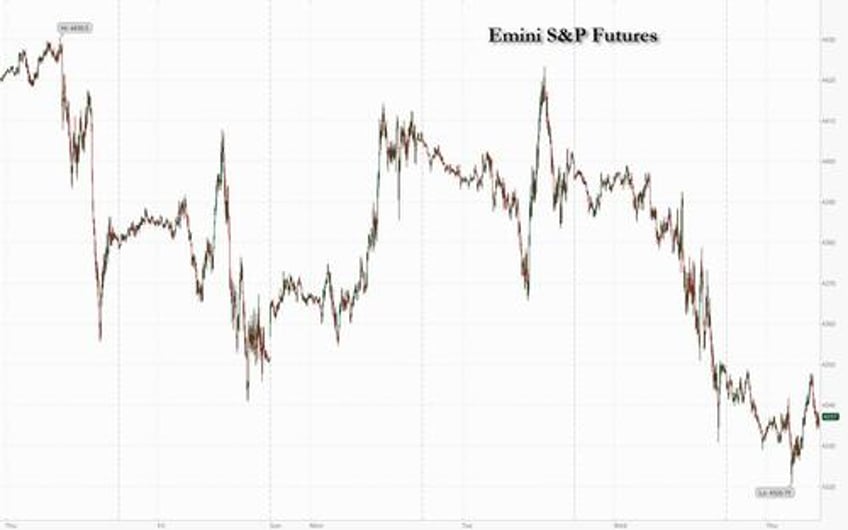

Futures dropped and global markets slumped again after treasury yields continued their relentless march higher (until something breaks), draining appetite for stocks as traders tracked earnings news and an intensifying diplomatic push to contain the Israel-Hamas war. Yields on 10-year US government bonds gained for a fourth day, pushing them just shy of 5% for the first time since 2007, while 30Y yields are well above 5% now. Many potential drivers for price action Thursday include weekly jobless claims data and a packed Fed speaker slate headed by Chair Powell at 12pm New York time...

... while the ridiculous explosion in US debt which has increased by over $600 billion in one month, or about $20 billion per day, is not helping.

One month later:

— zerohedge (@zerohedge) October 18, 2023

Total US Debt is now $33.649 trillion, up $58 billion in one day and up $604 billion in one month... up $20 billion every day, up $833 million every hour.

At this rate US debt will be $41 trillion in one year. https://t.co/tOrhqmkFXL pic.twitter.com/UfYOluX1Bq

As of 7:45am ET, US equity futures dropped 0.2% while Europe’s Stoxx 600 Index fell 0.8%. Markets are in wait and see mode until 12:00pm when Powell delivers remarks at the Economic Club of NY which will be very interesting given the recent run up in yields, the stronger data of late and the geopolitical events since we last heard from him.

In premarket trading, Tesla slid more than 7% in premarket trading after its third-quarter results missed already low expectations. On a brighter note, Netflix Inc. surged after posting the best quarter for subscriber growth in years. Here are some other notable premarket movers:

- Crowdstrike and Zscaler rose in premarket trading as Jefferies upgraded their ratings to buy from hold. The broker says the security software companies’ high-growth platforms “will continue to benefit from secular themes.” Meanwhile, Fortinet was downgraded to hold from buy.

- Lam Research dropped 3.0% after the chip manufacturing equipment supplier reported a decline in revenue for the third-straight quarter. Analysts flag that Chinese market gains are likely unsustainable and see the acceleration in R&D investment as potentially pressuring margins.

- Las Vegas Sands shares rise 5.1% after the casino operator reported third-quarter adjusted property Ebitda that came ahead of estimates. The company’s board of directors also authorized a $2 billion buyback program.

- Netflix shares surged 13% after the streaming-video company posted its best quarter for subscriber growth in years. Analysts were positive about the company’s paid sharing feature reaping dividends and KeyBanc Capital Markets raised its recommendation on the stock to overweight from sector weight.

- VMWare shares slid 6.8% after the Financial Times reported Chinese regulators may hold up its $61 billion acquisition by Broadcom, the latest chip deal to get snarled in Beijing.

