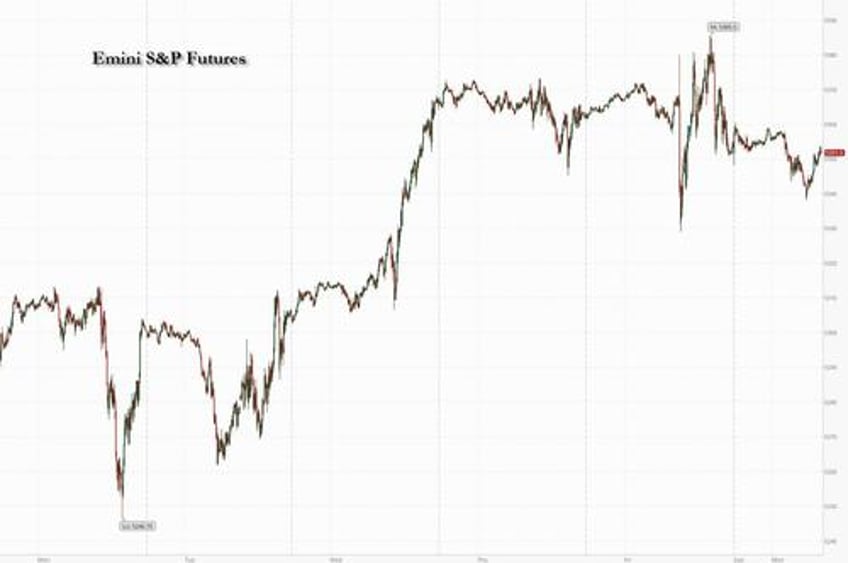

US equities were poised for modest losses to start the week after underlying indexes hit a new all time high on Friday, as focus shifted to Wednesday's CPI data and Thursday's Fed meeting. As of 8:10am, both S&P 500 and Nasdaq futures slid about 0.1%, rebounding from session lows hit shortly after Europe opened following a weekend trouncing of establishment parties in the European Parliament elections. The VIX Index rose, but remained well below its average over the past 12 months. The yield curve is twisting steeper, and the USD starts the week stronger. Cmdtys are mixed with strength in metals, weakness in Ags, and Energy flattish. AAPL and AMZN kick off today, with AAPL’s focused on AI. Today’s macro data focus is on NY Fed’s 1-year inflation expectations print; prior level was 3.26%.

In premarket trading, weakness in semis and AAPL is leading the Mag7 names, which are mostly lower. Despite mixed sentiment, Southwest Airlines jumped 6.9% after the Wall Street Journal reported that activist shareholder Elliott Investment Management has built an almost $2 billion stake in the carrier. Here are some other notable premarket movers:

- Advanced Micro Devices slips 2% after Morgan Stanley downgrades the chipmaker to equal-weight, saying investor expectations for AI business “seem too high.”

- CrowdStrike, GoDaddy and KKR are all up more than 3% as the stocks will join the S&P 500 Index in the latest quarterly weighting change.

- Diamond Offshore rises 6% after agreeing to be purchased by Noble Corp.

- GameStop gains 7%, putting the video-game retailer’s stock on track to recoup some of Friday’s 39% losses. Shares tumbled Friday after the highly-anticipated return of Keith Gill to YouTube, as well as the retailer unexpectedly releasing earnings.

- Perion drops 22% after the company cut its revenue guidance for the second quarter.

- ProKidney rises 5% after saying interim results of REGEN-007 Phase 2 trial show stabilization of kidney function for 18 months.

American stocks rose to all-time highs last Friday as stronger-than-expected jobs data bodes well for corporate earnings even as it suggests monetary policy will be on hold for longer, thwarting rate-cut bets. On Wednesday, investors will parse consumer-inflation data for May and tune in to a Fed meeting for any clues about the likely timing and pace of interest-rate cuts.

“The Fed should give a hawkish tilt to its stance, without dismissing a start of rate cuts in the second half,” said Paolo Zanghieri, senior economist at Generali Investments. “Our base case remains two rate cuts, in September and December, with just one cut as the second most likely scenario.”

