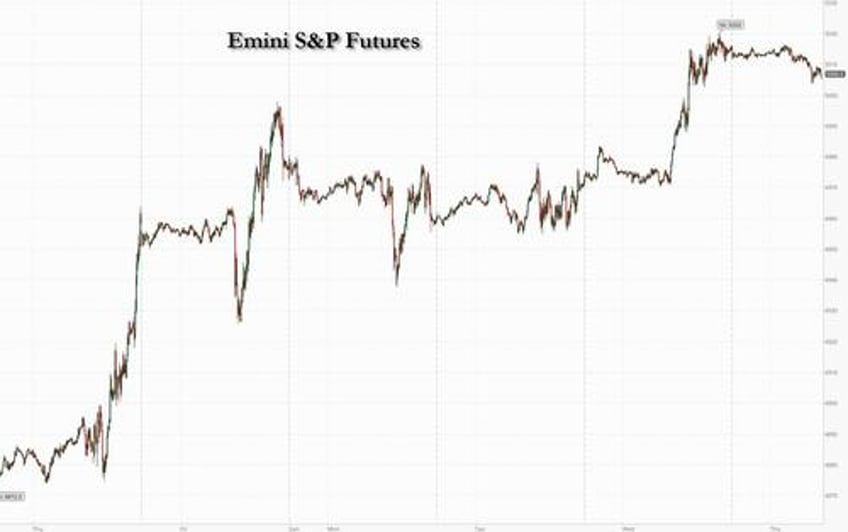

US equity futures dropped on Thursday after hitting a fresh all time high in the previous session, and bond yields rose as investors analyze a slew of earnings reports and also prepared for the sale of 30Y treassuries. As of 8:00am ET, S&P futures were down 0.2%, but even with the decline the S&P remains within striking distance of the 5,000 level and a small gain of just 5 points would take it there today. The MSCI World Index of developed-market stocks also rose to a record. The Stoxx 600 traded flat on the busiest day of the European earnings season. The dollar gains after the yen tumbled following dovish comments from BOJ Deputy governor Uchida who said the BOJ won't aggressively hike rates even after ending negative rates (unclear who expected the BOJ to unleash a hiking spree). Commodities are the standout pre-mkt as the energy complex leads the group higher and strength across metals. It's another busy day for earnings: the lineup in the US today includes Expedia, Philip Morris, ConocoPhillips, S&P Global and cereal maker Kellanova. On the macro side we get jobless claims and wholesale trade and inventories.

In premarket trading, Arm Holdings jumped 25% after a bullish forecast from the chip designer. Disney rose 7% after reporting disappointing revenue and a miss on subscriber growth offset by better-than-expected Q1 earnings, unveiling a new buyback and issuing an upbeat profit outlook for the year, citing cost-cutting benefits and the strong performance of its international theme parks. A.P. Moller-Maersk A/S tumbled after predicting a slowdown in the shipping industry. Here are some other notable premarket movers:

- Apollo Global Management (APO) rises 4% after reporting a profit that beat Wall Street expectations as higher interest rates bolstered the alternative-asset manager’s growing credit and insurance businesses.

- ARM (ARM) jumps 28% after the chip designer gave a surprisingly bullish forecast, showing that its push beyond smartphones is helping fuel growth and profitability.

- Axcelis (ACLS) tumbles 8% after the maker of equipment used to manufacture chips provided a 1Q revenue forecast that disappointed.

- Confluent (CFLT) soars 24% after the application software company gave a full-year revenue forecast that’s ahead of the analyst consensus.

- Digital Turbine (APPS) falls 17% as the company’s sales and EPS forecasts lag estimates.

- GoPro (GPRO) drops 13% after the consumer electronics company posted 4Q revenue that disappointed.

- Monolithic Power (MPWR) gains 6% after the semiconductor device company issued 1Q revenue guidance that beat expectations.

- Oscar Health (OSCR) jumps 21% after the health insurer forecast better-than-expected adjusted Ebitda for 2024.

- PayPal (PYPL) drops 9% after the digital payments firm issued a disappointing 2024 outlook, which Wells Fargo said would “vindicate the perma-bears.”

- Rapid7 (RPD) slips 7% after the software company gave a full-year revenue forecast that was weaker than expected.

