Tl;dr: The Fed kept rates unchanged, as expected but the addition of one word is key:

“Tighter financial and credit conditions for households and businesses are likely to weigh on economic activity, hiring, and inflation.”

Is that The Fed sending a message to Janet Yellen: "stop spending like drunken sailors."

* * *

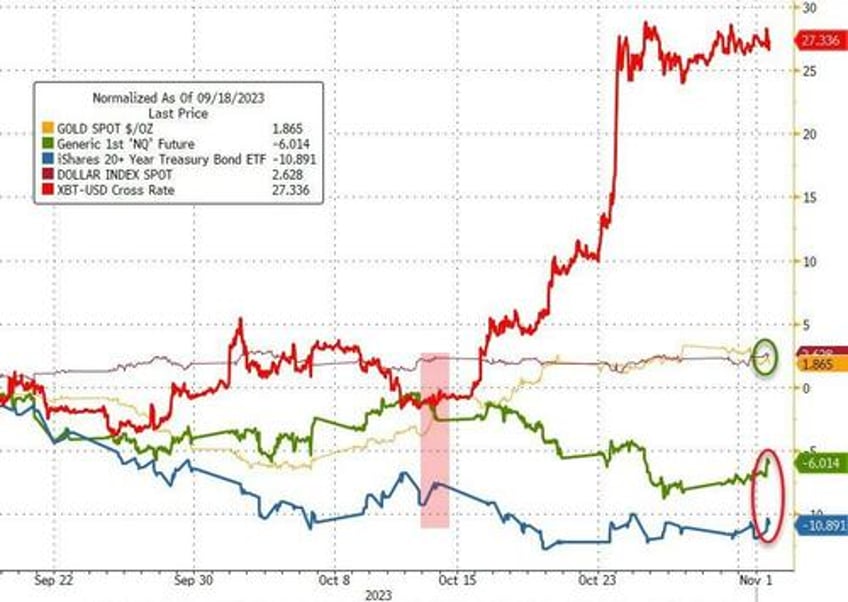

Since The Fed's last statement and press conference on September 20th, the market's movements (impacted by the ongoing chaos in Israel also) have been somewhat remarkable.

Bitcoin has soared higher, stocks and bonds (the latter worse than the former) have both been hammered as gold and the dollar have rallied in unison...

Source: Bloomberg

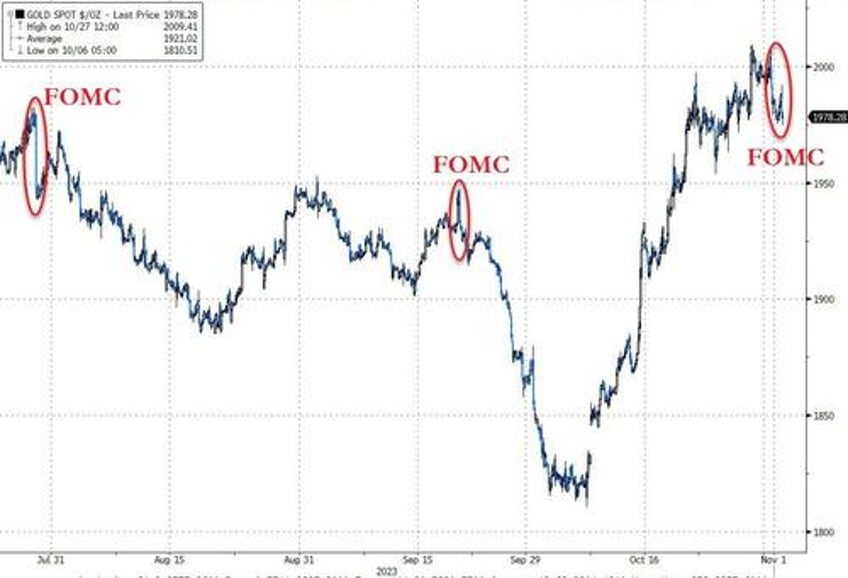

We note that Gold has been on quite a path in the last two months but is back - again - at around the same levels as it has been for the last two FOMC meetings...

Source: Bloomberg

Additionally, The Fed's jawboning of "higher for longer" is increasingly being accepted by the rates market as the SOFR spreads for Dec 2023-2024 and 2023-2025 have surged since the last FOMC...