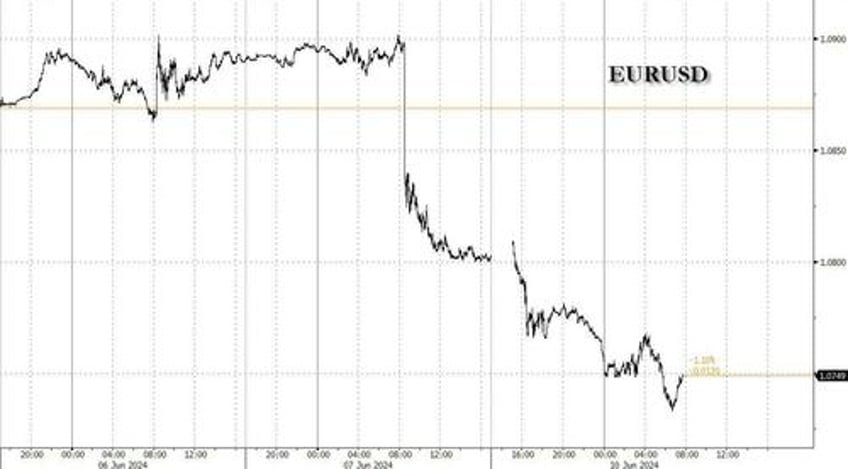

Meanwhile, in Europe, the euro fell to its lowest in a more than a month after French President Emmanuel Macron dissolved parliament and called a shock snap election in the wake of a crushing defeat in the European Parliament elections. The common currency dropped 0.6% to a one month low, and was already on the back foot after suffering its biggest loss in almost two months on Friday as stronger-than-expected US jobs figures lifted the dollar. Yields on France’s 10-year government bonds hit their highest level this year.

The Euro retreated alongside European equities, with BNP Paribas SA and Societe Generale SA tumbling more than 8% as banks led losses among stocks in Paris.

The fallout from the European elections also weighed on stocks, with the Stoxx 600 falling 0.5% with declines led by French banks after President Emmanuel Macron called a snap ballot following a defeat in the European Parliament election on Sunday. French construction and materials stocks also retreat. Here are the most notable European movers:

- Givaudan shares rise as much as 1.9% as Barclays upgrades the Swiss scent manufacturer to equal weight saying the outlook for fine fragrances is better than they had feared.

- BE Semiconductor shares gain 1.7% after being raised to hold from sell by Deutsche Bank, which said main negative catalysts on the stock, such as high expectations on hybrid bonding have played out.

- M&G shares rise as much as 1.9% after an upgrade at JPMorgan. The investment advisory services firm also announced develeraging actions totaling up to £450 million.

- Navigator Co shares gain as much as 5.1% after analysts at Oddo BHF upgraded the pulp and paper mill operator to neutral, arguing the risk-reward proposition has improved.

- Cancom shares jump as much as 7.4% after it was upgraded to buy, with analysts at Deutsche Bank opening a catalyst call on the IT services provider, arguing headwinds are overstated.

- Shares of oil producers operating in Kurdistan are climbing after Iraq said it expects to soon reach a final agreement with the semi-autonomous region and oil companies there to restart oil exports.

- PostNL shares rise as much as 9.3%, the steepest gain since August 2023, after analysts at ING Bank upgraded the Dutch postal group to buy from hold.

- French banks BNP Paribas and Societe Generale tumble, leading losses on the Paris market, after President Emmanuel Macron called a snap election following a drubbing for his group in weekend European parliamentary voting.

- Neoen shares slip as much as 1.7% after the French energy company was downgraded at Barclays, who argue the stock has reached full value in wake of news that Brookfield is in exclusive talks to acquire a majority stake.

- DS Smith shares fall as much as 2% after Brazilian pulp producer Suzano sees room to take on substantial debt as it weighs a new bid for International Paper, Bloomberg News reported.

ECB speakers largely went under the radar, including Government Council member Peter Kazimir, who said the September meeting will be key to determine whether to cut interest rates again.

Earlier in the session, Asian stocks traded in a narrow range as declines in South Korea and elsewhere offset advances in Japan. The MSCI Asia Pacific Index swung between a loss of 0.2% and gain of 0.1%. Samsung Electronics was the biggest drag as lowered bets on US interest rate cuts weighed on Korean shares. Japanese stocks gained as rising bond yields lifted financials while yen weakness supported exporters. Indian fluctuated after their post-election rally. China, Hong Kong, Taiwan and Australia were closed for holidays. The regional benchmark is coming off its first weekly gain in three. India was among the world’s top performers last week in whipsaw trading following parliamentary voting. South Korea and Taiwan followed close behind, lifted by tech optimism.

