Back in September 2019, when the Fed's aggressive tightening led to a sudden, catastrophic "repocalypse" when the lack of liquidity pushed overnight rates orders of magnitude higher and crushed levered Treasury cash-swap pair trades reliant on ultra-cheap funding (also known as basis trades ) there was a brief period of time when the world's largest multri-strat hedge funds such as Citadel, Millennium and Balyasny, who are exposed to hundreds of billions in basis trades, were on the verge of collapse. We described this in Dec 2019 in "The Fed Was Suddenly Facing Multiple LTCMs."

Several months later, when the same hedge funds were hammered by the double whammy of the covid crash, things hit a breaking point and had it not been for the Fed stepping in with unlimited multi-trillion repo operations and unleashing a massive $100BN+ monthly QE, the financial system would surely collapsed, as not just we but later Bloomberg also admitted. We discussed this in "Fed Bailed Out Hedge Funds Facing Basis Trade Disaster" where we reminded readers that "hedge funds such as Millennium, Citadel and Point 72 are not only active in the repo market, they are also the most heavily leveraged multi-strat funds in the world, taking something like $20-$30 billion in net AUM and levering it up to $200 billion. They achieve said leverage using repo."

We also quoted Morgan Creek CEO Mark Yusko who (correctly) said that "too big to fail is back, and this time it’s not the banks, it’s levered financial institutions." Yusko, who may have forgotten that the original Fed bailout was not of a bank but of an extremely levered hedge fund (LTCM), said he supported the Fed’s stepping in, but added that hedge fund firms have gotten too big by borrowing too much. “It’s a bailout,” Yusko said, repeating what we said in December.

It was a bailout, yet one which took place under the cover of the covid crash, when both the Treasury and the Fed jointly injected tens of trillions into the financial system and economy (the rest of the world joined too, in case anyone has forgotten what sparked the biggest inflation in 50 years), and without which the largest US hedge funds would no longer exist.

Unfortunately in the nearly six years since the first basis trade implosion... nothing has changed. This too we documented over time, with several notable timeline highlights below:

Ken Griffin using the HFT defense on his massive basis trades: "Look at all the basis points we are saving clients"... just bail us out again like you did in Sept 2019 and March 2020 please. pic.twitter.com/VQkcXmP3TU

— zerohedge (@zerohedge) October 25, 2023

Why the non-strop regulatory freakout about the basis trade? The answer in two charts pic.twitter.com/iytu85vIkR

— zerohedge (@zerohedge) December 6, 2023

basis trade leverage: from 20x to 56xhttps://t.co/esGiXp5VG4 pic.twitter.com/QHH84S03qX

— zerohedge (@zerohedge) February 6, 2024

Will $1 Trillion In Treasury Basis Trades Blow Up The Clearinghouses https://t.co/fb0d2xvuQ5

— zerohedge (@zerohedge) August 27, 2024

Will be hilarious if all the multi-strat HFs which are crushing their smaller peers and getting even bigger, end up in the same basis trades when we get another March 2020 TSY market lockup and everyone just LTCMs

— zerohedge (@zerohedge) February 27, 2024

And much more...

We bring up all of this because it's almost time for the Fed's next hedge fund bailout.

Bloomberg reports that a panel of financial experts advised the Fed to set up an emergency program that would close out highly leveraged hedge-fund trades "in the event of a crisis in the $29 trillion US Treasuries market."

According to the experts, a vicious unwinding of the roughly $1 trillion in hedge fund arbitrage bets would not only hamper the Treasuries market, but others as well, "requiring Fed intervention to assure financial stability." When the US central bank did that in March 2020, during the initial Covid crisis, it engaged in massive outright purchases of Treasury securities, to the tune of about $1.6 trillion over several weeks.

So, the thinking goes, since the Fed is powerless to regulate several multibillionaire hedge fund managers and rein them in, the next obvious action is to prepare trillions in taxpayer funds for another massive bailout enema, and leave them on the hook for trillions in capital just so the billionaires can keep on billionaireing.

