Retail sales data today further chiseled away at the odds of a March rate-cut, but the chance of reductions in subsequent meetings is likely to commensurately rise, and thus flatten e.g. the April versus May spread in fed funds futures.

“Who knows best?” is being played out again between markets and the Federal Reserve.

The market is of the (weighted-average) view that rate cuts – six of them – will be required this year.

The Fed, at least going by Board of Governors member Christopher Waller in a speech on Tuesday, is not yet convinced. He stressed there is no reason to move as quickly or cut as rapidly as in the past.

The market reluctantly knocked a couple of basis points off the pricing for a March rate cut, but leaving the probability still at 60-65%. About six bps were knocked off expected cuts through the whole of 2024.

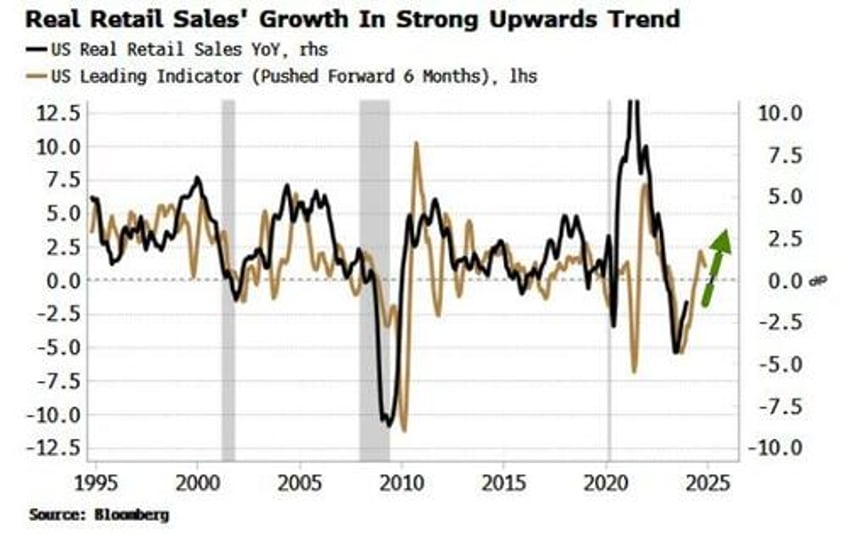

Retail sales in the US have been buoyant in recent months, exceeding many expectations as pandemic savings were estimated to have been depleted by now (for those with a propensity to spend).

Short-term leading data anticipates that real retail-sales growth should continue to rise...

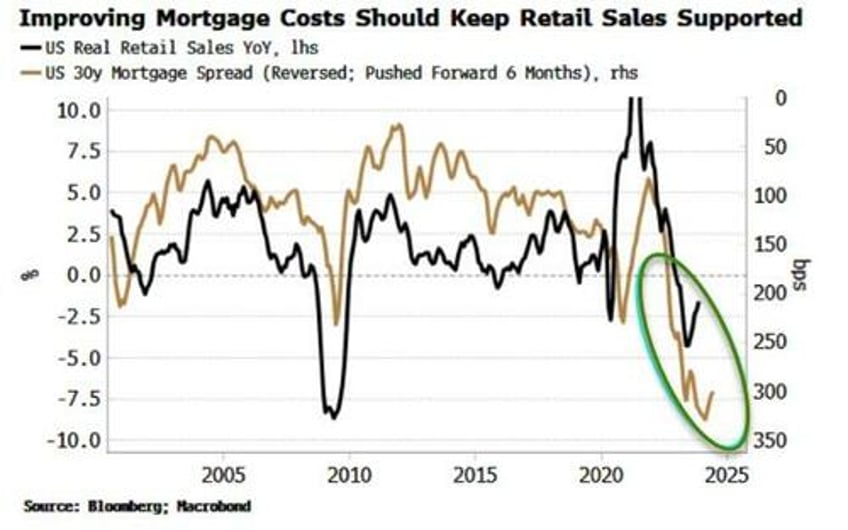

...while other data that was hitherto negative for consumption, such as homebuyer affordability and mortgage rates (see chart below), have inflected higher.

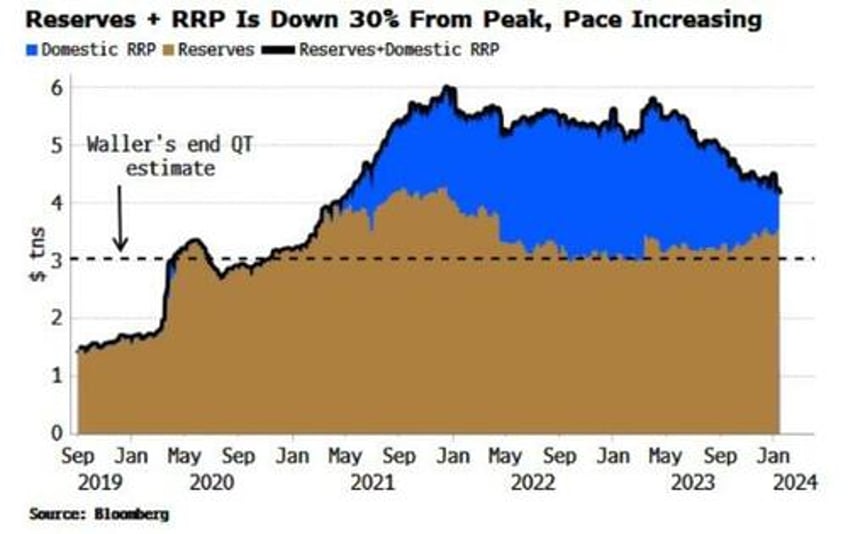

But the market is unlikely to give up on rate cuts so easily if perceived risks to financial stability are rising, which would be coherent with such a dovish outlook in the absence of a sudden deterioration in the economic data. Banks are bringing forward their tapering and end dates for quantitative tightening, while the Fed’s reverse repo facility (RRP) continues to fall at an increasing rate.

The chart below shows the domestic RRP and reserves. The horizontal dashed line is the approximate upper-end of where Waller believes the endpoint is for QT, which he re-iterated in Tuesday’s speech as being about 10-11% of GDP.

No bank will want to run their reserves down to their so-called lowest comfortable level, preferring instead to keep a buffer.

As the system approaches the Waller target, perceived risks will rise, and buffers are likely to be increased.

Reserves could go from abundant to scarce very quickly.

Under this lens, the greater expectation of rate cuts is the market’s way of expressing that the risk outlook could quickly deteriorate.

Thus even if a March cut is largely priced out, a cut in the May meeting is likely to be more priced in.

As we noted yesterday, this should keep pressure on the April versus May fed funds spread (which was 24.5 bps on Tuesday and is 23 bps today).