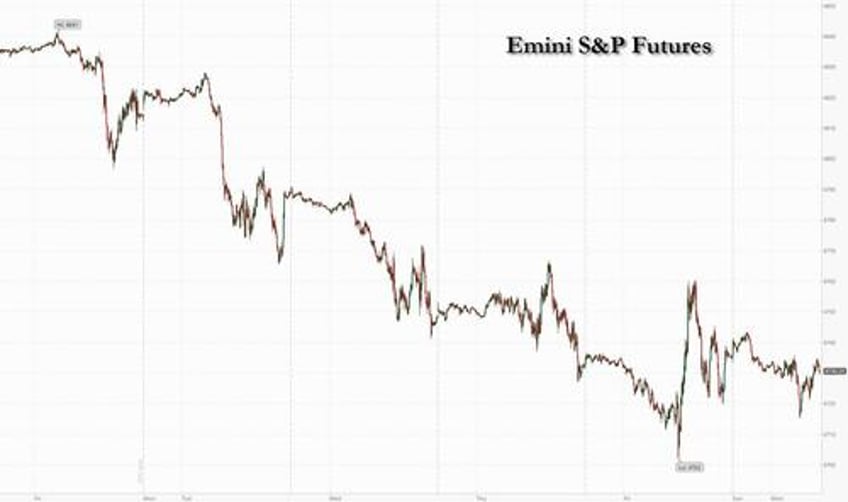

US stock futures dipped on Monday and Treasury yields gained as traders jostled for position in the wake of last week’s selloff coupled with at very confusing jobs report which was strong at the headline level and a disaster when looked closer. As of 7:40am ET, S&P 500 futures declined 0.1% with Boeing retreating almost 8% after a fuselage section on a 737 Max 9 aircraft ejected during a flight over the weekend, leading to another FAA-mandated grounding of the aircraft. Spirit AeroSystems, which installed the panel, slumped 21%. European stocks followed declines in Asia. The dollar was flat, bitcoin reversed earlier losses and and oil slid almost 3% after Saudi Arabia cut official selling prices for all regions amid persistent weakness in the market.

In premareket trading, the most notable mover was Boeing whose shares fell 8.4% after a panel blew out on a brand-new Alaska Airlines jet mid-flight, causing a temporary grounding of some 737 Max jets. Analysts saw need for greater focus on quality control if both Boeing and key supplier Spirit AeroSystems wanted to ramp up production, though hoped that a fix for the issue would be found quickly. Here are some other notable movers:

- DoorDash gains 2.3% after Jefferies upgraded the online food-delivery company to buy from hold on expectation the company will double its Ebitda in the next two years. Increased advertising penetration and lower losses in international restaurant delivery will drive the gains, it predicts.

- Harpoon Therapeutics shares surge 104% in premarket trading after Merck was reported to be in advanced talks to acquire the cancer drugmaker.

- PulteGroup shares fell 1.5% after the homebuilder was downgraded to neutral from buy at Citi, with analysts citing valuation and the company’s business model in a falling rates scenario.

- Crocs rises 7.6% after the footwear company’s boosted revenue forecast for the full year topped the average analyst estimate.

- Dell Technologies climbs 2.3% after JPMorgan upgraded the computer company to overweight.

- DoorDash gains 3.6% after Jefferies upgraded the online food-delivery company to buy on expectations that the firm will double its Ebitda in the next two years.

- Genesco tumbles 16% after the footwear and accessories retailer cut its year adjusted earnings per share forecast.

- Harpoon Therapeutics surges 110% after Merck was reported to be in advanced talks to acquire the cancer drugmaker.

- Lululemon slips 1% after the sportswear maker’s raised fourth-quarter revenue outlook lagged behind the average analyst estimate at the midpoint of the forecast range.

- Moderna rises 1% after product sales for 2023 modestly beat analyst estimates.

- Axonics gains 21% after Boston Scientific entered into a definitive agreement to acquire the medical technology company.

