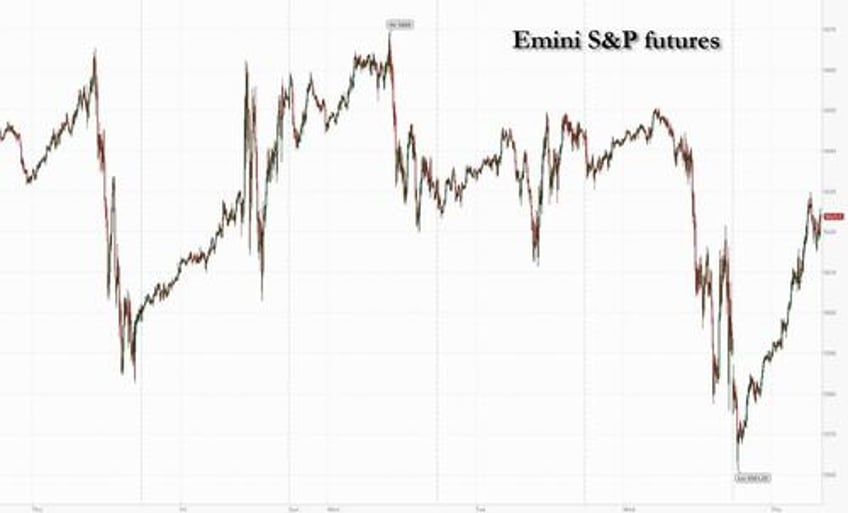

Tech stocks recovered from the knee-jerk selling of Nvidia, which plunged as much as 8% after the company's Q3 guidance disappointed some even as Q2 results met or beat analysts’ estimates on nearly every measure and showed that revenue more than doubled in the quarter, reinforcing the earnings power of artificial intelligence. As of 7:50am ET, Nasdaq 100 futures added 0.1% after sliding as much 1.4% earlier as Nvidia, which had tumbled sharply in trading after the close of US exchanges, trimmed losses to just down only 2% in pre-market trading. Intel Corp., Apple Inc. and Microsoft Corp. all posted small gains; S&P 500 futs rose 0.2%, fully reversing an earlier drop as Germany’s DAX Index hit a new record. Treasury 10-year yields and the dollar was steady. West Texas Intermediate crude rose to $75 after sliding back under $74 yesterday. On the macro calendar, we have the second 2Q GDP estimate, July trade balance and wholesale inventories and initial jobless claims (8:30am) and July pending home sales (10am).

In premarket trading, Nvidia fell 3%, reversing a much bigger plunge, after the company failed to live up to investor hopes with its latest results, delivering an underwhelming forecast and news of production snags with its much-awaited Blackwell chips. Here are some other notable premarket movers:

- Affirm Holdings soars 21% after the financial technology company’s 1Q revenue forecast came in ahead of estimates.

- Best Buy rises 6% after the company raised its annual profit guidance in a sign that demand for electronics and appliances could start to improve.

- Birkenstock falls 13% after the sandal maker reported 3Q revenue that just missed the average analyst estimate. Some analysts said expectations were high heading into results, with shares up about a third since its $1.5 billion initial public offering.

- Dollar General falls 23% after the company cut its full-year sales forecast, a sign that the discounter’s turnaround efforts may not be fending off competition.

- Five Below rises 6% after the discount retailer reported 2Q comparable sales that declined less than analysts had anticipated. While the company lowered its annual comparable sales forecast, the reduced outlook was also better than Wall Street expected.

- ILearningEngines sinks 42% after Hindenburg Research said it is short the stock.

- Nutanix gains 17% after the company gave a full-year revenue forecast that came in stronger than expected.

- Okta drops 13% after some of the application software company’s outlook disappointed.

- Salesforce rises 5% after the maker of customer management software reported 2Q results that beat expectations.

- Topgolf Callaway Brands declines 3% after Jefferies downgraded the golf equipment company to hold, saying it was “increasingly uncertain” about the company’s prospects, in particular its debt levels.

