By Michael Msika and Macarena Munoz, Bloomberg Markets Live reporters and strategists

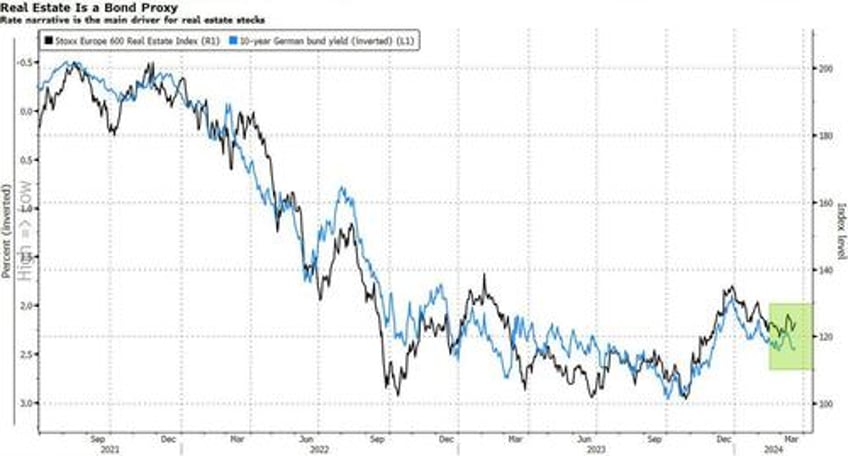

Real estate stocks just can’t seem to catch a break. Among this year’s worst performing sectors in Europe, even the prospect of interest rate cuts might not immediately reverse this year’s downward spiral.

Real estate is dismally lagging the broader equity index so far in 2024, with losses of 8% and erasing the outperformance seen at the end of last year. Dovish signals this week from the Federal Reserve and Bank of England could bring some relief, but few expect this to be forthcoming from the Fed.

Javier Miralles, equity fund manager at Mapfre Asset Management, reckons it’s still early for investors to position in real estate “as a strategic call betting on the rate drop.” Recent strong inflation data could well induce the Fed to send a higher-for longer message, he says, adding that “when rates are lowered, there will be a re-rating of the sector but it is still risky to position yourself like this.”

The first Fed cut is now expected in June, compared with March just a few months ago. What’s more, just three reductions are priced for this year, versus more than five last December. While this pushback hasn’t affected the broader market, real estate stocks have been hit badly. That’s possibly because of other sector-specific issues, including the commercial real estate overhang and mark-to-market property values.

“The problem for the sector in recent months is not so much in the swings in expectations of rate cuts, but in the fall in asset valuation, and how this affects its debt ratios and the need to forcefully sell properties,” says Roberto Scholtes, head of strategy at Singular Bank. The valuation adjustment could be almost complete in Britain, he says, but is less far along in continental Europe.

The depreciation of assets increases loan-to-value ratios, in some cases it’s even threatening to exceed the covenants of the loans and bonds. That can force real estate companies to sell assets at a time of low liquidity and weak investor appetite, Scholtes notes. However, he expects the adjustment to be complete in the second half of this year, which alongside upcoming rate cuts, should allow the property sector to start its recovery. For the time being, he remains underweight.

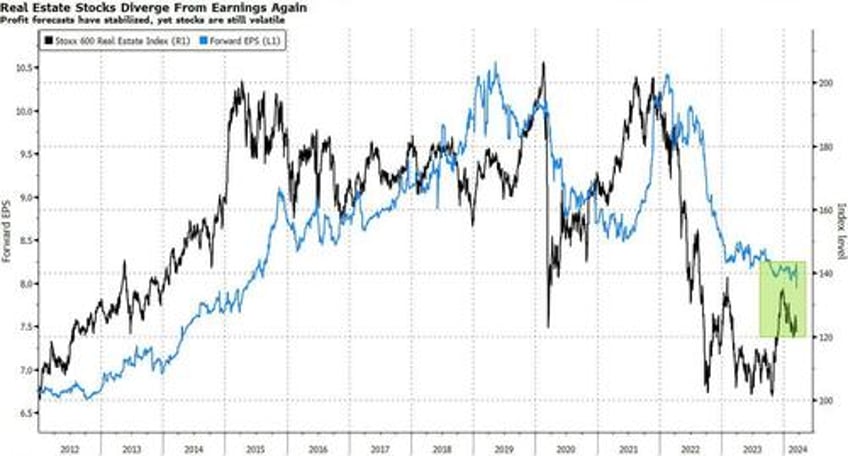

For Citi analyst Aaron Guy, what stands out is the discrepancy in views between company executives and investors. Recent panel discussions his bank organized on European and UK real estate featured CEOs who were confident the worst was over for the sector. Conversations with investors, on the other hand, revealed a high degree of caution.

“This dislocation of positive CEOs and more cautious investors is likely a significant factor behind most CEOs noting their stocks trading at significant and excessive discounts and are opportunistically inexpensive,” Guy says.

Goldman Sachs analysts including Jonathan Kownator point out that historically, an environment of falling rates, together with high - but falling - inflation, has tended to create a positive tailwind for real estate. They see “property valuations close to the bottom,” while debt maturities are “largely manageable.”

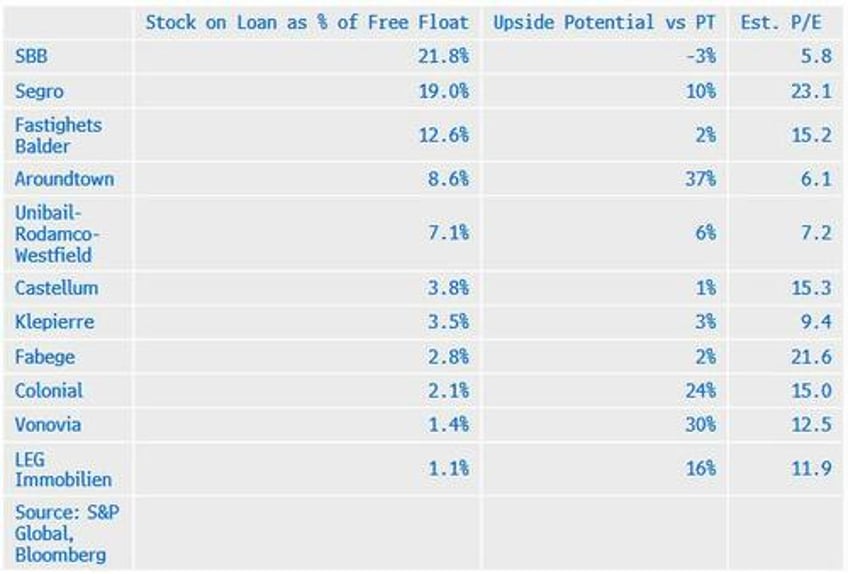

Meanwhile short-sellers have zeroed in on the sector, which is among the most actively targeted in Europe, according to S&P Global data. Real estate management and development stocks have the highest percentage of shares out on loan — an indication of short interest — at 0.37% of market cap, versus less than 0.19% for the overall European stock market. Some names, such as Segro, Unibail-Roadamco-Westfield, Balder and SBB have even higher stock-on-loan ratios, the data shows. With such high figures, any positive central bank message this week could well see a short squeeze unfold on property stocks.