US futures rebounded from yesterday's late day rout even as European stocks slumped the most in almost two months and Asian markets tumbled the most in a month, tracking Thursday's broad market retreat as oil prices held near five-month highs above $90 and investors braced for today's jobs report where the whisper is of a hotter than expected print. As of 7:30am, S&P futures rose 0.3% after tumbling 1.4% yesterday; even with the modest gain the index is on track for its biggest weekly decline since mid-February. Europe's Stoxx 600 slid more than 1%, following the previous session’s sharp retreat on Wall Street and losses in Asia earlier on Friday. US and euro-area bond yields inched higher as fears of an escalation in the Middle Eastern conflict kept Brent crude futures near $91 a barrel, fanning inflation concerns. The USD is stronger, bitcoin has resumed selling, commodities are higher led by Energy products and base metals. From a macro perspective, NFP is the focus, survey is +214k survey vs. BBG whisper +230k; both are down from the +275k prior.

In premarket trading, Mag7 and Semis are higher pre-mkt; Samsung earnings may aid the move. Here are some other notable premarket movers:

- Altice USA shares slip 3.9% after a downgrade to underweight at Wells Fargo.

- Cinemark shares rise 3.4% after an upgrade to overweight at Wells Fargo.

- Krispy Kreme shares gain 5.7% trading after the doughnut chain was upgraded to overweight from neutral at Piper Sandler following last week’s announcement of a national partnership with McDonald’s.

According to JPM's market intel desk, yesterday’s sell-off had a number of reasons offered for the move: Middle East Escalation, Oil Price Spike, No Rate Cuts, etc; and since the moves appeared to be a flight to safety, the likely answer is all of the above. We have now seen the first week of the year where the SPX has lost at least 70bps twice and is the first time since the week of Oct 23, 2023 whose close that Friday market the bottom before this current rally.

“Clearly, geopolitical risks are rising and that is on everyone’s radar right now, hence some softness in equity markets and credit spreads,” said Luke Hickmore, a portfolio manager at Abrdn Investment Management Ltd. He added that he was also focused on the upcoming US employment report for March.

Oil’s 18% surge this year, alongside gains across other crucial commodities such as copper and palm oil, raised the prospect of higher-for longer inflation. Minneapolis Federal Reserve President Neel Kashkari on Thursday flagged the possibility that rate cuts may not be needed this year at all if progress on inflation stalls.

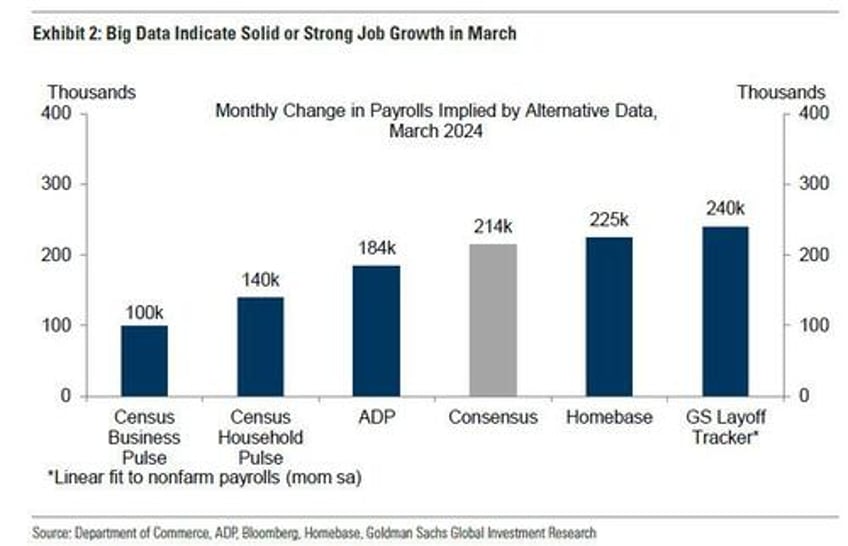

All eyes today will be on the March nonfarm payrolls report which are expected to show more than 200,000 new jobs (most of them going to illegal immigrants) added to the economy last month. A further sign of robust activity may lead the Fed to keep interest rates higher for longer. Currently, money markets are expecting fewer than three US rate cuts this year. As we discussed in our preview post, while most big data hints at a weaker than expected number...