- Under Armour (UAA) gains 6% after raising its outlook for full-year earnings, with cost cuts in its turnaround effort making up for a continued decline in revenue.

As DB's Jim Reid notes, markets put in a solid performance over the last 24 hours, with the S&P 500 (+0.82%) reaching an all-time high and closing just shy of the 5,000 mark at 4995.06. Indeed, at the intraday peak it had been even closer than that, with an intraday high of 4999.89. In the meantime, US Treasury yields saw a modest increase (+2.1bps) but there was strong demand at a 10yr auction that was the biggest ever, at $42bn.

Yet despite the decent performance in markets, yesterday also saw continued concerns about regional banks and commercial real estate, which means futures are still pricing a 21% chance that the Fed will cut rates next month. So even as several Fed officials have said they want to see more evidence on the inflation side, it’s clear that markets are still pricing in a risk that they may end up needing to move quicker than that. Meanwhile, markets have continued to shrug off fears around the commercial real estate sector and absorbed a run of warnings from Fed policy makers that a cut isn’t likely until May at the earliest. And so, traders have continued to pile into big tech stocks, helping propel the S&P 500 index to a fresh high on Wednesday — taking it closer to the 5,000 level.

“We think this rally has legs and we think it has room to run,” BlackRock Investment Institute head Jean Boivin, who’s overweight US equities, said in an interview with Bloomberg TV. “This soft landing narrative is pretty powerful and it’s going to take time for it to be challenged.”

Minneapolis Fed President Kashkari said that he thought 2-3 cuts would be appropriate for 2024, and that “We’re not looking for better inflation data, we’re just looking for additional inflation data that is also at around this 2% level”. So he said that if they “see a few more months of that data, I think that will give us a lot of confidence.” Later on, Governor Kugler said that she was “pleased by the progress on inflation, and optimistic it will continue”. And after that, Boston Fed President Collins said that “it will likely become appropriate to begin easing policy restraint later this year.” Finally, Richmond Fed President Barkin said he was “very supportive of being patient to get to where we need to get”.

Elsewhere, while the US Treasury had successful sales of three- and 10-year bonds this week, its latest auction on Thursday of longer-maturity debt could prove a tougher test. “This week’s government bond auctions have generally been well received, with the latest selloff in rates likely helping the case,” said Evelyne Gomez-Liechti, a multi-asset strategist at Mizuho in London.

European stocks gained as investors digest a slew of corporate earnings on the busiest day of the season. The Stoxx 600 rose 0.6%, trading at a fresh 23 year high. Unilever and British American Tobacco both rally after their respective updates. AstraZeneca falls on a disappointing outlook. Some 37 companies in the Stoxx 600 are due to release results today, according to data compiled by Bloomberg.

In Asia, stocks were mixed as mainland Chinese equities fluctuated on the final trading day before the Lunar New Year holidays. China’s CSI 300 Index swung between gains and losses after the nation replaced the head of its securities regulator Wednesday, a surprise move that may foreshadow more forceful steps to support the stock market. We also heard from Bank of Japan Deputy Governor Uchida, who said that even if they ended negative interest rates “ it is hard to imagine a path in which it would then keep raising the interest rate rapidly”. So that indicated a fairly dovish path, even if rates were hiked, which has helped the Nikkei (+2.18%) see a significant outperformance this morning. Yields on 10yr Japanese government bonds are also down -1.2bps.

- Hang Seng and Shanghai Comp were mixed with the former dragged lower by weakness in tech after Alibaba shares slumped on disappointing earnings, while the mainland gained despite the soft inflation data with sentiment upbeat heading into the Lunar New Year holidays and after the PBoC injected liquidity. China also recently replaced CSRC Chairman Yi Huiman with Wu Qing who is nicknamed the “Broker Butcher” for his crackdown on traders.

- Nikkei 225 outperformed and approached closer to the 37,000 level as earnings drove price action and with SoftBank among the biggest gainers after shares in unit Arm Holdings surged by around 20% post-earnings.

- ASX 200 benefitted from strength in tech and property, while the utilities sector outperformed amid a surge in AGL Energy after it reported a four-fold increase in its core net and returned to a statutory profit for H1.

