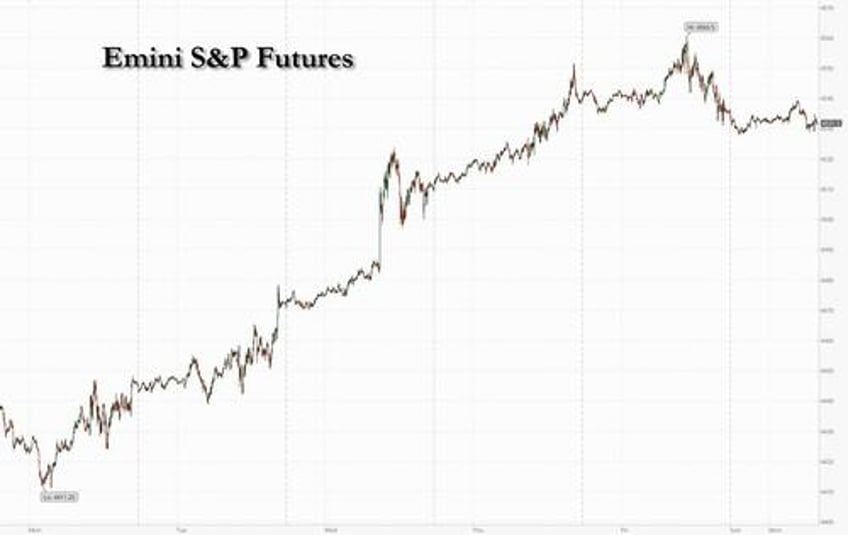

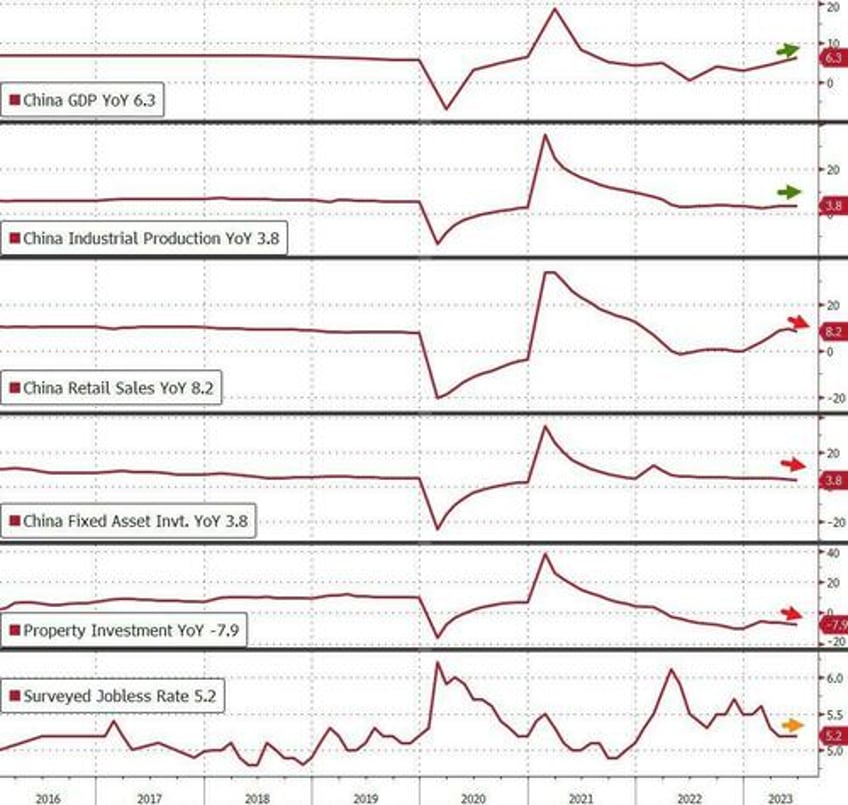

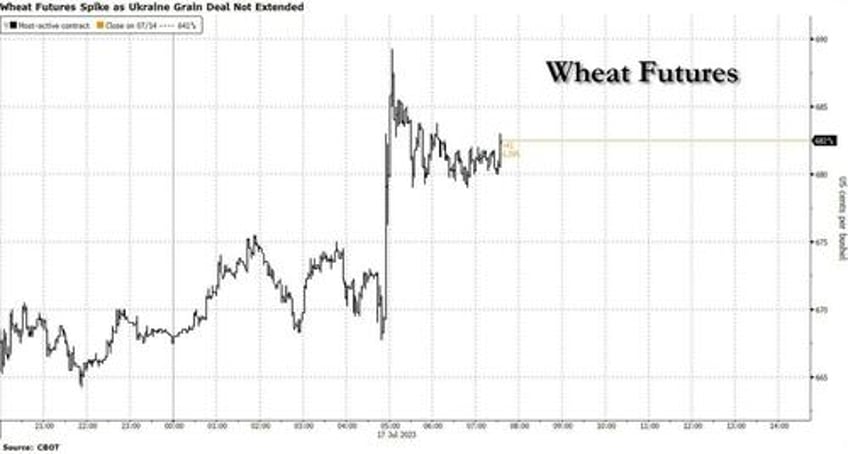

US equity futures were flat erasing, a modest earlier gain, while European stocks and oil retreated as bonds rallied after the latest Chinese data dump delivered more evidence of a slowdown in the world's second largest economy, where Q2 GDP rose just 6.3%. below the 7.1% consensus forecast. At 7:30am, S&P futures were down 0.1% to 4,531 while Nasdaq 100 futures were fractionally in the green. Bond yields are 3-5bp lower, with the benchmark 10Y at 3.78%; the USD is weaker again; commodities are mixed with wheat pricing spiking after Russia terminated the Black Sea Grain deal; base metals are lower after the soften China GDP print. Yellen said US should further de-escalate US-China tension, but lifting tariffs may be premature. Fed entered its blackout period ahead of its July 26th FOMC. On the calendar today, we get the Empire Mfg. index data today at 8.30am ET (-3.5 survey vs. 6.6 prior).

In premarket trading, mega cap tech stocks are mostly higher, led by shares in Microsoft and Activision Blizzard which rose after a US appeals court denied the FTC’s bid to pause the deal. Separately, Microsoft also says it has a binding agreement to keep the “Call of Duty” franchise on the Sony PlayStation platform. Activision Blizzard rose 4.2% in US premarket trading on Monday; Microsoft rose as much as 0.9%. Here are some other premarket movers:

- Chewy rises 4.5% in premarket trading on Monday after Goldman Sachs raised the recommendation on the online pet-supplies retailer to buy from neutral, saying margins could steadily expand over the next five years as the company grows its private label and healthcare businesses.