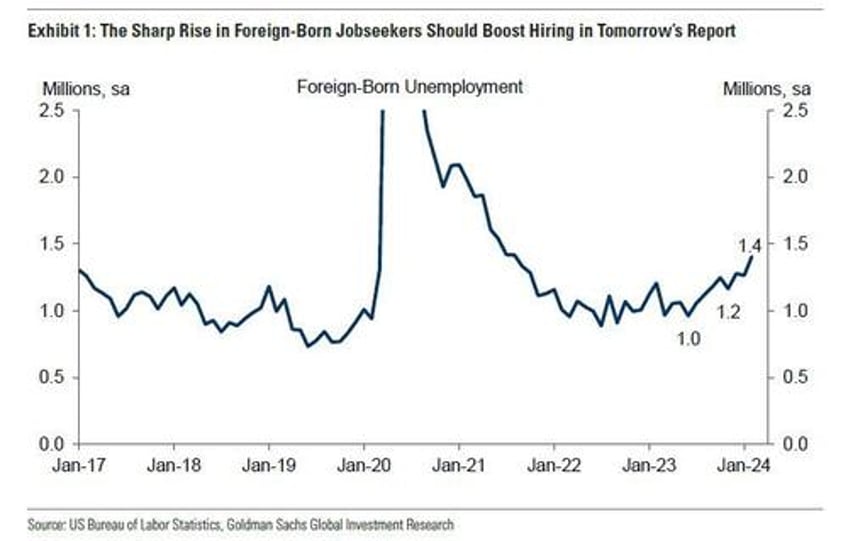

... the relentless surge in illegal immigrants may lead to another 200K+ print.

That said, a number between 150K and 250K will likely lead to some market gains while outliers in either direction will be met with selling. Here is Goldman S&P’s reaction function for the NFP number.

- <100k S&P sells off at least 50bps

- 100k – 150k S&P +/- 25bps

- 150k – 200k S&P +50 - 75bps

- 200k – 250k S&P +25 - 50bps

- 250k – 300k S&P +/- 25bps

- >300k S&P also sells off at least 50bps

European stocks fall with Financial Services leading the market lower as all sectors decline while energy stocks outperform as oil rises for a fourth day on escalating tensions in the Middle East, with concerns on jet-fuel costs weighing on travel stocks. Rising oil prices have forced a broad market retreat with bonds also slipping. FTSE 100 down 1% but outperforms peers, FTSE MIB lags with a 1.9% drop. Here are the most notable movers:

- Shell shares rise as much as 0.8% after giving a guidance update for the first quarter which analysts said was positive overall, highlighting an improvement in volumes and better margins.

- Marel shares gain as much as 6.4% as JBT says it expects to launch an offer for the food processing company in May. Oddo says the move indicates a potential takeover is a “done deal.”

- Billerud shares rise as much as 3.3%, the most since March 21, after DNB reiterated its buy rating and slightly boosted its price target, citing good positioning for 2024.

- Implenia shares gain as much as 7.4% after BURU Holding AG, owned by the Buhofer family of industrialists, bought a 13.7% stake in the Swiss group from anchor investor Max Roessler.

- Europe’s aviation stocks slide as escalating tensions in the Middle East drive a sustained rally in oil prices, spurring worries over pressure on costs.

- UK retailers are underperforming the broader market after a report showed wet weather prevented shoppers from rushing back to stores in March.

- Carlsberg shares decline as much as 2.5% after being downgraded by Barclays, which warns the beer brewer faces more challenges in China that could jeopardize its long-term sales guidance.

- Bureau Veritas shares fall as much as 3.7% after Wendel completes sale of 40.5m shares in the French goods-inspection company for total proceeds of about €1.1 billion.

- Renk shares fall as much as 9.8%, the most on record, after Oddo downgraded the defense firm to neutral from outperform seeing a strained valuation.

