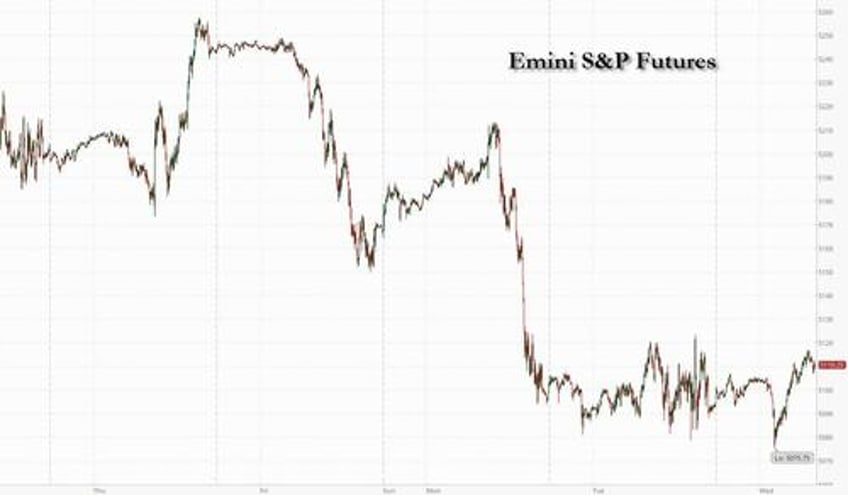

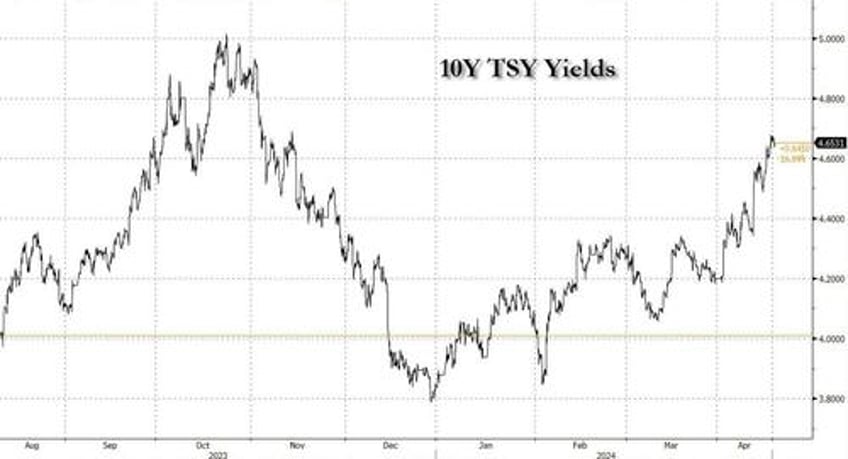

US equity futures and European markets are higher, reversing several days of losses after positive earnings from some of Europe’s biggest companies lifted the mood as markets were roiled by a more hawkish outlook for interest rates. Futures on the S&P 500 rose by 0.4% reversing three days of losses that saw the S&P drop by 2.9% to close Tuesday near a two-month low. Nasdaq 100 contracts edged higher, while consumer products and services led an advance of 0.7% in the Stoxx Europe 600. Treasury yields retreated from a 2024 peak helping small-caps outperform pre-market, and a gauge of the dollar snapped five days of gains that took it to a five-month high after Powell said it would likely take longer to have confidence that inflation is headed toward the central bank’s target. Commodities are mixed with metals stronger and oil weaker even as tensions in the Middle East persisted, while Israel weighs a response to Iran’s weekend attack. Macro data is light today with Beige Book, TIC (keep an eye on CB sales), and mortgage apps (which rose 3.3% after rising 0.1% last week).

In premarket trading, all seven Mag7 names are higher; semis are seeing some weakness following ASML’s earnings release (misses on orders/revs and beat on EPS; stock -4%). United Airlines shares rose 5.4% after the carrier’s second-quarter adjusted earnings per share forecast beat consensus estimates. Additionally, the company reported first-quarter operating revenue that came ahead of expectations. Here are some other notable movers:

- Alcoa shares advance 3.5% after Bloomberg reported that President Joe Biden will propose higher tariffs on Chinese steel and aluminum during a visit to Pittsburgh, Pennsylvania. Shares in steel producers United States Steel Corp. and Cleveland-Cliffs also rise after the news.