- Paramount Global shares decline 2.2% in premarket trading after Mission: Impossible — Dead Reckoning Part One, the seventh installment of the action franchise starring Tom Cruise, took in less than projected at the box office over its debut weekend in the US and Canada.

- Shares of electric-vehicle makers rose in premarket trading on Monday after BYD reported a three-fold increase in first-half net profit, with electric-vehicle sales showing little impact from a price war that has roiled the industry.Among premarket movers: Tesla rose 1.7% and Lucid was up +2.1%.

The MSCI ACWI of stocks worldwide dipped 0.1% on Monday after surging 3% last week. Shares in mainland China were the worst performers in Asia. After a week of historic stock-market gains, investors started Monday on a downbeat note after data that showed China’s growth for the second quarter missed estimates and its youth unemployment rose to a fresh, and dangerous, record high of 21.3%.

Indeed, the narrative that Chinese shoppers coming out of Covid lockdowns would be able to carry the global economy, despite rising US and European interest rates is dead and buried as economic reports continue to signal slowing momentum, sparking growing speculation that Beijing will have to put some action behind its endless words of "imminent" stimulus.

“China growth weakness has been brewing in the background for months,” said Pooja Kumra, senior European rates strategist at Toronto Dominion Bank. “Clearly growth has not been able to keep pace with expectations.”

While oil prices slumped as usual on the latest Chinese economic mess, wheat futures jumped after Russia terminated a grain-export deal, jeopardizing a key trade route from Ukraine, one of the world’s top grain and vegetable oil shippers.

