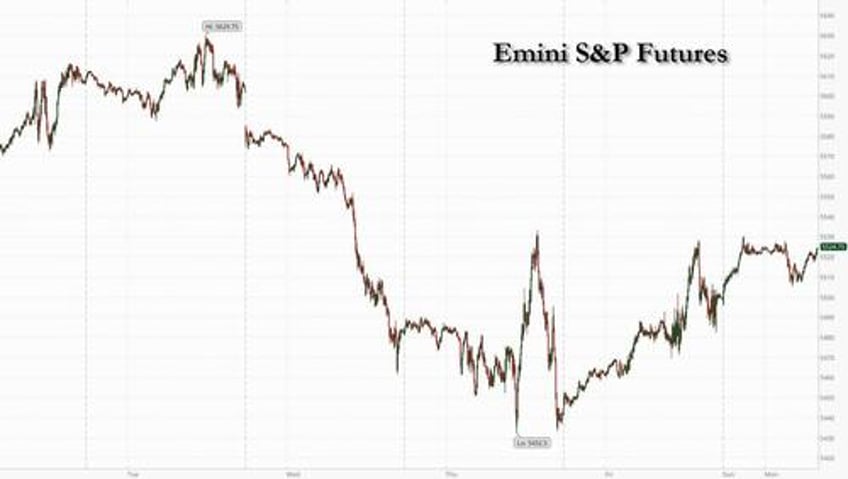

Starting what is the most important week for the market this summer - where 40% of the S&P reports earnings, the Fed reveals the September rate cut, along with decisions by the BOJ and BOE, and wel also get the July jobs report with countless other macro events on deck - stocks are solidly in the green as the carry trade destruction and tech rout that marked the past two weeks appears to have finally ended (as hedge funds buy the dip), and US equity futures as well as Asian and European markets are well in the green signaling rising optimism ahead of major central bank decisions and big tech earnings due this week. As of 7:45am ET, S&P 500 futures are up 0.4% while Nasdaq 100 futures gain 0.6%, with both set to extend their rebound for a second day after last week’s tech-fueled slump. Europe’s benchmark stock gauge rose 0.5% while Asian stocks gained more than 1%. Treasury yields declined four basis points to 4.16%, while the dollar edged higher against a basket of currencies. Bitcoin soared, rising just shy of $70,000 after Donald Trump said to "never sell your bitcoin." It's a quiet start to the extremely busy week, with just the Dallas Fed Manufacturing index on deck today.

In premarket trading, shares in crypto-linked companies rallied after Donald Trump expanded his pro-crypto agenda over the weekend, in a speech at the Bitcoin 2024 conference in Nashville, and said he’ll turn the US into the “crypto capital” of the world if he returns to the White House. Coinbase Global (COIN) +4%, Riot Platforms (RIOT) +4.3%, Marathon Digital (MARA) +4.5%. Bitcoin also rose, extending its gains to the highest level in six weeks. Here are some other notable premarket movers:

- Abbott drops 6% after the company was ordered by a jury to pay almost $500 million over allegations that it hid the risk that its premature-infant formula can cause a potentially fatal bowel disease.

- Alibaba ADRs gain nearly 3% as investors cheered the e-commerce company’s plan to earn more service fees from merchants.

- Alphabet shares rise 1.2% as Phillip Securities raised its recommendation on the Google owner’s stock to buy from accumulate, citing online advertising resiliency and an attractive valuation.

- Anavex Life Sciences jumps 14% after the drug developer gave data from a mid-late stage trial of its experimental therapy for Alzheimer’s disease.

- Cognition Therapeutics shares were halted as the company said a Phase 2 study showed consistent improvement in cognitive outcomes with once-daily oral CT1812 in mild-to-moderate Alzheimer’s patients.

- Enstar shares were halted as the company announced that it agreed to be acquired by Sixth Street for $5.1 billion.

- Inspire Medical Systems rises 12% after the medical-device maker boosted its revenue forecast for the full year.

- Iovance Biotherapeutics falls 11% after Piper downgraded the stock, citing an apparent slow launch of the firm’s recently approved treatment for patients with advanced melanoma, Amtagvi.

- Guardant Health rallies 14% after the firm’s Shield blood test received FDA approval for colorectal cancer screening in adults age 45 and older who are at average risk for the disease.

- Tesla rises nearly 2% after Morgan Stanley named the company as its new top pick within the US autos sector, replacing Ford.

As noted earlier, it is a very busy week: central bank decisions in the US, Japan and the UK will take center stage for investors in the coming days. Traders will be looking for answers about the near-term path of interest rates, after markets had been upended by conflicting signals from key economies.