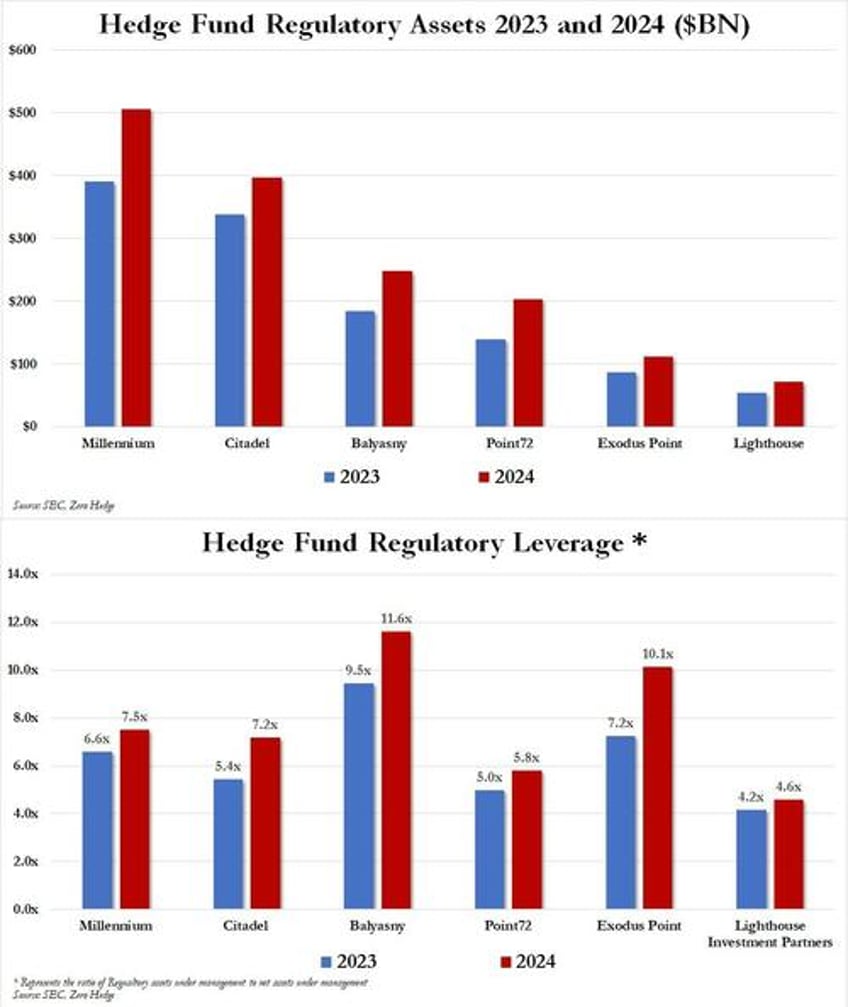

For those asking who is behind these basis trades, we share our updated chart of hedge fund leverage among the 6 largest multi-strat funds, all of whom are known to aggressively participate in basis trades. As seen below, the regulatory capital of just the "Big 6" multistrats - Millennium, Citadel, Balyasny, Poin72, ExodusPoint and Lighthouse - is a record $1.5 trillion, an increase of $300 billion from the previous year.

What is far more scary is that the average regulatory leverage, or the ratio of regulatory assets (i.e., levered exposure) to assets under management (or actual, tangible capital), has increased to a record 7.8x from 6.3x a year ago!

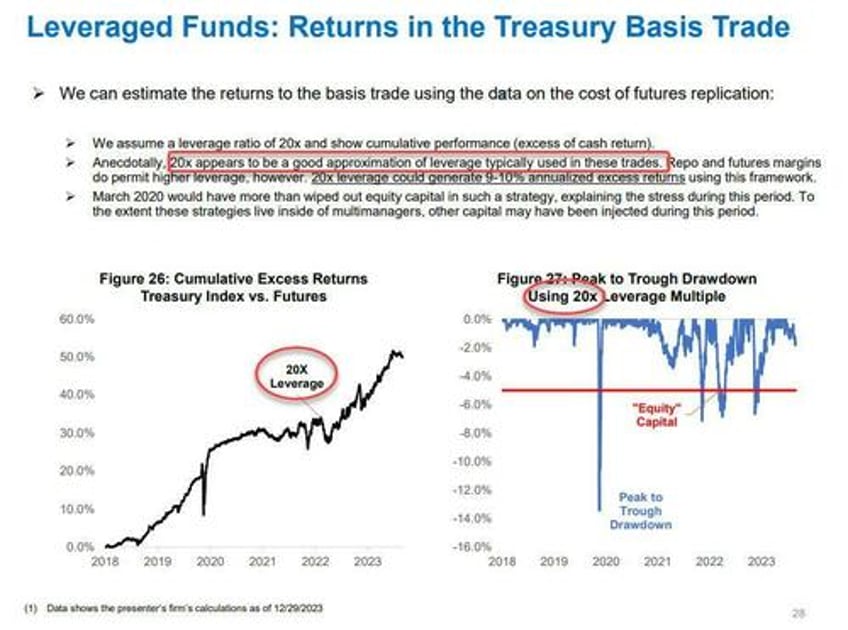

And for those wondering why a blow up in the $1 trillion basis trade would almost certainly require a Fed bailout, it's because the inherent leverage in going long cash and shorting futures is anywhere between 20x, according to the Treasury Borrowing Advisory Committee...

