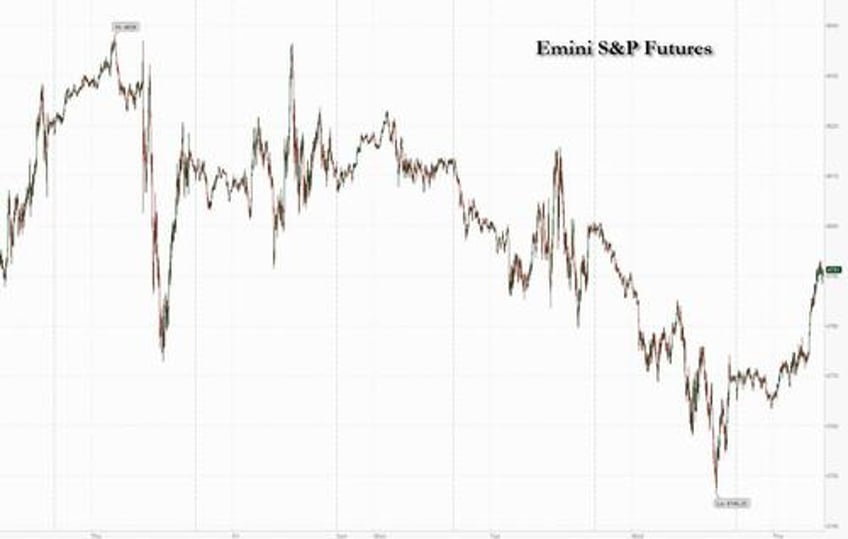

Global stocks and US futures rebounded from three days of losses, and climbed on Thursday as JPM suggests a relief rally may be starting as traders turn their attention to corporate news after conceding that rate cuts may be delayed beyond the first quarter. As of 8:10am, S&P futures rose 0.4% while Nasdaq 100 contracts gained 0.8%. A positive earnings report from Taiwan semiconductor giant TSMC is boosting AMD and NVDA. Europe's Stoxx Europe 600 index edged higher, having slumped almost 2% in the first three days of the week. China’s benchmark CSI 300 Index advanced 1.4% as a surge in ETF trading pointed toward state funds’ involvement to reverse an earlier rout. The dollar is flat while 10Y yields dipped by 1basis point to 4.09%. Heightened military action in the Middle East is pushing WTI up less than 1% with natgas appearing to react more to the cold snap in the US. Metals are weaker and Ags are rallying. Today’s macro data focus in primarily housing data plus weekly jobless data.

Chipmakers gained in US premarket trading after Taiwan Semiconductor, the main supplier to Apple Inc. and Nvidia Inc., said it expects a return to solid growth this quarter. Microchip Technology Inc., Advanced Micro Devices Inc. and Applied Materials Inc. added more than 2% each. Apple climbed 1.7%, while Nvidia rose 1.6%. Among other premarket movers, Boeing gained after winning an order for 150 of its troubled 737 Max jets from India’s newest airline. Humana Inc. plummeted after the health insurer forecast anemic enrollment growth for this year. Here are some other premarket movers:

- Plug Power (PLUG US) shares drop 16%, set to reach their lowest level since Sept. 2019, after the green hydrogen company filed for a possible at-the-market offering of up to $1 billion shares via B. Riley Securities. Analysts said that the equity raise suggests other financing routes were tricky to access, and questioned whether it would be enough to finance the embattled firm’s operations for the next year.

- Spirit Airlines (SAVE US) shares decline 4.6%, set to extend this week’s 59% drop as the ultra-low cost airline was downgraded to sell from neutral at Citi following the collapse of a planned merger with JetBlue.

Discover Financial (DFS US) shares slide 11% after its fourth-quarter results included earnings that missed estimates and higher provision for credit losses than anticipated by consensus.

Signs that European policy makers are converging around a June rate reduction helped calm markets, along with indications that Chinese state funds are coming to the rescue of equities battered by a flagging economy.