Oil stocks will be in focus Thursday as crude fell after a panicking Biden realized his best friends now that oil prices are soaring again, are banana republic dictators like Venezuela's Maduro, and the White House suspended sanctions on Venezuelan oil, gas and gold production. Occidental Petroleum Corp., Exxon Mobil Corp., Chevron Corp. and Schlumberger N.V. are lower by about 1% in premarket trading. Analysts estimate that Venezuela can produce about 200,000 more barrels a day, a roughly 25% jump in output.

In the Middle East, United Nations Secretary-General Antonio Guterres is due in Egypt, a day after US President Joe Biden’s visit to Israel, while UK Prime Minister Rishi Sunak has started a two-day trip to the region. Investor attention turns later to US data for fresh readings on the economy. Chair Jerome Powell rounds off another busy diary of speeches by Fed officials.

“US Treasuries have not been fulfilling their usual safe-haven role in recent days, with strong US data trumping worries about a deepening conflict in the Middle East,” said Mark Haefele, chief investment officer at UBS Global Wealth Management. “Instead, investors have been looking to gold and oil for a hedge against geopolitical risks.”

European equities fell for a third day as rising Treasury yields put pressure on risk assets across the world. The Stoxx 600 Fell 0.8% as real estate and automobile sectors led the drag, while technology and consumer products shares outperform. Here are the most notable European movers:

- SAP shares rise as much as 7.1% after the German software company maintained full-year guidance and reported 23% growth in cloud revenue at constant currencies. The growth met expectations and eased concerns that an economic slowdown could put the targets at risk

- LSE Group shares gained 1.1% after initially falling as much as 1.6% as the exchange operator delivered third-quarter total income that matched estimates. Analysts call an improvement in Annual Subscription Value reassuring

- Inficon shares jump as much as 7.3% on higher sales guidance and better-than-expected results. These reflect the broad end-market exposure for the Swiss vacuum instruments manufacturer, according to analysts

- Roche shares fall as much as 5.1% to the lowest since December 2018 after the drugmaker reported a decline in third-quarter sales and kept its outlook unchanged for the year

- Nestle shares decline as much as 2.6% after reporting sales for the nine-month period that missed the average estimate. Lower pricing and slower growth in North America weighed on sales, analysts said

- DNB Bank falls as much as 6.3%, the most since April, after the Norwegian lender reported a “low-quality” 3Q beat, which included misses to Net Interest Income (NII) as well as impairments

- RELX shares slip as much as 1.3%, retreating further from recent record highs, as unchanged guidance from the information and analytics provider disappointed analysts

- Nordea falls as much as 2% in Helsinki after the Nordic lender left its guidance unchanged in an otherwise solid third-quarter report, with several key performance indicators ahead of consensus expectations, analysts write

- Rightmove shares fall as much as 14% after Citi noted the negative read across for the property listings portal on the news that US property information firm CoStar has agreed to buy rival OnTheMarket

- Hargreaves Lansdown shares fall as much as 5.9% to their lowest intraday level since 2013 after a trading update for 1Q24 that Liberum said showed “sluggish” client growth

- Mondi drops as much as 7.5%, extending declines into a fifth day, after the packaging and paper company delivered results for the third quarter that analysts say show weak demand. They also highlight a subdued outlook

- Tate & Lyle shares drop as much as 3.6% to the lowest since March 2020. Barclays downgraded its rating on the ingredients maker to equal-weight from overweight, citing concerns over GLP-1 drugs

Earlier in the session, Asian stocks sank for a second day, driven by losses in Hong Kong, as concerns about China’s broader economy added to geopolitical tensions in the Middle East. The MSCI Asia Pacific Index declined as much as 1.6%, the most in about two weeks, led lower by Tencent and Samsung. Equities went south across the region. Nikkei, Kospi and Hang Seng indexes are all down about 2%. Singapore’s Straits Times Index fell to its lowest since March, while the benchmark in South Korea lost more than 1.5% as the central bank held interest rates steady and flagged upside risks to inflation. All other benchmarks in Asia were lower with those in Japan, Hong Kong and Australia down more than 1%.

- China’s onshore equity benchmark closed at the lowest level in nearly a year, amid weakness in Chinese tech stocks and the property industry with the latter not helped by ongoing debt woes and after Chinese property prices remained at a contraction. The country’s latest economic data showed the housing crisis remains a drag, despite growth surpassing expectations. Hong Kong’s heavyweight developers also dropped amid a report home purchase tax cuts could be smaller than expected.

