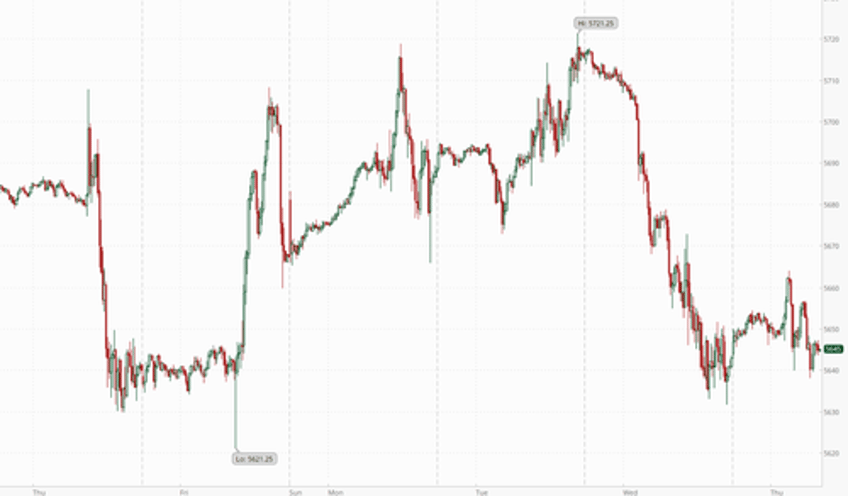

Futures are higher, rebounding from Wednesday's tech-fueled rout. At 7:40am, S&P futures are up 0.1% and off session highs, while Nasdaq futures rise 0.4% after concerns over tight US restrictions on chip sales to China drove its worst day since 2022; Semi stocks see some relief after Taiwan chip giant TSMC's earnings beat expectations: NVDA +2.7%, AMD +2.1%, AVGO +1.3%. Mag7 names are higher, too, with VRT +1.7% pointing to potential gains in second derivative AI plays. Major The Stoxx 600 index added 0.3% as most European markets trade higher ahead of the ECB at 8.15am ET, where the expectation is for rates to be held steady ahead of a potential Sept cut. China-exposed stocks are leading alongside macro recovery while AI/Semis remain under pressure despite positive TSMC earnings. Bond yields are higher 2-3bps with the belly underperforming; European bond yields are higher as many curves bear flatten. After tumbling to a 2-month low thanks to a surge in the yen driven by a reversal in the carry trade, the dollar was slightly higher as President Joe Biden faced intensified calls to bow out of the 2024 race. Commodity weakness continues with pockets of strength in precious metals and natgas (WTI is flat). Today’s macro data is focused on jobless claims and 3x Fed speakers.

In pre-market trading, US tech stocks were set to gain after Wednesday’s sharp selloff in the sector as a positive earnings update from Taiwan Semiconductor - the chipmaker for Apple and Nvidia - somewhat restored sentiment. Airline stocks lost ground after the earnings outlook for United Airlines fell short of estimates. Here are the other notable premarket movers:

- Beyond Meat shares drop 12% after a Wall Street Journal report that the firm has engaged with a group of bondholders to start talks about a balance-sheet restructuring.

- Chuy’s Holdings surges 47% after Darden Restaurants agreed to purchase the Tex-Mex restaurant chain for $37.50 a share.

- Leslie’s shares slumped 23% after the swimming pool supplies retailer slashed its full-year forecast and announced preliminary third-quarter results that missed estimates. Stifel cut the company to sell from hold and lowered its price target on the stock to a Street low, noting the enhanced risk around the company’s elevated leverage profile.

- Lilium shares rose 8.1% after Saudia Group signed a binding agreement for 50 jets with options for the purchase of 50 more from the eVTOL company.

- United Airlines (UAL US) shares rise 0.1%, erasing a drop of as much as 1.4%. The carrier’s adjusted earnings per share forecast for the third quarter missed consensus estimates. TD Cowen says the guidance was a “curve ball” but expects management to capture market share.

- VF Corp shares rise 1.5% after the apparel and footwear company was upgraded to buy from neutral at Citi, which said the sale of the Supreme brand has removed an overhang from the stock.

