Before we dive in – the LBMA situation remains a critical event and is still unfolding. While this missive expands on #COTY (Call of the Year), the reality at the LBMA makes everything we’ve been discussing even more urgent. If you haven’t read our breakdown of the LBMA de facto default, you can find it here.

INTRO

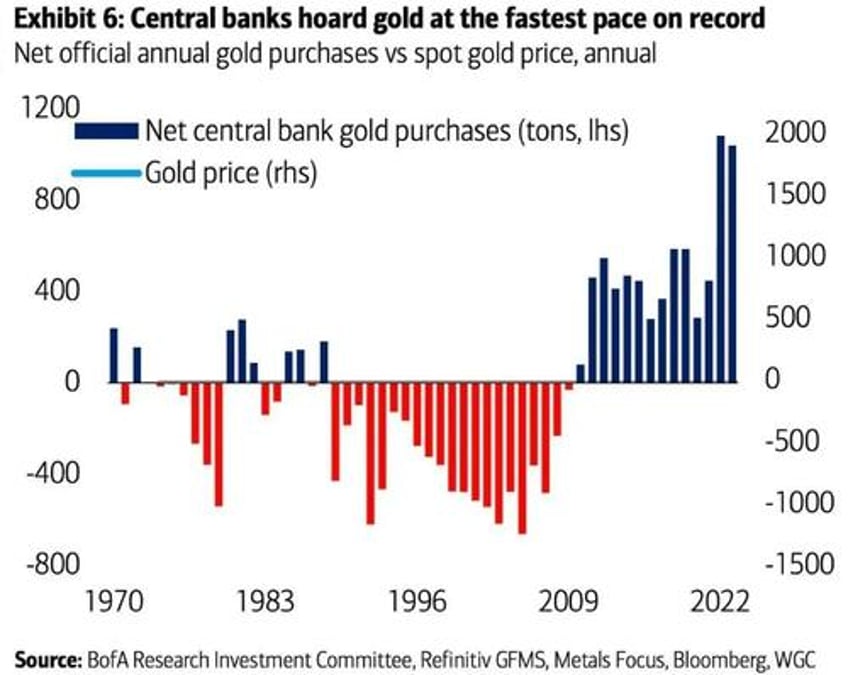

The central bank trading of gold tells a story, one marked by four distinct phases since Nixon closed the gold window on August 15th, 1971. We’ve recently entered this fourth and most pivotal phase. It is the biggest, the fastest, and most importantly, it is here now. This is our time.

We got a little lucky with our 2024 #COTY (Call of the Year) which focused on fiat alternatives. The S&P500 and NASDAQ both had a great 2024, meanwhile, our fiat alternatives of gold, silver, and Bitcoin kept pace/outperformed, depending on who’s counting.

As much as we’d like to call for a repeat performance and a COTY 2.0 for 2025, we’ll instead share a new perspective. Pure fiat was born in earnest in 1971 when Nixon untethered the dollar from gold, leaving the global reserve asset trading on faith. Let’s take a step back and view this experiment from afar.

PHASE 1 - THE INVENTION OF FIAT

New systems start with curiosity. Central banks watched and handicapped, and they bought and sold small amounts of gold with no real pattern (see chart on page 1). They tinkered and digested the new rules of engagement.

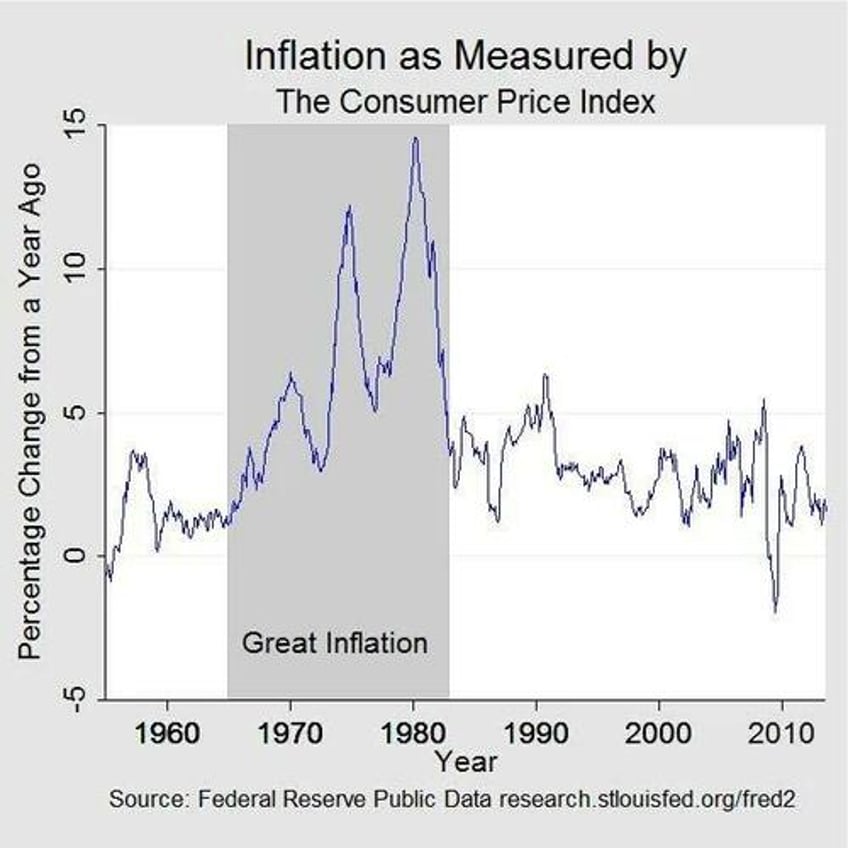

This period was also marred with major swings in inflation. The CPI fluctuated wildly, spiking into the teens and then dropped to the low single digits several times before settling down in the mid-1980’s. This paved the way for a major decline in rates.