As extensively discussed yesterday, Nvidia’s Q3 earnings report, the most anticipated part of the tech industry’s earnings season, beat analysts’ estimates on nearly every measure, but Nvidia spoiled investors have grown accustomed to blowout quarters, and the latest numbers didn’t qualify especially as regards guidance which came in below some of the more optimistic estimates. NVDA revenue more than doubled to $30 billion in the fiscal second quarter, and the company said third-quarter revenue will be about $32.5 billion; while analysts had predicted $31.9 billion on average, estimates ranged as high as $37.9 billion. Of concern to investors was the fact that Nvidia’s next big cash cow — the new Blackwell processor lineup — has proved more challenging to manufacture than anticipated. The product is the next generation of the company’s dominant artificial intelligence processor.

“Fundamentally, market participants are reflecting on those Nvidia results and saying: they were actually pretty good,” said Michael Brown, a senior strategist at Pepperstone Group Ltd. “The bar for a beat was impossibly high, so the results don’t derail the bull case for the chipmakers or the equity market more broadly.”

In any case, with Q2 earnings season officially at an end, focus is turning back to the macro landscape. Money markets are wagering on 100 basis points worth of rate cuts by year-end but uncertainty remains as to whether the Federal Reserve will ease policy by a quarter-point next month or deliver a larger 50 basis-point cut. Atlanta Fed President Raphael Bostic said it “may be time to cut,” but he’s still looking for additional data to support lowering rates next month. Key to that will be a reading of the Fed’s preferred inflation gauge, the core PCE, due Friday.

“What investors are looking for now is further confirmation that if economic momentum is weakening, the Federal Reserve are going to ride to the rescue and provide a series of substantial cuts,” said Brian O’Reilly, head of market strategy at Mediolanum International Funds.

European stocks gain as traders added to their ECB interest-rate cut bets after soft inflation data from Spain and Germany which reinforced expectations for a European Central Bank rate cut in September. The Stoxx 600 rises 0.8% to the highest since mid July while Germany’s DAX gained as much as 0.7%, reaching 18,912.47 points and topping its previous peak of May 15. Here are some of the biggest movers on Thursday:

- Pernod Ricard shares extend gains to as much as 9.7%, the biggest advance in almost 16 years, after China said it won’t take any anti-dumping measures over EU brandy for the time being. The stock extended gains that were initially fueled by relief over the French distiller’s in line results. Peers Diageo, Remy Cointreau and Campari also jump.

- Delivery Hero shares rise as much as 9% in early trading, to their highest intraday value two months, after the German online food service’s second quarter results showed strength in the Middle East and North Africa region and as the firm said it was planning a Dubai initial public offering of its Talabat operations.

- Universal Music shares rise as much as 4.2% after BNP Paribas Exane raised its recommendation on the music company to outperform from neutral. The broker says streaming expectations are now “materially reset” which offers an “attractive entry point.”

- Schott Pharma shares jump as much as 12%, the most on record, after the German healthcare supplier increased its revenue forecast for the year following strong third-quarter results.

- Close Brothers jumps as much as 11%, the most since March, after RBC upgraded its recommendation on the UK financial services group to outperform from sector perform. The broker says the firm’s shares are cheap historically as well as compared to sector peers.

- DEME Group shares rise as much as 6.2% after the marine engineering provider reported turnover for the half-year that beat estimates. KBC upgraded its its recommendation on the stock, citing a higher sales growth outlook.

- Corbion shares rise as much as 5.3% after the Dutch ingredients firm is upgraded to overweight at Barclays, which sees improving growth prospects and reduced balance-sheet risk prompting a rerating.

- Teleperformance falls as much as 6.2%, after the French digital business services company’s CEO told French paper Les Echos the company is considering listing its stock in the US, frustrated by its stock performance in Paris.

- CD Projekt drops as much as 4.4% after the video game maker’s revenues development disappointed analysts. Ipopema appreciated the update to the Polish game developer’s key asset Project Polaris, a codename for the new The Witcher game, and hopes to see a game trailer by the end of 2024.