With its heavy dependence on the Chinese import market, European stocks are especially vulnerable. Companies tied to energy and raw materials together make up about 12% of the Stoxx Europe 600, and consumer discretionary industries account for 11%. Indeed, European stocks are on the back foot after disappointing economic data from China hit risk sentiment. The Stoxx 600 is down 0.4% and set for its largest drop in almost two weeks. Luxury goods stocks are leading declines after Richemont signaled slowing demand in its quarterly update. JPMorgan strategists expect further weakness in the region driven by lower bond yields as well as earnings disappointments. Here are some other notable premarket movers:

- Luxury-goods makers LVMH, Hermes and Richemont slump and lead declines in European companies exposed to China, after data showed the nation’s economy grew more slowly than expected in 2Q

- Argenx shares jump as much as 27%, the most in more than three years, as analysts say the most recent trial success for its key drug Vyvgart marks another win for the Belgian biotech

- MorphoSys shares rise as much as 6.7% after Deutsche Bank upgraded the German biotech to hold, ahead of the phase 3 read-out of its MANIFEST-2 study of pelabresib to treat myelofibrosis (bone cancer)

- Oxford Nanopore shares gain as much as 3.9% after the DNA-sequencing firm’s 1H revenue beat estimates, with the company noting that growth continues to be driven by its expanding customer base

- Victrex rises as much as 2.7% as Berenberg says the specialty chemicals company’s profit warning “spooked” the market, but may act as a clearing event

- Gresham House gains as much as 57% after Searchlight agreed to buy the asset manager for 1,105p/share in cash, representing a 63% premium to the July 14 closing price

- Bakkafrost falls as much as 12%, the most since September, after the salmon firm issued weak 2Q preliminary results and a profit warning, undermined in particular by a poor harvest in the Faroes

- Coca- Cola HBC shares fall as much as 3.8%, the most since May 25, with Goodbody saying renewed Russia fears could weigh on the bottling firm’s stock price in the near term

- Johnson Matthey shares gain as much as 1.7% in London, outperforming its sector that is suffering from disappointing China data, after Deutsche Bank upgrades UK-based chemicals firm to buy

- GAM shares fall as much as 5.6% as company continues to report losses and declining assets under management, says Vontobel, adding the Swiss firm’s financial situation remains “very difficult”

Earlier in the session, Asian stocks declined as a slower-than-expected growth in China’s economy weighed on mainland equities. Trading in Hong Kong was delayed due to a typhoon. The MSCI Asia Pacific excluding Japan Index fell as much as 0.4%, on course to end the gauge’s five-day winning streak. Shares in mainland China and Taiwan, such as TSMC, were the biggest drags on the index. Japan was closed for a holiday while Hong Kong canceled morning trading and will likely scrap the afternoon session as well because of typhoon Talim. The second-quarter GDP data showed that China’s economy grew slower than expected with consumer spending easing notably in June. The disappointing growth data further dented sentiment after the central bank scaled back its injection of medium-term policy loans despite weak growth. The key stock benchmark in the mainland dropped as much as 1.1%, the most in three weeks.

Monday’s weakness came after the MSCI Asia Pacific Index capped its best weekly rally since November last week, thanks to big gains in North Asia. Analysts said Asian stocks will likely resume gains after Monday’s breather, driven by the recovery in tech cycle and China’s stimulus hopes.

“We remain tactically positive on Asian stocks,” Nomura analysts including Chetan Seth said, adding that “the positive momentum in stocks can continue at least in the very near term.” They said that Korean markets will be the main beneficiary of a softer dollar and a resilient US economy due to their exposure to tech and artificial intelligence. South Korea’s benchmark index fell Monday after its best weekly gain since mid-January. Investors are also monitoring a slew of corporate earnings this week as the quarterly reporting season begins.

The relentless bubble that is Indian stocks advanced for a consecutive third session as benchmark Sensex posted its biggest surge this month to extend its record run, supported by gains in banks and software firms. The S&P BSE Sensex rose 0.8% to 66,589.93 as of 03:45 p.m. in Mumbai, its biggest single-day gain since June 30, while the NSE Nifty 50 Index advanced 0.8% to 19,711.45. HDFC Bank contributed the most to the index gain, increasing 2.1%, as the lender said net income rose 30% to 119.5 billion rupees ($1.45 billion) for the three months ended June 30, compared with 92 billion rupees a year ago. That surpassed analyst expectations for 114 billion rupees in a Bloomberg survey. Out of 30 shares in the Sensex index, 18 rose, while 12 fell

In FX, the US Dollar was pressured against the yen and the euro, while the soft China data also impacted currency markets, where the Aussie and Kiwi are the worst performers among the G-10s; the yuan also declined. The yen and franc outperform on haven demand. “EUR/USD appears a bit overstretched in the short term and could face a correction this week,” ING strategists wrote in a note. Traders are almost fully discounting a 25 bps hike by the Fed later this month, and price roughly a one-in-three chance of a final tightening in November.