- JB Hunt shares fall 6.0% after the transportation company posted first-quarter earnings and revenue that fell short of expectations.

- Omnicom shares gain 2.6%. The company is now “on a trend of stable-to-improving” organic growth, Wells Fargo says in note as lifts its recommendation on the advertising and marketing company to overweight from equal-weight.

- Urban Outfitters shares drop 4.5% after the clothing retailer was downgraded to underperform from hold at Jefferies, which said it had “some concern” on the near-term positioning of the company due to data showing slowing foot traffic.

Stocks have come under pressure this week as traders recalibrated bets on the timing and extent of Federal Reserve interest rate cuts. Corporate earnings will now have to do the heavy lifting for any rally, according to strategist at Barclays Plc and Bank Julius Baer who recommend buying the dips in anticipation of an economic recovery that could boost profits.

“We would actually advise to use such an opportunity to gradually increase exposure to cyclicals in the anticipation of the new economic cycle starting to unfold in second half of this year,” said Leonardo Pellandini, equity strategist at Bank Julius Baer. He likes shares of companies tied to the business cycle, those poised to gain from growth and inflation.

With earnings season about to go into high gear as tech giants report next week, market-implied expectations for Fed rate cuts have collapsed as tensions in the Mideast fan inflation expectations and a resilient US economy defies calls for easier policy. After starting the year by pricing in as many as six rate cuts, traders are now betting on two or less. Fed Chair Jerome Powell said Tuesday it would likely take longer to have confidence that inflation is headed toward the central bank’s target.

Meanwhile, tensions in the Middle East continue to simmer. Israel is weighing a response to what was the first attack on the Jewish state from Iranian soil. Saudi Arabia and the United Arab Emirates called for maximum “self-restraint” to spare the region “from the dangers of war and its dire consequences,” in an unusually frank joint statement Wednesday.

European stocks rose: the Stoxx 600 is up 0.5%, led by consumer product shares after reassuring updates from LVMH and Adidas. Technology stocks underperform as ASML falls 4% after new orders fell short of expectations. Among individual movers, Sportswear maker Adidas AG climbed more than 6% after raising its revenue and profit outlook, while LVMH led luxury stocks higher on the back of reassuring results. Rio Tinto Plc rose after saying elevated steel exports by China will continue support demand for the raw material. Volvo AB gained after the Swedish truckmaker reported resilient margins. ASML Holding NV plunged more than 6% after missing estimates for first-quarter orders. Just Eat Takeaway.com NV shares slumped after the company said orders slipped in the first quarter, signaling continued weak demand for food deliveries.

Earlier in the session, Asia’s lagging stock benchmark briefly erased its gain for the year, as worries about higher-for-longer interest rates and geopolitical tensions triggered losses across the region. The MSCI Asia Pacific Index fell as much as 0.4% Wednesday before paring losses, with consumer discretionary and industrials among the biggest drags. The measure was hovering around 169.39, the closing level reached on the last trading day of 2023, after Federal Reserve Chair Jerome Powell signaled policymakers will wait longer than previously anticipated to cut interest rates.

Hong Kong stocks were little changed while mainland China gauges sharply rebounded from Tuesday’s losses that were driven by mixed economic data. Chinese small-caps rose, paring this week’s selloff, as the nation’s top securities regulator sought to ease concern over the potential delisting of firms with weak financial health. Overseas investors have sold more than $2.2 billion worth of equities on a net basis in emerging Asia excluding China in April, according to latest data compiled by Bloomberg. The bulk of the selling happened this week. Other bleak milestones are flashing across the region as the 10-day historical volatility on the MSCI index spikes. The Australian stock benchmark briefly erased its 2024 gains on Tuesday while South Korea’s small-cap gauge remains on the verge of entering a technical correction.

In FX, the Bloomberg Dollar Spot Index fell for the first time in six sessions while European stocks gain after positive earnings from some of the region’s biggest companies. The pound rises 0.4% after UK consumer prices slowed less than expected in March. Only the kiwi is having a better day among the G-10’s, rising 0.5% versus the greenback after data showed home-grown price pressures remained persistent.

In rates, treasury yields are lower by up to 3bp across belly of the curve with 5s30s spread steeper by 2.5bp on the day; 10-year yields trade around 4.645% down by 3bps from the 2024 highs hit yesterday...

