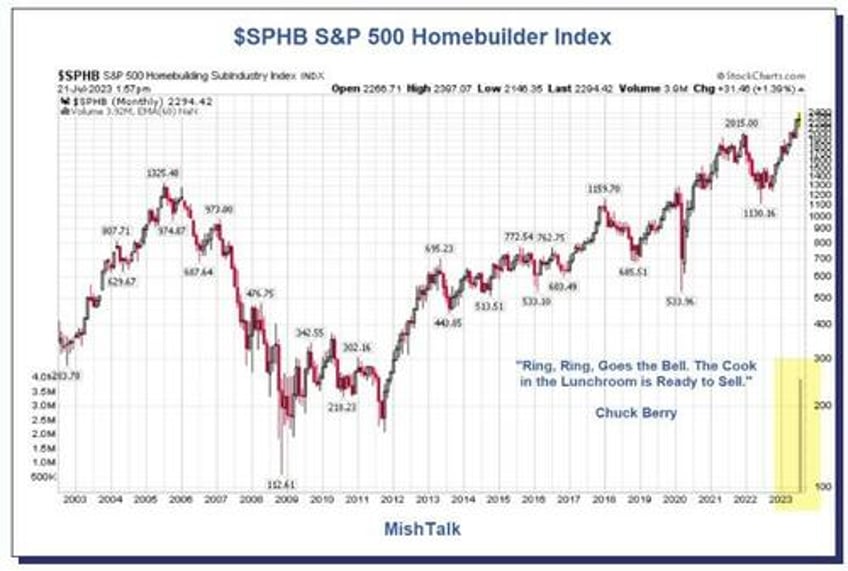

Everything has gone right for homebuilders for a long time. How much better can things get?

$SPHB S&P 500 Homebuilder Index courtesy of StockCharts.Com, annotations by Mish

What Went Right?

A hyperactive Fed with extremely loose monetary policy and repetitive rounds of QE until it finally ended on March 9th, 2022 the Federal Reserve conducted their final open market purchase.

Mortgage rates ticked up, but that impacted existing home sales more than new home sales.

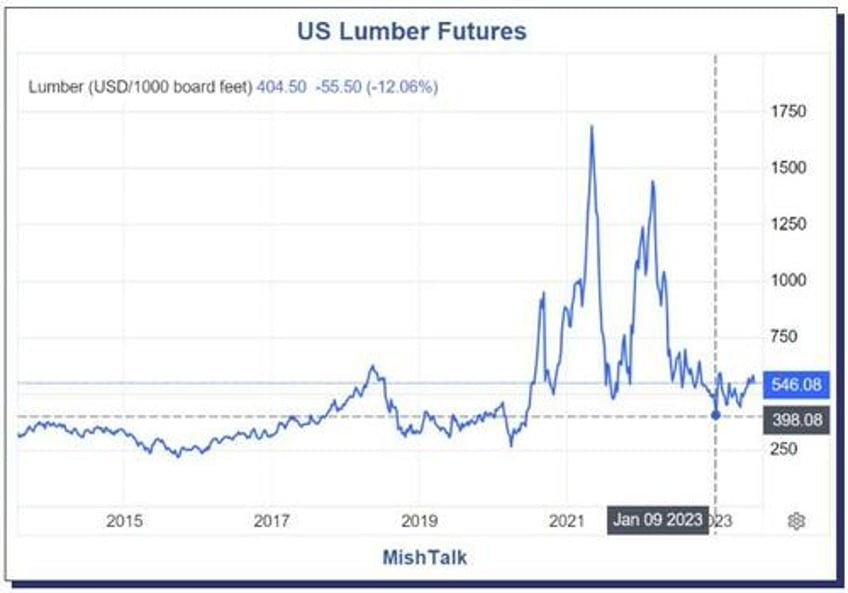

Lumber costs which soared to the moon crashed back to reality. Having hit a high of nearly $1700 in May of 2021, prices crashed to $400 in January of 2023.

Existing home owners who wanted to move were trapped, unable or unwilling to trade their 3.0 percent mortgage for a 7.0 percent mortgage.

To keep the building game going, homebuilders built smaller homes, bought down mortgage rates, and cut back on luxury items.