- Australia's ASX 200 was pressured amid mixed jobs data and with underperformance in yield-sensitive sectors.

- Japan's Nikkei 225 suffered firm losses despite the mostly better-than-expected Japanese trade figures.

In currencies, the Bloomberg Dollar Spot Index is up 0.2%. The pound fell as much as 0.4% against the dollar amid concern that the Bank of England may hold off from another rate hike due to concerns over weakness in the UK economy. Israel’s shekel declined for a ninth day, its worst streak since 2020. The Aussie underperforms after slower-than-expected job gains for September, falling 0.6% versus the greenback; the kiwi also lags.

In rates, treasuries were cheaper across the curve with losses led by long-end, extending disinversion of 2s10s beyond Wednesday’s high. Continued trend higher in Treasury yields sees 10-year approach 5%, peaking just below 4.98% in early London session. Many potential drivers for price action Thursday include weekly jobless claims data and a packed Fed speaker slate headed by Chair Powell at 12pm New York time. An auction 5-year TIPS closes an hour later. US yields cheaper by more than 6bp at long-end, widening 2s10s, 5s30s spreads by 3bp and 2bp; 10-year yields have eased from cheapest levels of the day to around 4.97% with bunds and gilts outperforming by 4.5bp and 1.5bp in the sector. Dollar IG issuance slate includes CAF 3Y; Goldman Sachs, MUFG, and Bank of New York raised almost $7b Wednesday, taking weekly total to $24b; this week’s seven offerings are all from the banking sector. $22b 5-year TIPS auction at 1pm is indicated around 2.53%, exceeding comparable results since 2008.

In commodities, oil prices slipped from a two-week high as the US eased crude sanctions against Venezuela, denting some of the price gains spurred by the conflict in the Middle East. Gold was steady after delivering gains of almost 7% on haven demand since the Oct. 7 attack by Hamas on Israel.

To the day ahead, the main highlight will be remarks by Fed Chair Powell on the economic outlook. Other Fed speakers include Vice Chair Jefferson, Vice Chair for Supervision Barr, along with Goolsbee, Bostic, Harker and Logan. Data releases include the US weekly initial jobless claims, existing home sales for September, and the Conference Board’s leading index for September. Finally, earnings releases include Union Pacific, AT&T and Blackstone.

Market Snapshot

- S&P 500 futures down 0.3% to 4,329.75

- STOXX Europe 600 down 0.9% to 440.93

- MXAP down 1.5% to 153.69

- MXAPJ down 1.5% to 481.59

- Nikkei down 1.9% to 31,430.62

- Topix down 1.4% to 2,264.16

- Hang Seng Index down 2.5% to 17,295.89

- Shanghai Composite down 1.7% to 3,005.39

- Sensex little changed at 65,839.45

- Australia S&P/ASX 200 down 1.4% to 6,981.60

- Kospi down 1.9% to 2,415.80

- Gold spot up 0.1% to $1,949.82

- U.S. Dollar Index little changed at 106.61

- German 10Y yield little changed at 2.95%

- Euro little changed at $1.0537

- Brent Futures down 1.3% to $90.34/bbl

Top Overnight News

- The world’s second largest economy has a deflating property bubble, local governments struggling to pay their debts and a banking system heavily exposed to both. Anywhere else these factors would be seen as precursors of a financial crisis. But not in China, conventional wisdom goes, because its debts are owed to domestic rather than foreign investors, the government already stands behind much of the financial system and capable technocrats are on top of things. Conventional wisdom might be dangerously out of date. WSJ

- China home prices fell at the fastest pace in almost a year in September, adding to doubts over whether Beijing’s steps to prop up the property market are enough to revive the sector. New-home prices in 70 cities, excluding state-subsidized housing, declined 0.3% last month from August, when they slipped 0.29%, National Bureau of Statistics figures showed Thursday. That was the steepest month-on-month decline since October 2022. BBG

- Fed Chair Jerome Powell will speak at the Economic Club of New York. Speech text and moderated Q&A are expected. On September 20, Chair Powell said “the fact that [the Committee] decided to maintain the policy rate at [the September FOMC] meeting doesn’t mean that we’ve decided that we have or have not at this time reached that stance of monetary policy that we’re seeking. GS GBM

