Tomorrow, the FOMC is expected to hold rates at 5.25-5.50% at its May meeting as strong incoming data which signals sticky inflation, and a slowing GDP growth narrative, are likely to keep the central bank cautious. That said, the recent meeting minutes stated that almost all participants judged it would be appropriate to pivot to a less restrictive policy stance at some point this year. Accordingly, traders will be attentive to the degree to which Chair Powell looks through recent upside in inflation data and comes off as dovish during the press conference amid an overwhelmingly hawkish consensus.

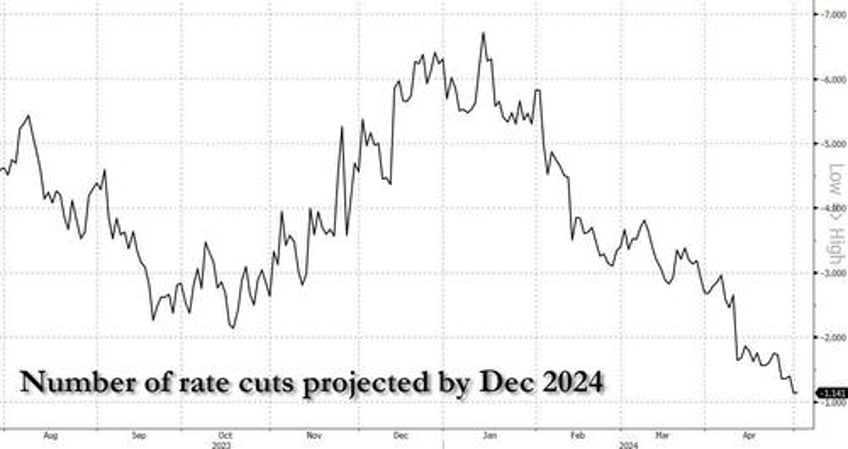

In wake of the March PCE report, traders were pricing around 36bps of rate cuts - or about 1 and a half cuts - through the end of this year, down sharply from almost 7 at the start of the year.