Exxon Mobil, which will soon be the largest and most important energy company in the US after it closes its acquisition of Pioneer, reported solid Q3 earnings that beat revenue expectations, boosted dividends more than expected and posted a surprise cash flow increase, reaping the benefits of strengthening crude prices and strong US oil-refining margins.

Here is what the company reported for Q3:

- Total revenues & other income $90.76 billion, beating estimates $88.81 billion

- Adjusted EPS $2.27 vs. $4.45 y/y, missing estimates of $2.37

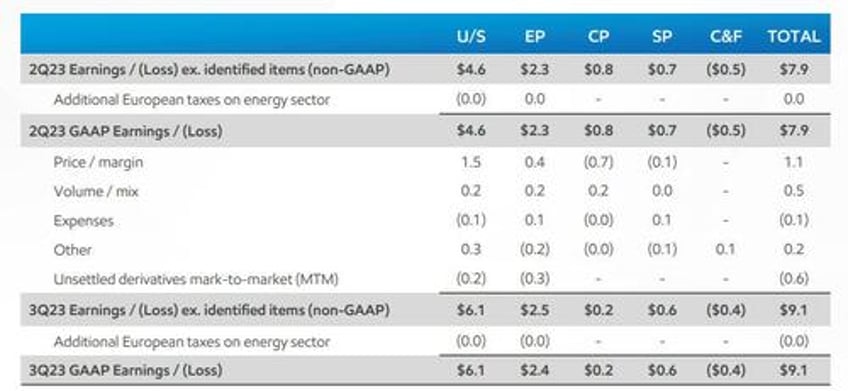

- Total Q3 earnings: $9.1BN, up $1.2BN from Q2

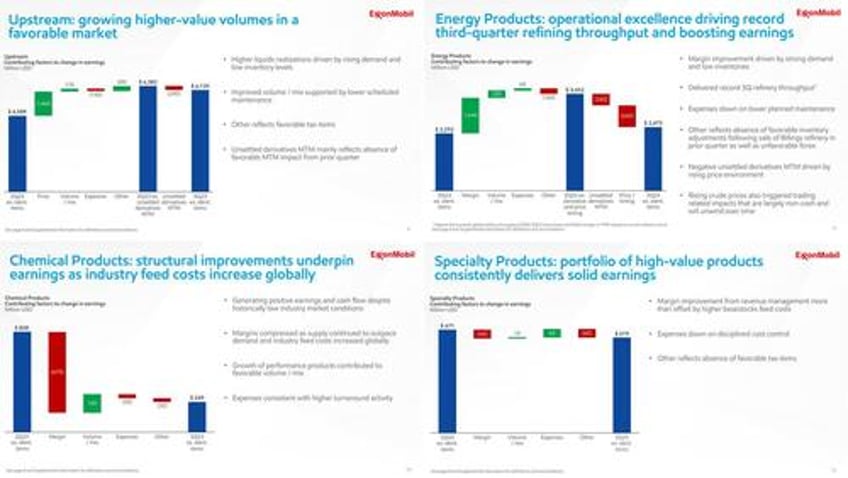

- Upstream adjusted net income $6.14 billion, -48% y/y, beating estimates of $6.07 billion

- Energy products adjusted net income $5.55 billion, +0.3% y/y, beating estimates of $3.12 billion (2 estimates)

- Chemical products adjusted net income $249 million, -69% y/y, missing estimates of $377.8 million

- Specialty products adjusted net income $619 million, -19% y/y, beating estimates of $588.2 million

- Chemical prime product sales 5,108 kt

- Production 3,688 KOEBD, estimate 3,720

- Crude oil, NGL, bitumen and synthetic oil production 2,397 KBD, estimate 2,420

- Refinery throughput 4,215 KBD, estimate 4,240

Earnings by division beat expectations in 3 out of 4, with the exception of chemical products where net income dropped 69% to $249MM due to a sharp compression in margins "as supply continued to outpace demand and industry feed costs increased globally."

Relative to Goldman's estimates, US/International E&P came in above, whereas US R&M and International Chemicals came in below. Worldwide production came in at 3,688 MBOE/d vs GS exp at 3,710 MBOE/d and FactSet consensus at 3,707 MBOE/d, with US liquids/gas lower vs Goldman's estimates on the quarter.