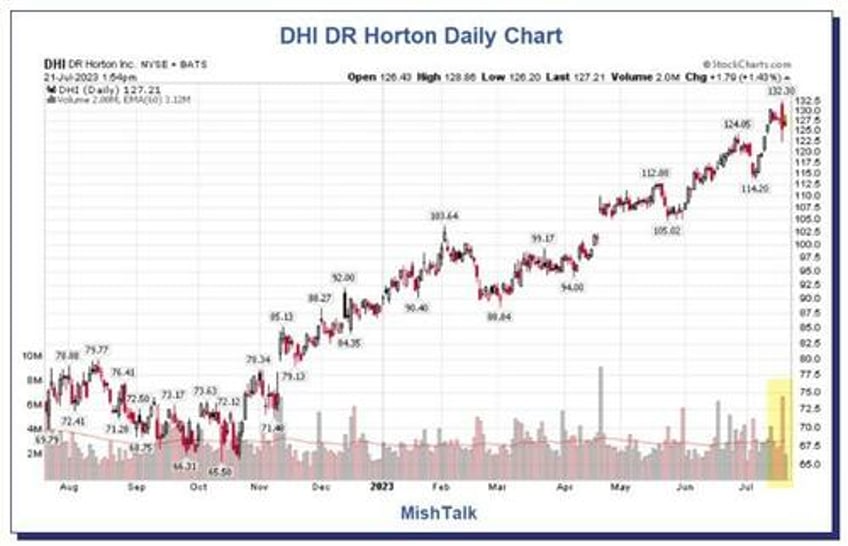

DHI DR Horton Daily Chart

Homebuilder DHI daily chart courtesy of StockCharts.Com, Annotations by Mish

As Good as It Gets

Bloomberg comments Homebuilders Rally Stalls After D.R. Horton Disappoints Bulls

D.R. Horton, which targets the entry-level housing market where inventory scarcity is most pronounced, blew away estimates but fell short on bullish expectations for new orders, according to Wall Street analysts.

Amid a 48% rally in D.R. Horton this year, traders have been in no rush to pile on hedges to guard themselves against losses. Earlier this week, the cost of contracts protecting against a 10% decline in the stock in the next month relative to bets for gains of the same magnitude fell to the lowest level since March, data compiled by Bloomberg show.

Tyler Batory, an analyst at Oppenheimer & Co. commented, Investors “might make the argument this is as good as it can possibly get.”

Yes, that is exactly what I am suggesting.

Ring, Ring Goes the Bell

Lumber Futures

Lumber futures courtesy of Trading Economics.

How much more lumber price cost reductions can homebuilders pass on?

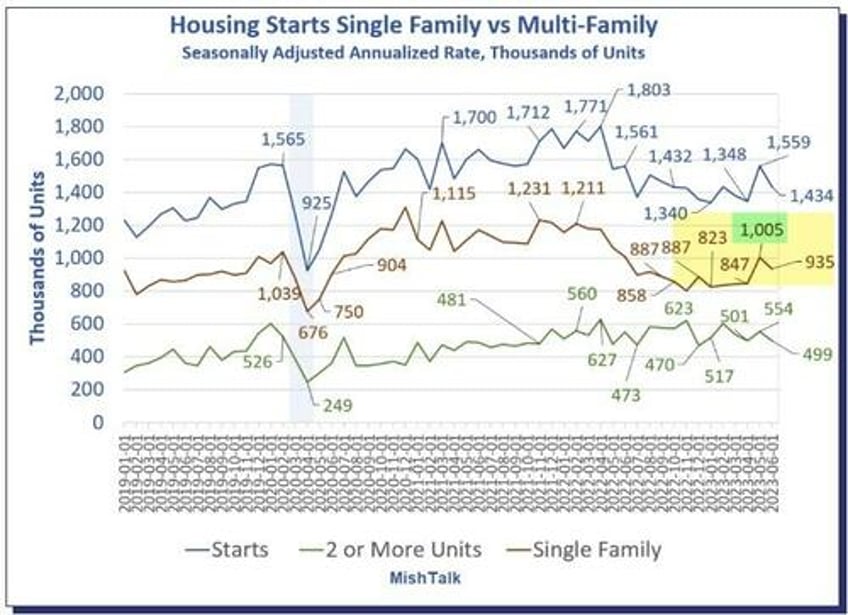

Housing Starts

Housing data from the Census Department. Chart by Mish.

Building Permits

Privately‐owned housing units authorized by building permits in June were at a seasonally adjusted annual rate of 1,440,000.

This is 3.7 percent below the revised May rate of 1,496,000 and is 15.3 percent below the June 2022 rate of 1,701,000.

Single‐family authorizations in June were at a rate of 922,000; this is 2.2 percent above the revised May figure of 902,000.

Authorizations of units in buildings with five units or more were at a rate of 467,000 in June.

Housing Starts

Privately‐owned housing starts in June were at a seasonally adjusted annual rate of 1,434,000. This is 8.0 percent (±10.3 percent) below the revised May estimate of 1,559,000 and is 8.1 percent (±9.2 percent) below the June 2022 rate of 1,561,000.

Single‐family housing starts in June were at a rate of 935,000; this is 7.0 percent (±11.7 percent) below the revised May figure of 1,005,000.

The June rate for units in buildings with five units or more was 482,000.