- Major markets are higher as markets prepare for the ECB at 8.15am ET, where the expectation is for rates to be held steady ahead of a potential Sept cut. Regional bond yields are higher as many curves bear flatten. China-exposed stocks are leading alongside macro recovery while AI/Semis remain under pressure despite positive TSM earnings. Value is leading, Cyclicals are lagging. UKX +0.9%, SX5E +0.2%, SXXP +0.4%, DAX +0.2%.

One day after the worst rout for the Nasdaq since 2022, analysts said a relatively robust earnings season and expectations of interest-rate cuts from the Fed and other central banks are also supporting sentiment. Later in the day, streaming services giant Netflix will be the first major US tech company to report results — it’s expected to show continued growth in global subscriber numbers. Meanwhile, concerns around tech haven’t fully dissipated, and Amsterdam-listed chip giant ASML - among companies that could be hit by any tougher US measures - extended Wednesday’s 11% rout. That, alongside the prospect of trade tariffs under a potential Donald Trump presidency, continue to weigh on Europe’s Stoxx 600 index.

“I’m not surprised people are trying to buy the dip,” said Michael Brown, senior strategist at Pepperstone Group Ltd. “The fundamental bull case remains strong for equities — earnings and economic growth look resilient and the Fed should start cutting rates from September.”

Later in the day, a string of Fed rate-setters are due to speak, including San Francisco Fed chief Mary Daly and Governor Michelle Bowman. Initial jobless claims figures due later Thursday will give investors the latest snapshot of the state of the economy.

European stocks rose with the Stoxx 600 up 0.3% led by the tech sector as TSMC lifted its revenue outlook for 2024. Major markets were higher as markets prepare for the ECB at 8.15am ET, where the expectation is for rates to be held steady ahead of a potential Sept cut. Regional bond yields are higher as many curves bear flatten. China-exposed stocks are leading alongside macro recovery while AI/Semis remain under pressure despite positive TSM earnings. Value is leading, Cyclicals are lagging. UKX +0.9%, SX5E +0.2%, SXXP +0.4%, DAX +0.2%. On the earnings front, Volvo AB rose after it reported better-than-expected profits for the second quarter, though the update from telecom firm Nokia Oyj disappointed, knocking the stock as much as 10% lower. Here are the most notable European movers:

- Volvo Car gains as much as 8.9% in early trading after the Swedish automaker reported operating income for the second quarter that beat the average analyst estimate, outweighing the company’s reduction in its growth outlook for the year.

- MIPS rises as much as 30% after reporting second-quarter figures that beat the average estimates.

- Hemnet surges as much as 18%, the most since January to take it to a record high, after the Swedish real estate listings platform reported very strong second-quarter earnings, boosted by strong uptake of the company’s premium listings offerings.

- Schroders shares rise as much as 6.2%, the most since November 2022, after Morgan Stanley upgraded the UK asset manager to overweight from equalweight, citing analysis of fund flows.

- Publicis shares jump as much as 8.5% after the advertising agency boosted FY organic sales growth guidance, as the company flagged market-share gains and double-digit growth in China. Peer WPP also rises.

- Getinge shares jump as much as 13%, the most since March 2020, after the Swedish medical technology firm reported 2Q results that were better than market expectations.

- Sulzer rises as much as 5.3% to a new high after upgrading full-year guidance on orders and sales.

- ABB shares fall as much as 7.1% after the Swiss industrial giant reported orders below estimates as weaker demand for its automation products offset gains in its power-grid business.

- European semiconductor stocks are trading lower on Thursday, extending this week’s rout in the technology sector as a positive update from TSMC failed to lift sentiment, with markets still worrying over rising geopolitical risks that threaten the industry.

- Novartis shares drop as much as 3.1% after the drugmaker raised its profit forecast for the second time this year — a move that had been expected by some analysts.

- Husqvarna falls as much as 14%, the most in over four years, as the Swedish outdoor maintenance products firm reported second-quarter earnings that missed estimates, with DNB markets seeing consensus downgrades ahead.