“The medium-term outlook should still be positive for markets as rates will be cut this year,” said Max Wolman, an investment director at abrdn in London. “Timing of the cuts is less relevant because when they start investors will reduce their cash holdings back into risky assets.”

“If US rates fall then most probably the rally will continue, but if inflation makes a come back then no,” said Michel Danechi, a portfolio manager at Vedra Partners. “Some profit-taking after the great run of last quarter is to be expected.”

European stocks inch higher after posting their largest three-day fall since October. The Stoxx 600 is up 0.2%, led by gains in travel, consumer product and technology shares. Luxury stocks are among the biggest gainers after a strong trading update from Cartier owner Richemont. Still, Watches of Switzerland sinks after cutting its full-year revenue guidance. Among individual movers in Europe, gambling group Flutter Entertainment Plc soared more than 10% after reporting results roughly in line with analysts’ estimates. Here are the biggest European movers on Thursday:

- Richemont climbs as much as 10%, the most since 2022, after the Swiss group’s sales came in above expectations and showed top-line resilience in a difficult luxury environment

- European luxury-goods stocks rally on the back of Richemont’s sales beat which assuaged worries over cooling demand for high-end goods, with LVMH rising as much as 4.1%

- ASML and fellow European chip equipment stocks rise after the world’s biggest contract chipmaker, TSMC, said its 2024 capex budget will be between $28b and $32b

- Evotec rises as much as 4.1% after RBC upgrades the German pharmaceutical company to outperform, citing a currently over-discounted valuation as well as underlying fundamentals

- Travis Perkins rises as much as 5.7% after the UK’s largest supplier of building materials said annual operating profit will be in-line with its previous guidance, with analysts flagging some caution

- Cranswick rises 2.9% to hit a one-month high after the food manufacturer said annual adjusted pretax profit will be ahead of expectations following stronger-than-anticipated trading

- Watches of Switzerland falls as much as 32% to the lowest since November 2020 after the luxury watch and jewelery dealer cut full-year revenue guidance due to “volatile” trading

- Harbour Energy shares slide as much as 8% after the UK-based energy company forecast lower production for 2024 than expected, something Canaccord attributes to planned shutdowns

- Ahold Delhaize falls as much as 3.1% after UBS cut the grocery-store operator to neutral from buy, citing a challenging backdrop and lack of catalysts for upside

- Sage falls as much as 2.7% after the software maker reported 10% total revenue growth in the quarter ending December, which analysts said was solid but already factored into elevated expectations

Earlier in the session, Chinese equity benchmarks rebounded in afternoon trading, recovering from what was a rout early in the session with a jump in turnover in some major exchange-traded funds raising speculation that buying by state funds maybe behind the reversal. Traded value of the Huatai-Pinebridge CSI 300 ETF surged to 15.3 billion yuan ($2.1 billion) on Thursday, the highest since 2015, while those for Harvest CSI 300 Index ETF and E Fund CSI 300 ETF also saw extraordinary spikes. That coincided with gains in the CSI 300 benchmark of mainland shares, which closed 1.4% higher after declining as much as 1.8%.

The drop in bond prices reflected a shift in investor expectations for a Federal Reserve rate cut in March. Swaps pricing shows the chances of such a cut slipped below 60% on Wednesday for the first time since the middle of December. That’s down from 80% on Friday. The decline followed comments from Fed officials this week pushing back against market expectations for imminent cuts and stronger-than-expected retail sales data Wednesday. Bumper consumer spending helped propel the economy in recent weeks, the Fed said in its Beige Book survey.

In FX, the dollar snapped a four-day rally against a basket of peers as the Bloomberg Dollar Spot Index fell 0.1%. The yen and Aussie share top spot among the G-10’s, rising 0.2% respectively.

