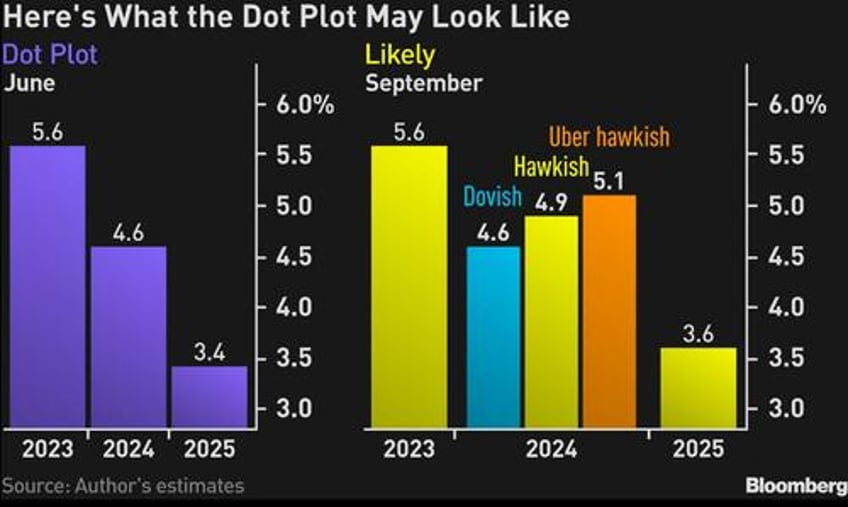

Tomorrow, the FOMC will hold rates at 5.25%-5.50% according to both the market consensus and money market pricing, delivering a dovish outcome wrapped in data dependence although one more hike indicated for 2023 in the dot plot or a median 2024 dot of 4.9% or higher, suggesting fewer rate hikes than priced in, would be seen as hawkish.

Where strategists and economists are torn, is whether we have already seen the Fed's final rate hike, or whether another one may be coming in November. Among the former are Goldman chief economist Jan Hatzius and UBS Chief US Economist Jonathan Pingle, who expects July was the last hike in this cycle. As Pingle writes in his note, Fed Chair Jerome Powell should continue to talk tough on inflation and reiterate determination to get inflation back to 2%. However, at this point, the FOMC should be trying to calibrate the real rate, which will rise just from inflation falling (Pingle does not expect Powell to endorse a "skip" or November rate hike. He would not rule it out, but say it depends on the data).