Source: Bloomberg

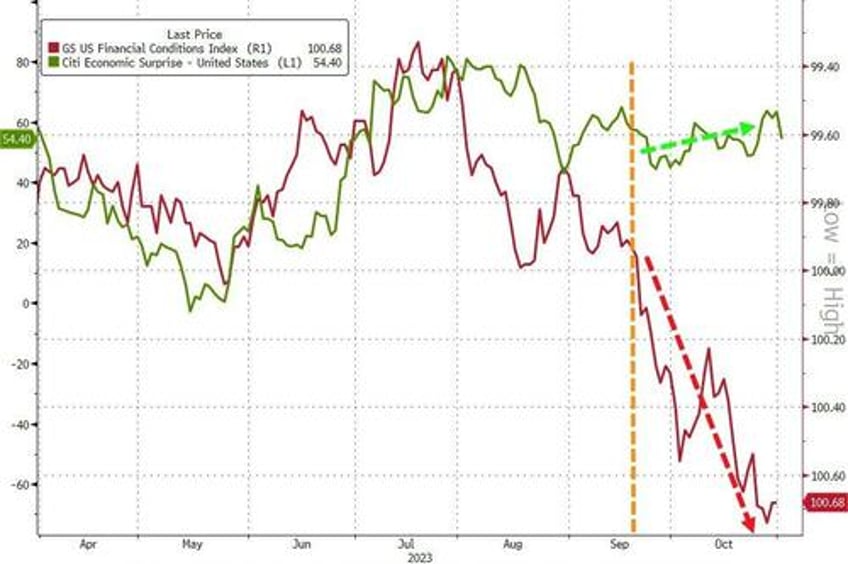

Of particular note, we have seen financial conditions tighten significantly since the last FOMC (while at the same time, macro surprise data has improved marginally - not fallen apart)...

Source: Bloomberg

Specifically, the period since the last FOMC brought some surprisingly strong readings on inflation and the economy more broadly. Here are some headline numbers:

Third-quarter GDP growth was a whopping 4.9%, higher than forecast and an a historic figure for the US, where growth tends to hover around 2%-3%

September payrolls were also strong, with employers adding 336,000 jobs, nearly double what economists had been expecting

A variety of inflation indicators cooled less than anticipated, or posted slight gains. The employment cost index, a broad and reliable indicator, ticked up 1.1% in the third quarter, a pace far above its pre-pandemic average of 0.7%.

However, the last chart above is of increasing relevance as the narrative that "the market is doing The Fed's job for it" continues to keep hopes alive that Powell and his pals are done (due to this dramatic tightening).

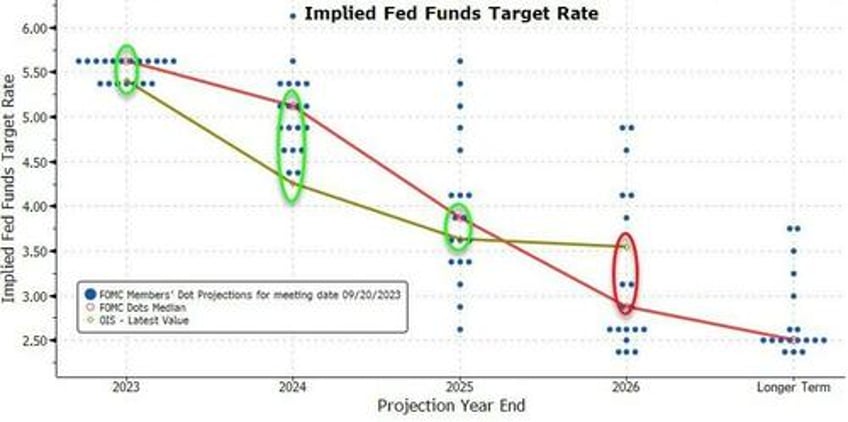

For today, expectations are for no change (0.5% odds of a rate-hike priced-in), but the market remains more dovishly priced still than The Fed's projections (at least until 2026)...

Source: Bloomberg

The Fed statement is expected to be more or less identical to September's.

And so, what did we get?