In FX, the Bloomberg Dollar Spot Index rose 0.3%, hitting its highest since May 1; the US currency extended gains after Friday’s blowout jobs number undercut the case for an early US rate cut; focus now shifts to the release of US inflation data and FOMC decision due later this week, Meanwhile, the euro declined against most of its Group-of-10 peers as investors weighed the fallout from the European Parliament elections. EUR/USD fell as much as 0.5% to 1.0748, the lowest in a month, after French President Emmanuel Macron and German Chancellor Olaf Scholz suffered defeats in the polls. The outcome led Macron to call a snap legislative ballot in a desperate bid to stop the rise of his far-right rival, Marine Le Pen. “Election risk remains fluid,” said Christopher Wong, strategist at Oversea-Chinese Banking Corp., referring to the European polls. It “deserves a close watch as the past decade has shown that a rise in far-right sentiment in Europe can undermine the euro”

In rates, treasuries are cheaper, with the curve steeper as Friday’s selloff extends and US yields follow wider moves seen across European government debt after Sunday’s European Parliament elections. French bonds notably underperform as French President Emmanuel Macron calls a snap legislative ballot after his party trailed far-right National Rally. US yields are cheaper by up to 3bps across long end of the curve with 2s10s, 5s30s spreads steeper by 2.5bp and 1bp on the day. US 10-year yields trade around 4.46% with French bonds lagging by additional 6.5bp in the sector and bunds by 1bp. US session focus includes 3-year note auction, with this week’s highlights coming Wednesday with both CPI and Fed policy announcement due. Treasury coupon auctions resume with $58b 3-year note sale at 1pm New York, followed by $39b 10-year Tuesday and $22b 30-year bonds Thursday. The WI 3-year at ~4.65% is around 4.5bp cheaper than May’s stop-out, which traded 0.3bp through the WI level.

In commodities, oil prices are little changed, with WTI trading near $75.50. Spot gold is steady around $2,296/oz. Bitcoin is flat and holds around $69K, whilst Ethereum drops below $3.7K.

On today's US economic calendar, we get the May NY Fed 1-year inflation expectations at 11am. This week also includes CPI, PPI and University of Michigan sentiment. Fed officials are expected to refrain from commenting until after their June 12 policy announcement

Market Snapshot

- S&P 500 futures down 0.1% to 5,348.00

- STOXX Europe 600 down 0.5% to 520.92

- MXAP little changed at 180.12

- MXAPJ down 0.3% to 561.09

- Nikkei up 0.9% to 39,038.16

- Topix up 1.0% to 2,782.49

- Hang Seng Index down 0.6% to 18,366.95

- Shanghai Composite little changed at 3,051.28

- Sensex up 0.3% to 76,895.70

- Australia S&P/ASX 200 up 0.5% to 7,860.02

- Kospi down 0.8% to 2,701.17

- German 10Y yield little changed at 2.65%

- Euro down 0.4% to $1.0760

- Brent Futures up 0.2% to $79.77/bbl

- Gold spot up 0.1% to $2,295.68

- US Dollar Index up 0.31% to 105.21

Top Overnight News

- After a crushing defeat in the European Parliament election on Sunday, President Emmanuel Macron plunged France into political uncertainty with a snap legislative ballot that re-stages his perennial battle with far-right rival, Marine Le Pen.

- The euro fell to its lowest in a month after French President Emmanuel Macron called a legislative vote in the wake of suffering a crushing defeat in the European Parliament elections.

- The European Central Bank may not cut interest rates again for a while as it watches to see how quickly inflation recedes to its 2% target, according to Governing Council member Joachim Nagel.

- German Chancellor Olaf Scholz’s ruling coalition is on course for another drubbing when three eastern German regions where the far-right Alternative for Germany is the strongest party hold elections in September.