Earlier in the session, Asian stocks slumped by the most in nearly four weeks, driven by the selling of technology stocks, amid concerns over US monetary policy and signs of rising risks in the Middle East.The MSCI Asia Pacific Index fell as much as 1.2%, with Toyota, Tokyo Electron and Samsung among the biggest drags. Most markets declined, led by Japan after the yen strengthened. Energy stocks outperformed as oil climbed amid tensions between Israel and Iran. Hong Kong stocks dropped after a holiday, tracking losses across the region after Minneapolis Fed chief Neel Kashkari floated the possibility of no rate reductions this year. Markets were closed in mainland China and Taiwan.

- Nikkei 225 retreated beneath 39,000 with intraday losses of around 1,000 points amid currency strength.

- KOSPI was dragged lower with Samsung Electronics pressured following its preliminary Q1 results in which operating EPS topped forecasts but it missed on revenue.

- ASX 200 suffered amid weakness in tech and mining stocks, while data showed a monthly contraction in Australian exports.

In FX, the Bloomberg dollar spot index is steady. NOK outperformed G-10 FX while CHF underperforms; the yen stood out as it hit a two-week high as Bank of Japan Governor Kazuo Ueda stoked bets about an additional interest rate hike later in the year. The currency’s rise on Thursday pulled it back from levels that traders speculated would spark intervention.

In rates, Treasuries were slightly cheaper across the curve, partially unwinding the haven bid into Thursday’s US close after a flare-up of geopolitical tension between Israel and Iran. Treasury yields cheaper by 1b to 2bp across the curve, spreads within 1bp of Thursday’s close; 10-year around 4.33% is nearly 2bp higher on the day, underperforming bunds by 1.5bp while gilts lag, underperforming the rest of core Europe

In commodities, WTI trades within Thursday’s range at about $86. Brent rises to around $90. Spot gold falls roughly $4 to trade near $2,287/oz. Base metals are mixed; LME lead falls 0.6% while LME tin gains 0.5%.

Bitcoin a touch softer as markets await the NFP print and any fresh geopolitical developments to drive the macro narrative into the weekend.

Looking to the day ahead now, and the main highlight will be the US jobs report for March. Otherwise, data releases include German factory orders and French industrial production for February, along with the construction PMIs for March from the UK and Germany. From central banks, we’ll hear from the Fed’s Collins, Barkin, Logan and Bowman.

Market Snapshot

- S&P 500 futures up 0.3% to 5,213.25

- STOXX Europe 600 down 1.1% to 505.08

- German 10Y yield little changed at 2.36%

- MXAP down 0.6% to 175.33

- MXAPJ down 0.4% to 537.38

- Nikkei down 2.0% to 38,992.08

- Topix down 1.1% to 2,702.62

- Hang Seng Index little changed at 16,723.92

- Shanghai Composite down 0.2% to 3,069.30

- Sensex little changed at 74,281.20

- Australia S&P/ASX 200 down 0.6% to 7,773.27

- Kospi down 1.0% to 2,714.21

- Euro little changed at $1.0844

- Brent Futures up 0.1% to $90.78/bbl

- Gold spot down 0.1% to $2,289.16

- US Dollar Index little changed at 104.22

Top Overnight News

- BOJ’s Ueda warns that inflation will likely accelerate from the summer toward the fall due to strong wage hikes, signaling another rate hike could arrive over the coming months. RTRS

- The Indian central bank's key interest rate was kept unchanged for a seventh straight policy meeting on Friday as growth in the economy is expected to remain robust while inflation stays above the 4% target. "Robust growth prospects provide the policy space to remain focused on inflation and ensure its descent to the target of 4%," RBI Governor Shaktikanta Das said in his prepared statement. Inflation was the "elephant in the room" for the Indian economy two years ago, Das said. "The elephant has now gone out for a walk and appears to be returning to the forest. We would like the elephant to return to the forest and remain there on a durable basis." RTRS

- Samsung Electronics plans to more than double its total semiconductor investment in Texas to roughly $44 billion, according to people familiar with the matter, a significant breakthrough in the U.S.’s quest to make more of the world’s cutting-edge chips. WSJ

- The EU launched investigations into two Chinese solar panel makers, the latest sign of Brussels taking steps to defend itself against Beijing’s alleged anticompetitive support for certain industries, including solar panels and autos/EVs. FT