- USD/JPY dropped 0.2% to 147.87 as the yen led G-10 gains against the dollar; Selling into the Tokyo fix contributed to the dollar gauge’s broad weakness, according to an Asia-based FX trader

- AUD/USD fell as much as 0.4% to 0.6526 before recovering to trade 0.2% higher at 0.6566; Australian unemployment surprisingly tumbled in December as the economy shed 65,100 roles

- USD/CHF steadied at 0.8643 giving the Swiss franc a breather from its longest losing steak against the dollar since September; SNB’s Jordan said Wednesday the franc’s strength is materially affecting the inflation outlook

In rates, treasuries climbed after further selling on Wednesday, which was concentrated on the short end of the curve. The policy-sensitive two-year yield fell four basis points after jumping 14 basis points on Wednesday, its biggest one-day gain since June. 10-year yields fell as much a 3bps to 4.07% before reversing. German 10-year yields are down 1bps at 2.31% as ECB officials look to be converging around June for their first rate cut.

In commodities, West Texas Intermediate held above $73 per barrel as twin incidents in the Middle East underlined the region’s rapidly escalating tensions, which have already snarled global shipping and carry the potential for interruptions to crude production. Gold rose after falling more than 1% Wednesday.

Looking to the day ahead now, and data releases include US housing starts and building permits for December, along with the weekly initial jobless claims, and the Philadelphia Fed’s business outlook for January. Meanwhile from central banks, we’ll hear from ECB President Lagarde and the Fed’s Bostic, and we’ll also get the ECB’s account of their December meeting. Japanese CPI will be out early tomorrow morning.

Market Snapshot

- S&P 500 futures little changed at 4,775.75

- STOXX Europe 600 up 0.2% to 468.63

- MXAP up 0.4% to 162.35

- MXAPJ up 0.4% to 493.18

- Nikkei little changed at 35,466.17

- Topix down 0.2% to 2,492.09

- Hang Seng Index up 0.8% to 15,391.79

- Shanghai Composite up 0.4% to 2,845.78

- Sensex down 0.5% to 71,149.02

- Australia S&P/ASX 200 down 0.6% to 7,346.48

- Kospi up 0.2% to 2,440.04

- German 10Y yield little changed at 2.31%

- Euro up 0.1% to $1.0896

- Brent Futures up 0.4% to $78.23/bbl

- Gold spot up 0.3% to $2,012.36

- U.S. Dollar Index down 0.20% to 103.24

Top Overnight News

- China is pouring stimulus into green manufacturing as the government looks to bolster its economy. WSJ

- TSMC rose premarket after signaling a return to “healthy growth” this year, adding to signs of recovery in the chip sector. Profit fell less than feared last quarter. With AI as the main driver, the company sees revenue growing as much as 25%. BBG

- ECB officials who until recently had been wary of even discussing interest-rate cuts now look increasingly open to commencing them in June. Speaking this week in Davos, President Christine Lagarde and several of her colleagues dismissed investor bets on reductions before then. But they signaled the chance of a move around mid-year, when they’ll know more about inflation, wages and the stuttering economy, as well as the harm to supply chains by Yemen’s Houthi rebels.

- The oil market may remain “reasonably well supplied” this year, as output from outside OPEC+ jumps 25% on gains in the Americas, the IEA said. In the US, gasoline and distillate stockpiles jumped, the API is said to have reported. BBG

- Oil rose as twin incidents in the Middle East underlined escalating tensions. The US struck more than a dozen Houthi missile launchers in its latest response to the Iran-backed group’s attacks on shipping. Separately, Pakistan carried out retaliatory strikes on what it called “terrorist hideouts” in Iran. BBG

- One of Nikki Haley’s billionaire backers has warned that he may withhold further support for her presidential candidacy unless she has a strong showing in next week’s Republican primary in New Hampshire. Ken Langone, the co-founder of US retail chain Home Depot, said he was prepared to give Haley “a nice sum of money” — but may wait until after Tuesday’s primary ballot before making the “major gift”. “If she doesn’t get traction in New Hampshire, you don’t throw money down a rat hole,” Langone told the Financial Times. FT

- McConnell said the Senate next week will likely vote on a Ukraine/border compromise bill, although it’s unclear whether this can make it through the House (Speaker Johnson’s rhetoric on Wednesday suggested the House could block the Senate’s bill). NYT

- AMZN is working on a new paid subscription version of Alexa, w/the updated product powered by AI technology. Business Insider

