Money-market fund total assets rose last week (+9.6BN) back to record highs ($6.15TN) as stocks tanked...

Source: Bloomberg

In a breakdown for the period to July 17, government funds - which invest primarily in securities such as Treasury bills, repurchase agreements and agency debt - saw assets rise to $4.96 trillion, a $6.83 billion increase.

Prime funds, which tend to invest in higher-risk assets such as commercial paper, saw assets rise to $1.06 trillion, a $4.66 billion increase.

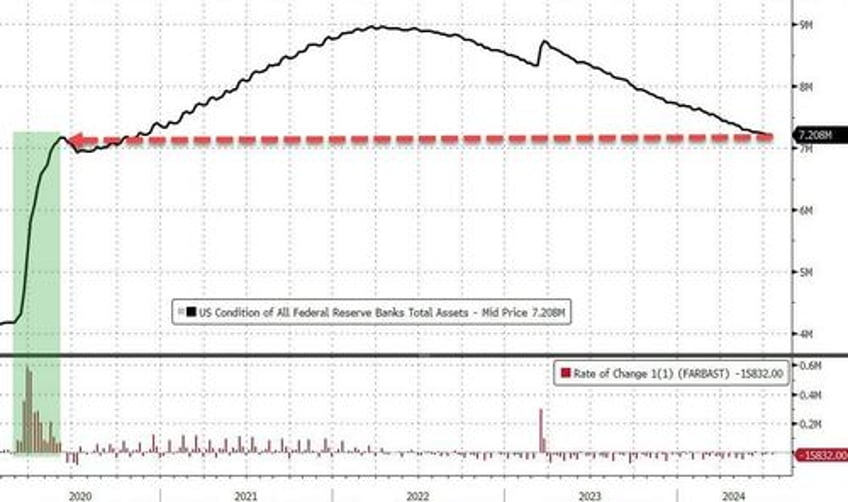

The Fed's balance sheet shrank modestly once again, to an interesting level...

Source: Bloomberg

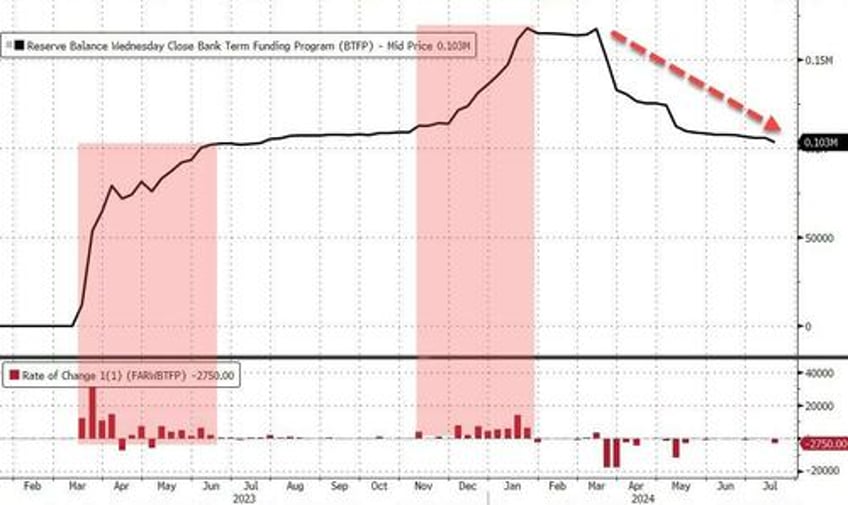

...with utilization of the bank bailout scheme actually dropping $2.75BN to $103BN... still quite a chunk for banks to roll at some point when their 12-month loans expire...

Source: Bloomberg

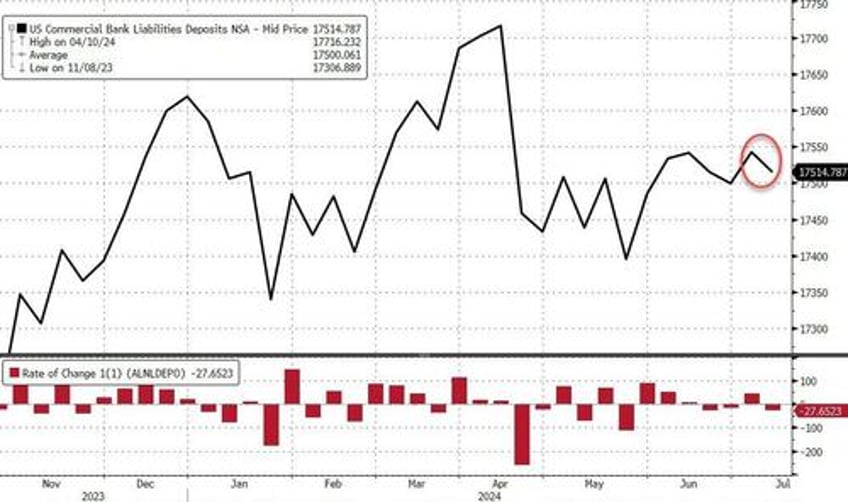

After last week's plunge, total US bank deposits (SA) rose a modest $9BN...

Source: Bloomberg

But, as we have grown accustomed to, on an NSA basis banks saw $27.6BN in outflows from deposits last week...

Source: Bloomberg

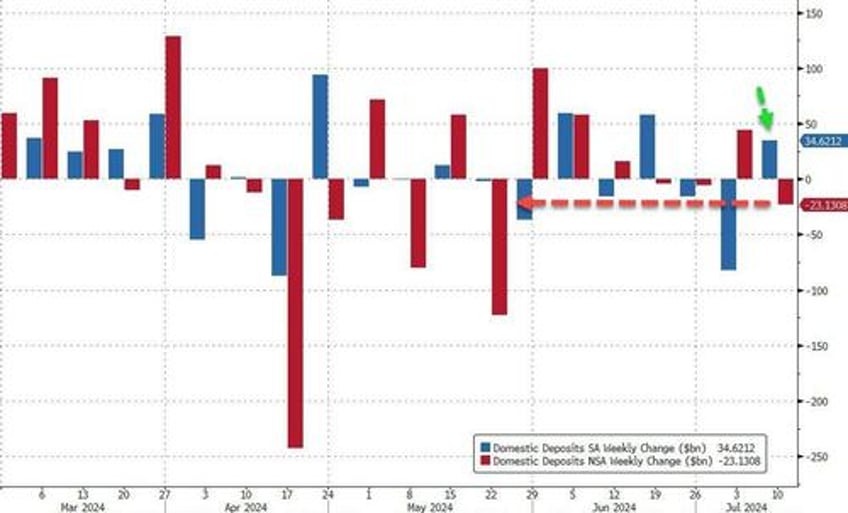

Which meant that, excluding foreign deposits, The Fed's magic turned a $23BN deposit outflow (NSA) into a $34.5BN deposit inflow (SA)...

Source: Bloomberg

Breaking that down, on an SA basis, large banks saw a $35BN surge in deposits with small banks a modest $0.5BN outflow. However, on an NSA basis both large (-$13.6BN) and small banks (-$9.4BN) saw sizable outflows.

This was all to the week-ending 7/10 - so before the equity market carnage began.

Loan volume rose overall during that week, thanks to a surge of $6.6BN from small banks (large bank saw volume shrink $0.6BN). Large bank loan volumes are down for four straight weeks...

Source: Bloomberg

Finally, US equity market cap may have started to catch back down to the reality of its tight historical relationship with bank reserves at The Fed...

Source: Bloomberg

...but it may be a little soon to call that.