- Nifty eventually weakened in the aftermath of the RBI rate decision where the central bank maintained its rates as expected and although there was a change in the vote split with MPC external member Varma the lone dissenter favouring a 25bps cut, the language from Governor Das remained hawkish in which he stated that monetary policy must be disinflationary and the MPC is to remain resolute in bringing inflation down to 4%.

In FX, the Bloomberg Dollar Spot Index rose 0.1%. The yen is the weakest of the G-10 currencies, falling 0.5% versus the greenback after BOJ Deputy Governor Uchida said it’s hard to see the bank raising its policy rate continuously.

In rates, treasuries are slightly cheaper on the day across long-end of the curve, holding a steepening move ahead of a $25BN 30-year bond sale at 1pm New York. US yields are higher on the day by up to 3bp across long-end of the curve with front and belly little change on the day, steepening 5s30s spread by 2bp vs. Wednesday close; 10-year yields around 4.135% with bunds and gilts slightly lagging Treasuries. Core European rates lag, led by weakness in gilts while JGB’s outperformed in Asia after BOJ Deputy Governor Uchida said it’s hard to see the bank raising its policy rate continuously. Treasury auctions conclude with $25b 30-year at 1pm, follows strong 3- and 10-year sales so far this week. Dollar issuance slate empty so far; Eli Lilly headlined a seven-deal, $13b calendar Wednesday, pushing weekly volume through $41b, above $25b to $30b expectations.

In commodities, oil prices advance, with WTI rising 0.7% to trade near $74.40 and near highs into early US session. Spot gold adds 0.1%.

Looking to the day ahead now, and data releases include the US weekly initial jobless claims. Otherwise from central banks, the ECB will publish their Economic Bulletin, and we’ll hear from the ECB’s Vujcic, Wunsch and Lane, the Fed’s Barkin, and the BoE’s Mann.

Market Snapshot

- S&P 500 futures little changed at 5,012.00

- STOXX Europe 600 up 0.2% to 486.78

- MXAP down 0.1% to 167.87

- MXAPJ down 0.4% to 512.66

- Nikkei up 2.1% to 36,863.28

- Topix up 0.5% to 2,562.63

- Hang Seng Index down 1.3% to 15,878.07

- Shanghai Composite up 1.3% to 2,865.90

- Sensex down 1.1% to 71,390.93

- Australia S&P/ASX 200 up 0.3% to 7,639.25

- Kospi up 0.4% to 2,620.32

- German 10Y yield down 1 bp at 2.31%

- Euro little changed at $1.0781

- Brent Futures down 0.1% to $79.11/bbl

- Gold spot down 0.2% to $2,030.84

- US Dollar Index little changed at 104.05

Top Overnight News

- China’s CPI deflation worsens in Jan (-0.8% vs. the Street -0.5% and vs. -0.3% in Dec) while the PPI remains deeply in deflationary territory (-2.5% vs. the Street -2.6% and vs. -2.7% in Dec). RTRS

- Beijing’s ousting of the country’s main securities regulator sent “shockwaves” throughout the industry and the CSRC as there hadn’t been any forewarning of such a dramatic step, a sign of the growing unease among Xi and senior leaders of the market slump. BBG

- BOJ official signals negative rates will soon end, but the overall pace of tightening will be extremely gradual (“Even if the BOJ were to end our negative interest rate policy, it's hard to imagine a path in which it would then keep raising the interest rate rapidly”). RTRS

- Novo Nordisk is getting calls from food makers as they face up to the potential threat from its appetite-suppressing drugs. CEO Lars Fruergaard Jorgensen said “scared” food bosses want to know how the treatments work and how fast they’ll roll out. BBG

- UK chip designer Arm said it was seeing higher royalty and licensing revenue amid strong AI demand as it lifted its outlook for the year, sending shares rocketing more than 20 per cent higher in after-hours trading on Wednesday. FT

- The United States bought more goods from Mexico than China in 2023 for the first time in 20 years, evidence of how much global trade patterns have shifted. NYT

- The USDA may cut its forecasts for global stockpiles of corn and soybeans in today’s WASDE report. The outlook for Brazil’s soy crop may be lowered by 3.3 million tons, or more than 2%. BBG

- US drone strike killed top commander of Iran-backed militia group blamed for attacks on US forces in Iraq and Syria. WaPo