PHASE 2 - THE NEW GAME

A new paradigm was born. The 40-year cycle of rising rates appeared to be over. Rates steadily declined and lifted all boats, as most assets surged higher: bonds, stocks, oil, and real estate. This was a wake-up call for central banks. As asset prices climbed, central banks allocated out of gold, which was left behind on a performance basis.

Lower rates became the cornerstone to financialization -- making money from money. Lower borrowing costs made it cheaper to borrow and easier to lever up. This was the new game and gold got left in the dust. After a parabolic spike high in the early 1980s, gold drifted sideways to down for 25 years.

Central banks seemed to have it all figured out, and they were net sellers of gold for over 20 years. This period also marked the start of global coordination and interconnectedness with central bank policies, rates, and markets beginning to work in unison. Through the lens of global central bank policy, the world was becoming smaller.

PHASE 3 - THE SHOT ACROSS THE BOW

The party had to end at some point. The Great Financial Crisis (GFC) in 2008 sent shock-waves around the world. The US housing market bust was felt globally, and the air came out of global markets.

But the bigger surprise was the central bank’s response to this breakage. This is when central bank “printing” and government bailouts took on a life of their own. Temporary bailout programs became permanent, the handouts grew in size and scope, and crazy concepts like negative yields were born.

Bailout nation was the new norm. The good news: the system was saved. The unfair news: those making these decisions and closest to the money spigot won the most. The reality: this was the very definition of inflation (creation of currency units), and central banks had just finished 20 years of selling their gold.

It was now time to flip the script. Goliath and the powers that be were happy to play along, but they also knew this was an inflationary game. With that, the global central banks started to buy their gold back. Since the “temporary” $700 billion GFC bailout, the US has gone through a myriad of additional bailouts, programs, twists and turns to keep the system afloat. Like any drug addict, each round of remedies required a bigger dose to have material impact.

PHASE 4 - OH SHIT

The QE experiment came with an “oh shit” moment. It became clear that the printer was the only tool in the kit. Every market hiccup and bank collapse came with the same response - more fiat currency poured into the system -- moar inflation.

To make matters worse, The Fed ramped up buying its own bonds…with freshly minted currency. This circular operation repeated regularly, making it clear these guys were playing for keeps. The Fed’s buying of their own bonds kept a lid on rates, as debts and deficits climbed. The entire QE experiment has suppressed rates in an ever-expanding, debt-fueled world, creating an astonishing divergence (lower rates and higher debts) that defies every rule, concept, and shred of logic in financial markets.

The real kicker was the freezing and seizing of Russian sovereign reserves. This was the ultimate “oh shit” moment. Rates and market manipulation was bad enough, but this one had a different feel. It’s one thing to press limits with our printing press, but it’s an entirely new game to steal.

All bets are off. BRICS membership is growing, new competing currency ideas are emerging, and there’s no attempt to slow or manage the US spending, debts, or deficits. The global central bank buying of gold has gone into overdrive.

BITCOIN - A SHORTER STORY

Bitcoin was invented at the scene of the crime. It emerged during the GFC and has charted its own adoption curve. Early bitcoin adopters were fighting the bad actors. New rules, regulations, education, investments, and resources evolved in the public eye.

Institutional adoption has begun, and we are even seeing bitcoin embraced at the sovereign level (Bukele in El Salvador). More importantly, bitcoin witnessed the same “oh shit” moment, sparking a fresh rally. Since November 2022, bitcoin is up over 500%. Rest assured – the central banks are watching closely.

SILVER - THE BASTARD CHILD

Silver is one part industrial, one part currency/precious metals, and one part chaos. There’s little transparency in the silver markets, it is impressively small relative to gold and other major asset classes, thus easy to manipulate.

“WallStreetBets” initiated a silver squeeze in early 2021, fresh on the heels of the GME (Game Stop) battle they had vs. Goliath. The results were mixed. The price reaction was muted, but it was a wake-up call for the asset (silver) in general. At Charts & Parts, we view silver as ground zero for the paper vs. physical fight. We believe the silver market is fractionalized (not enough physical silver to go around), much like our US dollar currency system. This is the basis for our hypothesis in A Silver Heist, summarized below:

A Silver Heist hypothesizes a scenario where manipulation and fraud in the precious metals market allow Goliath to seize control of physical silver, while paper silver futures settle in cash. We’ve already seen paper markets break down: in 2020 the oil market broke to the downside and oil futures plummeted to negative $30, and in 2022, nickel futures snapped to the upside and gained 250% in just two days, with exchanges stepping in to cancel trades – proving how far we have drifted from free and fair markets. The lack of transparency in the silver market, frequent and blatant paper smashes, and the extreme paper-to-physical leverage all signal that A Silver Heist is not just possible but increasingly likely.

CONCLUSION

The fiat alternative asset class is real, and it appears to be doing what it should. Gold, silver, and bitcoin are proving to be effective hedges against currency risks. The story makes sense, and the confirming action supports it. With a gnarly catalyst like a freeze and seize of sovereign reserves coupled with an inflation problem, this asset class just got a lot more interesting.

Currency systems do not change overnight, and one can argue that it is healthy to have competing currencies. We’ll watch the action and enjoy the ride, as we enter the “suddenly” part of the story.