- Nvidia will trade with its 10-to-1 stock-split price today

A more detailed look at global markets courtesy of Newsquawk

APAC stocks began mixed ahead of key events including the FOMC and BoJ policy decisions, as well as US and Chinese CPI data, while it was a holiday-thinned start to the week with markets in Australia, China, Hong Kong and Taiwan all closed for holiday. Nikkei 225 advanced on the back of recent currency weakness and after revised GDP data showed a slightly narrower annualised contraction in Japan's economy than initially reported. KOSPI traded subdued amid ongoing geopolitical tensions after South Korea restarted loudspeaker broadcasts and North Korea sent another round of waste balloons and warned of new responses.

Top Asian News

- China and Pakistan agreed to strengthen mining development and industrial cooperation, while they are willing to actively promote investment and cooperation between Chinese firms in the mining industry in Pakistan and jointly strengthen the planning of mining industry parks including deep processing of ores.

- BoJ is expected to consider whether to scale back its roughly JPY 6tln in monthly government bond purchases at the upcoming meeting as it moves toward policy normalisation, according to a report in Nikkei on Friday.

- Japan's government said in a draft economic blueprint that it will work closely with the BoJ and guide policy 'flexibly' as monetary policy has entered a new stage, while it added that consumption is lacking momentum and the price outlook is uncertain due partly to the declines of the yen.

European bourses, Stoxx 600** (-1.2%), sank at the open and resides at lows amid the political uncertainty in Europe whereby the centre-right strengthened its majority although the far-right made gains - this prompted French President Macron to announce a snap election, which has resulted in the CAC 40 (-1.8%) underperforming. European sectors are entirely in the red. Construction & Materials are found at the bottom of the pile, alongside Autos and Banks, largely dragged down by significant losses in French stocks. US equity futures (ES -0.3%, NQ -0.3%, RTY -0.8%) are entirely in the red, in tandem with broader sentiment in Europe, albeit to a lesser magnitude; the RTY underperforms, continuing the post-NFP downside seen on Friday.

Top European News

- UK PM Sunak is set to promise another 2p cut to national insurance in the Conservative manifesto, according to The Sunday Times.

- Transatlantic trade association BritishAmerican Business chief said US companies are worried the costs of operating in the UK would increase under a Labour government, making the country a less attractive place to invest, according to FT.

- Deltapoll survey showed UK opposition Labour Party with 46% of support (-2) vs the ruling Conservative Party at 21% (-4) with the Labour Party set to gain a 416 majority.

- The centre-right European People’s Party is set to hold the most seats in the European Parliament with 189 seats, according to the latest EU-wide projections cited by Reuters. However, far-right parties made significant gains as they performed well in Germany and comfortably won in France which prompted French President Macon to dissolve parliament and announce snap elections to be held on June 30th and July 7th. Furthermore, Belgian PM Alexander De Croo announced his resignation after the defeat of his party in the European elections, according to APA.

- EU's von der Leyen said there remains a majority in the centre for a strong Europe and the centre is holding but added that extremes on the left and right have gained support, while she is confident she can win a new mandate as EU Commission President.

- ECB’s Holzmann said the ECB can declare victory on inflation when it is at 2%, while he added that they are on the path to an economic recovery.

- ECB's Kazaks said future rate cuts depend on economic outlook; too early to make a definite statement about the future of rate cuts, via Econostream.

- ECB's Kazimir said should not rush into another rate cut and should sit out the summer; September will be a pivotal month as a lot of new data are published by then. Inflation beast not broken yet and price pressures can resurface. Disinflation will be bumpy but confident ECB is moving towards target.

- European Commission this week is expected to disclose the tariff rate for Chinese EVs amid "excessive subsidies", according to Reuters.

FX

- USD is extending on Friday's post-NFP gains with a softer EUR helping boost DXY to a 105.30 high (highest since May 14th). Macro focus for the US this week falls on CPI and FOMC both due on Wednesday.

- EUR is the standout laggard across the majors following the EU parliamentary elections which have stoked uncertainty across the bloc, particularly in France. EUR/USD gapped lower and slipped beneath its 100 and 200DMAs with the current low at 1.0748. In terms of notable OpEx, there are also some large near-the-money clips due to roll-off.

- GBP is softer vs the Dollar though is holding up better than peers due to cross-related selling in EUR/GBP which sits at its lowest level since August'22 (0.8454 is the current session low). Cable currently holding just above 1.27.

- JPY is losing ground to the broadly firmer USD in what is a big week for the pair with rate decisions from the FOMC and BoJ. In recent trade, the USD/JPY has dipped below 157.00, and currently holds around 156.80.