- Congress in chaos as border/Ukraine bill fails with a path forward on legislation pertaining just to national security (Ukraine, Israel, Taiwan) not in sight. WaPo

A more detailed look at global markets courtesy of Newsquawk

APAC stocks were ultimately mixed after the fresh record levels on Wall St where the S&P 500 touched just shy of the 5k level, while participants digested recent earnings releases and Chinese inflation data ahead of the Lunar New Year holidays. ASX 200 benefitted from strength in tech and property, while the utilities sector outperformed amid a surge in AGL Energy after it reported a four-fold increase in its core net and returned to a statutory profit for H1. Nikkei 225 outperformed and approached closer to the 37,000 level as earnings drove price action and with SoftBank among the biggest gainers after shares in unit Arm Holdings surged by around 20% post-earnings. Hang Seng and Shanghai Comp were mixed with the former dragged lower by weakness in tech after Alibaba shares slumped on disappointing earnings, while the mainland gained despite the soft inflation data with sentiment upbeat heading into the Lunar New Year holidays and after the PBoC injected liquidity. China also recently replaced CSRC Chairman Yi Huiman with Wu Qing who is nicknamed the “Broker Butcher” for his crackdown on traders. Nifty eventually weakened in the aftermath of the RBI rate decision where the central bank maintained its rates as expected and although there was a change in the vote split with MPC external member Varma the lone dissenter favouring a 25bps cut, the language from Governor Das remained hawkish in which he stated that monetary policy must be disinflationary and the MPC is to remain resolute in bringing inflation down to 4%.

Top Asian News

- China Auto Industry Body official says battery vehicle sales were -37% in Jan M/M; far below market expectations, which is a main source of pressure on auto market growth.

- US President Biden is poised to limit Americans’ personal data going to China with the administration planning to issue an order as soon as next week, according to Bloomberg.

- BoJ Deputy Governor Uchida said the BoJ won't aggressively hike rates even after ending negative rates and noted that Japan's real interest rate is in deeply negative territory and monetary conditions are very accommodative which is not expected to change in a big way. Furthermore, Uchida said uncertainty over the outlook remains high, but the likelihood of sustainably achieving our price target is gradually heightening and it is hard to imagine a path of continuous rate hikes.

- RBI kept the Repurchase Rate unchanged at 6.50%, as expected, while it maintained its stance of remaining focused on the withdrawal of accommodation in which 5 out of 6 members voted in favour of the rate decision and policy stance, with MPC external member Varma the lone dissenter who voted for a 25bps cut and for a change in stance to neutral. RBI Governor Das stated that growth in India is accelerating and inflation is on a downward trajectory in India, while he added that transmission of policy rate hikes is still underway and monetary policy must be disinflationary. Furthermore, Governor Das said inflation needs to align at 4% on a durable basis and the MPC is to remain resolute in bringing inflation down to 4%, as well as noted that monetary policy has to remain vigilant and that the last mile of disinflation is always the most challenging.

- Chinese President Xi says China should enhance positive economic recovery and China is going to comprehensively deepen reforms, via Xinhua.

- PBoC releases Q4 monetary policy report: vows to keep monetary policy prudent. Prudent policy will be flexible, precise and effective; will fend off risks in key areas

European bourses, Stoxx600 (+0.4%), began the session on a firmer footing and have extended modesty thereafter. The AEX is the European outperformer, led by post-earnings strength in Unilever (+2.9%), ArcelorMittal (+2.6%) and Adyen (+16%). European sectors are mixed; Food Beverage & Tobacco is lifted by strength in British American Tobacco (+7.5%) post-earning. Healthcare is hampered by losses in AstraZeneca (-2.3%). US equity futures (ES U/C, NQ U/C, RTY -0.3%) are mixed; the ES and NQ are within contained levels and meandering around the unchanged mark, whilst the RTY is softer, as the index continues the prior day’s underperformance. Disney (+6%) reported a mixed set of results though did boost its cash dividend by 50%.

Top European News

- ECB Economic Bulletin Issue 1, 2024: Governing Council will continue to follow a data-dependent approach to determining the appropriate level and duration of restriction.

- Riksbank's Jansson says inflationary pressures have continued to ease, makes it possible to cut earlier than thought in November.