- Argentine President Javier Milei said he won’t touch existing trade deals with Beijing — including a gigantic $18 billion swap line — walking back his campaign pledge to curb ties with China. BBG

- The Biden administration is drawing up plans to require goods produced in Jewish settlements in the occupied West Bank to be clearly labelled as coming from there, according to US officials, another sign of White House unhappiness with the government of Benjamin Netanyahu. The final go-ahead for the move, and its timing, have not been decided but it is intended to increase pressure on Israel over rising settler violence against Palestinians in the West Bank, and comes amid US frustration with the Jewish state’s conduct of the war in Gaza. FT

- The Biden administration is poised to issue a proposal aimed at reducing or eliminating student loan balances for millions of borrowers, according to people familiar with the matter, marking President Biden’s second attempt at large-scale loan forgiveness. WSJ

- The global supply of public equity is shrinking at its fastest pace in at least 25 years, as economic and geopolitical uncertainty weighs on new share sales while companies keep buying back large volumes of their own stock. Data shows that the global universe of public equities has already shrunk by a net $120bn this year, exceeding the $40bn taken out over all of last year. That puts the net figure on course for a third consecutive year of decline — a phenomenon not seen since the bank’s data series began in 1999. FT

- We now estimate nonfarm payrolls rose by 240k in March—above consensus of +213k. Our forecast reflects a continued boost from above-normal immigration, as new entrants to the labor force are matched to open positions. Big Data measures also generally indicate a solid or strong pace of job gains, and our layoff tracker indicates that the pace of layoffs remains low. We nonetheless assume a slowdown from the February payroll gain of +275k because we believe a favorable swing in the weather boosted that report by as much as 75k. GIR

- Net US immigration surged in 2023. Recent reports from the Congressional Budget Office and border encounter data from the Office of Homeland Security suggest that net US immigration was running above the estimate implied by the change in the foreign-born population in the household survey over the last couple of years. We estimate that net US immigration surged to roughly 2.5 million in 2023, the highest level in the last two decades. GIR

A more detailed look at global markets courtesy of Newsquawk

APAC stocks followed suit to the losses in the US amid geopolitical concerns and hawkish-leaning Fed rhetoric. ASX 200 suffered amid weakness in tech and mining stocks, while data showed a monthly contraction in Australian exports. Nikkei 225 retreated beneath 39,000 with intraday losses of around 1,000 points amid currency strength. KOSPI was dragged lower with Samsung Electronics pressured following its preliminary Q1 results in which operating EPS topped forecasts but it missed on revenue.

Top Asian news

- US Treasury Secretary Yellen seeks healthy China ties and warned of overcapacity during China visit, according to Bloomberg.

- US Commerce official Lago met with a Chinese official where she raised commercial and market access issues impacting US companies and workers like data flows and regulatory transparency, while she also raised 'strong concerns' regarding growing overcapacity in a range of Chinese industrial sectors that impact US workers and businesses, according to the Commerce Department.

- BoJ Governor Ueda said the chance of sustainably and stably achieving the bank's 2% inflation target is in sight and likely to keep heightening, while he added the BoJ will adjust the level of interest rates in accordance to the distance towards sustainably and stably achieving 2% inflation, according to Asahi newspaper. Ueda said whether to raise interest rates again this year will be dependant on data and if the BoJ become more convinced that trend inflation will approach 2%, that will be one reason to adjust interest rates but also stated as long as trend inflation is below 2%, it is necessary to maintain accommodative monetary conditions. Furthermore, he said if FX moves appear to have an impact on the wage-inflation cycle in a way that is hard to ignore, they could respond via monetary policy.

- Japanese Finance Minister Suzuki said rapid FX moves are undesirable and he is closely watching FX moves with a high sense of urgency, while he reiterated it is important for currencies to move in a stable manner reflecting fundamentals and won't rule out any options to deal with excessive FX moves.

- RBI kept its Repurchase Rate unchanged at 6.50%, as expected, while it maintained the stance of remaining focused on the withdrawal of accommodation in which 5 out of 6 members voted in favour of the rate and policy stance. RBI Governor Das stated monetary policy must be actively disinflationary and the MPC will remain resolute in its commitment to aligning inflation to the target, while he also stated that they must ensure the descent of inflation to the target of 4% and the last mile of disinflation is challenging.