- Antipodeans are both holding up relatively well vs. the USD despite the flimsy risk sentiment in the market. Performance is likely due to the particularly bruising session on Friday post-NFP which sent AUD/USD down as low as 0.6577 vs. an opening price of 0.6664.

Fixed Income

- USTs are currently immune to the downbeat mood in European fixed income markets; drivers this week for US paper include US CPI, FOMC alongside dot plots and a heavy supply slate. Sept'24 UST currently holding above the 109 mark, with the current low at 109.02.

- European bonds are pressured given the political events over the weekend, which saw the centre-right hold at an EU level, and a strong performance for the far-right. As it stands, Bunds have dipped below 130.00 and looking to test the trough from 3rd June at 129.83; OATs underperform, after French President Macron dissolved the French parliament and announced a snap election.

- Gilts are on the backfoot, in tandem with European peers, albeit to a lesser extent. The Sep'24 Gilt contract has slipped further on a 96 handle with 96.37 the current session low.

- DE/IT 10yr spread is wider by 7.5bps with the Italian 10yr yield at its highest level since December. DE/FR 10yr spread is wider by 5.6bps with the French 10yr yield at its highest level since May 31st.

Commodities

- Crude was firmer for a large part of the European morning, before succumbing to some selling pressure in tandem with the risk sentiment and stronger Dollar. Geopolitics over the weekend has not seen any major escalation. Brent Aug currently trading in a USD 79.34-80.14/bbl parameter.

- Upward tilt in spot gold and spot palladium but spot silver majorly outperform following the hefty post-NFP slump on Friday which took the metal from USD 31.50/oz highs to USD 29.10/oz lows.

- Base metals are modestly firmer as the complex attempts a recovery from the post-NFP slump on Friday, in which the pushback in US rate cut expectations hit the economy-linked base metals, whilst traders look ahead to China's inflation numbers before US CPI and FOMC on Wednesday.

- Iraq set the July Basrah medium crude official selling price to Asia at plus USD 0.60/bbl vs Oman/Dubai average and to Europe at minus USD 2.85/bbl vs dated Brent, while it set the OSP to North and South America at minus USD 0.65/bbl vs ASCI, according to SOMO.

- Iraqi Oil Minister said there was progress in talks held on Sunday with Kurdish regional government officials regarding resuming northern oil exports, according to Reuters.

- Citi on gold: Thinks support (May low and double top neckline) at USD 2,277/oz will hold short-term; if weekly close is below USD 2,277/oz, it would initiate a double top formation and could see further losses. Citi retains long-term bullish view between USD 2,500-2,523/oz.

Geopolitics: Middle East

- Gaza health ministry said 274 Palestinians were killed and 698 were injured during an Israeli offensive on a Nuseirat camp, while a Palestinian Islamic Jihad official said Israel’s offensive at Nuseirat will not affect the prisoners/hostages swap deal.

- Hamas chief Haniyeh said Israel cannot force its choices on them and they won’t accept any deal that doesn’t achieve security for their people. It was also reported that the Hamas armed wing said three Israeli hostages were killed including a US citizen during an Israeli hostage-freeing operation in Gaza.

- Israeli minister Gantz resigned from the emergency government and called for early elections, while he accused PM Netanyahu of mishandling Israel’s war in Gaza, according to FT.

- US circulated a new draft UN Security Council resolution calling on Hamas to accept the hostage and ceasefire deal, while a vote is expected on Monday, according to two sources with direct knowledge cited by Axios' Ravid.

- Hezbollah said it fired a salvo of Falaq 2 rockets at Israel for the first time.

- Yemen’s Houthis said they targeted a British destroyer and two related ships in the Red Sea with ballistic missiles, although the UK Defence Ministry said assertions by Houthis that they attacked a British destroyer in the Red Sea are false.

- UKMTO said a vessel was hit by an unknown projectile 70 NM southwest of Yemen’s Aden which resulted in a fire although no casualties were reported.

- "The Biden administration discussed the possibility of negotiating a unilateral deal with Hamas independently of Israel to release American hostages through Qatari mediators", via Sky News Arabia citing NBC

Geopolitics: Others

- Russian forces appeared to have made headway in the key Ukrainian town of Chasiv Yar, according to sources cited by Reuters.