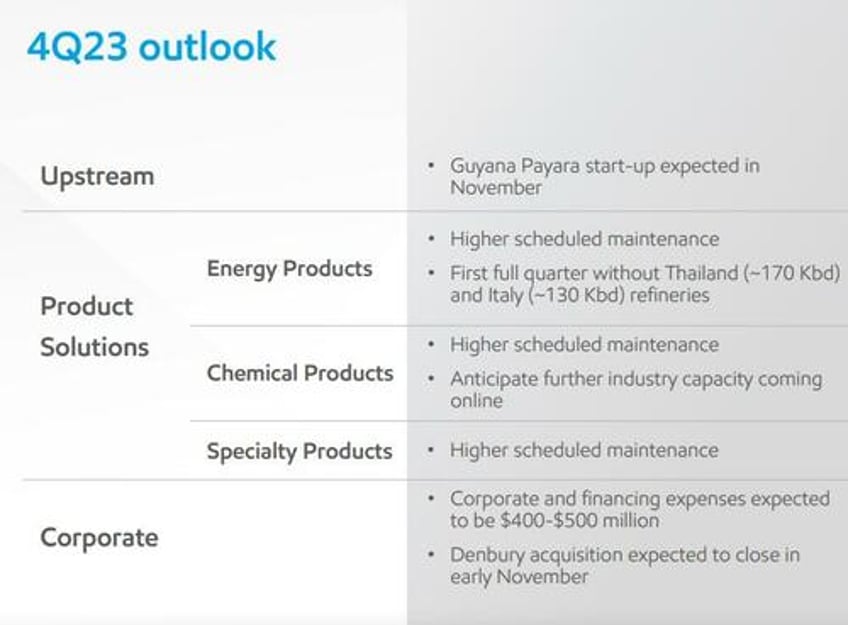

Needless to say, Exxon's Q4 outlook by segment was quite rosy.

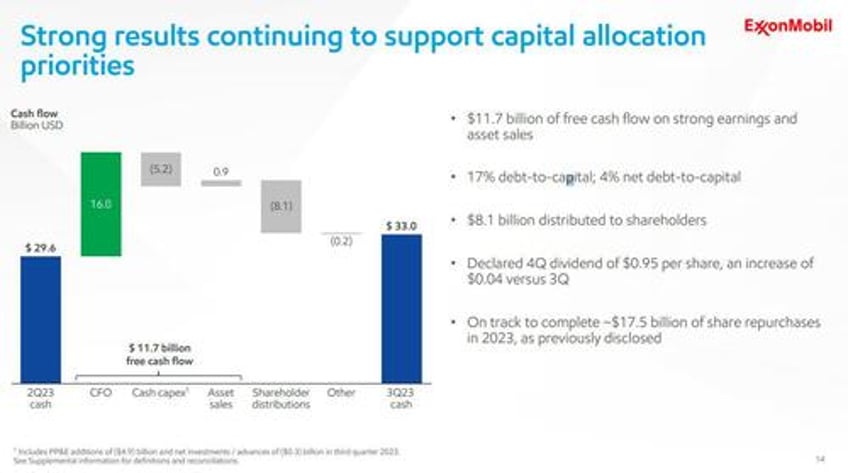

While the top and bottom line results were mixed, where there was no weakness at all was in the company's cash flow, which came in far stronger than expected, at $16.0 billion, and up $6.6 billion versus the second quarter. And in keeping with the senile president's claim that it makes "more money than god", in Q3, XOM free cash flow more than doubled from the prior period to $11.7 billion, far in excess of the $9.36 billion estimate. The company said that “strong earnings drove cash flow from operations of $16.0 billion and free cash flow of $11.7 billion, an increase of $6.6 billion and $6.7 billion respectively versus the second quarter.”

After $5.2BN in CapEx and distributing $8.1BN to shareholders in Q3, Exxon was left with $33 billion in cash, a level which it said it would stick with to offset future commodity crises (it has learned well from the 2020 debacle not to expect any bailouts from the progressive communists in government).

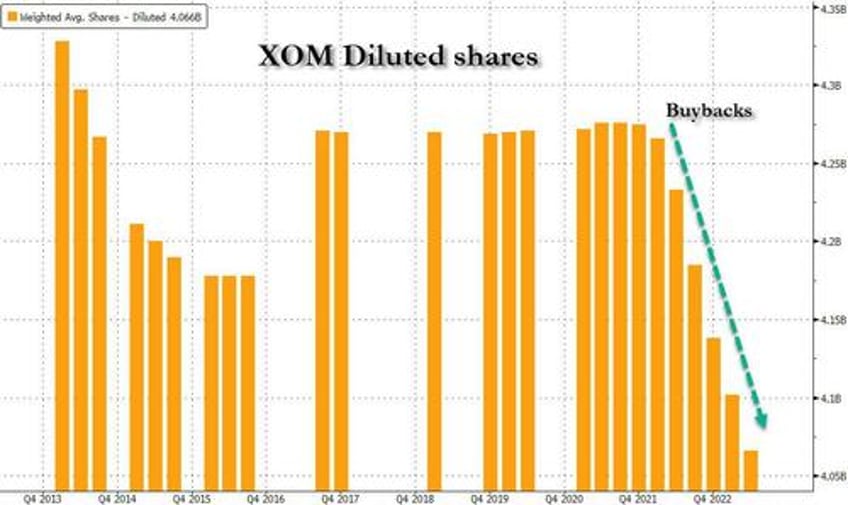

A closer look at the company's shareholder distributions revealed that it is on track to complete $17.5 billion of share repurchases in 2023, further shrinking its shares outstanding...