- IG Group shares fall as much as 2.6% in London after holders Tom Sosnoff and Scott Sheridan sold 6.5m shares in an offering to a limited number of institutional investors.

Earlier in the session, Asian stocks fell as tech shares declined in the wake of Nvidia Corp.’s disappointing forecast, while Chinese shares were mixed amid earnings misses. The MSCI Asia Pacific Index dropped as much as 0.6% before paring, with TSMC, Samsung Electronics and SK Hynix among the biggest drags. Asian chip shares declined as Nvidia’s less-than-outstanding outlook cooled investor sentiment on the artificial intelligence trade. Benchmarks in Taiwan and South Korea led declines in the region. “Nvidia had a good result yet share price was down on the back of big expectations for next year,” said Jun Bei Liu, a portfolio manager at Sydney-based Tribeca Investment Partners. The cooling-off in the shares after their strong performance this year “provides buying opportunities as long-term structural growth remains intact.”

In FX, the Bloomberg Dollar Spot Index slips 0.1% drop ahead of US GDP data and weekly jobless claims data; risk-sensitive currencies including the New Zealand and Australian dollars lead gains. the euro underperforms its G-10 rivals, falling 0.2% against the greenback after softer than expected inflation prints out of Germany and Spain. EUR/USD drops as much as 0.4% to 1.1072, lowest since Aug. 20 and set for its worst two-day run in more than two months. One-week risk reversals now at 12 basis points, versus Wednesday’s high at 58 basis points. The kiwi dollar is the best performer, rising 0.6% after New Zealand business confidence hit a 10-year high. The offshore yuan climbs 0.6%.

Treasuries are marginally richer across the curve following another narrow overnight trading range, keeping most yields within 1bp of Wednesday’s closing levels. US 10-year trades around 3.83% with bunds in the sector outperforming slightly while gilts keep pace. Most of the price action occurred during European morning as the German curve bull-steepened Core European rates outperform led by German front-end, where 2-year yields are lower by around 4bp on the day following domestic inflation data; German 10-year yields falling 2bps to 2.24%. This week’s Treasury coupon auction cycle concludes with $44b 7-year note sale at 1pm, following good demand for 2- and 5-year notes. WI 7-year yield near 3.73% is ~43bp richer than last month’s result and, like the earlier sales, lower than results over the past year at least

In commodities, oil prices declined, with WTI rising 1% to $75 a barrel. Spot gold rises $16 to around $2,520/oz.

Looking at today's US data calendar, we have the second 2Q GDP estimate, July trade balance and wholesale inventories and initial jobless claims (8:30am) and July pending home sales (10am). Fed speaker slate includes Bostic at 3:30pm.

Market Snapshot

- S&P 500 futures little changed at 5,609.00

- STOXX Europe 600 up 0.5% to 522.95

- MXAP down 0.2% to 185.56

- MXAPJ down 0.3% to 573.39

- Nikkei little changed at 38,362.53

- Topix little changed at 2,693.02

- Hang Seng Index up 0.5% to 17,786.32

- Shanghai Composite down 0.5% to 2,823.11

- Sensex little changed at 81,714.16

- Australia S&P/ASX 200 down 0.3% to 8,045.13

- Kospi down 1.0% to 2,662.28

- German 10Y yield down 3.3 bps at 2.23%

- Euro down 0.3% to $1.1084

- Brent Futures down 0.5% to $78.23/bbl

- Gold spot up 0.5% to $2,517.04

- US Dollar Index up 0.18% to 101.28

Top Overnight News

- AAPL has started mass producing the new iPhone lineup in India, including the Pro model, just days after commencing the process in China. Nikkei

- China growth doubts grow as local government debt issuance falls behind schedule amid a clamp down on inefficient infrastructure investment. China’s sluggish economic performance is creating a problem for the world as the company floods the globe with goods its companies can’t sell domestically. RTRS / WSJ

- China aims to clamp down on the recent iron ore rally, saying it doesn’t have any fundamental basis. BBG