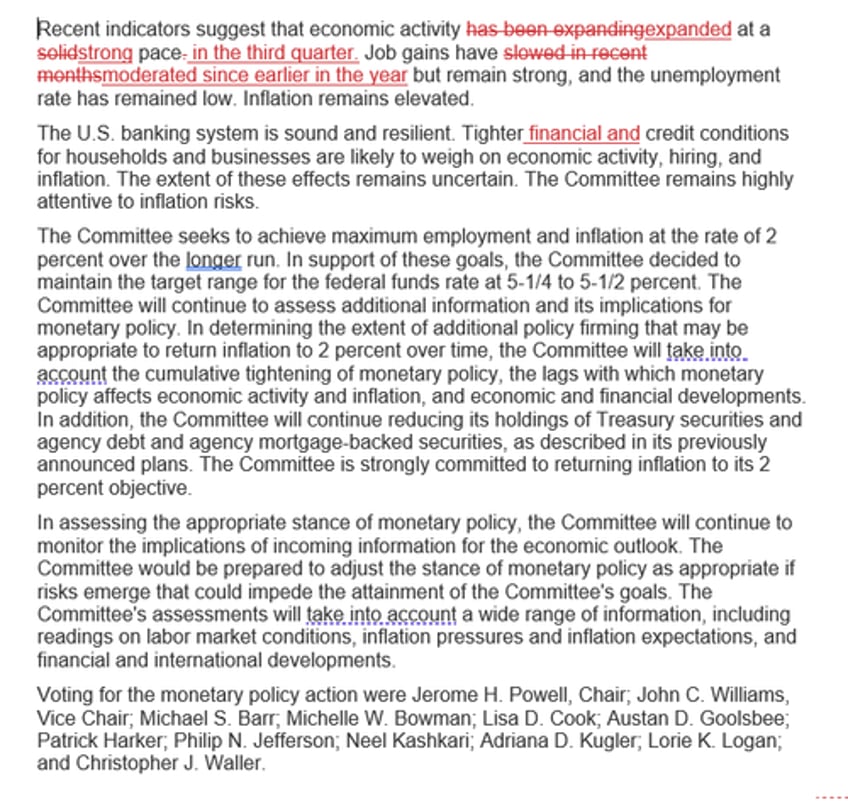

The Fed - as expected - left rates unchanged:

- *FED HOLDS BENCHMARK RATE IN 5.25-5.5% TARGET RANGE

The Fed leaves more hikes on the table:

- *FED REPEATS IT WILL ASSESS EXTENT OF ADDITIONAL POLICY FIRMING

And sure enough, as we noted above, The Fed likes the market doing its job for it, specifically adding reference to tighter "financial" conditions

- “Tighter financial and credit conditions for households and businesses are likely to weigh on economic activity, hiring, and inflation.”

The message is clear:

addition of "financial" = Powell to Yellen: "stop spending like a drunken sailor"

— zerohedge (@zerohedge) November 1, 2023

The question we are left with is - what is the trigger for The Fed to not 'leave the rate hike option' on the table.

Read the full redline below:

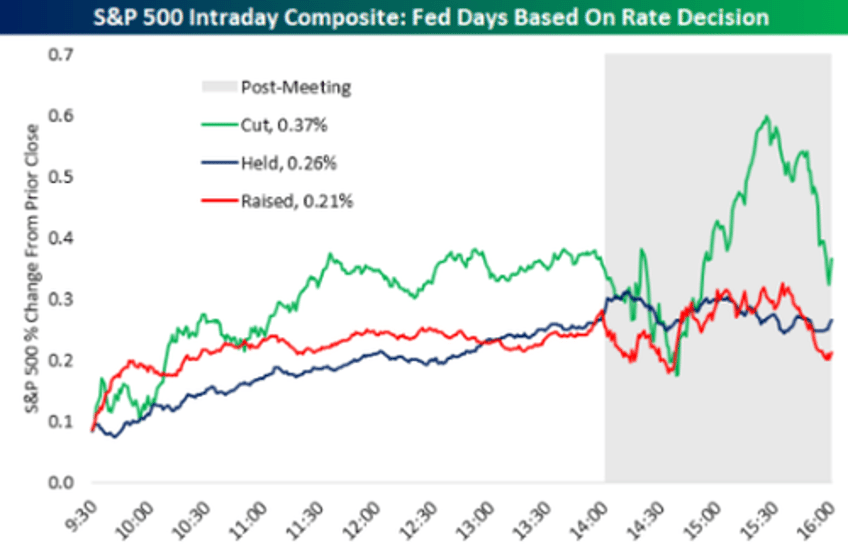

Powell's press conference is coming right up but we note that despite everything very much 'as expected', the market is uneasy and the implied-implied move in the S&P tomorrow is 0.89%, which would make it the highest implied move since May according to Goldman.

Here's what to expect (assume a 'hold')