“Commodity currencies are weighed by weaker-than-expected China activity data, while the precipitous USD decline last week has also given them scope to retrace lower,” said Fiona Lim, senior currency analyst at Malayan Banking Berhad in Singapore. “However, there could still be some hopes for a more significant stimulus package to be announced for China that could keep” commodity-linked currencies such as AUD and NZD from declining too sharply, she said

In rates, treasuries advanced with 10-year note futures testing Friday session highs and yields richer by 5bp-6bp across belly of the curve into early US session. Stocks slip, supporting gains in Treasuries, which are outperforming core European rates. US 10-year yields around 3.79%, richer by 4bp vs Friday close; belly-led gains in Treasuries steepen 5s30s by 2bp on the day while 2s5s30s fly is richer by almost 3bp in early session. Bonds extended a rally as investors looked to hedge any downturn in stocks and the economy. The yield on the 10-year Treasury fell five basis points to 3.77%. A busy week of dollar issuance is expected -syndicate desks are forecasting between $25 billion and $30 billion in new bond sales this week with banks leading the way coming out of earnings reports - and the resulting rate locks set to push TSY yields higher.

In commodities, crude futures declined with WTI falling 0.5% to trade near $75 as traders weighed disappointing Chinese economic data and restarting Libyan supplies against signs of a tightening market. Wheat futures jumped after Russia said it will not be extending the Ukraine grain deal.

While earnings season resumes in earnings tomorrow, today's calendar only sees the Empire Manufacturing report for July (exp. -3.5%, last 6.6)

Market Snapshot

- S&P 500 futures down 0.1% changed at 4,531

- MXAP down 0.1% to 168.55

- MXAPJ down 0.2% to 533.68

- Nikkei little changed at 32,391.26

- Topix down 0.2% to 2,239.10

- Hang Seng Index up 0.3% to 19,413.78

- Shanghai Composite down 0.9% to 3,209.63

- Sensex up 0.5% to 66,420.12

- Australia S&P/ASX 200 little changed at 7,298.51

- Kospi down 0.4% to 2,619.00

- STOXX Europe 600 down 0.3% to 459.59

- German 10Y yield little changed at 2.48%

- Euro up 0.1% to $1.1240

- Brent Futures down 1.6% to $78.60/bbl

- Gold spot up 0.1% to $1,956.44

- U.S. Dollar Index little changed at 99.83

Top Overnight News

- Treasury Secretary Janet Yellen said the US should look for ways to further “de-escalate” tensions with China, though it would be premature to eliminate the tariffs imposed on it by the Trump administration. BBG

- China’s economic data is mixed, with a miss on Q2 GDP (+6.3% Y/Y vs. the Street’s +7.1% forecast) and June retail sales (+3.1% vs. the Street +3.3% and down from +12.7% in May) while property investment fell further, but industrial production for June exceeded expectations (+4.4% vs. the Street +2.5% and up from +3.5% in May). BBG

- China’s medium-term lending facility is smaller than anticipated with a modest net liquidity injection of only CNY3B as the gov’t remains relatively stringy with stimulus despite fading growth momentum. BBG

- Oil markets are (finally) showing signs of tightening as OPEC+ supply cuts begin to take effect while demand continues to gradually recover (especially in China). BBG

- Critical Russian artery to Crimea disabled in a presumed Ukraine strike as Kyiv looks to isolate the peninsula and impede Moscow’s ability to supply its frontlines. WSJ

- Wall Street is more convinced than ever that inflation is subsiding. That’s giving investors hope that the Federal Reserve might be able to pull off what once seemed impossible: containing pricing pressures without tipping the economy into recession. WSJ

- BlackRock predicted a surge of investment into bond funds once the US Federal Reserve stops raising interest rates as the money manager beat earnings expectations and reported assets under management had recovered to $9.4tn. “There is finally income to be earned in the fixed income market and we are expecting a resurgence in demand,” said Rob Kapito, president.* “There are trillions . . . that are ready, when people feel rates have peaked, to flood the market and we need to position ourselves to capture that.” FT