Markets are looking for direction after mixed US economic data on Friday capped a week that saw global equities sink the most since October on speculation the Federal Reserve was in no rush to reduce interest rates. Further catalysts may come from the US inflation print due Thursday and the earnings season kicking off Friday with US financial names including JPMorgan and Citigroup Inc.

“Multiples are already priced at rich levels,” BNP Paribas analysts including Calvin Tse and Sam Lynton-Brown wrote in a note. “With the probability of a disappointment in full-year earnings elevated, we believe that downside risks outweigh upside ones.”

Elsewhere, yields on US Treasuries reversed earlier declines and were back to Friday's closing level of 4.05%. Some traders are unfazed by the recent pullback, seeing it as a chance to seize on elevated yields before the Fed starts driving down rates. The dynamic was on display Friday, when bond prices dipped after the Labor Department reported that job growth unexpectedly accelerated last month. But the selloff was curtailed because buyers swooped in as 10-year Treasury yields neared 4.1%, the highest since mid-December.

Energy names lead a selloff in European stocks, tracking a drop in oil after Saudi Arabia cut its official selling prices by more than analysts expected. The Stoxx 600 is down 0.2% having snapped a seven-week win streak on Friday with energy, real estate and mining stocks the biggest laggards. German factory orders rose much less than anticipated in November, a discouraging sign for Europe’s largest economy, data showed on Monday. Here are the most notable European movers:

- ASML gains as much as 1.4% after Kepler Cheuvreux upgrade, saying the chip equipment giant is positioned to benefit from new chipmaking facilities and the rising use of AI-centric devices.

- Airbus rises as much as 1.6% after carriers across the globe pulled Boeing’s 737 Max 9 model from service after a fuselage section on a brand-new Alaska Airlines jet blew out during a flight.

- Novartis gains as much as 0.6% after its Scemblix drug showed positive results at week 48 of an ongoing late-stage trial for newly diagnosed patients with chronic myeloid leukemia.

- HSBC rises as much as 0.8% after Citi opens a positive catalyst watch ahead of results.

- Drax soars as much as 7.8% after the Telegraph reported this weekend that the UK government is set to approve a multibillion-pound carbon capture project for the UK energy company this week.

- Argenx rises as much as 5% after preliminary 4Q sales for the biotech firm’s Vyvgart medication beat the average analyst estimate.

- Shell falls as much as 2.5%, after the company said profits from buying and selling oil products and chemicals will be lower in the fourth quarter.

- TotalEnergies drops as much as 2.1%, as part of a pullback in energy stocks, after Saudi Arabia cut official selling prices for all regions, underscoring a worsening outlook.

- Galp declines as much as 4.7% after Morgan Stanley cut its and Equinor’s ratings late Friday as part of a broader industry downgrade

Earlier in the session, Asia stocks fell, weighed by Chinese and Hong Kong shares as concerns over the country’s regulatory developments in the technology space and the broader economy’s growth persisted. The MSCI Asia Pacific Excluding Japan Index slipped as much as 0.8%, with Tencent and Alibaba among the biggest drags. The tech selloff weighed on the broader benchmarks on the mainland and Hong Kong, with a gauge of Chinese stocks listed in the city poised to close at its lowest level in more than a year. The Hang Seng China Enterprises Index closed down 2.3%, led by a selloff in technology shares. Sentiment remains quite negative in China, Nomura Group analysts including Chetan Seth in Singapore wrote in a client note. “There have been more signs of support for the economy, but equity investors still do not appear convinced,” they said.

In FX, the Bloomberg Dollar Spot Index is flat. The Japanese yen tops the intraday G-10 rankings, rising 0.2% versus the greenback. The Taiwan dollar gained after falling in the previous five sessions as bets on the Federal Reserve interest rate-cuts eased after a robust jobs report Friday.

