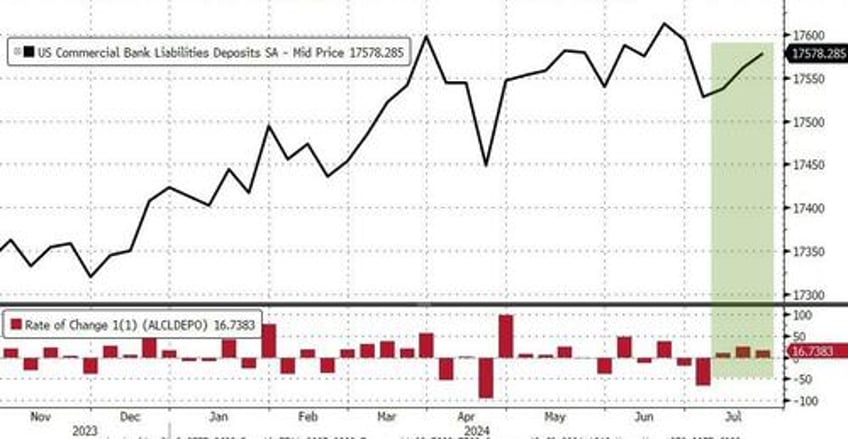

For the third straight week, US bank total deposits rose last week (+$16.7BN) on a seasonally-adjusted basis...

Source: Bloomberg

Meanwhile, on a non-seasonally-adjusted basis, US bank total deposits dropped (for the third straight week) by $55.7BN (back near two-month lows)...

Source: Bloomberg

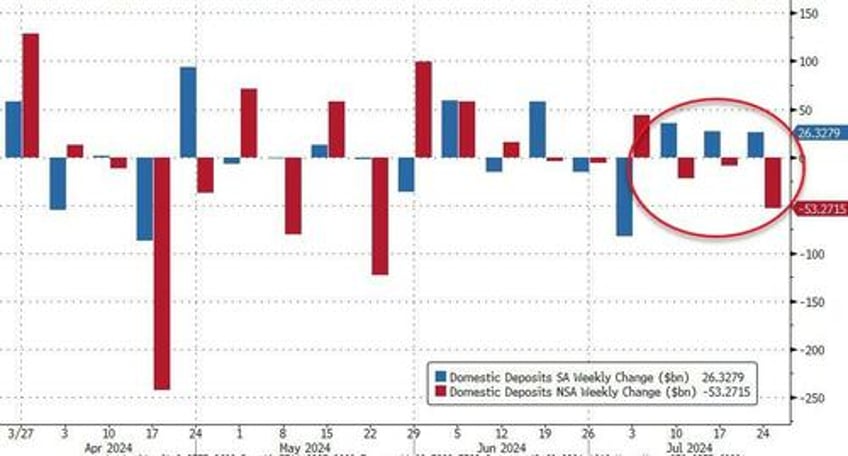

And that means, excluding foreign deposits, we have a third straight week of domestic deposit inflows (SA) and outflows (NSA). Last week saw $53BN in NSA outflows (large bank -$54BN, small bank +$1BN) morphed into $26BN of SA inflows (large bank +$11BN, small bank +15BN)...

Source: Bloomberg

Over the last three weeks, domestic deposits have risen $89BN (SA) or fallen $84BN (NSA)...

Source: Bloomberg

Obviously, given our lack of PhD-ness, we could not possible question the reality of either of these streams of data - but $173BN difference in three weeks seems like a lot to us simple folk.

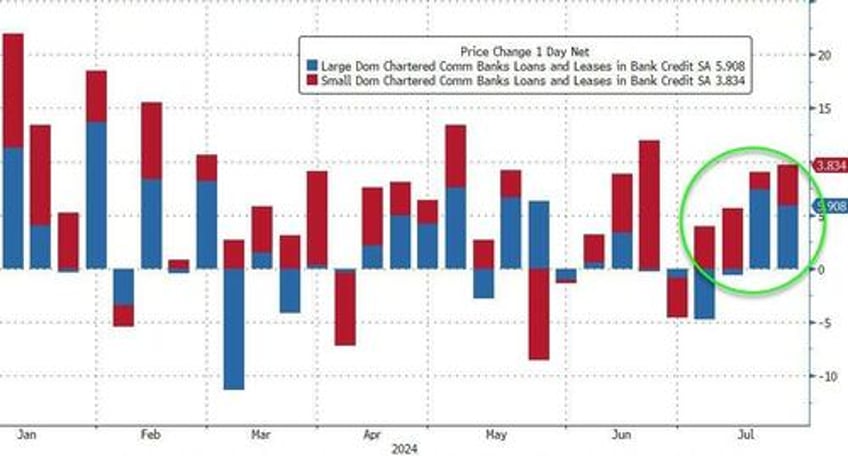

Loan volumes increased for the fourth straight week...

Source: Bloomberg

Finally, we note that US equity market caps are starting to decline...

Source: Bloomberg

How far will they be allowed to decline before The Fed steps in with some liquidity boost?