Equities lower across the board on catch-up play from the late selling seen on Wall Street given geopols/hawkish Fed rhetoric; Stoxx 600 -1.0%. Sectors in-fitting with defensives outperforming slightly given the tone and macro drivers. Stateside, futures are slightly firmer but action is more a consolidation than an uptick after the pressure seen late doors on Thursday, ES +0.3%.

Top European news

- Hungary’s Industry Returns to Growth After More Than a Year

- Maersk Reinstates Panama Canal Transit as Drought Subsides

- Europe Gas Prices Jump as Mideast Tensions Rattle Energy Markets

- Russian Governor Stabbed in Rare Attack on Official

- Latvia Deploys Finance Tools to Fight Russian Sanctions Evasion

- UK Retailers Slide as Decline in Shoppers Persists in March

- Israel Debate Opens Fresh Rift in Sunak’s Fractious Cabinet

FX

- DXY is essentially unchanged in 104.13-35 parameters as markets count down to the NFP report. Strong release could see a test of 105.00 while a softer print brings 104.00 and below into play.

- G10 peers generally rangebound given the tepid USD action into Payrolls with specifics otherwise light as broader market focus remains on geopols into a potential risk-filled weekend.

- GBP slightly softer despite the Construction PMI moving back into expansionary territory, EUR treading water into the data and was unaffected by the morning's German data points.

- USD/JPY holding at the top-end of a 150.82-151.45 bound; little move to familiar commentary from officials overnight.

Fixed Income

- Benchmarks slightly softer as they give back some of Thursday's risk-inspired upside which more than offset any hawkish impulses at the time from Fed speak.

- Bunds at the session low of 132.53 with no real reaction to a handful of German data points as markets remain focused on Payrolls.

- Gilts are pulling back a touch more than peers, with losses in excess of 30 ticks currently but holding just above Thursday's 98.64 trough, a pullback which is largely a function of their relative outperformance on Thursday.

- USTs a touch softer but remain towards the top-end of Thursday's parameters; NFPs and Fed speak the highlights ahead where an above-forecast number could see a resumption of the earlier bear-steepening while a soft print could see this unwind further - geopolitical updates also a potential key factor.

Commodities

- Modest gains across the crude complex following yesterday's geopolitically-induced upside which led a bid into the settlement. Rhetoric this morning remains heightened, but as of yet no significant follow through to price action.

- WTI and Brent currently firmer by around USD 0.20/bbl, towards the top-end of Thursday's parameters.

- Mixed trade for precious metals with slight underperformance in silver/palladium while gold is more resilient and underpinned by remarks from RBI's Das that they are building reserves; XAU near highs of USD 2293/oz.

- RBI Governor Das says they are building up gold reserves.

- LME says no further deliveries of aluminium alloy brand SMI, produced by State Metals Industrial, will be accepted for LME warranting with effect from 05 July.

Geopolitics: Middle East

- Israel told the US that if Iran launched an attack from its soil against Israel in retaliation for the killing of an Iranian General earlier this week, it would draw a strong response from Israel and take the current conflict to another level, according to Axios.

- White House said US President Biden emphasised to Israeli PM Netanyahu that the strikes on humanitarian workers and the overall humanitarian situation are unacceptable, while Biden made it clear Israel needs to announce and implement a series of specific, concrete, and measurable steps to address, civilian harm, humanitarian suffering, and the safety of aid workers. It was also stated that US policy with respect to Gaza will be determined by its assessment of Israel's immediate action of these steps.

- US President Biden’s administration recently authorised the transfer of over 1k 500-pound bombs and over 1k small-diameter bombs to Israel, despite US concerns over the country’s conduct in Gaza, according to CNN sources. It was also reported that the White House said the process of US military aid to Israel was not tied to the Hamas conflict.

- Israeli government approved opening Erez crossing into Gaza and opening of Ashdod Port to expand aid into Gaza, according to Times of Israel.

- "IRGC commander: Any aggression against Iran will not go unanswered", according to Sky News Arabia; "IRGC commander: Israel is in our crosshairs and knows what will happen", via Al Arabiya.