- DeSantis was forced to shed some workers from his campaign as he struggles to gain traction while facing fundraising and spending challenges. NYT

- United Airlines and its pilots’ union reached in principle a new labor agreement that is the richest ever at a US carrier, ending more than four years of negotiations. The agreement will result in about $10 billion in value over the life of the contract, the Air Line Pilots Association said in a statement Saturday. The deal will provide pilots a pay raise of 13.8% to 18.7% upon signing and amount to a cumulative increase of as much as 40.2% over the life of agreement, according to the union. BBG

- On July 24, the Nasdaq-100 will undergo its second ever “Special Rebalance” to address the index’s high level of concentration among a handful of stocks. The weight of the largest 7 stocks in the index will be reduced by 12 pp (56% to 44%). AAPL and MSFT will remain the largest constituents but their index weights will be reduced by roughly 4 pp to 12% and 10%, respectively. AVGO’s index weight will increase the most (+0.6 pp to 3%). $261 billion in mutual fund and ETF AUM is benchmarked to the NDX while hedge funds have an estimated $20 billion of net short exposure. Passive funds that track NDX will rebalance their portfolios but the 2011 special rebalance experience suggests the stock-level impact will be limited. GIR

A more detailed look at global markets courtesy of Newsquawk

Asia-Pac stocks began the week subdued as participants digested mixed economic growth and activity data from China with conditions also thinned due to the holiday closure in Japan and typhoon disruption in Hong Kong. ASX 200 was rangebound with gains in healthcare and tech counterbalanced by losses in consumer and commodity-related industries, while Australian Treasurer Chalmers provided a glum outlook in which he expects a substantial economic slowdown and unemployment to increase as inflation eases. KOSPI was constrained by a sombre mood after the deadly floods in South Korea and lingering US concerns that North Korea will move forward with another intercontinental ballistic missile test. Shanghai Comp underperformed in the absence of Stock Connect flows owing to the unscheduled closure in Hong Kong and as participants reflected on the mixed bag of tier-1 releases from China which showed economic growth was firmer than expected QQ but disappointed on the YY reading, while Chinese Industrial Production topped estimates in June and Retail Sales missed. Furthermore, the data was seen to be distorted by the effects of the lockdowns in China last year and attention was also on the PBoC which maintained its 1-year MLF rate unchanged at 2.65%, as expected. TSMC (2330 TT) may reportedly cut FY23 guidance to a decline of 10% Y/Y from a previous low-to-mid-single digit decline Y/Y, citing weaker than expected demand for traditional servers, high chip inventories and slow demand for non-Apple (AAPL) smartphones, via money.udn.

Top Asian News

- PBoC conducted CNY 103bln (CNY 100bln maturing) in 1-year MLF with the rate kept unchanged at 2.65%.

- China's stats bureau said the national economy showed good momentum of recovery in H1 but reiterated that the foundation of the domestic economic recovery is not solid, while it stated that China is confident and capable to achieve economic growth targets.

- US Treasury Secretary Yellen commented at the G20 meeting that her Beijing visit put the US-China relationship on a super footing and is eager to mobilise further action on areas of mutual concern. Yellen said tariffs on China were put in place as there were concerns about unfair trade practices and those concerns remain, while she added that China’s slowdown is significant to the global economy and seems in part a reflection of a consumption slowdown. Furthermore, Yellen said US corporates want to see an environment where they can invest and thrive in China, according to Reuters.

- US Senate Majority leader Schumer said Democrats will amend the defence policy bill to impose sanctions on China and declare a national emergency over fentanyl, while he hopes the China amendment will pass with strong bipartisan support, according to Reuters.

- US climate envoy Kerry arrived in China and commented that it is imperative the US and China make real progress in the little more than 4 months left before COP28.

- New Zealand PM Hipkins said the region is becoming more contested, less predictable and less secure, while he added that China’s rise and how it seeks to exert influence is a major driver of the increasing strategic competition. Furthermore, he stated the relationship with China will continue to require careful management and that New Zealand is stepping up engagement with India as it expands its role and interests in the Indo-Pacific.

- Australian Treasurer Chalmers said he expects a substantial economic slowdown and unemployment to increase as inflation eases, according to Bloomberg.

- China's State Planner Chairman met with Cos in the steel smelting, electronic devices and modern logistics sector; adding, efforts will be made to optimise the development of the private economy.