- Boeing could not “afford another slip-up” with its 737 Max family of aircraft and must set aside financial targets to focus solely on quality and safety, warned the head of one of the world’s largest aircraft owners. “Given what has happened with the two fatal crashes and this incident, the financial targets have to take a back seat for Boeing and its supply chain,” said Aengus Kelly, chief executive of the world’s biggest aircraft leasing company AerCap. FT

A more detailed look at global markets courtesy of Newsquawk

APAC stocks traded mixed with the region mostly negative after the unwinding of central bank rate cut pricing. ASX 200 was dragged lower by the mining-related sectors with attention on BHP's lower quarterly iron ore output. Nikkei 225 swung between gains and losses after recent currency weakness and disappointing machinery orders. Hang Seng and Shanghai Comp were mixed as the Hong Kong benchmark composed itself following yesterday's near-4% collapse, while the mainland index slipped to its lowest level since 2020 after recent data and rate disappointment.

Top Asian News

- Working group of US Treasury and Chinese officials will meet on Thursday in Beijing for the first time, while the topics to be discussed include financial stability, cross-border data regulations, capital markets, sustainable finance, anti-money laundering, financial terrorism and IMF policies, according to FT.

- “The possibility of the BOJ being behind the curve in addressing inflationary risks is small; “There’s no pressure to rush towards the exit", according to sources cited by Asahi

Bourses are mixed and have traded fairly contained throughout the European morning, though have just edged towards session highs in recent trade. The CAC 40 (+0.5%) outperforms, lifted by gains in the Luxury sector, post Richemont (+8.7%) earnings. European sectors are mixed; Significant outperformance in Travel & Leisure, due to hefty gains in Flutter (+10.7%) after strong earnings. Tech is also higher after strong TSMC earnings; ASML (+1.6%), ASM International (+3.5%). US equity futures are meandering around the unchanged mark, with slight outperformance in the NQ (+0.2%); with optimism filtering through into the Tech-heavy index post TSMC earnings. TSMC (2330 TT / TSM) guidance: Sees Q1 revenue between USD 18-18.8bln (exp. 18.26bln); Sees Q1 operating margin between 40-42% (vs 41.6% in Q4), sees Gross Margin between 52-54% (vs 53% in Q4); says 2023 was a "challenging year"

Top European News

- ECB's de Cos said he backs US proposals to impose more stringent requirements on banks than their US and EU counterparts and said countries should go beyond global regulations if required, according to FT.

- Maersk (MAERSK DC) says winter weather conditions and Red Sea contingencies are expected to affect operations across Europe and hub terminals

- EU27 New Car Registrations (Dec) -3.3% Y/Y ". This drop can be attributed to the high baseline performance in December 2022. December also marked the first month of contraction after 16 consecutive months of growth."

- A primer for the ECB Minutes at 12:00GMT/ 07:00 ET can be found here.

- DHL (DHL GY) CEO says still have sufficient air freight capacity despite pressure on supply chains amid Red Sea attacks; says e-commerce is rising after the post-COVID-19 dip

- BoE Credit Conditions Survey - 2023 Q4: Lenders reported that the availability of secured credit to households increased in the three months to end-November 2023 (Q4). It was expected to be unchanged over the next three months to end-February 2024.

- BoE Bank Liabilities Survey - 2023 Q4: Lenders reported that total funding volumes increased in the three months to end-November 2023 (Q4). Total funding volumes were expected to decrease in the three months to end-February 2024 (Q1)

- UK PM Sunak's Rwanda bill passed the third reading in the Commons by 320 votes to 276.

FX

- DXY is contained albeit with a slight downward bias, with the index within a 103.14-39 intraday parameter at the time of writing in the absence of news flow ahead of the weekly jobless claims - in which initial claims coincide with the BLS survey period.

- EUR trades in tandem with the Dollar after seeing more pushback against market pricing for an ECB cut yesterday; EUR/USD sits in the middle of a 1.0875-1.0906 range with the 50 DMA (1.0913) to the upside.