... outperforming bunds and gilts by ~2bp, with front-end and belly leading, re-steepening 5s30s spread back toward middle of Tuesday’s range. Core European rates lag, led by front-end gilts after March UK inflation data showed less slowing than expected. US session includes 20-year bond auction but no major economic releases or Fed speakers. Treasury coupon sales resume at 1pm New York time with $13b 20-year bond reopening; a $23b 5-year TIPS new issue sale is ahead Thursday. WI 20-year yield ~4.875% is roughly 33bp cheaper than last month’s, which got a strong reception and stopped 2bp through.

In commodities, European natural gas edged higher for a fifth day. Oil dipped, with Brent crude falling below $90 a barrel and WTI falling 0.7% to trade near $84.70 a barrel as traders wait to see how Israel would respond to Iran’s weekend attack. Spot gold rose 0.4% to around $2,393/oz.

In crypto, Bitcoin is modestly firmer and back above USD 63.5k, Ethereum narrowly holds above USD 3k.

Looking to the day ahead now, and there are plenty of central bank speakers, including ECB President Lagarde, the ECB’s Cipollone, de Cos and Schnabel, BoE Governor Bailey, and the BoE’s Greene and Haskel, along with the Fed’s Mester and Bowman. In addition, the Fed will be releasing their Beige Book. Otherwise, data releases include the UK CPI print for March. Finally in the political sphere, EU leaders will be meeting in Brussels.

Market Snapshot

- S&P 500 futures up 0.3% to 5,107.50

- STOXX Europe 600 up 0.6% to 501.10

- MXAP down 0.2% to 169.51

- MXAPJ up 0.4% to 520.15

- Nikkei down 1.3% to 37,961.80

- Topix down 1.3% to 2,663.15

- Hang Seng Index little changed at 16,251.84

- Shanghai Composite up 2.1% to 3,071.38

- Sensex down 0.6% to 72,943.68

- Australia S&P/ASX 200 little changed at 7,605.59

- Kospi down 1.0% to 2,584.18

- German 10Y yield little changed at 2.48%

- Euro up 0.3% to $1.0646

- Brent Futures down 0.5% to $89.58/bbl

- Gold spot up 0.3% to $2,390.79

- US Dollar Index down 0.16% to 106.09

Top Overnight News

- Biden during a speech in Pittsburgh today will call for increasing the tariff rate on Chinese steel/aluminum products to 25% (he will reiterate his prior comment about US Steel staying domestically owned and operated) and plans to launch an investigation into China’s shipbuilding industry. BBG

- Japan’s largest life insurer, Dai-ichi Life, said it would only start buying 30-year JGBs if yields rise to 2%. BBG

- ASML slumped after new orders for its most-advanced chip making machines missed. Total bookings were €3.6 billion, down from a record €9.2 billion in the fourth quarter. Bearish analysts said the results dent optimism over the 2025 outlook, while others pointed to a strong order backlog. BBG

- UK CPI cools in Mar, but by less than anticipated, with headline coming in +3.2% (vs. +3.4% in Feb but ahead of the Street’s +3.1%) and core +4.2% (vs. +4.5% in Feb, but ahead of the Street’s +4.1% forecast). RTRS

- Israeli leaders on Tuesday were debating how best to respond to Iran’s unprecedented weekend airstrike, officials said, weighing a set of options calibrated to achieve different strategic outcomes: deterring a similar attack in the future, placating their American allies and avoiding all-out war. NYT

- The US and EU are preparing fresh sanctions on Iran’s missile and drone program in response to the Islamic republic’s attack on Israel, but the UK and European governments are resisting pressure to designate the elite Revolutionary Guards a terrorist organization. FT

- The US will impose new sanctions on Iran targeting the country’s missile and drone program following its weekend attack on Israel that threatened to push the Middle East into a wider conflict. BBG

- Morgan Stanley will cut about 50 investment-banking jobs in Asia, including its biggest round of layoffs in China in years. The move will affect 13% of its staffers in APAC, excluding Japan. HSBC is expected to reduce 20 more investment banking roles in the whole region. BBG

- US crude stockpiles rose by more than 4 million barrels last week, API data is said to show. That would put the total holdings at their highest in 10 months if confirmed by the EIA today. The gasoline drawdown resumed. BBG

Earnings

- ASML (ASML NA) Q1 (EUR): Revenue 5.29bln (exp. 5.39bln). Bookings 3.61bln (exp. 4.63bln). Adj. EPS 3.11 (exp. 2.68). 2024 outlook unchanged; Guides Q2 revenue between 5.7-6.2bln (exp. 6.62bln)

- Results from LVMH (MC FP) and Adidas (ADS GY) were release within US hours on Tuesday, in the European morning the stocks are firmer by 4% and 8% respectively.