- China accuses European brandy makers of dumping, but declines to impose tariffs (for now) in a step that should help cool trade tensions between Brussels and Beijing. BBG

- Spanish inflation eased to its lowest level in a year — a retreat that’s likely to be mirrored across the euro zone, allowing the European Central Bank to continue lowering interest rates. Consumer prices advanced 2.4% from a year ago, according to data published Thursday by the national statistics agency. That’s less than the 2.5% median estimate in a Bloomberg survey of economists. BBG

- The Fed’s Raphael Bostic said it “may be time” to cut interest rates but he’s still looking for additional data to support a move next month. “I don’t want us to be in a situation where we cut and then we have to raise rates again,” he said. BBG

- Kamala Harris leads Donald Trump by one point in Arizona and by two points in Georgia and Nevada, according to a Fox News poll. Trump is ahead by one point in North Carolina. The margin of sampling error for each state is 3 ppts. Tonight, Harris and Tim Walz will have their first campaign interview, with CNN. BBG

- GOOGL is relaunching its Gemini AI tool used to create images of people after pulling it from the market in Feb following criticism. CNBC

A more detailed look at global markets courtesy of Newsquawk

APAC stocks traded mostly with modest losses following the weak lead from Wall Street and in the aftermath of NVIDIA's ill-received earnings. The tech sector was among the laggards in the region with Samsung Electronics (005930 KS), Tokyo Electron (8035 JT), and TSMC (2330 TT) all opening lower by 2-3%. ASX 200 was subdued amid the broader market mood and with Australia's earnings season picking up in pace. Materials, energy and Tech resided as some of the lagging sectors. Nikkei 225 briefly dipped under USD 38k in early trade, with Japanese activity also affected by the approaching Typhoon Shanshan, although the index eventually eked mild gains amid gains in Industrial names. Hang Seng and Shanghai Comp both conformed to the APAC mood and later extended their losses, whilst earnings season in Hong Kong saw Meituan jump almost 10% while Li Autos slid 10.6%.

Top Asian News

- PBoC injected CNY 150.9bln via 7-day Reverse Repo at a maintained rate of 1.70%.

- South Korean President Yoon said the government will introduce an automatic stabilization tool for the long-term sustainability of pension fund and is to raise the basic monthly pension by KRW 400k within his term, according to Reuters.

- PBoC will step up counter-cyclical adjustments; will strengthen financial support to the real economy

European bourses, Stoxx 600 (+0.5%) began the session with a modest upward bias. As the session progressed, indices continued to edge higher, but most notably in the Euro Stoxx 50 (+0.9%) and AEX (+0.9%), with Tech leading, despite NVIDIA (-2.8% pre-market) slipping post-earnings (albeit. metrics were strong). European sectors hold a strong positive bias. Tech is the clear outperformer, propped up by gains in the ASM International (+2.4%) and ASML (+2%), benefiting from strong NVIDIA results, despite the Co. itself being down by around 2.8% in the pre-market. Alcohol names shot higher following an announcement that China's Commerce Ministry will not impose provisional anti-dumping subsidy on brandy imported from the EU; Pernod Ricard (+4.5%) / Remy Cointreau (+7.6%). US Equity Futures (ES +0.1%, NQ +0.1% RTY +0.6%) are flat/mixed, with very slight outperformance in the RTY, whilst the NQ fails to find a firm direction, following NVIDIA’s results on Wednesday.

Top European News

- Riksbank's Bunge foresees two or three further rate cuts this year, monetary policy should still be characterised by a gradual adjustment.

- China's Commerce Ministry says it will not impose provisional anti-dumping subsidy on brandy imported from the EU.

FX

- DXY is extending the upside seen on Wednesday's session after basing out at 100.51 on Tuesday. DXY has printed a 101.36 peak with the pre-Powell high at 101.55 coming into view.

- EUR/USD is pressured and back on a 1.10 handle after regional German CPI metrics came in softer than suggested by expectations for the mainland data. German CPI due at 13:00BST ahead of the EZ-wide data on Friday.