- A firm session for the JPY with overnight desks citing importers supporting the currency at the Tokyo fix, whilst USD/JPY continued to retrace yesterday's upside which took the pair to a 148.52 peak.

- Antipodeans benefit amid their high-beta status with the broader market risk tone holding above water with the support of firmer commodities.

- PBoC set USD/CNY mid-point at 7.1174 vs exp. 7.1976 (prev. 7.1168).

Fixed Income

- USTs are steadily grinding higher since yesterday's Retail Sales hit which prompted a decline to the 111-09 region before edging back towards 111-20 highs in early European hours.

- Bunds are contained having kicked off the session subdued but found support at 134.15 despite a lack of drivers this morning; contracts are languishing not far off overnight lows following the recent slew of pushback from ECB officials on market pricing.

- Gilts resumed trade at 98.25 (vs yesterday's 98.33 close) with the UK bonds attempting to trim some of the losses from yesterday's hotter-than-expected CPI.

- Spain sells EUR 6.265bln vs exp. EUR 5.5-6.5bln 2.50% 2027, 1.25% 2030, 3.90% 2039 Bono

- France sells EUR 11.99bln vs exp. EUR 10.5-12bln 2.50% 2027, 2.75% 2029, 0.50% 2029 OAT

Commodities

- Crude futures are firmer following yesterday's mixed settlement, with the contracts seemingly underpinned by the expanding geopolitical arena. Prices saw fleeting downticks on the IEA OMR which, after suggestions that the IEA "stands ready to respond decisively if there is a supply disruption".

- Precious metals trade horizontally with modest gains in the absence of a catalyst in the European morning and amid a stead Dollar; XAU is confined to a tight USD 2,005.02-2,013.89/oz intraday range.

- Base metals are mostly but modestly firmer trade across base metals, in fitting with the broader performance seen in European equities.

- IEA OMR (Jan): 2024 global oil demand growth forecast upgraded by 180k BPD to 1.24mln BPD, citing improved GDP outlook and Q4 23 price drop; "IEA stands ready to respond decisively if there is a supply disruption"

- Iraqi oil minister said oil exports are not affected by the Red Sea as most of the country's oil goes to Asia

- Qatar set March-loading Al-Shaheen crude term price at USD 0.88/bbl above Dubai quotes.

Geopolitics: Middle East

- US Central Command said a drone launched from Houthi-controlled areas in Yemen struck a US-owned vessel in the Gulf of Aden, while there were no injuries and some damage reported. US military also announced it conducted strikes on 14 Houthi missiles that were loaded to be fired from Yemen and said the missiles presented an imminent threat to merchant vessels and US Navy ships in the region.

- Houthi-controlled Saba News Agency said US and British aircraft targeted several governorates in Yemen.

- UK Foreign Secretary Cameron met with the Iranian Foreign Minister at the WEF and condemned the attacks in Erbil, Iraq, while he also made it clear that the Houthi attacks on shipping in the Red Sea are illegal and unacceptable, according to Reuters.

- Pakistan's Foreign Minister held a call earlier with his Iranian counterpart and underscored the attack conducted by Iran inside Pakistani territory was a serious breach of Pakistan's sovereignty and a violation of international law, while he added that Pakistan reserved the right to respond to this provocative act. It was later reported that Pakistan hit Baluchi militant targets in Iranian territory.

- Pakistan Foreign Ministry said it undertook a series of military strikes against terrorist hideouts in the Sistan and Baluchistan Province of Iran, while it added that Pakistan fully respects the sovereignty and territorial integrity of Iran and it will continue to endeavour to find joint solutions with Iran against terrorism, according to Reuters.

- Lebanon's Foreign Minister said the war on Lebanon is not easy for Israel and will be a regional war, adds if a regional war breaks out, rockets will fall on Israel from all sides, according to Al Arabiya.

- Pakistan's armed forces are on "extremely high alert", adds that any more "misadventure" from Iran will be met forcefully, according to Reuters citing Pakistan's top security official

Geopolitics: Other

- Russian Defence Ministry said air defence units shot down Ukrainian drones in Moscow and Leningrad regions, according to Reuters.