- Telenor drops as much as 3.4%, the most in more than two months, after the Norwegian telecom operator delivers its second-quarter results.

- EQT slides as much as 8.2% after the Swedish private equity group’s second-quarter earnings missed Ebitda expectations, reflecting smaller-than-expected fee income as the company remains in a holding pattern waiting for exit activity to pick up.

Earlier, Asia stocks slumped echoing the tech rout stateside. Nikkei 225 underperformed amid recent currency strength and as large tech stocks suffered similar fates to their US counterparts amid the threat of tighter restrictions to supply China, while Japanese trade data showed exports and imports missed estimates. Hang Seng and Shanghai Comp. were mixed and ultimately rangebound with sentiment sapped by ongoing protectionist concerns. Australia's ASX 200 was pressured by weakness in tech and telecoms but with downside cushioned after mixed jobs data which showed higher-than-expected employment change.

In FX, the dollar index traded near the lowest level in two months, while the yen was slightly weaker at around 156.32 per dollar, while the pound wasn’t able to stay above $1.30. The euro weakened slightly ahead of a European Central Bank meeting that’s expected to signal the next rate cut will come in September.

In rates, treasuries are cheaper by 2bp-3bp, following similar move in bunds ahead of European Central Bank policy decision at 8:15am New York time. While no change is expected, President Lagarde in subsequent press conference may signal another rate cut is likely in September. US session includes weekly jobless claims, 10-year TIPS auction and several Fed speakers. Treasury 10-year yields around 4.185% are cheaper by 2.5bp on the day, broadly in line with bunds; curve spreads are within a basis point of Wednesday’s close. French bonds hold losses while auctions saw decent demand.

In commodities, WTI pares gains to around $82.90. Spot gold rises roughly $7 to near $2,466/oz. Most base metals fall.

US economic data slate includes initial jobless claims, July Philadelphia Fed business outlook (8:30am), June leading index (10am) and May TIC flows (4pm). Fed members scheduled to speak include Goolsbee (10am), Logan (1:45pm), Daly (6:05pm) and Bowman (7:45pm)

Market Snapshot

- S&P 500 futures up 0.3% to 5,654.25

- STOXX Europe 600 up 0.3% to 516.13

- MXAP down 0.9% to 185.95

- MXAPJ down 0.4% to 578.73

- Nikkei down 2.4% to 40,126.35

- Topix down 1.6% to 2,868.63

- Hang Seng Index up 0.2% to 17,778.41

- Shanghai Composite up 0.5% to 2,977.13

- Sensex up 0.8% to 81,380.43

- Australia S&P/ASX 200 down 0.3% to 8,036.52

- Kospi down 0.7% to 2,824.35

- German 10Y yield little changed at 2.44%

- Euro little changed at $1.0935

- Brent Futures up 0.2% to $85.29/bbl

- Gold spot up 0.4% to $2,469.51

- US Dollar Index little changed at 103.79

Top Overnight News

- US President Biden tested positive for COVID-19 and is experiencing mild symptoms, while he received his first dose of Paxlovid: White House.

- US Senate Majority Leader Schumer told President Biden in a meeting on Saturday it would be better for the country if he ended his re-election bid: ABC News.

- Former House Speaker Pelosi privately told President Biden in a recent conversation that polling showed Biden cannot beat Trump and that he could destroy Democrats' chances of winning the House: CNN.

- CNN quoted a senior adviser stating that US President Biden is now more receptive to calls for him to withdraw, while he reportedly asked advisers if they think VP Harris can win the election: CNN

- TSMC raised its projections for full-year revenue growth after results beat estimates, as it continued to ride the global wave of spending on AI. Shares rose premarket. BBG

- China’s Communist Party vowed to deepen supply-side reform and implement measures to resolve debt risks in property and local government. It also plans to attract foreign investment. More details are expected in coming days. BBG

- The ECB looks set to keep rates on hold today, but investors will be watching Christine Lagarde for hints at an expected reduction in September. Most analysts predict two more 25-bp rate cuts this year. BBG