Earnings

- Walt Disney Co (DIS) - Q1 2024 (USD): Adj. EPS 1.22 (exp. 0.99), Revenue 23.55bln (exp. 23.64bln). Disney boosts cash dividend by 50% and targets USD 3bln buyback in FY24. Disney+ subscribers 149.6mln (exp. 151.2mln). Entertainment revenue USD 9.98bln (exp. 10.52bln). Sports revenue USD 4.84bln (exp. 4.62bln). Experiences revenue USD 9.13bln (exp. 9.04bln). Sees FY Adj. EPS about USD 4.60 (exp. 4.27). CEO Iger said parks and resorts continue to do extremely well. Co. is to invest USD 1.5bln in Fortnite maker Epic Games. (Newswires) Shares +6.7% in pre-market trade

- PayPal Holdings Inc (PYPL) - Q4 2023 (USD): EPS 1.48 (exp. 1.36), Revenue 8.02bln (exp. 7.87bln). Total payment volume USD 409.83bln (exp. 403.6bln). Transaction revenue USD 7.28bln (exp. 7.1bln). Active customer accounts 426mln (exp. 427.98mln). Payment transactions 6.80bln (exp. 6.60bln). Sees FY24 Adj. EPS USD 5.10 (exp. 5.49). Sees FY24 share repurchase of at least USD 5bln. (Newswires) Shares -8.9% in pre-market trade

- AstraZeneca (AZN LN) – FY (USD): Revenue 45.8bln (exp. 45.7bln), Core EPS 7.26 (exp. 7.27), Dividend 2.90/shr (exp. 3.00/shr). Q4: Core EPS 1.45 (exp. 1.51), Revenue 12.02bln (exp. 11.94bln). (Newswires) Shares -2.7% in European trade

- British American Tobacco (BATS LN) - FY23 (GBP): Revenue 27.28bln (exp. 27.6bln, prev. 28.1bln Y/Y), EPS 375.6p (exp. 376.1p); takes a non-cash impairment charge of GBP 27.3bln, mainly related acquisition of US combustibles brands. (Newswires) Shares +7.5% in European trade

- Siemens (SIE GY) - Q4 (EUR): Net Income 2.5bln (exp. 1.7bln). Industrial Business Profit 2.72bln (exp. 2.67bln). Revenue 18.4bln (exp. 18.8bln); Free cash flow rose sharply to EUR 1.0bln (prev. 86mln) driven by Industrial Business. Reaffirms FY24 outlook. (Siemens). Index Weightings: DAX 40: 8.8% (Second largest); Euro Stoxx 50: 3.4%; Stoxx 600: 1.1%. Shares +0.6% in European trade

- Kering (KER FP) – FY (EUR): Revenue 19.56bln (exp. 19.59bln), Net 2.98bln (exp. 3.16bln), EBITDA 6.6bln (exp. 6.4bln), EPS 24.38 (exp. 25.60), Gucci Revenue 9.87bln (exp. 10.48bln), Yves St Laurent Revenue 3.18bln (prev. 3.3bln), Dividend 14/shr (exp. 12.89/shr). CFO: end-year trends were, overall, like the rest of the year but saw an improvement in Europe & US. Will continue to invest in brands in the long term, margins could be impacted more this year. FY24 Guidance: Recurring Operating Income to decline Y/Y, particularly within H1. (Newswires) Shares +3.7% in European trade

- ArcelorMittal (MT NA) - Q4 (USD): Revenue 14.6bln (exp. 15.7bln). EBITDA 1.27bln (exp. 1.23bln). Net Income -2.97bln (exp. -1.82bln). Co. says Chinese economic growth "is expected to weaken". Co. remains positive on the medium/long-term steel demand outlook. OUTLOOK "As anticipated, apparent demand conditions are now showing signs of improvement as the destocking phase reaches maturity." "Despite continued headwinds to real demand, World ex-China apparent steel consumption ("ASC") in 2024 is expected to grow by +3.0% to +4.0% as compared to 2023." Shares +2.6% in European trade

- Maersk (MAERSKB DC) - Q4 (USD): Revenue 11.7bln (exp. 11.46bln), EBITDA 0.839bln (exp. 1.13bln), EBIT -537mln (exp. -407mln), EPS -27 (exp. -42), Dividend 5.15/shr. Suspends buyback. High uncertainty remains around the duration & degree of Red Sea disruption, duration from one-quarter to FY reflected via the FY guidance ranges.. Shares -17% in European trade.