- The Biden administration on Wednesday broadly eased sanctions on Venezuela's oil sector in response to a deal reached between the government and opposition parties for the 2024 election - the most extensive rollback of Trump-era restrictions on Caracas. RTRS

- The Gaza Strip was waiting for humanitarian aid on Thursday, a day after Israel and Egypt agreed to allow basic assistance into the south of the enclave. With US president Joe Biden warning that Israel risked “losing credibility worldwide” if it did not “relieve the suffering of people who have nowhere to go”, Israeli officials said a small convoy with food, water and medicine would soon be allowed to enter the enclave through Egypt. But they provided no clear timeline. FT

- Donald Trump leads Joe Biden in key swing states, according to a poll by Bloomberg News and Morning Consult. Trump’s cumulative advantage is a significant 4-point lead. Voters in those states trust Trump more on the economy. BBG

- UBS is doubling down on wealth management and expanding in the US following the return of CEO Sergio Ermotti and the Credit Suisse acquisition. Ermotti wants to bulletproof UBS as the undisputed global wealth champion, but he faces one of the most complicated fusions banking has ever seen. BBG

- OpenAI is in talks to sell existing employees’ shares at an $86 billion valuation, people familiar said. BBG

- Out-of-production Boeing 737NG and Airbus A320ceo single-aisle jets have become hot commodities, with values and monthly lease rates soaring. They’re now valued at about $20 million or more, according to pricing specialists at Ishka, thanks to an unexpected surge in popularity among airlines starved for planes. BBG

- Chinese investors offloaded the most US bonds and stocks in four years in August, fueling speculation the authorities may have moved to beef up their war chest to defend a weakening yuan. The bulk of the $21.2 billion of sales were in Treasuries and US equities, with funds in the Asian nation also cutting holdings of agency debt, according to data from the US Department of the Treasury released on Wednesday. BBG

A more detailed look at global markets courtesy of Newsquawk

APAC stocks were lower across the board amid spillover selling from global peers following the latest earnings releases and as geopolitical risks lingered, while further upside in yields also added to the headwinds. ASX 200 was pressured amid mixed jobs data and with underperformance in yield-sensitive sectors. Nikkei 225 suffered firm losses despite the mostly better-than-expected Japanese trade figures. Hang Seng and Shanghai Comp. conformed to the downbeat mood with the Hong Kong benchmark being the worst hit amid weakness in Chinese tech stocks and the property industry with the latter not helped by ongoing debt woes and after Chinese property prices remained at a contraction.

Top Asian News

- BoK kept its base rate unchanged at 3.50%, as expected, with the decision unanimous although one of the six board members said the policy rate should remain flexible in both ways and the five other board members remained open for a future rate hike. BoK said it will maintain a restrictive policy stance for a considerable time and will monitor inflation slowdown, financial stability risks, economic downside risks, household debt growth monetary policy changes in major countries and developments in geopolitical risks, as well as noted that the Middle East crisis adds to uncertainties for South Korea. BoK also stated that South Korea's economy is to grow as projected earlier but uncertainties to the growth path are high, while it sees upside risks to inflation and said it might take longer to reach the inflation target.

- Country Garden (2007 HK) bondholders are reportedly forming groups and seeking urgent talks after Co. missed a USD 15mln coupon payment, raising risks of default, according to Reuters sources; subsequently,

- Moody's says it could downgrade Country Garden's (2007 HK) corporate family rating in the scenario that recovery prospects weaken further.

- Indonesian 7-Day Reverse Repo* (Oct 2023) 6.0% vs. Exp. 5.75% (Prev. 5.75%).

- Japanese Bankers Association Chair says if long-term rates rise significantly from their current figures, could result in downward pressure on economic activities.

European bourses are softer, Euro Stoxx 50 -0.2%, with broader macro driver somewhat light as earnings take centre stage. Sectors are largely dictated by earnings with Healthcare pressured post-Roche (-3.7%) with Nestle (-2.1%) also lower and impacting the SMI (-1.2%) while Autos stall after Renault (-6.3%). On the flip side, Tech is the standout outperformer given well received SAP (+4.8%) results. Stateside, futures are similarly in the red, ES -0.1%, ahead of highly anticipated commentary from Chair Powell and after mixed earnings from Netflix (+13.5%) and Tesla (-4.8%) Beijing weighs delaying approval of USD 69bln Broadcom (AVGO)-VMware (VMW) deal, FT reports.