- GBP is flat vs. the USD with UK-specific updates once again on the light side. Cable has returned to a 1.31 handle after printing a fresh YTD peak earlier in the week at 1.3266.

- USD/JPY is flat in quiet newsflow and opting to consolidate on a 144.00 handle and within yesterday's 143.69-145.04 range.

- NZD is the best performer across the majors after ANZ data showed NZ business confidence soaring. AUD is also firmer vs. the USD but to a lesser extent due to pressure in the AUD/NZD cross, though AUD/USD is within reach of the YTD peak.

- PBoC set USD/CNY mid-point at 7.1299 vs exp. 7.1297 (prev. 7.1216)

Commodities

- Crude is slightly softer, but with specifics light and the complex essentially in a holding pattern until there is an update to the geopolitical and/or Libya front. Brent'Oct currently near session lows at around USD 78.30/bbl, weighed on by EUR-driven USD strength.

- Spot gold is firmer and relatively unreactive to the referenced uptick in the USD as pressure in yields globally are serving as a countering impulse for the yellow metal. At the top-end of a relatively wide USD 2503-2521/oz band.

- Base metals are broadly on the backfoot, largely in continuation of the broader negative sentiment seen in APAC trade overnight.

- South32 (S32 AT) expects to see improvement in aluminium prices on USD weakness and China buying, according to Reuters.

- Russian gov't has announced that fuel and oil production numbers are to be a state secret, via KyivPost.

US Event Calendar

- 08:30: Aug. Initial Jobless Claims, est. 232,000, prior 232,000

- Aug. Continuing Claims, est. 1.87m, prior 1.86m

- 08:30: 2Q GDP Annualized QoQ, est. 2.8%, prior 2.8%

- 2Q Personal Consumption, est. 2.2%, prior 2.3%

- 2Q Core PCE Price Index QoQ, est. 2.9%, prior 2.9%

- 2Q GDP Price Index, est. 2.3%, prior 2.3%

- 08:30: July Advance Goods Trade Balance, est. -$97.8b, prior -$96.8b, revised -$96.6b

- 08:30: July Retail Inventories MoM, est. 0.5%, prior 0.7%

- July Wholesale Inventories MoM, est. 0.3%, prior 0.2%

- 10:00: July Pending Home Sales (MoM), est. 0.2%, prior 4.8%

- July Pending Home Sales YoY, est. -2.0%, prior -7.8%

DB's Jim Reid concludes the overnight wrap

As we go to press this morning, the main market focus is on Nvidia’s latest results, which came out after the US close last night. Although the results slightly beat expectations, their share price was down around -7% in after-hours trading, partly because it fell short of some estimates that had been looking for an even stronger release. For instance, the revenue outperformance was the smallest relative to expectations in six quarters, so this wasn’t the sort of massive beat that Nvidia has often reported over the last 18 months. At the same time, the Q3 revenue guidance came in a touch above the average estimate ($32.5bn vs $31.9bn est.) but still well within the range of analysts’ views. So there’s been a pullback overnight, and that decline in after-hours trading has built on the -2.10% decline in yesterday’s session. In turn, US equity futures are lower more broadly this morning, with those on the S&P 500 (-0.33%) and the NASDAQ 100 (-0.64%) both falling back.

That more negative tone has also been evident overnight, with many of the major indices losing ground in Asia. That includes losses for the KOSPI (-0.81%), the Hang Seng (-0.65%) and the Shanghai Comp (-0.45%), alongside smaller declines for the CSI 300 (-0.07%) and the Nikkei (-0.06%).

Ahead of Nvidia’s release, US markets had already lost ground yesterday, with the S&P 500 filling -0.60%, though it did partially recover from a -1.1% fall intra-day. The decline came primarily because of losses among tech stocks, with the Magnificent 7 (-1.19%) falling back for a third consecutive day, whilst the NASDAQ also fell -1.12% to a two-week low. Sentiment around tech wasn’t helped by a -19.02% drop for Super Micro Computer, which saw the largest decline in the S&P 500 yesterday after they said they’d delay filing their annual financial disclosures. And the pick up in volatility ahead of Nvidia’s results also saw the VIX index rise +1.68pts to 17.11, its largest daily increase since the market turmoil on August 5.