- United Airlines Holdings Inc (UAL) - Q1 2024 (USD): Adj. EPS -0.15 (exp. -0.57), Revenue 12.50bln (exp. 12.45bln). PRASM USD 15.79 (exp. 15.68)Revenue passenger miles 57.43bln (exp. 57.36bln). Available seat miles 71.67bln (exp. 71.19bln). Load factor 80.1% (exp. 80.7%). Co. said the demand environment remained strong. (PR Newswire) Shares rose 5.2% pre-market. +5.3% in pre-market trade

A more detailed look at global markets courtesy of Newsquawk

APAC stocks traded mixed as the region picked up the pieces from the prior day's heavy selling but with the recovery limited after the choppy performance stateside amid Fed commentary and geopolitical concerns. ASX 200 eked mild gains albeit with upside capped by a lacklustre mining sector after Rio Tinto's quarterly production update which showed a decline in iron output and shipments from a year ago. Nikkei 225 was choppy after somewhat mixed trade data and recent speculation of FX intervention. Hang Seng and Shanghai Comp. were varied with the mainland underpinned by supportive measures with China's Financial Regulator vowing to allocate more credit resources to support manufacturing industry development and will continuously increase the proportion of medium to long-term loans for the sector, while financial institutions in Shanghai are to provide CNY 2tln in funding to support innovative technology companies over the next three years under an initiative backed by the PBoC.

Top Asian News

- PBoC said the China and US financial working teams held a meeting and both sides conducted professional, pragmatic, candid and constructive communication on monetary policy and financial stability, as well as financial regulatory cooperation. China's Finance Ministry said China expressed concern over US economic and trade restrictions against China and made further responses on the issue of production capacity at the economic work group meeting.

- Japanese Chief Cabinet Secretary Hayashi says closely watching FX moves, "prepared for full measures"; rapid FX moves undesirable, important for FX to move in a stable manner reflecting fundamentals; no comment on policies related to FX.

- China's CPCA says NEV retail sales +32% Y/Y to 260k between April 1-14th

European bourses, Stoxx600 (+0.4%) are mostly firmer, with the exception of the AEX (-0.2%), hampered by poor ASML (-3.5%) results. Luxury name LVMH (+2.5%) leads the CAC 40 (+1%) higher. Sectors hold a positive tilt; Basic Resources tops the pile, benefiting from broader strength in underlying metals prices, namely iron. Consumer Products is lifted by Luxury bellwether LVMH, as well as post-earnings strength in Adidas (+8.1%). Tech is found at the foot of the pile after the poor ASML metrics. US Equity Futures (ES +0.3%, NQ +0.3%, RTY +0.3%) are modestly firmer and are trading towards session highs. UAL (+4.9%) benefits post-earnings, after reporting solid metrics and noting that demand remained strong.

Top European News

- UK Chancellor Hunt raised the possibility of further tax cuts before the next general election as he counts on recent national insurance cuts and prospects of lower interest rates to improve the ruling Conservative party's fortunes, according to FT.

- ECB confirms renumeration ceiling for Euro Area for deposits and adjusts remuneration of other non-monetary policy decisions

FX

- USD is losing ground vs. peers but holding above the 106 mark after printing a 106.51 high yesterday; the "hawkish comments" from Chair Powell on Tuesday were unable to provide further sustained support.

- EUR is enjoying some reprieve vs. the USD after finding a base just above the 1.06 mark yesterday. No revisions to EZ CPI will have come as a relief but talk from FX strategists continues to favour a potential approach to 1.05.

- GBP is firmer vs. both the USD and EUR post-UK inflation metrics which came in slightly firmer-than-expected. As such, BoE rate cut bets have been scaled back with the first fully-priced cut pushed back to Nov. from Sept. Cable has eclipsed yesterday's 1.2472 peak with attention now on a potential test of 1.25.

