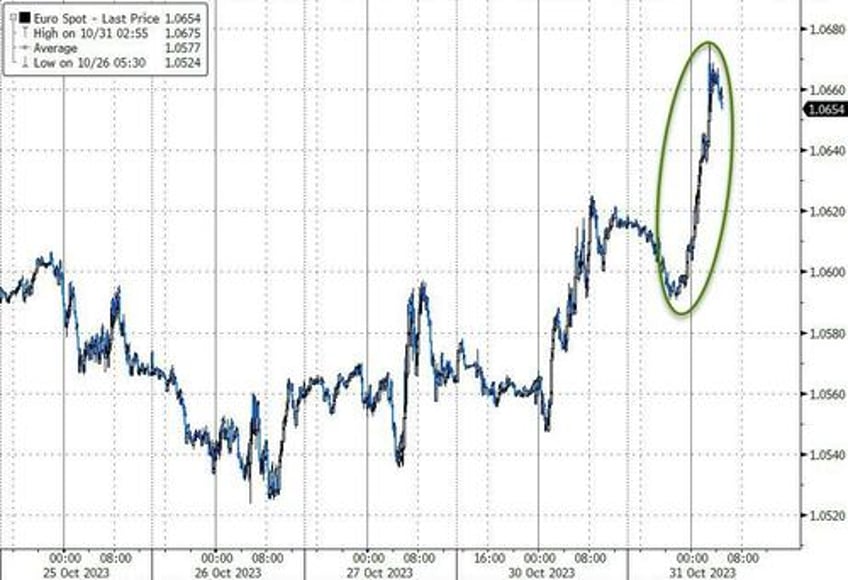

The GDP reading stands in stark contrast to the US, which last week reported bumper growth between July and September, while also managing to bring down inflation, but after all that... the euro is rallying against the dollar...

Source: Bloomberg

Why is the euro rallying?

Bloomberg's Simon White has some thoughts.

GDP disappointed slightly to the downside, as did CPI, although expectations were skewed to the downside by softer-than-expected German inflation data on Monday.

GDP and especially CPI, though, are lagging economic indicators, and give us little insight about what is going to happen.

Leading data for inflation and growth have shown nascent signs of turning higher in Europe, which would indicate a re-acceleration in inflation and less negative economic growth than is currently anticipated.

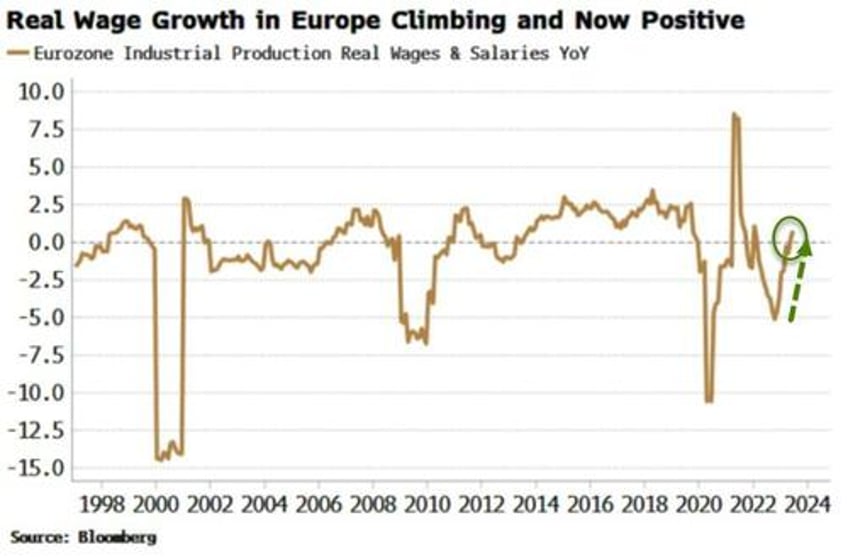

On top of that, the ECB will be concerned about wage growth, which in real terms is positive and rising quickly.

Euribor futures are basically unchanged after the data, which makes sense given it is only telling us what has already happened. But the cuts priced in for next year are looking vulnerable if leading data maintains its momentum.

Simply put, leading data (not the lagging data released today) for the eurozone showed early signs of stickier inflation and a stabilization in the economic outlook. If sustained, that would mean market expectations for a rate cut by June are premature.