The Bank of Japan is expected to release details of plans to cut monthly bond purchases at the conclusion of its two-day policy meeting on Wednesday, while most economists also see the possibility of an interest rate hike. Hours later, the US Federal Reserve is likely to signal its intention to cut rates in September, according to economists surveyed by Bloomberg. Money markets are fully pricing a September move, with a chance of two more by year-end, according to swaps data compiled by Bloomberg. As for the Bank of England, most economists expect it to reduce rates for the first time on Aug. 1 since the start of the pandemic, although a close vote is anticipated.

“While the July FOMC meeting is likely too soon to initiate the cut, it is not too early to begin preparations for a rate reduction in September,” wrote Stephen Gallagher, an economist at Societe Generale.

Also in focus this week are earnings including Apple, Amazon.com and Microsoft following an underwhelming start to the reporting season for tech megacap companies.

“If it goes well for the remaining members of the Magnificent Seven, it could stop this movement toward a correction that we just had,” said Jacques Henry, head of cross-asset research at Silex in Geneva. “It could turn out to be an interesting entry point for investors.”

European stocks are green after a largely positive Asian session. The Stoxx 600 rises 0.4%, led by gains in energy and real estate. Here are the biggest movers Monday:

- Merck KGaA shares gain as much as 4.5%, the most since mid-May, after the company increased its full-year guidance, citing strong demand for its pharmaceutical and electronics businesses

- Philips shares rise as much as 11%, the most in three months, after the Dutch medical-equipment maker reported second-quarter results, with order intake gaining for the first time in two years

- Cranswick shares advance as much as 2.3% after the meat producer said first-quarter revenue was ahead of the same period last year, driven by strong volume growth

- Sandoz Group rises as much as 2.9%, hitting a record high. Analysts at Barclays initiated coverage with an overweight recommendation, saying the undervalued Swiss pharma company has promising drug launches in the pipeline

- Stabilus shares rise as much as 9.1%, the most since October, after the German machinery and equipment manufacturer reported third-quarter results

- Reckitt Benckiser shares drop as much as 9.8% to touch an 11-year low, after a US court ordered Abbott Laboratories to pay $495 million in damages over claims its baby formula caused an infant’s bowel disease

- Heineken drops as much as 7.6%, the most since July 2023, after the brewing giant announced first-half results which analysts say are slightly disappointing

- Pearson shares slip as much as 5.1%, the biggest drop since September. Analysts note that earnings expectations are unlikely to increase in the medium-term, following solid first-half results

Earlier in the session, Asian stocks advanced as traders braced for a week of policy decisions from major central banks, including the Bank of Japan and the Federal Reserve. The MSCI Asia Pacific Index rose as much as 1.5%, poised to snap a three-day losing streak. TSMC and Alibaba were among the biggest boosts to the benchmark. Most regional markets including Japan, South Korea and Hong Kong gained, while onshore Chinese stocks dipped. Global sentiment was helped by a pause in the recent tech selloff, with rising expectations of Fed easing boosting demand for riskier assets. Money markets are now fully pricing in a September interest rate cut, with a chance of two more by year-end, according to swaps data compiled by Bloomberg. Meanwhile, Japanese stocks rallied even as the yen extended gains on bets that the Bank of Japan may hike its key rate.

In FX, the Bloomberg Dollar Spot Index rose +0.2% ahead of policy decisions by major central banks including the Fed. The yen is the best performing G-10 currency alongside the Norwegian krone while the pound falls 0.4% to its lowest level in over two weeks ahead of the Bank of England interest rate decision on Thursday where money markets imply roughly equal odds of a cut or a hold. The yen extended last week’s rally before erasing the gains: USD/JPY slipped as much as 0.5% to 153.02 before recouping some of the lost ground. Still, the long-beleaguered unit remains on course to post its best monthly performance against the dollar for 2024.

In rates, treasuries hold gains that sent 5-year note’s yield to lowest level since March, following steeper advances for gilts and most euro-zone bond markets as prospect of a Bank of England rate cut mounts ahead of Thursday’s policy meeting. Yields are lower by 2bp-4bp with curve spreads flatter; 2s10s, 5s30s reached least-inverted or steepest levels since May 2023 last week amid declines for US stock benchmarks and increased expectations for Fed rate cuts. Coupon auctions resume Aug. 6, with Treasury set to unveil August-to-October issuance plans July 31; Treasury officials in May said they anticipated steady note and bond auction sizes for “at least the next several quarters.” Gilts lead a rally in European government debt, with UK 10-year yields falling 7bps to 4.04%.