- JPY is firmer vs. the USD but to a lesser extent than peers. That will be of little consolation to JPY bulls given the recent surge in the pair. Yesterday was defined by a sharp sell-off in the European afternoon; suspected by some to be intervention.

- Antipodeans are both top of the leaderboard vs. the USD. NZD is digesting the latest NZ inflation metrics. Headline prints were in-line but some stickiness was seen in underlying data.

- PBoC set USD/CNY mid-point at 7.1025 vs exp. 7.2404 (prev. 7.1028)

Fixed Income

- USTs are firmer by a handful of ticks as the benchmark lifts slightly from Tuesday's Fed-induced hawkish action. Currently at a high of 107-25+ from Tuesday's 107-13+ contract low which was spurred by Fed speak.

- Bund price action is directionally in-fitting with USTs and were unreactive to the unrevised Final HICP metrics; impetus today will be from several ECB speakers including Schnabel (Hawk). Bunds at the mid-point of 130.99-131.36 parameters with the contract low just below at 130.97.

- Gilts gapped lower by around 11 ticks before slipping further to a 96.01 trough and new contract low below Tuesday's 96.03 base after hotter-than-expected March CPI numbers. Gilts have since pared and are modestly firmer on the session, holding around 96.37.

- UK sells GBP 3.75bln 4.00% 2031 Gilt: b/c 2.97x (prev. 3.0x), average yield 4.218% (prev. 4.085%), tail 1.4bps (prev. 2.2bps)

- Germany sells EUR 0.805bln vs exp. EUR 1.0bln 0.00% 2050 & EUR 0.802bln vs exp. 1.0bln 2.50% 2054 Bund

Commodities

- A subdued session for crude thus far as markets still await Israel's response to the Iranian attacks from over the weekend; Brent Jun fell under USD 90/bbl to notch a current USD 89.40-90.17/bbl range.

- Precious metals are higher across the board but to varying degrees. Spot silver (+1.2%) outperforms, with spot palladium (+0.5%) firmer and spot gold (+0.1%) just about in the green. XAU rebounded from intraday lows to the top of a USD 2,372-91/oz range.

- Base metals are mostly higher, with the rally in iron ore prices overnight offering optimism for the sector. 3M LME copper is now back on a USD 9,500/t handle.

- US Energy Inventory Data (bbls): Crude +4.1mln (exp. +1.4mln), Cushing -0.2mln, Gasoline -2.5mln (exp. -0.9mln), Distillate -0.4mln (exp. -0.3mln).

- TC Energy (TRP) responded to an incident in Yellowhead County involving NGTL which affected a section of the pipeline that was shut down, while there are no reported injuries.

- Russia's primary oil refining oil capacity has been revised up April to 4.4mln tons; refining capacity is set to fall in May by 39% from April to 2.791mln ton, via Reuters calculations.

- US President Biden has directed his administration to work with Mexico to stop Chinese evasion of metals tariffs, according to the White House; calls on trade reps to consider increasing the tariff rate on Chinese steel and aluminium products to 25% (currently averages 7.5%)

Geopolitics: Middle East

- Iranian ground forces commander said any action by the Zionist entity against us will be met with greater force than last Saturday's operation, according to Al Jazeera

- White House's Sullivan said the US will impose new sanctions targeting Iran in the coming days which will include Iran's missile and drone program, as well as entities supporting the IRGC and its defence ministry, while the US anticipates its allies and partners will soon be following with their own sanctions.

- Several Iran-related bills passed the committee stage of the US Senate Tuesday that enhance sanctions on Iran’s leaders and require the President to sanction ships, ports, and refineries carrying or processing Iranian oil, according to Iran International via X.

- Iranian Admiral says they are to escort Iranian commercial ships to the Red Sea given the regions tensions, via Tasnim; "We are ready for confrontation at all levels and any mistake from the enemies will be met with a wide attack", via Al Jazeera. "If Israel makes any strategic mistake, it will receive a strong blow"

Geopolitics: Other

- US Defense Secretary Austin spoke with Chinese Defence Minister Dong for the first time in the latest effort to stabilise ties. China's Defence Minister said China and the US should explore ways to get along with each other and the Taiwan issue is 'core of China's core interests' and must never be hurt, while he added the US side should recognise China's firm position, as well as respect China's territorial sovereignty and maritime rights and interests in the South China Sea.