European bourses are pressured following the soft APAC handover given mixed China data and subsequent growth forecast downgrades by various desks, Euro Stoxx 50 -1.20%. The FTSE 100 and Energy names saw a bid on a since withdrawn Saudi report, with the complex reverting back to the initial downside following overnight data and the resumption of Libyan activity. Consumer discretionary names lag after Richemont's update with a particular focus on the demand impulses from US and China. Stateside, futures are little changed but with a slight negative bias given the above, ES -0.1%. The US session is a light one but earnings ramp up again on Tuesday, in the pre-market today the main updates have related to MSFT/ATVI.

Top European News

- German economy may disappoint as sentiment worsens; GDP recovery may be weaker in remainder of 2023 than implied June forecasts; inflation may fall further in coming months, core to stay higher over summer, according to Bundesbank cited by Reuters.

- UK PM Sunak is to appoint a new Defence Secretary after Ben Wallace said he will leave the cabinet at the next reshuffle and will not stand as an MP in the next election, according to FT.

- UK signed a treaty to join the CPTPP Indo-Pacific trade deal but sees chances of reaching a free trade agreement with the US as very low, according to Bloomberg citing Business Secretary Badenoch.

- UK consumer group Which? called for government action on grocery prices and noted that supermarket prices have increased 25.8% in two years, while it noted that some prices have jumped by as much as 175%, according to Reuters.

- Spanish PM Sanchez says there is a window of opportunity to conclude EU-Mercosur deal in H2'23; we expect trade deals with Mexico and Chile to be ratified in H223. Follows on from, Brazilian President Lula says hopes to finish EU-Mercosur agreement this year, it will "open new horizons". Reminder, Spanish elections take place on July 23rd and currently Sanchez is lagging behind People's Party leader Feijoo.

FX

- DXY hits resistance at 100.000 again and drifts down towards 99.750.

- Franc bounces off a shorter IMM spec base as USD/CHF eyes 0.8575 from 0.8625 at one stage.

- Yen rebounds towards 138.00 axis amidst softer Treasury yields and Euro forms firmer foothold above 1.1200.

- Kiwi and Aussie underperform within 0.6368-32 and 0.6849-05 ranges vs Buck as NZ performance of services index slips and the Australian Treasury sees substantial economic slowdown.

- Yuan weakens after mixed Chinese data as PBoC sets fix closer to spot and banks cut 2023 GDP forecasts.

- PBoC set USD/CNY mid-point at 7.1326 vs exp. 7.1386 (prev. 7.1318)

Fixed Income

- Bonds volatile after a relatively muted start as early Gilt weakness waned and prices picked up markedly on a mix of risk, technical and oil-related factors.

- Bunds, Gilts and T-note are now nearer the top of wider 133.41-132.60, 95.39-94.58 and 112-29+/14 respective ranges awaiting more ECB speakers and Empire State survey.

Commodities

- Marked two-way crude action with initial pressure on Libya's resumption and Chinese data was eroded by a since withdrawn update to Saudi's production, an update which lifted WTI and Brent to session highs. The subsequent withdrawal of the headline has seen the benchmarks return back to their overnight lows.

- Spot gold is contained as the US risk tone remains tentative and the USD struggles for clear direction; base metals are particularly hampered on the updates to and from China on the growth front.

- Libya’s El Sharara oil field and the El Feel oil field resumed production, according to Reuters.

- Kuwait plans to raise oil output from 2.7mln bpd to 3.15mln bpd within four years, according to Reuters.

- Saudi’s Energy Minister said they will continue to guarantee oil supply to Japan and maintain the position as the reliable partner, while he added that Saudi is Japan’s largest oil exporter fulfilling 40% of its total needs and will continue cooperating with Japan in clean hydrogen and recycled carbon fuels, according to state TV.

- Japan is to ensure private sector loans for LNG procurement with Nippon Export & Investment Insurance to receive premiums from private lenders in turn for policies that will cover more than 90% of the loaned amount, with NEXI is to insure a loan by Sumitomo Mitsui Banking Corp (8318 JT) to a unit of LNG importer JERA, according to Nikkei.

- Turkey raised the special consumption tax on oil and gasoline with taxes on petrol increased by about 200%, according to Official Gazette and FT.

