The cost-of-living squeeze is crushing low-income consumers, so much that Goldman's top consumer trader, Scott Feiler, recently pointed out that his desk is "getting bearish on consumer and our soft landing basket." Days ago, Goldman analysts led by Bonnie Herzog provided clients with a fascinating list of corporate America's warnings about mounting cracks materializing in the consumer space.

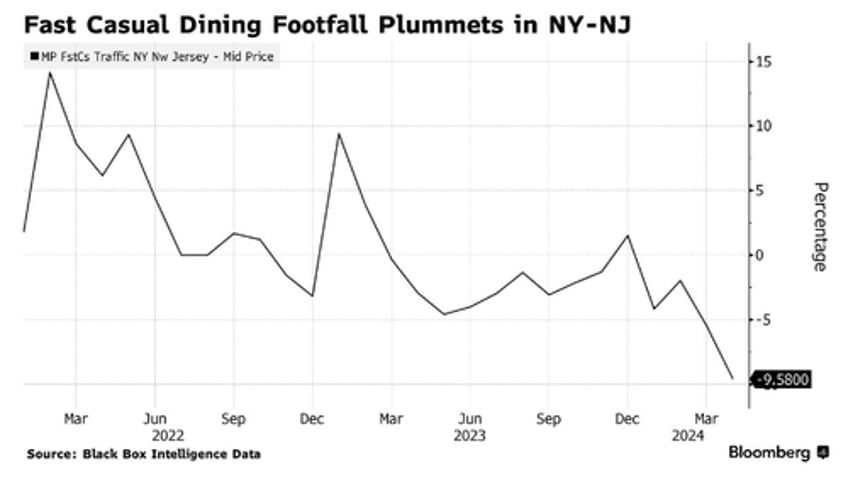

A Bloomberg report, citing new data from research firm Black Box Intelligence, continues the theme of the low-income consumer under severe financial stress. This data shows that fast-casual dining foot traffic across New York and New Jersey has abruptly plunged into early spring.

The slide in foot traffic comes as Red Lobster is considering a bankruptcy filing, and TGI Friday's is in distress, closing stores and working with Guggenheim Partners to address its debt problem as sales decline.

Moody's Ratings wrote in a report last week that rising menu prices have slowed fast-casual sales as the working poor ditch restaurants for food at home.

Dennis Cantalupo, chief executive officer of credit-rating and consulting shop Pulse Ratings, said restaurant chains relying on that demographic "are feeling it the most.'

Cantalupo warned operators are concerned about a more prolonged slump since price-conscious consumers are eating at home.

The big takeaway here is that working-poor consumers are pulling back on restaurant spending as pandemic excess savings have been depleted and credit card debt has hit insurmountable levels, just to survive the era of failed Bidenomics.