In rates, treasuries were unchanged despite a drop in their European counterparts. US 10-year yields reversed 2bps of earlier losses and last traded around 4.05% with WTI futures down almost 3% into early US session; in 10-year sector bunds and gilts underperform Treasuries by 3.5bp and 4bp on the day ahead of this week’s supply. It's a busy week for sovereign debt supply includes Treasury auctions and European Union 5- and 10-year offerings, while Italy, Belgium, Ireland and Spain are possible candidates for syndicated bond sales. Data highlights this week include US CPI and PPI. Treasury auctions resume Tuesday with $52b 3-year notes, followed by $37b 10- and $21b 30-year sales Wednesday and Thursday

In commodities, Brent crude fell below $77 a barrel, after rising 2.2% last week. State producer Saudi Aramco lowered its flagship Arab Light price to Asia by a more-than-expected $2 a barrel due to persistent weakness in the global crude market. Its pricing is the lowest since November 2021. Gold resumed its slide after whipsawing moves at the end of last week, with a recent rebound in the dollar and US bond yields posing a threat to the precious metal’s appeal.

Looking at today's calendar, US economic data includes December New York Fed 1-year inflation expectations (11am) and November consumer credit (3pm); December CPI and PPI are ahead this week. Fed members scheduled to speak include Bostic at 12:30pm; Barr, Williams and Kashkari are slated to appear later this week

Market Snapshot

- S&P 500 futures down 0.4% to 4,716.00

- MXAP down 0.7% to 164.75

- MXAPJ down 1.0% to 510.68

- Nikkei up 0.3% to 33,377.42

- Topix up 0.6% to 2,393.54

- Hang Seng Index down 1.9% to 16,224.45

- Shanghai Composite down 1.4% to 2,887.54

- Sensex down 0.9% to 71,368.41

- Australia S&P/ASX 200 down 0.5% to 7,451.55

- Kospi down 0.4% to 2,567.82

- STOXX Europe 600 down 0.7% to 473.03

- German 10Y yield little changed at 2.18%

- Euro down 0.2% to $1.0925

- Brent Futures down 1.2% to $77.85/bbl

- Gold spot down 0.8% to $2,028.73

- U.S. Dollar Index up 0.19% to 102.60

Top Overnight News

- China has detained an executive of Evergrande’s vehicle unit, threatening to further complicate the outlook for the restructuring of the world’s most indebted property group.

- China’s chip industry comes under further scrutiny in Washington as a bipartisan group of lawmakers call on the White House to take steps aimed at countering Beijing’s growing footprint in making older-generation semiconductors. WSJ

- The Israeli military says it has successfully destroyed Hamas as an organized fighting force in northern Gaza and has shifted its focus to the center and south of the battered territory in a fresh stage of its war against the Palestinian militant group. FT

- Hezbollah fired a barrage of rockets in northern Israel Saturday morning, a move analysts called a “symbolic response” to the recent assassination of a Hamas official in Lebanon rather than a significant escalation. NYT

- Obama has expressed concern to Biden about the state of the president’s 2024 reelection campaign, warning that Trump will be a formidable opponent. WaPo

- Dallas Fed President Logan warned that easing financial conditions could require the Fed to hike rates further. Logan also hinted at slowing the pace of QT during her Sat speech (“given the rapid decline of the ON RRP, I think it’s appropriate to consider the parameters that will guide a decision to slow the runoff of our assets. In my view, we should slow the pace of runoff as ON RRP balances approach a low level”). Dallas Fed

- Congressional leaders announced a bipartisan deal on top-line spending levels for the current fiscal year, lessening the chances of a partial shutdown on Jan. 20. The move clears the way for the Senate and House to work out detailed spending bills. BBG

- Boeing fell ~10% premarket as carriers pull the 737 Max 9 model after a door-shaped panel on a brand-new Alaska Airlines jet blew out. The FAA grounded 171 planes. The problem on the Alaska Airlines 737 MAX 9 plane was likely a manufacturing error and not a design flaw (SPR/Spirit manufactured and initially installed the fuselage part in question). BBG