Geopolitics

- Russian President Putin said Russia reserves the right to mirror actions in the event that cluster munitions are used against Russia and that they have a sufficient stockpile of them, while he also stated that Ukraine’s attempts to break through Russian defences have failed, according to IFX and Reuters.

- Russian-backed Governor of Crimea said Russian air defences and fleet engaged in repelling Ukraine’s drone attacks on Crimea, while the Russian Defence Ministry said it stopped Ukraine’s “terrorist attack” on Crimea’s Sevastopol, according to RIA. It was also reported that the Russian-backed Governor said traffic was stopped on the Crimean bridge due to an "emergency", while Ukrainian media reports explosions were heard on the Crimean bridge to Russia.

- Russia moved to ban Apple (AAPL) iPhones for government officials after claiming they were hacked by the US, according to SCMP. It was also reported that Moscow seized the Russian subsidiaries of Danone (BN FP) and Carlsberg’s (CARLB DC) Baltika, according to FT.

- UN sources said the Black Sea grain deal has not been extended yet but everything is possible, according to TASS.

- China and Russia will start joint air and sea drills in the Sea of Japan, according to Reuters.

- Japan is reportedly being pressed by the US to consider a military role in a Taiwan conflict, according to WSJ.

- White House National Security Adviser Sullivan said the administration remains concerned North Korea will move forward with another intercontinental ballistic missile test, according to Reuters.

- N. Korea says the US' offer of discussions is just a ploy, via KCNA. Follows the US offering to engage in talks without preconditions around the nuclear programme, according to Secretary of State Sullivan.

US Event Calendar

- 08:30: July Empire Manufacturing, est. -3.5, prior 6.6

Central Banks

- Fed enters blackout period ahead of July FOMC

DB's Jim Reid concludes the overnight wrap

It's fair to say that if there was a soft-landing ETF it would have soared last week after soft Manheim auto prices, soft US CPI and PPI, and weekly jobless claims that are edging back down after a recent move higher. It would be crazy to deny the good news however it's worth highlighting that it's still very early in the Fed hiking cycle for a recession to occur and quite early in the yield curve window. There is plenty of time for the usual lags to work before you would say that this cycle is acting massively different to what you would expect given the tightening of policy. This time could indeed be different but it's far too early to say that with any confidence. Until there is something to dispute the soft-landing narrative though, it will undoubtedly be in the ascendancy.

In a week ahead where the Fed are on their pre-FOMC blackout period, US Retail sales (tomorrow), US housing starts (Wednesday) and US existing home sales (Thursday) are the main data highlights stateside. Housing starts unexpectedly spiked last month so there will be a lot of attention on this. Soft-landing proponents will suggest that it’s hard for there to be a hard landing if housing is recovering.

As US earnings season gathers momentum the standouts are Tesla, Netflix, ASML and IBM on Wednesday and TSMC (Thursday) in tech. Financials reporting including BofA, Morgan Stanley (both tomorrow), and Goldman Sachs (Wednesday), with around 60 of the S&P 500 reporting over the week. It was interesting that the big US banks to report on Friday gave back notable opening gains after strong headline results. As we showed in our CoTD on Friday (link here), earnings season sees a disproportionate amount of the annual return in the S&P so you would expect the next few weeks to have upward momentum all things being equal. However the potential headwinds are the strong rally leading up to it and also the fact that our equity strategist’s positioning measures moved to 18-month highs last week (77th percentile). See their latest report on this from Friday night here.

Elsewhere UK inflation on Wednesday has the potential to be a global bond mover given recent prints. A relatively quiet week in Europe sees PPI in Germany on Thursday, with Eurozone consumer confidence and business confidence in France also due. The retail sales data in France will round up the week on Friday.

In Asia, after today’s important China numbers that we review below, the next stop is the country’s loan fixings on Thursday as we wait to see what stimulus might be on offer in the weeks ahead. Over in Japan, the main highlight next week will be the June nationwide CPI report due Friday.

Talking of Asia, China's monthly data dump has been released this morning. GDP expanded +6.3% in Q2 from a year ago, falling short of +7.3% expectations (v/s +4.5% growth in Q1) as internal as well as the external demand remained tepid. For the June quarter alone, growth slowed to +0.8% (exceeding expectations of a +0.5% expansion) as against a +2.2% expansion in the March quarter. Additionally, retail sales grew +3.1% y/y in June (v/s +3.3% expected) compared with May’s +12.7% surge, highlighting that the post-COVID momentum is faltering rapidly in the world’s second biggest economy. Other data showed that industrial output grew +4.4% y/y in June (v/s +2.5% expected) up from the +3.5% growth in May. So a bit of a mixed bag but certainly soft enough for the stimulus cries to get louder as we approach the Politburo meeting at the end of the month.

