The February jobs report is due at 8:30am ET on Friday morning. Coming at a time when suddenly markets are freaking out about an imminent recession (one which Trump himself would welcome as he would blame Biden, and get a fresh start), the odds of a sharp downside surprise are far higher than a right-tail outcome, although an inline number is also likely after last month's dismal report. Here is what Wall Street expets.

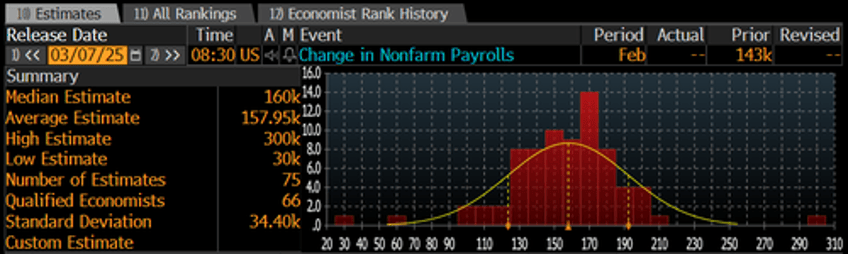

- The February NFP is expected to show 160k nonfarm payrolls were added to the US economy last month, up from Januaryʼs 143k, which was likely hit by weather conditions)

- The January release also saw upward revisions to the November and December data, sending the three month average higher (current 3mth avg. of 237k, 6mth avg. of 178k, and 12mth avg. of 168k).

- Capital Economics says that survey indicators point to February being a weak month for payrolls growth, noting that S&P Globalʼs composite employment index (in the PMI data) dropped below the 50 “no change” mark for the first time in three months, and the NFIB hiring intentions indicator edged down in January (though CapEco sees some rebound in weather-sensitive sectors).

- The median estimate is 143K, with the range from 30K on the low side (from High Frequency Economics) to 300K on the high side (from Landesbank).

- Goldman estimates nonfarm payrolls rose by 170k in February, slightly above consensus of +160k but below the three-month average of +237k. According to the bank, alternative measures of employment growth indicated a "firm pace of job creation, and we expect continued, albeit moderating, contributions from catch-up hiring and the recent surge in immigration." Goldman also expects a limited drag of 10k from the combined reduction in force actions of the federal government, consisting of layoffs, a hiring freeze, and a deferred resignation program. Finally, the bank expects the net impact of the winter weather - lower temperatures but less snowfall than usual - on job growth to be roughly neutral after exerting a 60k drag in January.