... while in a surprise announcement, XOM hiked its quarterly dividend to 95 cents a share, payable on Dec. 11, a penny higher than the Bloomberg Dividend Forecast.

Next, turning to CapEx, Exxon said that "capital and exploration expenditures were $6.0 billion in the third quarter, bringing year-to-date 2023 expenditures to $18.6 billion.” And looking ahead, Exxon sees capital expenditure toward the "high end" of the previously noted 23BN-$25BN range, vs the estimate of $21.89 billion.

A look at the company's Q4 outlook reveals that it sees corporate and financing expenses next quarter at $400-$500 million, while the permian is on track to deliver 10% year-on-year growth.

As expected, days after announcing the biggest deal since its merger with Mobil, Exxon CEO Darren Woods had some more comments on the coming combination with shale giant Pioneer:

“Pioneer will help us grow supply to meet the world’s energy needs with lower carbon intensity while Denbury improves our competitive position to economically reduce emissions in hard-to-decarbonize industries”

“The two transactions we’ve announced further underscore our ongoing commitment to the ‘and’ equation by continuing to meet the world’s needs for energy and essential products while reducing emissions”

Separately, Exxon said it has achieved $9.0 billion of cumulative structural cost savings versus 2019, ahead of schedule, with further savings expected by year-end.”

Exxon is also on track to close the Denbury acquisition in early November, while the Guyana Payara start-up is expected in November.

In an interview with Bloomberg, CFO Kathy Mikells said that Exxon is banking on investments in fossil-fuel projects that date back to the pandemic, combined with cost-reduction efforts to deliver shareholder value. Meanwhile, the landmark Pioneer deal will vault Exxon to the pinnacle of Permian Basin output, giving it unmatched ability to flex production depending on oil demand during the energy transition. Chevron’s agreement to buy Hess, meanwhile, will secure the company a 30% stake in Exxon’s fast-growing Guyana operation.

Investors’ feedback on the Pioneer deal has been “overwhelmingly positive,” Mikells said. “They completely understand the strategic fit and the strong synergies that we expect to be able to achieve from the transaction.”

It sure does, something which one can't say about its much lower quality competitor, Chevron, which - by one oil-industry metric known as cost-per-flowing-barrel - is paying a much higher price for Hess. Chief Executive Officer Mike Wirth has sought to ease investor concern about the high price for Hess by pledging to fatten dividends and buybacks. The combination will assuage concerns in some corners that Chevron is too reliant on just two regions — the Permian Basin and Kazakhstan — to meet future production targets.

After initially kneejerking higher, XOM stock has since resumed its drift lower as it was dragged by not only the far uglier CVX earnings, but because it is tracking the price of oil tick for tick, and despite the US attacking Iran proxies in Syria overnight, some idiot algos once again expect the worst middle east war in 50 years to be resolve quickly and efficiently with no futher fallout.

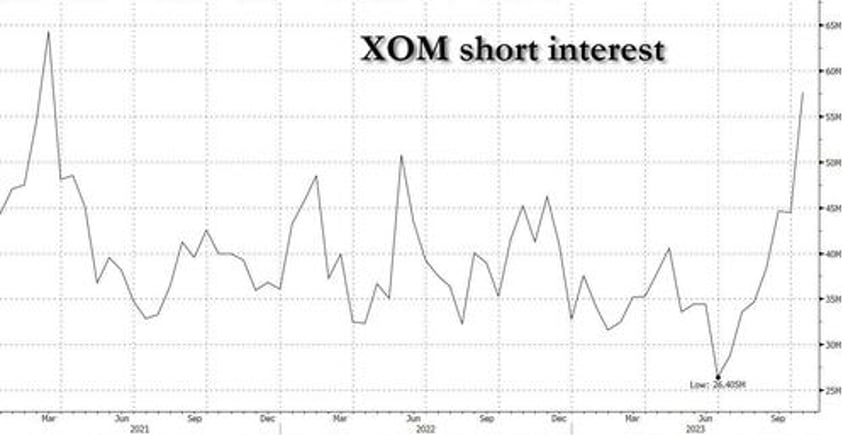

What is remarkable is that it appears that hedge funds have now picked Exxon as their preferred recession/de-escalation proxy and have boosted their shorting of the name to the highest level since oil was trading at half the current price. Good luck to them.

For the conference call, we expect the company to focus on (a) additional color on the recently announced PXD transaction, (b) update on structural cost savings efforts, (c) real-time product demand commentary, (d) Chemicals earnings expectations and (e) Upstream production outlook

The full XOM earnings presentation is below (pdf link).