- NVDA faces a problem in China as customers there don’t want to buy its new degraded chips (Nvidia has degraded the performance of its chips for the Chinese market that firms like Alibaba, Tencent, and others, are seeking alternatives). WSJ

- Consensus expects 4Q profits for the aggregate S&P 500 index will grow by 3% year/year. Analysts have not entered a quarterly reporting season with positive S&P 500 EPS growth expectations since 3Q 2022. EPS growth estimates for 4Q create a higher bar for positive surprises compared with recent quarters (-7% ahead of 1Q, -9% in 2Q, 0% in 3Q) when results beat expectations by 4 pp on average. Nonetheless, Goldman expects S&P 500 firms in aggregate will benefit from continued strong economic growth and subsiding input cost pressures and beat consensus forecasts. GIR

A more detailed look at global markets courtesy of Newsquawk

APAC stocks gradually deteriorated following a muted start and last Friday’s post-data whipsawing stateside with Japanese participants absent for Respect for the Aged Day and markets awaiting this week's key inflation data releases. ASX 200 declined as initial gains in energy, resources and financials were overshadowed by losses in miners and tech. KOSPI was initially underpinned by strength in Samsung Electronics after its unit showcased a line-up of various foldable displays, although the gains were later faded amid geopolitical tensions after North Korea conducted a third day of artillery firing on Sunday. Hang Seng and Shanghai Comp were pressured amid shadow banking woes and geopolitical frictions, with the losses in Hong Kong exacerbated by tech selling and as China Evergrande New Energy Vehicle shares slumped following the arrest of its vice chairman.

Top Asian News

- China’s State Council issued guidelines on improving operating budget systems for state-owned capital.

- US lawmakers reportedly push to defuse China's dominance of older-generation chips with House panel leaders reported to have sent a letter to the Commerce and Trade Secretaries urging action including possible tariffs, according to WSJ.

- China is to sanction five US defence manufacturers regarding US arms sales to Taiwan, according to Bloomberg.

- Taiwan's Defence Ministry said they detected three Chinese balloons flying over the Taiwan Strait on Sunday.

- US intelligence sees a less likelihood that Chinese President Xi will contemplate major military action in the coming years due to several examples of the impact of graft and corruption in China’s Rocket Forces, according to Bloomberg.

- Sony (6758 JT) is reportedly set to call off the USD 10bln Zee (ZEEL) merger, according to Bloomberg citing sources.

European equities, Stoxx600 -0.2%, on the backfoot amid a cautious risk tone; the FTSE 100 -0.3% underperforms amid broad based losses in the Energy space. European sectors are mainly in the red; though Airbus (+1.7%) lifts Industrial Goods & Services whilst Energy and Basic Resources are hampered by downbeat commodity benchmarks. US Equity Futures (ES, -0.2%) are modestly lower, in-fitting with the broader risk tone in APAC and early European trade; Boeing (-8.4%) slumps after the FAA directed over 170 Boeing 737 Max 9 planes to be grounded for inspection.

Top European News

- UK’s RMT trade union said strike action on the London Underground planned for this week was suspended after the union made progress in discussions with TFL, according to Reuters.

- British employers increased pay and regained some of their appetite for hiring in December, according to a survey from the Recruitment and Employment Confederation.

- Germany’s GDL train drivers’ union called for a rail strike in Germany on January 10th-12th, according to Reuters.

- EU Council President Michel will run in the election for the European Parliament in June and will leave his post in mid-July if elected, according to an interview with De Standard.

FX

- DXY is choppy and within a tight range between 102.32-62 with little upside resistance until 103.00.

- EUR is a touch softer and towards the bottom of a 1.0924-52 range and unreactive to mixed German data.

- JPY is the G10 outperformer, starting the week on firmer footing after hefty selling in the prior week; resides just shy of its 144.92 peak.

- Antipodeans are softer against the Dollar alongside losses in Chinese stocks overnight.

