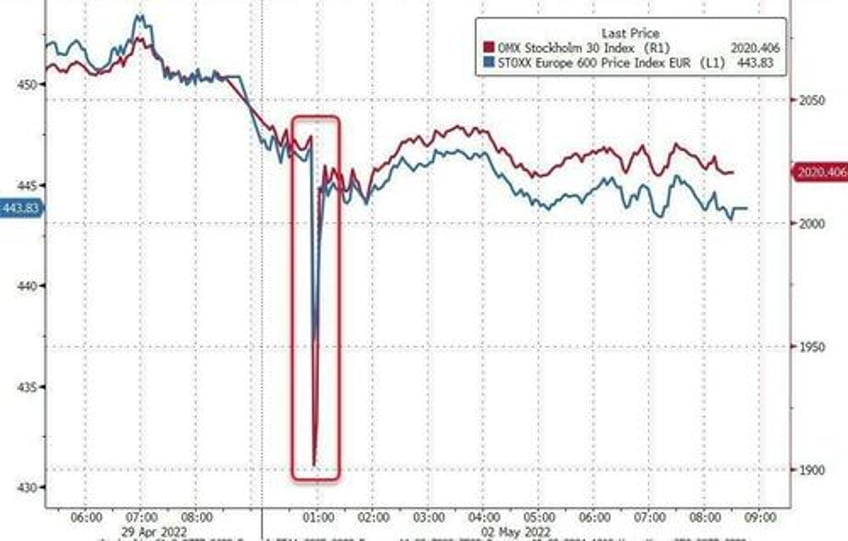

While much of the world was still snoring in the post-labor day hangover on May 2nd of 2022 - and markets were even more devoid of liquidity than usual - early in the morning Europe's stock market suddenly puked following a flash-crash in Stockholm, which as we reported at the time was sparked by some shitty math by a London-based Citi index trader.

Source: Bloomberg

The flash-crash was caused by "an inputting error", according to the UK's Financial Conduct Authority (FCA) - or what most of us call a 'fat finger' - which at the time reportedly cost the bank around $50 million.

The trader had intended to sell a basket of equities valued at $58 million but made an error while inputting the order that resulted in a basket valued at $444 billion being created instead, according to the FCA.

Today, the costs of 'fat fingers' increased further as Citigroup was fined £61.6 million ($79 million) (the FCA fined Citigroup £27.77 million for the blunder, while the Prudential Regulatory Authority saddled the bank with a £33.88 million penalty), stating that the bank's systems were poorly designed and its real-time monitoring was "ineffective."

“Some primary controls were absent or deficient,” the FCA said in its statement.

“In particular, there was no hard block that would have rejected this large erroneous basket of equities in its entirety and prevented any of it reaching the market.”

"Due to poor design, the trader was also able to manually override a pop-up alert, without being required to scroll down and read all the alerts within it," the FCA added.

"These failings led to over a billion pounds of erroneous orders being executed and risked creating a disorderly market," said Steve Smart, the FCA's co-head of enforcement and market oversight.

“We are pleased to resolve this matter from more than two years ago, which arose from an individual error that was identified and corrected within minutes,” Citigroup said in a statement.

“We immediately took steps to strengthen our systems and controls, and remain committed to ensuring full regulatory compliance.”

It is not the first time Citigroup has blundered.

In 2020, the bank accidentally wired $900 million in interest payments to the lenders of cosmetics company Revlon - more than 100 times the intended amount.

Some lenders returned the money, but others did not.

A US district court judge ruled in 2021 that the bank would not be allowed to recover the outstanding $500 million.

For context with regard the fine - Citi made $4.037 Billion in Equities trading in 2023...