- Iranian official says the decision to retaliate against Israel has been made and will be implemented, via Al Arabiya.

Geopolitics: Other

- US Secretary of State Blinken commented via X that the US and its allies are united in their commitment to Ukraine, while he added they reaffirmed at the Foreign Ministers meeting of the NATO-Ukraine Council that Ukraine's future is in NATO.

- Japan's METI announced Japan will expand the export ban to Russia to include more industrial items such as lithium-ion batteries, thermostats and grinders effective April 17th.

- Russian Foreign Ministry said Sweden's plans to set up a NATO base on Gotland Island are provocative, according to RIA.

US Event Calendar

- 08:30: March Change in Nonfarm Payrolls, est. 214,000, prior 275,000

- March Change in Private Payrolls, est. 170,000, prior 223,000

- March Change in Manufact. Payrolls, est. 3,000, prior -4,000

- March Unemployment Rate, est. 3.8%, prior 3.9%

- March Underemployment Rate, prior 7.3%

- March Labor Force Participation Rate, est. 62.6%, prior 62.5%

- March Average Hourly Earnings MoM, est. 0.3%, prior 0.1%

- March Average Hourly Earnings YoY, est. 4.1%, prior 4.3%

- March Average Weekly Hours All Emplo, est. 34.3, prior 34.3

- 15:00: Feb. Consumer Credit, est. $15b, prior $19.5b

Central Bank Speakers

- 08:30: Fed’s Collins Gives Opening Remarks

- 09:15: Fed’s Barkin Speaks on Economic Outlook

- 11:00: Fed’s Logan Speaks at Duke University

- 12:30: Fed’s Bowman Speaks on Risks in Monetary Policy

DB's Jim Reid concludes the overnight wrap

Markets took a sharp risk-off turn in the US afternoon yesterday, continuing their tough start to Q2. The main catalyst were rising tensions in the Middle East, with Brent crude oil prices closing above $90/bbl for the first time since October, which in turn added to existing fears about inflation. Moreover, there were also some hawkish remarks from Fed officials, with Minneapolis Fed President Kashkari saying that if “we continue to see inflation move sideways, then that would make me question whether we needed to do those rate cuts at all.” So there was an open acknowledgement that rate cuts might not happen in a scenario with more persistent inflation, which the latest rise in oil prices won’t help with.

All that meant the S&P 500 fell by over 2% intraday, ending the session down -1.23%. That leaves the index on course for its worst weekly performance since October, having shed -2.04% since the start of the week. And it marks a big shift from its relentless run-up since the end of October. In fact, the S&P 500 is now -0.2% beneath its level 4 weeks earlier, which makes this the biggest 4-week decline for the index since 2024 began.

The equity selloff coincided with the sharp run-up in oil prices yesterday, which came amidst the news that Israel was preparing for a possible attack by Iran. This brought fears of a broader regional conflict back into the market’s view, leading oil prices to spike by almost 3% from the day’s lows. That took Brent crude up +1.45% to $90.65/bbl, while WTI (+1.36% to $86.59/bbl) extended its year-to-date gain above 20%. And overnight there’ve been further gains for oil, with Brent crude up +0.31% to $90.93/bbl.

This backdrop weighed heavily on equities, with the S&P 500 closing -1.23%, its biggest decline since mid-February, after being up +0.8% intraday. Notably, that also helped push the VIX index of volatility up to a 5-month high of 16.35pts. The decline was a broad one, with 23 of the 24 S&P 500 industry groups lower on the day, and tech stocks slightly underperformed, with the NASDAQ down -1.40%. The Magnificent 7 (-1.06%) saw diverse moves, with Nvidia (-3.44%) and Alphabet (-2.83%) posting large declines, whereas Tesla (+1.62%) and Meta (+0.82%) both advanced.

Treasuries benefited from the risk-off turn, with 10yr yields down -3.8bps to 4.31%, while 2yr yields fell by -2.5bps. Notably, this was fully driven by real yields, with breakevens higher on the day, as the 5yr inflation swap rose to its highest level in nearly 5 months (+2.9bps to 2.54%). Fed funds futures saw sizeable volatility, with pricing of a June cut moving from 63% earlier on to as high as 80%, before settling at 74% by the close. Earlier in the day, the jobless claims data further cemented expectations of a June cut, after initial claims rose to 221k over the week ending March 30 (vs. 214k expected), their highest level since January.