In commodities, oil traded near a six-week low as doubts over global demand overshadowed positive Chinese economic data and renewed tension in the Middle East. WTI fell 0.3% to trade near $76.90. Spot gold rises $5 to around $2,392/oz with its proponents tipping the precious metal as the best portfolio hedge in the event that Trump retakes the White House.

Bitcoin rose 2% to its highest since mid-June after Donald Trump expanded his pro-crypto agenda.

It's a quiet start to the week: today's US economic data calendar includes July Dallas Fed manufacturing activity (10:30am). Fed officials have no scheduled appearances until after the next FOMC meeting ends July 31

Market Snapshot

- S&P 500 futures up 0.3% to 5,512.75

- STOXX Europe 600 up 0.2% to 514.05

- MXAP up 1.1% to 180.72

- MXAPJ up 0.6% to 561.92

- Nikkei up 2.1% to 38,468.63

- Topix up 2.2% to 2,759.67

- Hang Seng Index up 1.3% to 17,238.34

- Shanghai Composite little changed at 2,891.85

- Sensex little changed at 81,272.55

- Australia S&P/ASX 200 up 0.9% to 7,989.64

- Kospi up 1.2% to 2,765.53

- German 10Y yield little changed at 2.37%

- Euro down 0.2% to $1.0835

- Brent Futures up 0.1% to $81.22/bbl

- Gold spot up 0.0% to $2,387.84

- US Dollar Index up 0.19% to 104.52

Top Overnight News

- The US government has disclosed new national security concerns around TikTok and its Chinese parent ByteDance, as it fights their challenge to a law that would force a sale or ban of the app. In legal documents filed on Friday, the US Department of Justice alleged some of TikTok’s US user data had been stored in China and the company was able to collect data based on users’ views on sensitive issues such as abortion. FT

- Moscow called Washington to warn that a covert plot being formulated in Ukraine risked destabilizing relations even further between the US and Russia and the Pentagon agreed, telling Kyiv to abandon the plan. NYT

- Tensions between Hezbollah and Israel flared over the weekend after a strike in the Golan Heights killed 12 children (the deadliest day for Israel since the Hamas attack on 10/7), but both sides take steps to avoid further escalation. WSJ

- Tensions grew in Venezuela after President Nicolás Maduro was declared winner of Sunday’s election with 51.2% of the vote. The opposition rejected that claim and called on the military to enforce what it said was the will of the people. Antony Blinken said the US has “serious concerns” about the results. BBG

- Harris up 1 point over Trump when 3rd party candidates are considered (the same poll had Biden down 6 points); Harris tied with Trump in PA and MI, and down 1 point in WI; Shapiro, Kelly, and Walz are the frontrunners to be Harris’s VP. WSJ / BBG

- Harris raises a staggering $200M in the first week of her candidacy, reflecting a surge of enthusiasm for the Democratic Party since Biden exited the race. Politico

- JD Vance’s hardline positions and comments have stoked mounting unease among Republicans about Donald Trump’s choice of presidential running mate. Democrats have pounced on Vance’s past statements to paint him as “weird” while Republican strategists warn that the Trump-Vance campaign has to rapidly redefine the Ohio Senator in the eyes of voters. FT

- Harris’s campaign has reached out to the crypto industry in an effort to improve relations vs. where things currently stand with the Biden administration; Trump vowed to create a “strategic national bitcoin stockpile” and fire SEC Charman Gary Gensler if he wins in Nov. FT / WSJ

- A Fed rate cut is (finally) within sight – the FOMC will leave rates unchanged at its 7/31 meeting, but Powell is likely to lay the groundwork for a cut in Sept given progress on inflation and growing worries about employment. WSJ

A more detailed look at global markets courtesy of Newsquawk

APAC stocks traded mostly higher as the region resumed the momentum following last Friday's gains on Wall St heading into a pivotal week of risk events, while markets also shrugged off the rising Israel-Hezbollah tensions. ASX 200 was led higher by early outperformance in tech and telecoms, while all sectors traded in the green. Nikkei 225 outperformed and gapped above 38,000 at the open as markets second-guessed whether the BoJ will hike rates. Hang Seng and Shanghai Comp. were somewhat varied as the former conformed to the improved global risk sentiment, while the mainland index lagged after stalling just shy of the 2,900 level and failed to benefit from improved industrial profits.

Top Asian News

- Italian Premier Meloni said Italy is to sign a three-year action plan with China to experiment with new forms of cooperation, according to ANSA.