- Chinese Foreign Ministry official and Philippines Deputy Foreign Secretary reaffirmed that the South China Sea dispute is not the whole story of bilateral relations and they believe maintaining communication and dialogue is essential to maintaining maritime peace. Furthermore, they agreed to improve maritime communication and continue to properly manage maritime conflicts and differences through friendly consultations, while they agreed to properly handle maritime emergencies in certain waters of the South China Sea.

- Philippines Foreign Ministry said the Philippines and China had frank and productive discussions to de-escalate the situation in the South China Sea, while both sides agreed to calmly deal with any incidents through diplomacy and they assured each other of mutual commitment to avoid escalation of tensions, according to Reuters.

- Russian-installed official says Ukraine attempted to attack Russian oil terminal in St. Petersburg with drones overnight,

US Event Calendar

- 08:30: Jan. Initial Jobless Claims, est. 205,000, prior 202,000

- 08:30: Jan. Continuing Claims, est. 1.84m, prior 1.83m

- 08:30: Dec. Housing Starts MoM, est. -8.7%, prior 14.8%

- 08:30: Dec. Housing Starts, est. 1.43m, prior 1.56m

- 08:30: Dec. Building Permits MoM, est. 0.6%, prior -2.5%, revised -2.1%

- 08:30: Dec. Building Permits, est. 1.48m, prior 1.46m, revised 1.47m

- 08:30: Jan. Philadelphia Fed Business Outl, est. -6.7, prior -10.5, revised -12.8

DB's Jim Reid concludes the overnight wrap

The big question for markets at the moment is whether 2024 to date is just a understandable hangover to an exceptionally good end to 2023 or a marker for a more challenging year ahead. I suppose our highest conviction thought so far this year has been that the least likely scenario would be the level of rate cuts priced in by the market occurring without a recession. Such a scenario has felt completely out of place with history and still does. We have corrected back a bit this week after a slew of relatively ‘hawkish’ central bank speak (vs. market expectations), and yesterday’s surprisingly strong US retail sales, but it still feels optimistic to assume such levels of cuts without economic troubles.

The recent very strong correlation between bonds and equities that started bearishly for both in August around the QRA (quarterly refunding announcement) and flipped bullish in October around the QRA, has flipped bearish again in 2024. History tells us the tight correlation won’t last forever, and one will break out from the other, but for now the relationship is lockstep and yesterday was another day where both sold off as investors dialled back the prospect of near-term rate cuts. There were several drivers behind that, including comments from ECB President Lagarde pushing back on market expectations, an upside surprise for UK inflation, as well as strong data on US retail sales. And given the comments from Fed Governor Waller the previous day about cutting “methodically and carefully”, it all fed (pardon the pun) the narrative that central banks aren’t in a hurry to cut rates. In turn, that led to a sizeable market sell-off, with yields on 2yr Treasuries up by +14.0bps on the day, their sharpest rise since June, whilst the S&P 500 (-0.56%) put in its worst performance in two weeks. Overnight China equities are back down to March 2020 levels.

Looking at those drivers in more detail, the first were comments from several central bank officials, including ECB President Lagarde. She struck a concerned tone about market pricing, saying that it was “not helping our fight against inflation, if the anticipation is such that they are way too high compared with what’s likely to happen”. Separately, Slovenia’s Vasle said that for him “it’s absolutely premature to expect the first cuts at the beginning of the second quarter”. Meanwhile, Dutch central bank governor Knot made similar comments to Lagarde, saying that markets were “getting ahead of themselves, it’s pretty clear, and the problem for us is that in the end that might become self-defeating”.

All that pushed back on the prospect of imminent ECB rate cuts, and by yesterday’s close the amount of cuts priced in by the December meeting was down by -8.0bps to 138bps (and down -25bps since last Friday). That also helped drive a sell-off across European sovereign bonds, with yields on 10yr bunds (+5.7bps), OATs (+6.4bps) and BTPs (+8.8bps) all moving higher on the day. The moves were even more pronounced at the front end. For instance, 2yr German yields were up +10.2bps, and 2yr Italian yields were up +13.4bps.