- PBoC set USD/CNY mid-point at 7.1006 vs exp. 7.1499 (prev. 7.1029)

- Czech Central Bank Vice Governor Zamrazilova said interest rate cuts will continue in relation to the decline in inflation and that a faster decline could lead to larger than 25bps lowering steps, according to Reuters.

Fixed Income

- USTs are contained given an absence of overnight trade owing to the Japanese holiday. Little by way of specific newsflow aside from weekend commentary from Fed's Logan.

- Bunds began the session on the backfoot and overall unreactive to mixed German data; recently Bunds have edged higher in tandem with peers.

- Gilts lag against its European peers with action largely a continuation of last week's moves as markets scale back the magnitude of easing expected across 2024 from the BoE.

Commodities

- WTI and Brent (-2.2%) continue to edge lower amid the firmer Dollar and broader risk aversion in early European trade; Saudi Aramco slashed its OSPs further hampering the complex.

- Precious metals are falling victim to the firmer USD with Base Metals also suffering from the downbeat risk tone; XAU falls below USD 2050/oz and under its 21 DMA at 2035/oz.

- Saudi Arabia cut its February light crude OSP to Asia by USD 2/bbl from January to a premium of USD 1.50/bbl over Oman/Dubai quotes which is a 27-month low, while it set light crude OSP to NW Europe at a premium of USD 0.90/bbl over ICE Brent settlement and light crude OSP to the US at a premium of USD 5.15/bbl over ASCI, according to Reuters.

- Qatar set February marine crude OSP at Oman/Dubai minus USD 0.75/bbl and set land crude OSP at Oman/Dubai minus USD 0.75/bbl, according to Reuters.

- Libya’s NOC declared a force majeure in the Sharara oil field effective on Sunday due to its closure by protesters and said that negotiations are ongoing to resume production as soon as possible.

- "Report on an attack on the Al-Omar oil facility in eastern Syria, where there is an American presence", according to Walla News' Elster

Geopolitics

- Israel said it has destroyed Hamas as a fighting force in northern Gaza and that the war is moving into a fresh phase with a more targeted focus on the centre and south of the Palestinian enclave, according to FT. It was separately reported that Israel’s military chief of staff asserted there would be ongoing military operations in Gaza throughout the entire year, while PM Netanyahu instructed to prepare for a return of residents to the Gaza town of Sderot by February 4th, according to Al Arabiya.

- Hezbollah said it hit an Israeli observation post with 62 rockets as a preliminary response to the killing of Hamas’s deputy chief.

- Qatar’s PM said the killing of a senior Hamas official on Tuesday has affected Qatar’s efforts to negotiate between Hamas and Israel, but Qatar continues to negotiate.

- US Secretary of State Blinken said this is a moment of profound tension in the region and conflict could easily metastasize, while he added that they will continue to defend maritime security in the region after Houthi attacks on shipping in the Red Sea.

- Jordan’s King Abdullah warned US Secretary of State Blinken of the catastrophic repercussions of the continuation of the war in Gaza and said Washington should put pressure on Israel to agree to an immediate ceasefire in Gaza, according to a royal court statement.

- EU foreign policy chief Borrell said it is ‘absolutely necessary’ to avoid Lebanon being dragged into a regional conflict and no one will win from a regional conflict, while he visited Saudi Arabia to discuss steps toward peace in the region.

- French Foreign Minister Colonna said she told her Iranian counterpart that the risk of regional conflagration has never been greater, while she added that Iran and proxies must immediately stop their destabilising actions, according to Reuters.

- US Central Command said an unmanned aerial vehicle launched from Yemen was shot down in self-defence by USS Laboon in international waters of the southern Red Sea which was in the vicinity of multiple commercial vessels, according to Reuters.

- Russia launched a large-scale air assault on several Ukrainian regions with all of Ukraine under air raid alerts, according to Ukraine's military cited by Reuters.

- South Korea’s military said North Korea fired shots on Sunday into the sea north of Yeonpyeong Island, while it urged North Korea to cease military activity raising tensions near the border and said North Korea’s provocation will face an overwhelming response.