... and a stunning 56x, according to the Federal Reserve itself.

It is against this background that plans for the next hedge fund bailout are already swirling. Bloomberg reports that one proposed intervention would be via hedged bond purchases, according to a Brookings Institution paper by Anil Kashyap at the University of Chicago, Harvard University’s Jeremy Stein — a former Fed governor, Harvard Business School’s Jonathan Wallen and Columbia University’s Joshua Younger.

“If the Fed is tempted to buy again, we’d rather they do that on a hedged basis,” Stein told reporters in a briefing on the paper, which was released late Wednesday. This approach “can be a valuable addition to the policy toolkit” at the Fed, the authors wrote in the paper.

Echoing what ZeroHedge readers have known for over a decade, Bloomberg documents that the key source of risk to address is the so-called basis trade, where hedge funds seek to profit from tiny price gaps between Treasuries and derivatives known as futures. Kashyap also echoed what we have been saying for years, that the basis trade "is a pretty concentrated trade,” involving perhaps 10 hedge funds or fewer.

If hedge funds need to unwind their basis pair trade positions quickly, similar to what they did in Sept 2019 and March 2020 when the move itself crippled the entire bond market, the danger is that bond dealers will not be able to handle the enormous sudden volume of transactions. And consider this: when the Fed had to intervene in 2020, the basis trade was roughly $500 billion in total — less half today’s figure.

“To relieve the stress on dealers, it would be sufficient for the Fed to take the other side of this unwind – purchasing Treasury securities, and fully hedging this purchase with an offsetting sale of futures,” the authors wrote.

Ironically, the paper recognized that “bailing out hedge funds” - similar to what the Fed did after LTCM, after the Sep 2019 repocalypse and again in the depths of the covid crash, would raise questions, including moral hazard, where the existence of the facility could potentially encourage hedge funds to take on even more risk.

“The basis of comparison shouldn’t be ‘no moral hazard,’” Stein said. That’s because the 2020 example of outright purchases is already part of the Fed’s record. Simple purchases of Treasuries involve their own costs. They remove “duration” from the Treasuries market, because the Fed is buying securities maturing over time and creating bank reserves, which carry an overnight interest rate. That can blur the line between financial-stability operations and monetary policy, the authors highlighted.

The cost of massive Fed Treasuries purchases is also seen in the diminished remittances from the US central bank to the Treasury, they noted. Amusingly, the US central bank is still unwinding its bond purchases, known as quantitative easing, from the 2020-2022 period... when it last bailed out the billionaire multi-strat hedge funds!

“Purchases are an inelegant way to proceed,” Kashyap said on the reporter call Tuesday. “Buying looks a lot like QE and probably influences term premia,” he said, referring to the extra yield investors demand for longer-term securities versus just rolling over short-term ones. Another advantage is that it’s basically self-liquidating — removing questions about the timing of future bond sales or a new quantitative tightening regimen. It also protects the Fed from taking on interest-rate risk.

He is right, and yet when the next crash happens (one of those not if but when things), QE is precisely what the Fed will use again, because it is a known and effective way of bailing out the entire financial sector. On the other hand, trying to convince markets that some sterilized, "hedged" trade will have the same firepower as stocks are puking 10% per day, is a shortcut to the financial apocalypse.

The authors were so enamored in their thought experiment of bailing out hedge funds without someone bailing out hedge funds, they argued that a basis purchase facility wouldn’t be “that far afield from current open market operations.” The Fed already engages in repo transactions, either through standing facilities or open market operations. Because basis trades involve a spot purchase and future sale, they are “conceptually very similar” to repo transactions — the only difference being different counterparties for the purchase and sale, according to the paper.

Right... the only difference is that repo operations are used by everyone in the market, directly and indirectly, while basis trades only serve to pick the proverbial penny in front of steamrollers, and the only ones profiting from this are "less than 10 hedge funds." Might as well put all taxpayers on the hook for when this trade eventually blows up, why not/

The legality of such a new facility “is an important question but beyond the scope of this discussion,” the authors wrote.

Policymakers in recent years have put forward suggestions to improve Treasury market functioning, ranging from adjusting bank regulations that impair dealer capacity, the creation of a Standing Repo Facility where the Fed could lend directly to hedge funds and imposing minimum margin requirements for repo-financed Treasury purchases. A mandate for central clearing for Treasuries and repo is set to take effect Dec. 31, 2026.

“Hedge funds are in a very aggressive position, where a relatively small move in the basis could push them out,” Stein said. “It doesn’t look like the dealers are super well positioned to handle this.”

Here, for once, the paper authors are spot on for one simple reason: we said all of this more than a year ago...

btw this is where the next really big crash will start https://t.co/XcK2RezYEk

— zerohedge (@zerohedge) February 1, 2024