The market continues to anticipate a benign inflation outcome, but price growth is becoming ingrained and CPI is poised to begin rising again. Still, markets are able to ignore the inflation elephant in the room for now as central-bank reserve-based liquidity keeps rising, despite ongoing quantitative tightening.

Inflation is becoming like the guest at a dinner party who just won’t leave. Tuesday’s data shows that it is getting at least one more drink, and may yet try to stay the night. The market’s attitude, however, is becoming one of avoidance – if you ignore inflation, hopefully it’ll just go away.

Certainly the early reluctance after the data to move yields higher, and stocks’ resilience give that impression. But price-growth is likely to prove much more stubborn, and assets are not priced for such an outcome.

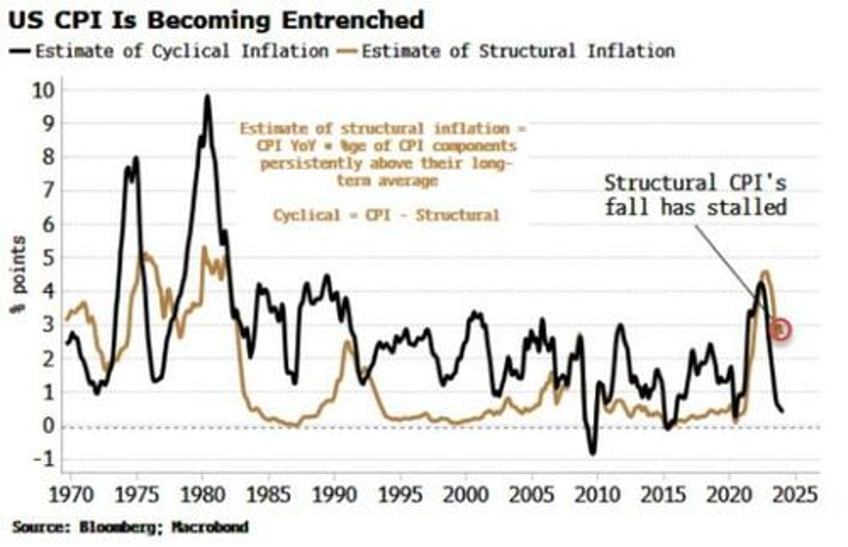

Underneath the surface, US CPI is becoming embedded. The chart below shows structural CPI – defined as the index components which are persistently above their long-term average – and cyclical CPI, which is all the components not counted as structural. As we can see, most of the fall in headline CPI has been driven by cyclical CPI, while the fall in structural CPI has stalled at an elevated level.

Cyclical CPI might keep falling, but it has only very rarely been lower than it is now, and anyway its pace of descent looks to be easing. The risk is rising that it starts to climb again, reinforcing still-elevated structural CPI, and taking headline higher again.

There are a raft of signs that cyclical inflation forces are turning higher again. Profit margins, supply constraints and an incipient recovery in China (discussed here) are all moving in an inflationary direction.

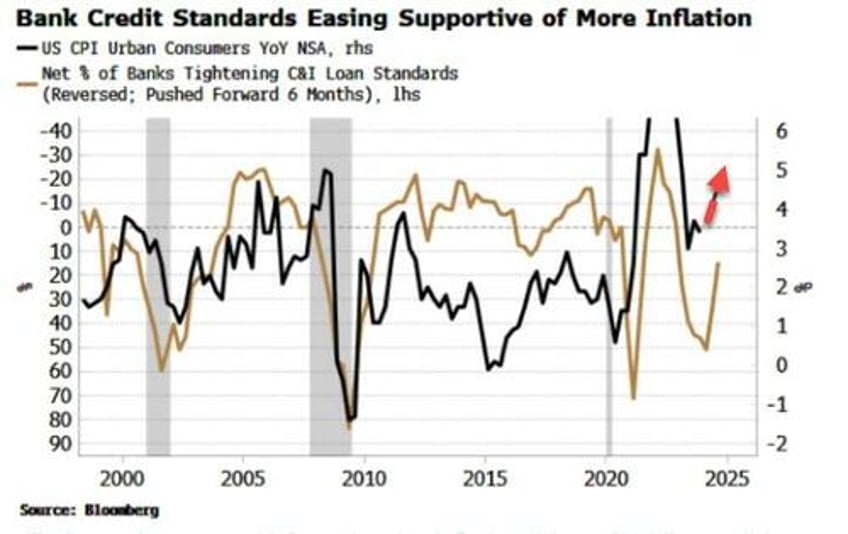

There are other clues too, such as banks re-easing credit standards (perhaps faster than most thought after SVB’s self-immolation), which points to a turn in CPI.

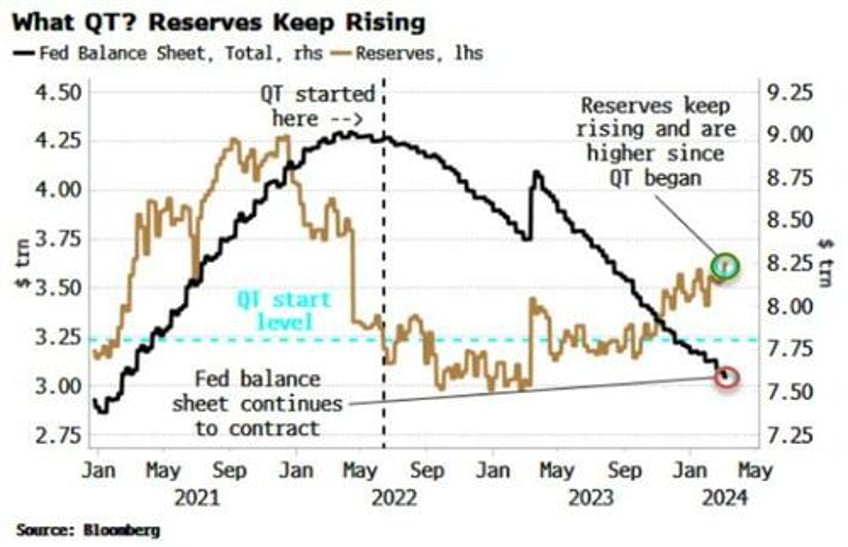

Still, the market can avoid these dawning inflation risks as liquidity conditions continue to be asset friendly. Despite ongoing QT and Fed balance-sheet contraction, reserves in the system keep rising.

That’s been a great support for risk assets. But it’s likely to hit some turbulence in the coming months. The reverse repo facility (RRP) continues to fall. Moreover, tax receipts will soon pick up, boosting the Treasury’s account at the Fed (the TGA) and depleting reserves, while the Treasury could soon start slowing the pace of T-bill issuance.

All told, it may soon be much harder for the market to pretend inflation is about to call a taxi and leave everyone in peace.