- Germany plans to halve its military aid to Ukraine next year, despite concerns that U.S. support for Kyiv could potentially diminish if Republican candidate Donald Trump returns to the White House. German aid to Ukraine will be cut to 4 billion euros ($4.35 billion) in 2025 from around 8 billion euros in 2024, according to a draft of the 2025 budget seen by Reuters. RTRS

- JD Vance railed against Wall Street and corporate America on Wednesday night, putting economic populism at the center of the Republican party’s campaign to return Donald Trump to the White House. FT

- Biden has become “more receptive” in recent days to arguments about why he should exit the race as momentum for a change builds within the party (Schumer and Jefferies apparently both told Biden privately he should consider departing the race, and they intervened to prevent an accelerated nomination process to buy more time for a potential adjustment). NYT

- Biden in an interview said he would consider dropping out if a “medical condition” emerged, a comment that came before news of a positive COVID test (which forced the president to cancel some campaign events). WaPo

- United Air reported upside on Q2 EPS (4.14 vs. the Street 3.93), but RASM was soft (down 2.4%) and the Q3 guidance falls short of expectations (they see EPS of 2.75-3.25 vs. the Street 3.38). UAL mgmt. spoke positively on the industry capacity outlook in its Q2 earnings release (“sees mid-August as inflection point when industry-wide oversupply eases and United is best positioned to benefit”). RTRS

- Leslie’s issued a downside preannouncement for FQ3/June, w/EPS forecast to come in at 32-33c (vs. the Street 42c). In light of the June Q miss, mgmt. is cutting its guidance for the year (F24 EPS is seen at just 3-9c vs. the Street 28c). RTRS

A more detailed look at global markets courtesy of Newsquawk

APAC stocks followed suit to the tech rout stateside owing to recent concerns of China tech curbs and tariff fears. ASX 200 was pressured by weakness in tech and telecoms but with downside cushioned after mixed jobs data which showed higher-than-expected employment change. Nikkei 225 underperformed amid recent currency strength and as large tech stocks suffered similar fates to their US counterparts amid the threat of tighter restrictions to supply China, while Japanese trade data showed exports and imports missed estimates. Hang Seng and Shanghai Comp. were mixed and ultimately rangebound with sentiment sapped by ongoing protectionist concerns.

Top Asian News

- Chinese President Xi will unveil his long-term vision for China’s economy with the CPC set to publish a document on Thursday offering the first glimpse of what some 400 officials discussed during the Third Plenum, according to Bloomberg. It was later reported that China's Communist Party Central Committee will hold a news conference on Friday to brief the media on the Third Plenum.

- BoJ's Osaka Manager says they wish to maintain an accommodative monetary environment as much as is possible, via JiJi; believe the next monetary policy meeting is extremely important.

- Japanese Cabinet Secretary Hayashi says no comment on FX moves; specifics of monetary policy is up to BoJ, BoJ policy not aimed at guiding forex; closely monitoring forex market. Expects BoJ to conduct appropriate policy to sustainably, stably hit price target, working closely with the government.

- China Third Plenum Communique: Adopts resolution on further deepening reform comprehensively

European bourses, Stoxx 600 (-0.1%) opened on a firmer footing, but at the cash open, contracts quickly dipped off best levels; weakness which was led by a renewed sell-off in the Tech sector. European sectors hold a slight positive bias; Autos take the top spot, lifted by post-earning strength in Volvo Car AB (+7.2%). Energy is also towards the top of the pile, given the upside in the crude complex; potentially also weighing on the Travel & Leisure sector, which underperforms. US Equity Futures (ES +0.3%, NQ +0.6%, RTY -0.2%) are mixed, with clear outperformance in the tech-heavy NQ, catching a bid following strong TSMC earnings; industry peers such as Nvidia (+2.5%), Micron (+1.7%) and AMD (+2%) all gain.