To be fair, there were some relatively brighter spots, with more than 40% of the S&P 500 constituents higher on the day, while the Dow Jones (-0.39%) saw a more modest decline, having initially been on track to close at a new all-time high. It was a strong day for banks as well, with those in the S&P 500 up +0.70%. And in other news, Berkshire Hathaway (+0.86%) became the first US company that’s not in the tech sector to achieve a $1 trillion market capitalisation.

Whilst equities were losing ground, US Treasuries put in a pretty subdued performance, with the main theme being an ongoing curve steepening. While there was little data or commentary from Fed officials, the 2yr yield still fell by -3.4bps to 3.87%, its lowest closing level since May 2023. By contrast, the 10yr yield was up +1.3bps to 3.84% and the 2s10s slope ended the session at -3.4bps, only a basis point from its 2-year high on August 7. Meanwhile, we got more indication that the prospect of rate cuts was filtering through to the real economy. Specifically, data from the Mortgage Bankers Association showed that the contract rate on a 30yr mortgage was down to 6.44%, the lowest since April 2023. Bear in mind that investors are still pricing in rapid rate cuts over the months ahead, with over 100bps priced in by the December meeting. This pricing was little changed despite somewhat hawkish comments from Atlanta Fed’s Bostic later on, who said that it “may be time” to cut but that he still wanted to see additional data to support a September cut.

Today, we should start to get some more data that will help to shape investors’ views. In particular, there’s the weekly initial jobless claims out of the US, which will offer a timely indicator on the state of the labour market. We’ll also get the second estimate of Q2 GDP, and although that’s a backward-looking reading, that will include the latest revisions to core PCE inflation in Q2. Any revisions to that would add to the uncertainty when it comes to tomorrow’s core PCE print for July, so that could have implications for the 25bps vs 50bps debate depending how that looks. As of this morning, futures are placing a 35% probability on a 50bp rate cut in September, so the view remains that 25 is more likely. But it’s far from a done deal, and we’ve still got both the jobs report and CPI release for August before that meeting, so plenty of time for that to shift around still.

Over in Europe, markets put in a more robust performance, with the STOXX 600 (+0.33%) closing in on its all-time high, ending the day just -0.78% beneath its record from May. Germany’s DAX (+0.54%) was even closer to its own record, with yesterday’s advance leaving it just -0.46% beneath its peak. That optimism was also echoed among sovereign bonds, with yields on 10yr bunds (-3.0bps), OATs (-2.8bps) and BTPs (-2.1bps) all moving lower.

Europe will stay in focus today, as we’ll start to get the flash HICP prints for August, including Germany and Spain today, ahead of the Euro Area release tomorrow. Those will be important for the ECB, as even though a September cut is widely expected, markets have been pricing around a 50% chance of a second cut at the subsequent meeting in October. So the release could influence whether they cut at a quarterly pace (having already delivered an initial cut in June), or whether they speed that up and start cutting every meeting. In a mini series of notes this week, our European economists examine the factors that will determine both how far (see here) and how fast (see here) the ECB is likely to cut. When it comes to upcoming inflation data, our economists expect the Euro Area headline to slow to +2.2% in August, which would be the weakest since July 2021, with core HICP also coming down to +2.8%.

There was very little other data yesterday, although the Euro Area M3 money supply grew by +2.3% year-on-year in July (vs. +2.7% expected). Otherwise, French consumer confidence ticked up to 92 in August as expected, which is its highest level since February 2022.

To the day ahead now, and data releases include the German and Spanish CPI prints for August. In the US, we’ll also get the second estimate of Q2 GDP, the weekly initial jobless claims, and pending home sales for July. From central banks, we’ll hear from the ECB’s Lane and Nagel, as well as the Fed’s Bostic.