By Wes Goodman, Bloomberg Markets Live reporter and strategist

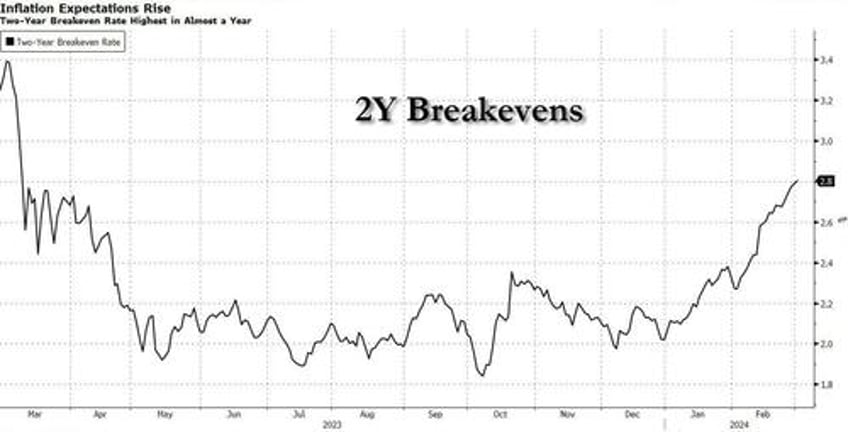

The US two-year breakeven rate is showing an eye-popping increase and will put upward pressure on yields.

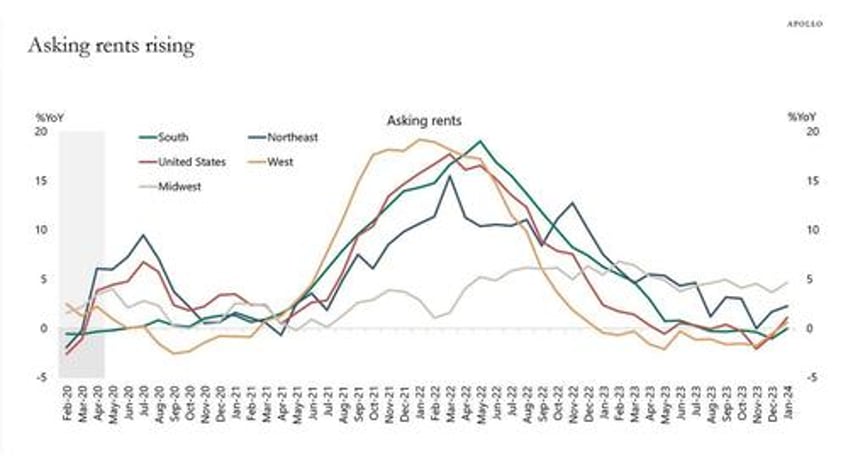

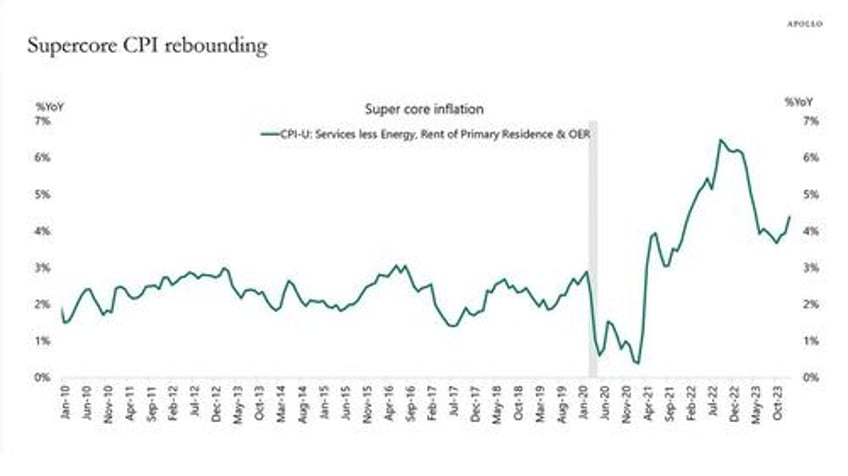

Inflation expectations are climbing as the Fed’s fight against rising prices seems to be sputtering. The latest warning for bond investors came from Apollo Management Chief Economist Torsten Slok, who said that a re-accelerating US economy, coupled with a rise in underlying inflation, will prevent the Federal Reserve from cutting interest rates in 2024.

The numbers tell the tale of a Fed battle against inflation that has yet to be won. Core PCE is the highest in almost a year. CPI and PPI both beat expectations.

All of this comes at a time when breakeven rates and yields are moving together more. This signals breakevens are asserting more influence on yields. The chart below shows the 30-day correlation between two-year breakeven rates and two-year yields is rising.

Bloomberg’s Correlation Finder shows that two-year breakeven rates are also moving largely in line with five- and 10-year yields, suggesting rising inflation expectations have the potential to buoy yields across maturities.

My theory is being put to the test today because Treasury yields are falling. Still, it’s worth keeping these risks in mind. The most potent warning from these breakevens came after they rose in 2019, 2020 and 2021. The Bloomberg US Treasury Total Return Index went on to tumble a stunning 12% in 2022, its biggest loss based on Bloomberg data going back to 1974 –- the year President Richard Nixon resigned and I turned 10 years old.