Looking forward, the next focal point will be the US jobs report for March today, which will offer fresh clues as to the likelihood of future rate cuts. In recent months, nonfarm payrolls have seen a noticeable improvement, and the 3m average gain was up to +265k in February, which is its fastest since June last year. So when you combine that with the upside inflation surprises over January and February, that’s seen investors push out the likely timing of rate cuts. In terms of what to expect today, our US economists are forecasting growth in nonfarm payrolls of +200k, with the unemployment rate ticking down a tenth to 3.8%. They see the risks to their payroll forecasts as roughly balanced, but when it comes to the Fed, they think that unless there are any substantial surprises, the inflation report next week will get more attention given the Fed’s focus on the inflation outlook. For more details, see their full preview along with how to register for their webinar (link here)

Yesterday also brought several Fed speakers before the jobs report. In aggregate, they did little in aggregate to move the needle on rate cut expectations. However, there was some hawkishness from Minneapolis Fed President Kashkari, who described the January and February inflation prints as “a little bit concerning”, and as mentioned at the top, he questioned whether rate cuts would need to happen at all if inflation did move sideways. Apart from Kashkari, Cleveland Fed President Mester said she wanted “to see a couple more months data” to discern if there was enough confidence in the inflation decline to begin lowering rates. Chicago Fed President Goolsbee suggested that the higher January and February inflation readings “should not knock us off the path back to target”, though he was watchful over the still elevated housing inflation. And Richmond Fed President Barkin said that “Given a strong labor market, we have time for the clouds to clear before beginning the process of toggling rates down ”, which was similar to Chair Powell’s comment the previous day.

This negative tone has continued in Asian markets overnight, where the Nikkei (-1.93%) and the KOSPI (-1.05%) have both experienced sharp losses. Otherwise, the Hang Seng (-0.71%) saw a smaller decline as it caught up after the previous day’s holiday, whilst markets in mainland China remain closed for a second day. Meanwhile, the Japanese Yen strengthened after comments from BoJ Governor Ueda that suggested another potential rate hike later this year. In particular, he said that the “possibility of achieving the BOJ’s long-awaited target will further increase as wage hikes are reflected in higher consumer prices from summer through autumn”. That supported a further rise in front-end government bond yields, with the 2yr Japanese yield up +2.1bps to 0.20%, its highest level since 2011.

Back in Europe, markets closed before the late run-up in oil prices, so yesterday’s session had been more cheerful for investors. Bonds experienced a sizeable rally, with yields on 10yr bunds (-3.4bps), OATs (-4.1bps) and BTPs (-10.9bps) all seeing a noticeable decline. And most European equity indices posted modest gains, with STOXX 600 up +0.16%. In part, sentiment was supported by the final services and composite PMIs for March. Those saw upward revisions compared to the flash PMIs, and the Euro Area composite PMI was up to 50.3 (vs. flash 49.9), marking its first time it’s been in expansionary territory in 10 months. A similar pattern of upward revisions was evident elsewhere, with the German composite PMI at 47.7 (vs. flash 47.4), whilst France’s was at 48.3 (vs. flash 47.7). The main exception to that pattern was in the UK, where the final composite PMI was down a tenth from the flash reading to 52.8.

Elsewhere in Europe, we saw the release of the accounts of the ECB’s March meeting, which were consistent with the ECB seeing June as the baseline for the first rate cut. The accounts noted that “While it was wise to await incoming data and evidence, the case for considering rate cuts was strengthening”, and pointed out that “the Governing Council would have significantly more data and information by the June meeting, especially on wage dynamics. By contrast, the new information available in time for the April meeting would be much more limited”. For more, see our European economists’ take on the accounts here.

To the day ahead now, and the main highlight will be the US jobs report for March. Otherwise, data releases include German factory orders and French industrial production for February, along with the construction PMIs for March from the UK and Germany. From central banks, we’ll hear from the Fed’s Collins, Barkin, Logan and Bowman.