- China Evergrande. New Energy Vehicle said some creditors of two subsidiaries applied to the court for their bankruptcy reorganisation, while it said the matter has a major impact on the Co. and its units’ production and operating activities.

- Japan's Top Economic Council says the government and BoJ needs to guide policy with a "close eye" on recent JPY weakness. Adding, that the impact of a weak JPY and rising prices cannot be overlooked on household purchasing power.

- BoJ sources suggest some policymakers believe rate increases would have positive effects on consumption as the major cause of weak spending is the JPY depreciation; other policymakers doubt how much a small rate hike could help the JPY recovery, via WSJ.

A positive start for European bourses, following the APAC handover, quickly shifted into a more mixed picture as the broader risk tone became increasingly tepid; Euro Stoxx 50 U/C. The sectoral configuration remains the same as at the open, but with more dropping out of the green and the strength of those still firmer has also waned; Energy and Utilities outperform while Personal Care & Drug names lag. FTSE 100 outperforms given the weaker Pound, CAC 40 lags and has slipped under the 7.5k mark with the Luxury sector continuing to drift while the AEX remains firmer despite marked pressure in Heineken post-earnings as Phillips numbers offset. Stateside, futures are in the green but off best levels; ES +0.3% & NQ +0.4%. Directionally in-fitting with the above and the overall tone is a tentative one as we approach numerous megacap earnings this week including Amazon, Apple & Microsoft.

Top European News

- UK Chancellor Reeves is to accuse the former Conservative government on Monday of committing to billions of pounds of spending that has not been properly budgeted for, according to Reuters. The Telegraph reports that Reeves will attempt to fill the "black hole" by selling off land and building sites, whilst also banning the use of non-essential consultants. CityAM notes that the Treasury has refused to deny rumours it is planning to hike capital gains tax today.

- UK ports are to demand compensation if post-Brexit trade barriers with the EU are reduced after they were forced to spend millions of pounds building border-control facilities, according to FT.

- Trade between the UK and Germany is starting to recover from the post-Brexit decline, according to FT citing official figures which showed that the UK was Germany's ninth-largest trading partner during most of H1.

FX

- USD now broadly firmer vs. peers after a sluggish start to the session; last week’s high of 104.55 has been tested but not surpassed thus far. Reminder, month-end flows are weak to neutral for USD demand.

- EUR and GBP pressured with the week packed for both markets. EUR/USD down to a 1.0828 base which is in a 1.4bln 1.0825-35 OpEx band while Cable nears 1.28 to the downside as pricing for a BoE cut intensifies but before that a speech from Chancellor Reeves.

- JPY gave back initial gains vs. the USD which saw the pair delve as low as 153.02. BoJ due on Wednesday, markets assigning a 41% chance of a 15bps hike.

- Antipodeans under pressure but to varying degrees with AUD faring slightly better after managing to halt its nine-session slump on Friday, Kiwi now lower for the 8th consecutive session and nearing the 0.5852 YTD base.

- PBoC set USD/CNY mid-point at 7.1316 vs exp. 7.2522 (prev. 7.1270).

Fixed Income

- A firmer start to the session with benchmarks benefitting from the tepid risk tone into a week packed with central bank activity outside of the bloc.

- Bunds at a 133.25 peak, surpassing the 133.21 high from June and bringing a virtual double-top at 133.70/71 from April into view.

- Gilts bid as pricing for a BoE cut on Thursday continues to creep higher, up to a c. 60% chance at the time of writing; reside at the top end of 98.34-98.78 bounds and is beginning to work through a cluster of recent highs between 98.66-98.93 from 16th-19th July.

- USTs are bid and approaching the July high of 111-15, within half a tick of the mark at best thus far. Session’s highlight is the Treasury Financing Estimate, ahead of Wednesday’s refunding which is expected to see coupon sizes maintained for a second consecutive quarter

Commodities

- Crude benchmarks under modest pressure after trimming APAC gains in the European morning in conjunction with a negative tilt in risk which also saw the Dollar index rise to session highs.

- WTI Sep resides in a USD 76.85-77.69/bbl range at the time of writing, with its Brent counterpart within USD 80.87-74/bbl parameters.

- Macro focus for the complex remains on geopols, after the escalation in rhetoric from Netanyahu and Erdogan. Reminder, this week also features the JMMC but no policy recommendation is expected to be put forward.

- A slightly mixed picture for metals with spot gold firmer despite the mentioned USD strength and at highs of USD 2403/oz while base metals have come under pressure from the tone & USD, causing 3M LME Copper to test USD 9k/T to the downside.