- Senior Russian Lawmaker says F-16 jets and their bases beyond Ukraine will be legitimate goals for Russian forces if they take part in combat missions

- US National Security Advisor said the Ukrainian army carried out strikes with US weapons on targets in Russian territory, according to Asharq News.

- US President Biden and French President Macron committed to supporting efforts to bring forward extraordinary profits from immobilised Russian sovereign assets for the benefit of Ukraine. Furthermore, they expressed strong concern about transfers of weapons especially from Iran and North Korea, as well as dual-use materials from China to support Russia’s war against Ukraine, while they support actions to curtail access to US and French financial systems for such transfers.

- G7 plans to warn small Chinese banks over helping Russia evade Western sanctions, according to sources cited by Reuters.

- South Korea restarted loudspeaker broadcasts in response to North Korea's sewage balloons, according to Asahi. It was separately reported that North Korean leader Kim's sister warned of new responses against South Korea’s loudspeaker broadcasts and leafleting, while she called for South Korea to stop dangerous acts. Furthermore, the South Korean military later announced that North Korea sent around 310 trash-carrying balloons in its latest launch, according to Yonhap.

- Philippines National Security Adviser said they reaffirmed a commitment to uphold their sovereign rights and jurisdiction over the second Thomas Shoal, while they will continue to maintain and supply their outposts in the South China Sea without seeking permission from any other nation.

US Event Calendar

- 11:00: May NY Fed 1-Yr Inflation Expectat, prior 3.26%

DB's Jim Reid concludes the overnight wrap

For this week the whole financial world will be focused on Wednesday with three huge events occurring. The latest US CPI, the FOMC, oh and my 50th birthday. We'll preview the first two below but other events this week include NY Fed 1-yr inflation expectations today, UK employment data, US small business optimism and a 10yr UST auction tomorrow, China CPI and Japanese PPI on Wednesday, waking up to a mid-life crisis on Thursday alongside US PPI and a 30yr UST auction, with the BoJ decision and the US UoM consumer sentiment on Friday.

Before we delve deeper, it'll be fascinating to see the reaction of French bond markets this morning (likely negative) after the surprise news last night that Macron has called for snap legislative elections which will take place in two rounds on June 30th and July 7th. This is after his party trailed with 15% in the European Parliamentary (EP) elections with Le Pen's National Rally (RN) winning 32%. Although this was broadly in line with expectations, Macron is likely hoping to win back some momentum and hope a notable part of the EP results were a protest vote and also encourage other centrist parties to help rally round to limit the charge of Le Pen. His other hope would be that if RN have a bigger part in government, their appeal may diminish before the next Presidential elections in 2027. So a big gamble.

In terms of the wider EP elections the main takeaway is that even with the uncomfortable results in France and Germany, the centrist majority is holding as the far-right didn’t outperform expectations in aggregate. See DB Marion Muehlberger’s initial reaction piece here published in the early hours of this morning for more, and the implications. As the results have started to materialise the Euro is -0.44% lower as I type, at 1.0753 against the dollar, its weakest level in nearly a month.

Moving forward, let's preview the main events of the week in more detail now. It's not very often you have a US CPI released on the same day as a FOMC meeting and the former will certainly factor into the latest Fed Summary of Economic Projections (SEP). On Friday, a few US houses who were expecting summer Fed cuts pushed back their projections after the strong payroll number and this release will also influence the tone of the meeting. Our economists believe the new SEP forecasts are likely to revise core PCE inflation higher this year (2.8%), and move the median dot from three rate cuts to two with a desire for optionality for September perhaps the only thing preventing this moving nearer to DB's long standing expectation of a cut only arriving in December. Our econ team also expect the 2025 median dot to move up by 25bps as well and the long-run dot to 2.75% (with risks it moves even higher). Powell's press conference will no doubt offer nuances around any changes and will have the ability to put a dovish or hawkish spin on them. At this stage optionality will likely be preferred with little specific guidance.

May's CPI release hours earlier will cast a long shadow over the meeting (see May CPI preview & webinar registration from our economists). Our team expect headline CPI (+0.12% forecast vs. +0.31% previously) to come in softer than core (+0.27% vs. +0.29%), helped by declining gas prices last month. This would reduce the core YoY rate by a tenth to 3.5%, with the headline remaining steady at 3.4% (in-line with consensus). Under these forecasts the three-month annualised core rate would fall three-tenths to 3.8%, while the six-month annualised rate would remain at 4.0%. Obviously as ever rents will get a lot of attention to see if they are falling as the models suggest they should be and then for PPI on Thursday, the components that feed directly into core PCE (namely health care services, domestic airfares, and portfolio management) will be the main thing to watch.

