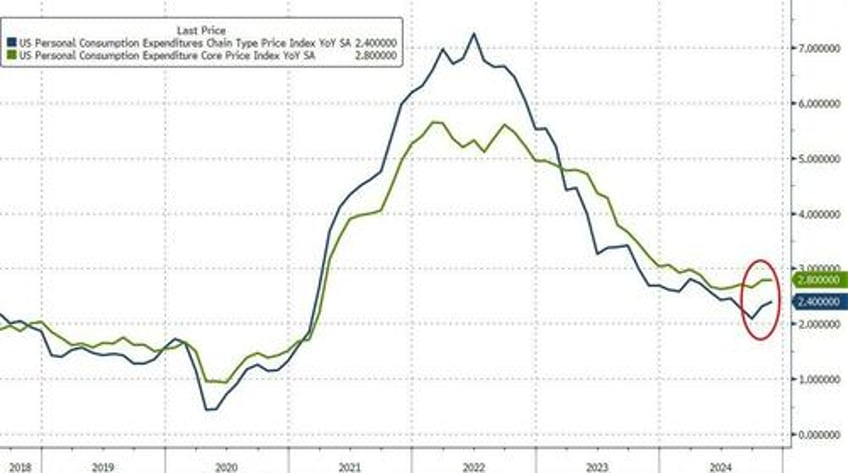

The Fed's favorite (until it starts rising) inflation indicator - Core PCE - printed cooler than expected for November (+0.1% MoM vs +0.2% MoM exp) which held it steady at +2.8% YoY (below the expected 2.9%) - tied for the highest since April...

Source: Bloomberg

However, Headline PCE rose to +2.4% from +2.3% - its highest since July...

Finally, both the cyclical and acyclical components of inflation are on the rise once again (the latter being out of the control of The Fed implicitly)...

Source: Bloomberg

Not a good sign and perhaps The SF Fed's report is what prompted Powell's pivot to the hawkish dark-side. Or is this what he realy fears?

Source: Bloomberg

Of course, we all know who will get the blame if that replay occurs!