Housing Starts Dive 8 Percent in June On Top of Significant Negative Revisions

For more discussion, please see Housing Starts Dive 8 Percent in June on Top of Significant Negative Revisions

Pent Up Demand

I keep hearing talk from the NAR cheerleaders of pent up demand. Perhaps, but at what mortgage rate, and what price level?

Homebuilders were able to adjust to Fed rate hikes, but how more more low hanging fruit is left?

Meanwhile, there are significant signs of consumer stress.

Credit Scores Abruptly Plunge As Americans Stop Paying Down Debt; Synchrony Financial Warns

ZeroHedge noted Credit Scores Abruptly Plunge As Americans Stop Paying Down Debt; Synchrony Financial Warns

“What we are seeing is people who are doing significant score migration — a 680 or a 690 going to a 620,” Synchrony Financial CFO Brian Wenzel said in an interview.

That’s a dive from good to fair.

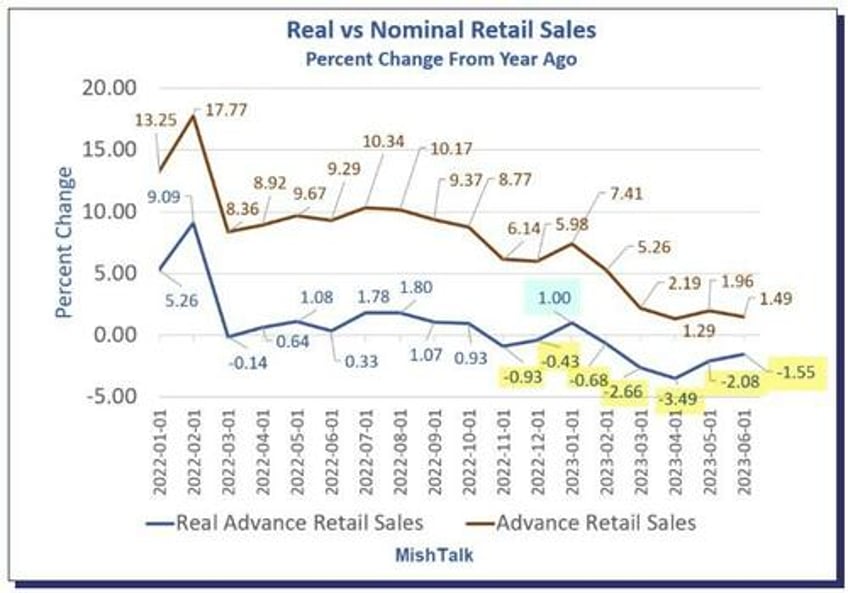

Inflation-Adjusted Retail Sales Are Weak

Real vs nominal retail sales percent change from year ago, data from Commerce Department, chart by Mish.

On July 18, I noted Inflation-Adjusted Retail Sales Weak Four of the Last Five Months

It’s not just consumers.

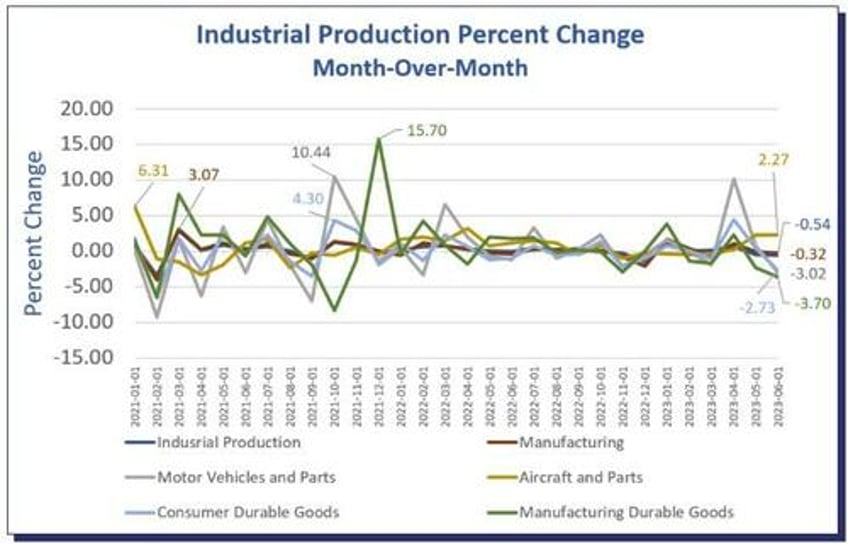

The Fed Reports Abysmal Industrial Production Numbers and Negative Revisions Too

Industrial production data from the Fed, chart by Mish

Please note The Fed Reports Abysmal Industrial Production Numbers and Negative Revisions Too

The Bloomberg Econoday consensus estimate was unchanged in May from June. Instead, Industrial production fell 0.5 percent and the Fed revised May from -0.2 percent to -0.5 percent.

Meanwhile, the consensus opinion has changed from recession to soft landing. Ring, ring goes the bell.

* * *