Top European News

- Sulzer Gains After Upgrading Full-Year Sales and Orders Guidance

- New UK Labor Force Survey Delayed to 2025 Amid Fresh Data Issues

- Schroders Rises as Morgan Stanley Upgrades on Flows; Cuts DWS

- ION Set to Close $1.5 Billion Deal for Italy’s Prelios This Week

- European Airlines, Hotels Fall as United’s Outlook Misses

- EU’s Von der Leyen Courts Greens in Bid for Second Term

FX

- DXY is a touch firmer with an initial attempt at recouping recently lost ground eventually running out of steam. 103.85 is the peak for today but is a far cry from yesterday's 104.29 best.

- EUR is steady vs. peers in the run up to today's ECB release which is largely expected to be a non-event. EUR/USD is currently lingering just below yesterday's multi-month peak at 1.0948.

- GBP was relatively unreactive to what was a relatively in-line UK jobs report which saw the unemployment hold steady and wage growth recede, albeit remain at elevated levels. Nonetheless, Cable has returned to a 1.29 handle after topping out yesterday at 1.3045.

- JPY is slightly steadier trade for the pair after yesterday's sharp sell-off. As it stands, the pair has bounced around a point of its overnight base at 155.38, and currently holds around 156.40.

- AUD the marginal best performer across G10 FX following better-than-expected Australian jobs growth, albeit this was accompanied by an unexpected uptick in the unemployment rate.

Fixed Income

- USTs are slightly lower, holding under 111-10 and as such shy of yesterday’s 111-15 best while the overnight high of 111-12+ stalled on approach to Tuesday’s 111-13+ peak. Busy US docket ahead, IJC, Philly Fed and leading index and Fed speak from Daly, Logan and Bowman.

- Bunds are marginally softer and nearing yesterday’s 132.25 base which resides just beneath the low-end of today’s 132.29-58 parameters. Region is focused on the upcoming ECB, though no policy change is expected now. Modest and fleeting pressure was seen following the Spanish auction given the robust French outing thereafter which served to bring OATs back above 125.00.

- Once again, Gilts had no real reaction to the morning’s UK data points. The labour series came in almost entirely in-line with expectations, pertinently showing an as-expected easing in the wage rate, and only had a slight dovish impact on BoE pricing. Currently pivoting the 98.57 opening level which is at the bottom-end of a very narrow 11 tick parameter that is entirely within Wednesday’s slim 98.31-66 band.

- Spain sells EUR 6.44bln vs exp. EUR 5.5-6.5bln 1.25% 2030, 3.45% 2034, 0.85% 2037 Bono.

- France sells EUR 11.49bln vs exp. EUR 9.5-11.5bln 1.00% 2027, 2.50% 2027, 2.75% 2030, 2.00% 2032 OAT.

Commodities

- Crude spent much of the morning on the front foot, though in recent trade, the crude complex has slipped off best levels, in tandem with today's strength in the Dollar; Brent Sept currently trading around USD 84.90/bbl.

- Firmer trade across precious metals this morning despite a somewhat resilient DXY, but with broader European sentiment tilting lower, particularly in the stock market.

- Mixed trade across base metals amid a lack of drivers this morning, and with the China Third Plenum Communique offering little in terms of explicit stimulus commentary.

- Russian President Putin held a phone call with Saudi Crown Prince MBS, while they noted the importance of cooperation within OPEC+ to ensure energy market stability and both highly appreciate friendly relations between their countries, according to the Kremlin.

Geopolitics

- Russian Deputy Foreign Minister says Moscow does not exclude deployment of missiles with nuclear warheads in response to deployment of US missiles in Germany, according to Interfax

US Event Calendar

- 08:30: July Initial Jobless Claims, est. 229,000, prior 222,000

- July Continuing Claims, est. 1.86m, prior 1.85m

- 08:30: July Philadelphia Fed Business Outl, est. 2.9, prior 1.3

- 10:00: June Leading Index, est. -0.3%, prior -0.5%

- 16:00: May Total Net TIC Flows, prior $66.2b

Central Banks

- 10:00: Fed’s Goolsbee on Yahoo Finance

- 13:45: Fed’s Logan Gives Opening Remarks

- 18:05: Fed’s Daly Participates in Fireside Chat

- 19:45: Fed’s Bowman Gives Keynote Address

DB's Jim Reid concludes the overnight wrap