For the Fed to cut rates in September (unlikely in our eyes), or earlier (only in an imminent crisis), inflation must fall sharply, or employment needs to weaken considerably. For the latter, Friday's payroll suggested that this will be tough to see in the data quickly enough. May's headline (+272k) and private (+229k) payroll gains were well above the +180k and +165k expected respectively with a 0.4% gain in average hourly earnings a tenth higher than expected. The diffusion index (63.4) was the highest level since January 2023 which shows that job growth has broadened out after narrow gains for a lot of the last year.

The household survey did contain a surprise tenth of a percent increase in the unemployment rate to 4.0%, the highest since November 2021 (4.1%). It's possible that this survey isn't capturing the surge in immigration our economists discussed in How large was the inflation mitigation from immigration?, so for now the establishment survey might be the more reliable although such a big difference between the surveys does keep you vigilant. For a deeper take on the data, see our US economists’ chart book here.

The other two big events of the week are probably Chinese inflation and the BoJ. For the former, current median estimates on Bloomberg suggest the CPI may improve to +0.4% YoY in May from +0.3% in April, with the PPI also coming in higher relative to the previous reading (-1.5% vs -2.5% in April). For the latter, our Chief Japan economist expects the target short-term interest rate to remain unchanged but highlights that the focus will be on guidance for JGB purchases. He sees changes including a reduction of the central bank's purchases from the current 6tn yen per month to 5tn yen. His detailed forecasts are in the meeting preview here.

Asian equity markets have little overall direction this morning in a holiday thinned session with China, HK and Australian markets closed. The Nikkei (+0.49%) is higher whilst the KOSPI (-0.71%) is lower. US equity futures are flat. 10yr USTs yields (+1.4bps) are edging up to trade at 4.447%.

Early morning data showed that the Japanese economy shrank slightly less than initially estimated in Q1 on upward revisions to capital spending and inventory data. GDP contracted -1.8% y/y in the three months to March as against a revised decline of -2.0% in the initial estimate. On a q/q basis, GDP fell -0.5% in the first quarter, the same as initially estimated, after rising +0.1% in Q4.

Recapping last week, fixed income markets were roiling on Friday after the substantial upside surprise to the May nonfarm payrolls we discussed above. The amount of Fed cuts priced in by December fell -12.8bps on Friday to 37bps, almost exactly reversing their rise earlier in the week following downside surprises in other US data. This saw Treasuries post their biggest daily loss in nearly two months. 2yr yields rose +16.2bps on Friday, leaving them +1.4bps higher on the week at 4.89%. Similarly, 10yr yields gained +14.6bps on Friday to 4.43%, though they were still -6.6bps lower on the week. The dollar index also rose on Friday, up +0.75%, and +0.20% over the week.

Over in Europe, it was also a tale of two halves for bonds. The strong US payrolls saw 10yr German bund yields rise +7.0bps on Friday, adding to the +3.7bps rise on Thursday following the hawkish rate cut by the ECB. However, this was insufficient to retrace gains from the rally earlier in the week, with yields down -4.5bps.

The rise in yields saw the equity rally run out of steam on Friday. The S&P 500 edged -0.11% lower, though it was still +1.32% higher on the week having posted a new record high on Wednesday. Tech outperformed as the NASDAQ rose +2.38% (-0.23% on Friday) in its largest weekly rise since April. On the other hand, the Russell 2000 slipped -2.10% (and -1.12% on Friday) and the equal-weighted S&P 500 was also down -0.77% (-0.35% Friday). So the rally in US equities was far from broad based. Over the Atlantic, the STOXX 600 also notched another record high following the ECB cut but traded modestly down on Friday (-0.22%), leaving it with a +1.04% weekly gain.

Finally in commodities, oil had a tough week after OPEC+ announced its intention to start rolling back its voluntary supply cuts starting in October. Brent crude fell -2.45% (-0.31% on Friday) to $79.62/bbl, and WTI by -1.90% to $75.53/bbl (-0.03% on Friday).