By Benjamin Picton, Senior Macro Strategist at Rabobank

Bumps and Potholes

UK Q1 GDP surprised to the upside at the end of last week to print at +0.6%, rather than the more modest 0.4% that market economists had been expecting. That means that Britain is officially out of recession. Perhaps even more importantly for Prime Minister Rishi Sunak, GDP per capita grew for the first time in two years and the Governor of the Bank of England has been talking about rate cuts. The FT reports that corporate takeover activity for UK companies has hit the highest level since 2018 as international capital managers realise that UK stocks are comparatively cheap. Suddenly, everything is coming up Rishi, but that’s unlikely to save him from an electoral drubbing later in the year.

Of course, faster economic growth can in some ways be a double-edged sword. If the economy is turning over more quickly, it raises questions about inflationary pressures – which might delay those rate cuts that Governor Bailey was hinting at. In the case of the UK this might not be an issue because the stronger GDP result was driven by fixed capital formation – suggesting that businesses are investing to raise the speed limit of the economy – while households seem to have taken Huw Pill’s advice to accept that they are poorer and kept a lid on their own spending.

Over in Canada it might be a different story. Labour market figures for April showed employment growth of 90,000 in the month. That’s a mighty bounce back from the loss of 2,200 jobs in March, and well above the consensus estimate of +20,000 jobs. The unemployment rate duly fell (despite a 1-tick climb in the participation rate) to a still high 6.1%, and hourly wages growth also came in firmer than expected at 4.8% y-o-y (albeit down on March’s 5% figure).

Consequently, the 65% probability of a June rate cut that the OIS futures were suggesting last Thursday has suddenly fallen to a 45% probability. The market is still fully-priced for a cut by July, but only just.

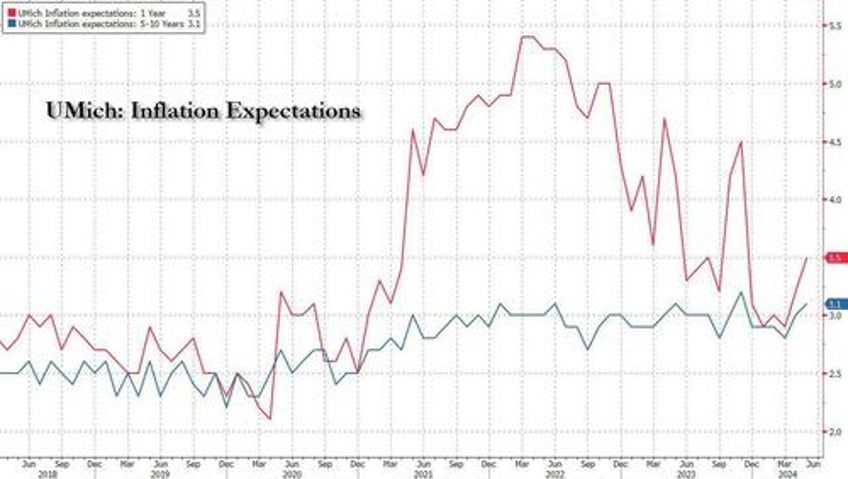

There were further bumps in the road for the global crusade against inflation last Friday when the latest iteration of the University of Michigan consumer sentiment report was released. Consumer confidence dropped like a rock, all the way from 77.2 in April to 67.4 in May. Both ‘current conditions’ and ‘future expectations’ looked grim, which perhaps suggests a “plague on both your houses” attitude to the two leading contenders for the Presidency. Crucially, 1-year inflation expectations leapt from 3.2% to 3.5%, and 5-10 year expectations (generally a low volatility number) edged higher from 3% to 3.1%. Even if Jerome Powell “can’t see the stag and can’t see the flation”, it appears that consumers can.

Powell is scheduled to speak tomorrow, but the timing presents a few potential landmines for the Fed Chief. Powell’s remarks will come after the release of April PPI figures, but ahead of the CPI report. CPI is likely to be the key point of interest for financial markets this week, but there’s also the not-insignificant issue of big new tariffs on Chinese EVs (amongst other things) expected to be announced tomorrow. The CPI numbers are expected to print at +0.4% m-o-m, as they did in March. Unfortunately, 0.4% m-o-m is incompatible with 2% annual inflation, so Powell might still be a little cagey on there whereabouts of the stag and the ‘flation.

Japan, China and Australia have lately thrown up some potholes in the road back to at-target inflation. Japanese March labour cash earning figures reported last week showed year-on-year growth of less than half the expected number. China PPI slipped further into deflation at -2.5% in April (although CPI nudged up slightly to 0.3%) and aggregate financing actually fell for the first time since 2005.

China’s housing woes are clearly ongoing, and it appears that this has started to worry Xi Jinping, who is reportedly looking at ways to protect state-owned developers that may also help to staunch the balance sheet recession being experienced by Chinese households. The long-awaited stimulus bazooka might be on the way (of sorts), but almost certainly not for private sector developers who might be too close to decadent Western-style capitalists for Xi’s liking.

The fortunes of Chinese real estate developers are of particular interest to Australia, since bulk commodities used in the production of steel and concrete (iron ore, coking coal) sit atop the list of Australia’s major exports.

The Australian Government will deliver a budget tomorrow night - Treasurer Jim Chalmers’ third, and likely his second successive surplus. The now traditional pre-budget leaks to the media suggest a more growth-oriented fiscal impulse which would ordinarily be a concern for the RBA - who inexplicably maintained their neutral outlook on interest rates last week, despite big upward revisions in their inflation forecasts and downward revisions to unemployment forecasts.

One suspects that the RBA dead-batted the strong Q1 inflation print of a week earlier with the benefit of advance warning from Treasury that budget initiatives would substantially reduce measured CPI. Treasury is reportedly expecting CPI to be back below 3% by the end of the year as new subsidies for electricity bills, rent assistance and childcare shift the burden of payment from households to government. Those increased subsidies will mechanically reduce measured CPI, but they won’t reduce underlying cost pressures, which will instead be paid through the tax system. Happily, the budget will also include income tax cuts.

So, there have been a few bumps to inflation here, and a few unanticipated drops there. Ultimately the US CPI report will be the main game of the week as markets look for continued signs of an upward trend in price pressures.