FX

- Contained trade for the USD thus far within tight 103.95-104.16 parameters which near enough matches yesterday's range; 100DMA provides resistance at 104.18.

- The EUR is steady vs. the USD with recent hawkish comments from Schnabel providing support after Tuesday's 1.0722 YTD trough. Upside resistance comes via 100DMA at 1.0785 ahead of the round 1.08 mark.

- JPY the slight underperformer across the majors following dovish BoJ commentary overnight. USD/JPY topped out around the YTD peak of 148.89. CPI revisions tomorrow or CPI next week could provide the next inflection point.

- Antipodeans are both out of favour vs. the USD with AUD marginally more so. (Relatively) hawkish RBA unable to reverse downtrend for AUD/USD absent an economic recovery in China; currently holding above its YTD trough at 0.6486.

- PBoC set USD/CNY mid-point at 7.1063 vs exp. 7.1911 (prev. 7.1049).

- CBRT Inflation Report: year-end 2024 forecast 36% (prev. 36%), 2025 14% (prev. 14%), 2026 9%

Fixed Income

- USTs are trading heavy into the 30yr auction which has historically had a softer reception than the shorter-dated peers sold already this week, with clear and relatively pronounced steepening in play; holds above session trough at 111-00+.

- Bunds are pressured given the above with specifics a touch light as newsflow has been dominated by earnings. Ahead, numerous ECB speakers but Chief Economist Lane will take centre stage where we are attentive for any fresh remarks around waiting for Q1 wage data; trade has been in a narrow 133.88-134.19 range.

- Gilt action has been in-fitting with European/US peers. Specifics light with no reaction to the latest RICS survey which remains pressured but to a lesser extent than forecast; 10yr yield has probed 4.00% to the upside, but is once again yet to convincingly breach with January's 4.07% peak still elusive.

Commodities

- Crude is modestly firmer in what has largely been a choppy session but within narrow parameters thus far. News flow has remained quiet in early European hours with participants on the lookout for geopolitical headline; Brent Apr sits above USD 79.50/bbl.

- Mixed trade across precious metals with spot gold largely horizontal and spot silver trimming some of yesterday's losses; XAU back under its 50 DMA (USD 2,034.04/oz).

- Contained trade across base metals with little reaction seen to the mostly soft Chinese inflation report overnight and ahead of the Chinese market closures for the Chinese New Year and Spring Festival.

- Chevron's 290k BPD El Segundo California refinery reports unplanned flaring

- Iraq sets March Basrah medium crude official selling price to Asia at USD -0.80/bbl to Oman/Dubai average; Europe: USD -5.54/bbl vs dated Brent; North & South America: USD -1/bbl.

US Event Calendar

- 08:30: Feb. Initial Jobless Claims, est. 220,000, prior 224,000

- 08:30: Jan. Continuing Claims, est. 1.88m, prior 1.9m

- 10:00: Dec. Wholesale Trade Sales MoM, est. 0.3%, prior 0%

- 10:00: Dec. Wholesale Inventories MoM, est. 0.4%, prior 0.4%

Central Bank speakers

- 08:30: Fed’s Barkin Speaks on Bloomberg TV

- 12:05: Fed’s Barkin Speaks at Economic Club of New York

DB's Jim Reid concludes the overnight wrap

Markets put in a solid performance over the last 24 hours, with the S&P 500 (+0.82%) reaching an all-time high and closing just shy of the 5,000 mark at 4995.06. Indeed, at the intraday peak it had been even closer than that, with an intraday high of 4999.89. In the meantime, US Treasury yields saw a modest increase (+2.1bps) but there was strong demand at a 10yr auction that was the biggest ever, at $42bn, and this morning they’ve since come down by -2.5bps, so are back at 4.10%. Yet despite the decent performance in markets, yesterday also saw continued concerns about regional banks and commercial real estate, which means futures are still pricing a 21% chance that the Fed will cut rates next month. So even as several Fed officials have said they want to see more evidence on the inflation side, it’s clear that markets are still pricing in a risk that they may end up needing to move quicker than that.