- Venezuelan President Maduro won a third term, according to the electoral authority. US Secretary of State Blinken said the US applauds the Venezuelan people for their participation in the election despite significant challenges and deep concerns about the process, while he added it is vitally important that every vote is counted fairly and transparently. Furthermore, he said the US calls for electoral authorities in Venezuela to publish detailed tabulation of votes to ensure transparency and accountability.

- Iraq’s June oil exports averaged 3.4mln bpd, according to the Oil Ministry.

- Ukraine said it struck an oil depot in Russia’s Kursk region.

Geopolitics: Middle East

- A dozen were killed including children and more were injured by a rocket that hit a football pitch in Golan, according to Israeli Channel 13.

- Israeli PM Netanyahu said Hezbollah will pay heavily for the rocket attack that killed children, while the PM’s office later announced that the cabinet authorised the PM and Defence Minister to determine the type and response to the Hezbollah attack. It was also reported that Israel’s Foreign Minister said they are approaching the moment of an all-out war against Hezbollah and Lebanon.

- Israeli military spokesperson said they are preparing a response against Hezbollah, while the Israeli military later said it struck Hezbollah targets deep inside Lebanese territory and in southern Lebanon.

- Hezbollah announced it was on high alert and cleared some key sites in east and south Lebanon in case of possible Israeli escalation, according to two securities sources cited by Reuters.

- US Secretary of State Blinken said every indication is that the rocket that hit Golan Heights was from Hezbollah and the US stands with Israel’s right to defend its citizens from terrorist attacks, while he added that a ceasefire in Gaza would be an opportunity to bring lasting calm to the blue line between Israel and Lebanon.

- US asked Lebanon’s government to restrain Hezbollah, while Hezbollah asked the US to urge restraint from Israel, according to Lebanon’s Foreign Minister who warned a significant attack by Israel would lead to a regional war.

- US is highly concerned that the Golan Heights attack could lead to an all-out war between Israel and Hezbollah, according to Axios. It was also reported that the White House said it has been in continuous contact with Israeli and Lebanese counterparts since the attack that killed a number of children playing football and it is working on a diplomatic solution that would end attacks on the Israeli-Lebanon border.

- UN officials urged maximum restraint on the Lebanon-Israel front and warned exchanges of fire on the Lebanon-Israel border could engulf the region in catastrophe beyond belief.

- Iran’s Foreign Ministry spokesperson warned Israel about any new ‘adventure’ in Lebanon regarding the Golan Heights incident. In other news, Iran's Supreme Leader endorsed reformist Pezeshkianas president, according to FT.

Geopolitics: Other

- Russian President Putin said Russia took note of US and German plans to deploy long-range missiles in Germany and noted that important Russian facilities will be in range of those US systems, while he warned that Russia will take similar actions to deploy and will no longer adhere to its unilateral INF moratorium if the US goes ahead with such plans.

- Russia’s Defence Ministry said its forces have taken two villages in Ukraine’s Donetsk region.

- US State Department senior official said Secretary of State Blinken and Chinese Foreign Minister Wang Yi had an extended conversation about Taiwan and Blinken raised concerns over China’s recent provocative actions regarding Taiwan including the simulated blockade around Taiwanese President Lai’s inauguration. Blinken raised human rights issues including Tibet, Hong Kong and Taiwan, while they agreed to keep making progress on military-to-military ties.

- US and Japan expressed concern Russia will undermine regional stability by giving North Korea WMD and missile technology, while they are concerned about the rapid expansion of China’s nuclear arsenal and will advance talks on a high-priority effort to expand co-production of defence equipment including air-to-air missiles and enhanced patriot air defence interceptors. Furthermore, the US reiterated its commitment to defend Japan with conventional and nuclear forces, while they condemned Russia’s procurement of North Korean weapons.

- South Korean Foreign Minister Cho stressed the importance of freedom of navigation and flight in the South China Sea at the ASEAN meeting, while he added peace and stability in the Taiwan Strait are just as important as the South China Sea.

- ASEAN communiqué said they strongly condemn violence against civilians in Myanmar and call for an immediate cessation, while they underlined the importance of a serious engagement and cessation of hostilities in Ukraine, as well as expressed concern over the dire humanitarian situation and alarming casualties in Gaza. Furthermore, they said North Korean missile tests are worrisome developments and urged UNSC resolution compliance, while they also affirmed the need to cease actions in the South China Sea that can complicate and escalate disputes.

- Russian Foreign Minister Lavrov expressed concern over the US-South Korean nuclear operations plan, according to Yonhap.

US Event Calendar

- 10:30: July Dallas Fed Manf. Activity, est. -15.5, prior -15.1