US Event Calendar

- 07:00: April MBA Mortgage Applications 3.3%, prior 0.1%

- 14:00: Federal Reserve Releases Beige Book

- 16:00: Feb. Total Net TIC Flows, prior -$8.8b

Central Bank Events

- 14:00: Federal Reserve Releases Beige Book

- 17:30: Fed’s Mester Gives Update on Fed

- 19:15: Fed’s Bowman Speaks at IIF Global Outlook Forum

DB's Jim Reid concludes the overnight wrap

Markets have stabilised a bit this morning after losing further ground yesterday, as investors continued to be increasingly sceptical about the chance of rate cuts, especially in the US. That was driven by some hawkish remarks from central bank officials, but risk appetite was also dampened by ongoing fears about a military escalation in the Middle East. That meant it was a pretty tough backdrop for most assets, and the selloff saw yields on 10yr Treasuries (+6.5bps) reach a fresh 5-month high of 4.67%. The S&P 500 (-0.21%) lost ground for a third day running even if futures are up by around the same amount this morning. Meanwhile in Europe, the losses were even bigger, and the STOXX 600 (-1.53%) had its worst performance in 9 months.

Yesterday's losses gathered pace as the day went on, but a key catalyst were remarks from Fed Vice Chair Jefferson. He said that “ if incoming data suggest that inflation is more persistent than I currently expect it to be, it will be appropriate to hold in place the current restrictive stance of policy for longer. I am fully committed to getting inflation back to 2 percent.” So an explicit acknowledgement that further upside inflation surprises would lead to a longer period of restrictive policy. Later in the day, Fed Chair Powell echoed the risks of a greater delay to rate cuts, saying that the “The recent data have clearly not given us greater confidence and instead indicate that is likely to take longer than expected to achieve that confidence” in the path of inflation and noting that the Fed can keep rates steady “as long as needed”.

Those remarks saw investors price increased chances of higher-for-longer rates, with Fed funds futures now pricing only 40bps of cuts by year-end, the lowest this has been so far in this cycle. 2yr Treasury yields briefly passed 5% intra-day around the time of Powell’s comments, before closing +6.6bps higher on the day at 4.99%. And 10yr yields hit their highest level since early November (+6.5bps to 4.67%). Real rates drove the increase, with 10yr real yields up +8.0bps to 2.25%, but there were also rising market concerns about inflation. For instance, the US 2yr inflation swap (+2.2bps) reached a fresh one-year high of 2.68%, its highest level since the SVB turmoil back in March 2023.

Over in Europe, yesterday also brought some new comments from ECB President Lagarde. She confirmed that the ECB were moving closer towards a rate cut, saying that “If we don’t have a major shock in developments, we are heading towards a moment where we have to moderate the restrictive monetary policy that we have”. But even so, it was clear that the potential for a more hawkish Fed was having an impact on their thoughts, and Lagarde said that the ECB needed to pay attention to changes in exchange rates. Moreover, investors slightly dialled back the chance of a June cut, which fell from 90% the previous day to 87% by the close. Sovereign bonds sold off across the continent, with yields on 10yr bunds (+4.7bps), OATs (+5.3bps) and BTPs (+6.5bps) all experiencing fresh losses. For 10yr bunds, that left them at 2.48%, their highest level since November as well. On Monday DB changed their ECB rate profile from five cuts this year to three, even if the terminal rate remains at 2%, albeit pushed back three quarters to Q1 2026. See the note with the rationale here.

For Europe, a recent complication has been the path of natural gas prices, and yesterday saw futures rise another +6.53% to €33.45/MWh, well off the recent lows of €25.80/MWh on April 3. That’s been driven by growing geopolitical risk, and the move has left prices at their highest levels since early January. In the meantime, oil prices saw some stabilisation, with Brent Crude down a marginal -0.09% to $90.02 yesterday, and trading slightly lower at $89.50/bbl as I type.

For equities, there was growing concern about the prospect of rates staying higher, leading to a fresh selloff on both sides of the Atlantic. In Europe the selloff was particularly sharp, driven by growing concern about energy prices, as well as a catchup to the late US selloff the previous day. Indeed, both the STOXX 600 (-1.53%) and the FTSE 100 (-1.82%) experienced their worst daily performance since July, back when yields were breaching post-GFC highs. In the US, there was a much better performance, and the S&P 500 only fell -0.21%, which was pretty stable after its heavy declines in the previous two sessions. But this was still a rather broad decline, with the equal-weighted version of the S&P 500 down -0.54%. Banks (-1.82%) underperformed within the S&P 500, with Bank of America falling -3.53% after reporting higher charge-offs (despite a slight earnings beat). The NASDAQ (-0.12%) and the Magnificent 7 (-0.32%) saw modest declines.