- North Korea’s army said it conducted a coastal artillery firing drill on Sunday and that the drill did not pose any threat to the enemy. There was also a prior report that North Korean leader Kim’s sister said North Korea did not fire artillery shells but instead detonated explosives and she warned that the army would launch a ‘baptism of fire’ at any provocation, according to state media.

US Event Calendar

- 11:00: Dec. NY Fed 1-Yr Inflation Expectat, prior 3.36%

- 15:00: Nov. Consumer Credit, est. $9b, prior $5.13b

Central Bank speakers

- 12:30: Fed’s Bostic Speaks on the Economic Outlook

DB's Jim Reid concludes the overnight wrap

I'm off to Helsinki today where yesterday it was -26C, with a wind chill factor of -32C. Today it's supposed to be slightly warmer so happy days. I've been going there every year at this time for probably 25 years and it's a marvel that everything works as normal regardless of the weather.

As I pack my thermals and take the plunge, the week after payrolls is usually a quieter one for data but this week the orientation of the calendar means we have US CPI this Thursday as an exception to this rule it's hard to look much beyond this over the next few days but before we preview it, review a payrolls report on Friday that was much weaker under the surface than the headlines, and finally look back on a fascinating first week of the year, let's quickly summarise the rest of the global highlights for the week ahead.

In the US Friday's PPI is the next most important release but we also have consumer credit and the latest NY Fed 1yr inflation expectations survey today and the international trade balance tomorrow. There is a decent list of Fed speakers that you'll see in the week ahead diary at the end but if you want want more detail of their biases ahead of their speeches, Brett Ryan's US week ahead here gives a good overview. We also have 3, 10 and 30-yr Treasury auctions Tuesday, Wednesday and Thursday which will be interesting given the first set back in bonds in a couple of months. Before we leave the US, note that US earnings season unofficially starts on Friday with the release of several big financials' Q4 results (including JPM, Citi, BoA and Blackrock). Elsewhere, important inflation numbers are also released in China on Friday with the country still battling with deflation. Japanese wages and the Tokyo CPI tomorrow will also be of note.

In Europe it will be relatively quiet with the German trade balance and factory orders today and industrial production tomorrow. At the Eurozone level, there will be a number of sentiment indicators today as well. Otherwise, notable economic data includes industrial production (Thursday) and retail sales in Italy, as well as industrial production in France (both Wednesday). The UK monthly GDP report for November is also out on Friday.

Now onto US CPI on Thursday. Our economists expect headline CPI (+0.26% forecast vs. +0.10% previously. Consensus at 0.2%) to come in roughly in line with core (+0.28% vs. +0.28%. Consensus at +0.3%). This would equate to 3.9% and 3.3% YoY, a tenth ahead of consensus. We were at 4.0% and 3.1% last month. So core is not yet breaking through 3% on the downside and the 3 and 6m annualised rates are also likely to stay slightly above this mark.

Asian equity markets are most trading lower this morning. The Hang Seng Tech Index (-3.3%) is the standout and is heading towards its lowest level since November 2022. The latest moves are being exacerbated by fears of tighter gaming regulation rules. This in turn is weighing on the Hang Seng (-2.04%), the Shanghai Composite (-0.91%) and the CSI (-0.89%). Elsewhere, the KOSPI (-0.31%) is also losing ground with markets in Japan closed for a public holiday. Outside of Asia, S&P and NASDAQ futures are both down around -0.1% with DOW futures -0.37% likely influenced by Boeing after the inflight blowout in the Alaska Airline's 737 Max 9 fuselage over the weekend.

There is no trading of USTs in Asia on account of the Japanese holiday but futures prices are slightly lower. Yesterday US congressional leaders agreed on a $1.6 trillion top-line federal spending level deal that will reduce the risk of a government shutdown later this month. Elsewhere on Saturday Dallas Fed President Lorie Logan created some attention by suggesting that given we no longer live in a world where Fed liquidity is super abundant, there may be a case for slowing the pace of QT. This follows a similar mention in the FOMC minutes last week so the debate is moving that way at the moment.