Asian equity markets are fairly subdued this morning partially due to a Japanese holiday and not helped by a severe typhoon warning halting morning trading in Hong Kong. Mainland China stocks are leading losses with the CSI (-1.09%) and the Shanghai Composite (-1.19%) both trading lower while the KOSPI (-0.49%) is also down as I type. Outside of Asia, S&P 500 (-0.10%) and NASDAQ 100 (-0.12%) futures are edging lower ahead of the start of a busy week for corporate earnings.

Looking back on last week, the risk asset party finally lost some steam on Friday as the S&P 500 was down marginally (-0.10%) after four daily gains with the rates rally seeing a sizeable reversal (US 10yr +6.8bp), though these moves only partially offset the week’s strong cross-asset rally.

On Friday, we had the release of the University of Michigan consumer sentiment survey for July. US consumer sentiment soared to a two-year high, surprising significantly to the upside at 72.6 (vs 65.5 expected). During June and July, consumer sentiment saw the largest 2-month rise since 2005, which comes as inflation continues to ease, and the labour market remains robust in the face of Fed rate hikes. However, 1-year inflation expectations rose one tenth from June to 3.4% (vs 3.1% expected) and 5-to-10-year inflation expectations also ticked higher, up a tenth to 3.1% (vs 3.0% expected), although the latter often gets revised in the final number.

Following the data, markets partially reversed the downward revision of Fed rate expectations that occurred earlier last week following Wednesday’s CPI report. For example, the terminal rate priced in for November’s meeting gained +3.5bps on Friday off the back of the survey data but was down -2.6bps on the week at 5.40%. And the rate expected for December 2024 climbed a strong +20.3bps on Friday, in weekly terms it fell -16.6bps to 3.93%.

The bounce in Fed rate expectations saw US Treasuries reverse course on Friday, as 10yr yields gained +6.8bps to 3.83%, but this retraced only a fraction of the drop in yields that followed Wednesday’s CPI report, with 10yr yields down -23.4bps week-on-week, the largest weekly drop since the SVB crisis in mid-March. The Fed repricing saw the 2yr yield posting a larger rise of +13.5bps to 4.77% (-17.8bps in weekly terms). The short-end sell off on Friday was driven by real rates (+15.1bp for 2yr), while breakevens showed a continued decline of near-term inflation expectations. The 2yr breakeven was down -14.6bp on the week to 1.91%, its lowest since late 2020. In contrast, the 5y5y US breakeven was marginally on the week at 2.17%. Over in Europe, the Friday rates sell off was more moderate, as 10yr bund yields climbed +3.2bps, but fell back -12.5bps week-on-week. The Euro gained +2.38% on the week (flatish on Friday) as Fed rate expectations pivoted.

In US equity markets, both the S&P 500 (-0.10%) and the NASDAQ (-0.18%) saw slight declines on Friday despite initially opening higher again, though they were still up +2.42% and +3.32% respectively in weekly terms. Within the S&P 500, energy was the main underperformer on Friday (-2.75%), while healthcare outperformed (+1.50%). In the tech megacap space, the FANG+ index fell by -0.33% on Friday, despite at one point in the morning trading +1.7% above its all-time closing highs seen on Thursday. Still, it posted a solid +3.61% weekly gain. Across the Atlantic, the STOXX 600 gained +2.94% week-on-week, its largest weekly increase since the last week of March, but traded modestly lower on Friday, falling -0.11%.

Turning to commodities, WTI crude fell -1.91% on Friday to $75.42/bbl, breaking its three-day rally, but ended the week up +1.74% to its highest weekly close since the end of April. Brent crude likewise fell on Friday, down -1.83% to $79.87/bbl, ending the week up +1.78%. Base metals headed for their biggest weekly gain of the year amid the risk-on sentiment, with the Bloomberg Industrial Metals index gaining +4.68% week-on-week (and -0.14% on Friday). Aluminium stood out from the industrial metals pack, rallying +6.04% over the week, and copper closely followed, gaining +4.11%.