The negative sentiment also saw US high yield spreads (+6.0bps) widen for the fourth session in a row, the longest such run since January. By contrast, safe haven assets again benefitted, with gold up +1.71% to yet another record high of $2,398/oz while the broad dollar index (+0.05%) eked out another 5-month high.

Markets are stabilising in Asia with small catch-up declines but no additional falls. In fact Chinese stocks are rising on positive regulatory news. The small cap CSI 2000 is up +5.49% after the stock market regulator suggested only around 100 small caps would be delisted on tighter rules that would eliminate those in poor financial health. The number had been expected to be far higher but the regulator has said it will be confined to pure zombie companies. The Shanghai Composite (+1.24%) and the CSI (+0.79%) are rising in sympathy.

Elsewhere the KOSPI (-0.30%), Nikkei (-0.17%) and the Hang Seng (-0.13%) are lower but there is more calm than earlier in the week. The S&P/ASX 200 (+0.19%) is higher.

Early morning data showed that Japan’s exports grew +7.3% y/y in March (v/s +7.0% expected), up from +7.8% increase in the previous month as the slump in the yen provided a tailwind alongside demand in China picking up. Imports fell -4.9% y/y in March, compared with Bloomberg's estimate of a -5.1% decline as against a +0.5% gain in February. The total merchandise trade surplus stood in line with analysts' projections in March, coming in at ¥366.5 billion (v/s ¥345.5 billion) as against a revised -¥377.8 billion deficit recorded in February.

Here in the UK, the focus will now be on this morning’s CPI release for March, which is coming out shortly after we go to press. But yesterday we also heard from BoE Governor Bailey, who struck a relatively sanguine tone, noting “strong evidence” of price pressures easing in the UK. Bailey’s remarks came after the European close, where yields on 10yr gilts (+5.8bps) had already hit a 5-month high in the session. At the same time, investors continued to discount the chance of BoE rate cuts this year, with just 43bps now priced by the December meeting, down -9.3bps from the previous day. This came after yesterday’s stronger-than-expected February wage data, which saw regular average weekly earnings growing at +6.0% on a 3-month year-on-year basis (vs. +5.8% expected).

Whilst bonds were selling off globally, the one exception to that pattern came in Canada, where the latest inflation data surprised on the downside. It showed median core CPI fall to +2.8% (vs. +3.0% expected), trim core CPI fall to +3.1% (vs. +3.2% expected), whilst headline was in line with expectations at +2.9%. In turn, investors ratcheted up the chance of a rate cut at the Bank of Canada’s next meeting to 71%, up from 60% the previous day. And yields on 10yr government bonds were down -1.0bps, in contrast to the moves elsewhere.

In terms of yesterday’s other data, US industrial production was in line with expectations, showing +0.4% growth in March. But that came alongside an upward revision of three-tenths to the previous month’s growth. However, housing starts fell to an annualised rate of 1.321m in March (vs. 1.485m expected), the lowest in seven months. Similarly, building permits were down to an annualised rate of 1.458m (vs. 1.510m expected), the lowest in eight months. With all those releases, the Atlanta Fed’s GDPNow model for Q1 is pointing to an annualised growth rate of 2.9%, up a tenth relative to the previous day.

Finally, the IMF released their latest World Economic Outlook yesterday, including growth forecasts for the global economy. They upgraded their global growth forecast for 2024 by a tenth relative to January, and now see growth of +3.2% this year. In particular, there were upgrades for the United States, which moved up six-tenths to +2.7%, although the Euro Area was downgraded a tenth to +0.8%. For 2025, they left their global growth forecast unchanged at +3.2%.

To the day ahead now, and there are plenty of central bank speakers, including ECB President Lagarde, the ECB’s Cipollone, de Cos and Schnabel, BoE Governor Bailey, and the BoE’s Greene and Haskel, along with the Fed’s Mester and Bowman. In addition, the Fed will be releasing their Beige Book. Otherwise, data releases include the UK CPI print for March. Finally in the political sphere, EU leaders will be meeting in Brussels.