Looking back at last week now, markets had a challenging start to the New Year, as the strong late 2023 rally lost steam. Risk assets regained some composure on Friday but bonds continued to lose ground.

Friday saw significant rates volatility amid mixed signals from the December payrolls and the services ISM print in the US. The headlines of the jobs report painted a solid picture, with stronger headline payrolls (+216k vs +173k expected), the unemployment rate staying at 3.7% (vs 3.8% expected) and average hourly earnings rising +0.4% on the month (vs +0.3% expected). That said, other details were some somewhat softer with -71k of payroll revisions for the previous two months, a decline in the average working week (34.3 vs 34.4 previous) and with unemployment rate stability coming thanks to a decline in the participation rate (62.5% vs 62.8%) after -673k supposedly left the labour force (surely unlikely). Indeed the household survey showed a loss of -686k jobs, the largest since the first April 2020 lockdowns. This follows gains of +586k the previous month so its hard to believe these spot numbers in isolation although the momentum is certainly trending lower for the household survey.

If that mess of a data release wasn't enough, 90 minutes later, we had a clear disappointment in the December services ISM. The headline index fell from 52.7 to 50.6 (vs 52.5 expected), its weakest in seven months, and with a dramatic decline in the employment subcomponent from 50.7 to 43.3, which is its weakest level since the initial Covid disruption in 2020. So sowing some doubts over the resilience of the US economy even if the numbers again look unbelievable taken at face value.

Having closed at 4.00% on Thursday, 10yr Treasury yields almost touched 4.10% immediately after the payrolls print on Friday, before soon reversing and trading as low 3.95% after the services ISM. However, the bond sell-off dominated in the end, with the 10yr closing at 4.05% (+4.6bps), its highest level since the December FOMC. Over the week, the 10yr yield was up +16.7bps, its largest rise in 11 weeks. The 2yr yield was up +13.1bps to 4.38% (-0.4bps Friday). The front-end outperformance on Friday came as the weak ISM saw the chances of a rate cut being priced by March inch up from 69% to 73% (but still down from being fully priced in a week earlier).

European rates saw a similar sell-off last week, with 10yr bund yields up +13.4bps over the week to 2.15%, their highest level in nearly a month (+3.2bps Friday). OATs (+13.9bps) and BTPs (+15.3bps) saw slightly larger sell-offs during the week. But it was gilts that led the bond sell-off in Europe, with the 10yr yield up +25.0bps over the week (+6.0bps Friday) helped by several stronger data releases. When it comes to ECB pricing, the chances of a 25bp cut by March fell to 49% on Friday, down from 65% at the start of the week.

Broad equity weakness saw the S&P 500 post a weekly decline of -1.52% after nine consecutive weekly gains. It did see a slight recovery on Friday (+0.18%) after falling for the first three trading days of the year. The equity weakness included an unusual pattern of major underperformance for both tech stocks and small caps, with the NASDAQ (-3.25%) and Russell 2000 (-3.75%) indices both seeing their worst weeks since September. The Russell 2000 has now declined for six sessions in a row since its recent peak on December 27, after rising by an impressive +26.2% over the previous two months. Back in Europe, the Stoxx 600 fell -0.27% on Friday, but saw a more modest decline over the course of the week (-0.54%). Credit also lost ground, with US high yield spreads up +30bps over the week to 353bp (-7bps Friday), their largest weekly rise since the banking stress last March.

One of the few assets to see a strong performance last week was the US dollar, with the broad dollar index (+1.06%) having its best week since July. In the commodity space, oil prices also gained amid a supply outage in Libya and ongoing risks over shipping via the Red Sea – with Brent up +2.23% to $78.76/bbl (+1.51% Friday) and WTI up +3.01% to $73.81/bbl (+2.24% Friday).

Lets see what week 2 brings!