Nevertheless, the biggest bond sell-off was in the UK yesterday, which followed an upside surprise in the latest CPI print. That showed a rebound in headline CPI to +4.0% in December (vs. +3.8% expected), with core CPI also holding steady at +5.1% (vs. +4.9% expected). That led investors to dial back the likelihood of rate cuts from the Bank of England, with the probability of a cut by May down from 88% on Tuesday to 54% by yesterday’s close. And for the year as a whole, the amount of cuts priced by the December meeting came down by -20.0bps to 111bps, so the better part of a 25bp rate cut being taken out of market pricing in 2024. For gilts, that led to a dramatic sell-off, with the 10yr yield up +18.7bps to 3.98%, which was its biggest daily move higher since February last year, whilst the 5yr yield saw an even larger increase of +23.7bps, taking it up to 3.90%.

That narrative pushing back on rate cuts got further support from the US data yesterday, which pointed to continued resilience in December. For instance, retail sales were up by +0.6% (vs. +0.4% expected), whilst the retail control group was up +0.8% (vs. +0.2% expected). So Q4 US GDP forecasts will get a decent boost. Moreover, industrial production then saw growth of +0.1% (vs. -0.1% expected), albeit with a downward revision of two-tenths to the previous month’s growth. Lastly, we found out that the NAHB’s housing market index had risen to a 4-month high of 44 in January (vs. 39 expected). On the back of the data, the Atlanta Fed’s GDPNow estimate for Q4-23 improved from +2.2% to +2.4%. That equates to the US economy growing in line with its 25-year trend.

As in Europe, this all contributed to the push-back on rate cuts, with the likelihood of a Fed cut by March down to its lowest level since the last Fed meeting, at just 59%. That helped the US Dollar inch further up, with the dollar index (+0.09%) closing at its highest level in over a month. But for Treasuries there was a pretty sharp sell-off, with the 2yr yield seeing its sharpest daily rise since June (+14.0bps) to 4.36%, whilst the 10yr yield saw a more muted rise of +4.5bps to 4.10%. Overnight in Asia, 2 and 10yr US yields are back down by -2.7bps and -1.3bps respectively.

For equities, all this proved to be a tough backdrop, which left the S&P 500 down -0.56% on the day. This decline was very broad, with 22 of the 24 industry groups in the S&P 500 down on the day. Tech stocks saw similar declines, with the NASDAQ down -0.59%, while the small-cap Russell 2000 (-0.73%) saw its 4th consecutive daily decline. With equities under pressure, the VIX volatility index (+0.9pts to 14.8) rose to its highest level since early November. And over in Europe there were even sharper losses, as the STOXX 600 fell -1.13%, its largest decline in nearly three months.

Asian equity markets are mixed this morning with most markets higher but with China slumping again. As I check my screens, the Hang Seng (+0.64%) is reversing its initial sell-off with the Nikkei also rebounding +0.27% along with the KOSPI (+0.12%). However, the Shanghai Composite (-1.59%) has fallen to its lowest level since March 2020 and the CSI (-0.63%) is also lower. S&P 500 (-0.13%) and NASDAQ 100 (-0.14%) futures are slightly lower.

Early morning data showed that Australia’s unemployment rate held steady at 3.9% for a second month in December despite employment dropping by 65,000 people, compared with an expected increase of 15,000 people. At the same time, the labour participation rate also fell more than expected to 66.8%, down from the Bloomberg estimates of 67.1% and below November’s 67.3%. Our economists' first take is that a lot of the odd anomalies in the report are more likely to be noise than a signal. See his reaction here.

To the day ahead now, and data releases include US housing starts and building permits for December, along with the weekly initial jobless claims, and the Philadelphia Fed’s business outlook for January. Meanwhile from central banks, we’ll hear from ECB President Lagarde and the Fed’s Bostic, and we’ll also get the ECB’s account of their December meeting. Japanese CPI will be out early tomorrow morning.