Starting with the good news, yesterday marked another solid performance for US equities that saw both the S&P 500 (+0.82%) and the Dow Jones (+0.40%) close at an all-time high. That rally was supported by the Magnificent Seven (+1.72%) also posting a new all-time high, whilst the NASDAQ (+0.95%) closed at a two-year high. And unlike some recent sessions, the gains were fairly broad-based, with the equal-weighted S&P 500 up +0.39%, even if it continued to lag the overall index.

In terms of the latest on the regional banks, it was a volatile day, and New York Community Bancorp was initially down by -14.29% at its intraday low, before recovering to close +6.67% higher, so there were some pretty sizeable moves. The initial decline followed the overnight news that Moody’s had downgraded NYCB to Ba2 from Baa3, with the recovery later on boosted by a Bloomberg report that the company was exploring a sale of some of its assets. The broader KBW Regional Banking Index closed -0.14% lower, having traded nearly -2.5% down early on after trading in NYCB was briefly suspended.

Those fears about regional banks and commercial real estate had supported a rally in US Treasuries around the US open. However, that reversed later in the session, with the 10yr yield moderately up on the day (+2.1bps to 4.12%) despite a solid 10yr auction. That came as several Fed officials continued to stick to the general consensus from Chair Powell’s remarks last week. So overall, the message was that some sort of easing was likely to happen this year, but they still wanted more evidence that inflation was back at target before shifting towards rate cuts.

When it came to the details, Minneapolis Fed President Kashkari said that he thought 2-3 cuts would be appropriate for 2024, and that “We’re not looking for better inflation data, we’re just looking for additional inflation data that is also at around this 2% level”. So he said that if they “see a few more months of that data, I think that will give us a lot of confidence.” Later on, Governor Kugler said that she was “pleased by the progress on inflation, and optimistic it will continue”. And after that, Boston Fed President Collins said that “it will likely become appropriate to begin easing policy restraint later this year.” Finally, Richmond Fed President Barkin said he was “very supportive of being patient to get to where we need to get”.

Against that backdrop, neater-term pricing of Fed rate cuts was little changed yesterday. By the close, futures saw a 21% probability of a cut by March and 81% odds of a cut by the May meeting. For May, that pricing was down from nearly 90% early in the US session when fears about regional banks were at their peak, but is still up from its intraday low of 69% on Monday, shortly after the ISM services print came out. By contrast in Europe, investors continued to pare back the chance of imminent rate cuts from the ECB, with the chance of a cut at the next meeting in March down to just 11% this morning, the lowest it’s been since October. In turn, sovereign bonds in Europe saw a moderate selloff, with yields on 10yr bunds (+2.3bps), OATs (+3.0bps) and BTPs (+3.3bps) all moving higher. That echoed a weaker performance for European equities as well, where the STOXX 600 fell -0.23%, with the STOXX Banks Index down -1.44%.

Overnight in Asia there’s been several important headlines driving markets as well. First, there’ve been fresh signs of deflation in China, with consumer prices down -0.8% year-on-year in January (vs. -0.5% expected). That’s their fastest decline since 2009 around the global financial crisis, whilst producer prices were also down -2.5% (vs. -2.6% expected). Nevertheless, there’s been a mixed reaction among Chinese equities ahead of the Lunar New Year holiday, with the Shanghai Comp (+0.71%) advancing, whereas the CSI 300 (+0.02%) has been broadly unchanged. Meanwhile, the Hang Seng has seen larger losses, with the index down -1.22%.

Separately, we also heard from Bank of Japan Deputy Governor Uchida, who said that even if they ended negative interest rates “ it is hard to imagine a path in which it would then keep raising the interest rate rapidly”. So that indicated a fairly dovish path, even if rates were hiked, which has helped the Nikkei (+2.18%) see a significant outperformance this morning. Yields on 10yr Japanese government bonds are also down -1.2bps.

Finally, there wasn’t much data out yesterday, but we did get German industrial production for December, which posted a -1.6% decline (vs. -0.5% expected).

To the day ahead now, and data releases include the US weekly initial jobless claims. Otherwise from central banks, the ECB will publish their Economic Bulletin, and we’ll hear from the ECB’s Vujcic, Wunsch and Lane, the Fed’s Barkin, and the BoE’s Mann.