Top European News

- Sanctions Fail to Stop Kim Jong Un Snapping Up Luxury Imports

- UK Pushes to Label AI as Capable of ‘Catastrophic Harm’

- Technogym Rises as Berenberg Rates New Buy on Valuation

- UK’s OnTheMarket Surges by Record on Takeover Deal by CoStar

- I Squared to Acquire Deutsche Bahn’s Arriva Transport Unit

- Tusk Confronts Poland’s Hostile Media Machine After Election Win

- Sunak Lands in Israel as UK Joins Effort to Contain Conflict

- Deutsche Bahn Agrees to Sell Arriva to I Squared

FX

- Greenback continues to grind higher in tandem with Treasury yields, DXY extends to 106.670 from higher 106.490 low and eyes last Friday high at 106.790.

- Euro and Yen buck broadly weak trend vs Dollar as EUR/USD holds above trendline support at 1.0521 and USD/JPY remains capped ahead of 150.00.

- Aussie undermined by payrolls miss with AUD/USD probing 0.6300 to the downside and prone towards 2023/double bottom not far below.

- Pound flounders amidst UK economic concerns as Cable loses 1.2100+ status and EUR/GBP breaches 0.8700 on way to scaling 200 DMA.

- Loonie undermined by downturn in WTI pre-Canadian PPI data with USD/CAD elevated above 1.3700.

- PBoC set USD/CNY mid-point at 7.1795 vs exp. 7.3226 (prev. 7.1795)

- Brazilian Finance Minister Haddad says preparing currency hedging tools this year to attract long-term foreign investments; Congressional resistance to executive orders has created "impasse" for new revenue measures. Brazils Q3 economic performance was very poor.

Fixed Income

- Bonds bounce after hitting new lows as round number levels in futures and cash offer some support ahead of IJC, Philly Fed and a raft of Fed speakers including Chair Powell.

- Bunds eke marginal new peak at 127.68 vs 127.28 at worst, Gilts nearer 91.47 than 91.19 and T-note hovering within 105-12+/27 range.

Commodities

- Crude benchmarks are in the red after Wednesday's session of gains and with newsflow since somewhat lighter than has been the case recently; as it stands, WTI resides towards the bottom of a USD 86.21-87.36/bbl intraday range thus far, with its Brent counterpart similarly heavy within USD 90.25-91.35/bbl confines.

- Qatar set December-loading Al-Shaheen crude term price at about USD 3.25/bbl above Dubai quotes.

- US relaxed some sanctions on Venezuela's oil, gas and gold sectors. US Treasury said it is issuing a 6-month licence authorising transactions in Venezuela's oil and gas sectors and also issued a general licence authorising dealings with Venezuela's mining Co. Minerven. Furthermore, the general licence will only be renewed if Venezuela meets election commitments and other commitments related to those wrongfully detained, while there were later comments from Venezuelan President Maduro that all sanctions must be lifted.

- Spot gold is flat and trades on either side of USD 1,950/oz and holding onto the bulk of its recent geopolitically driven gains, with the yellow metal still well within yesterday’s USD 1,923.23-62.67/oz parameter.

- Spot silver is holing into modest gains on either side of the USD 23/oz mark but well within yesterday’s 22.68-23.32/oz range

- Base metals are mixed with 3M LME copper trading on either side of the USD 8,000/t and within tight USD 7,958-8,024/t parameters following modest APAC weakness as the region conformed to risk aversion.

Geopolitics

- Four French airports reportedly evacuated after the threat of bombs, according to Al-Arabiya correspondent; Figaro reports airports in Bordeaux, Nantes, Lille, and Montpellier airport have been evacuated after threats.

- Israel conducted an air strike on Kafr Shuba in southern Lebanon, according to Al Mayadeen TV.

- Israeli PM Netanyahu won private backing from US President Biden to push ahead with a ground invasion of Gaza, according to accounts of a closed-door meeting between the leaders cited by The Times.

- US President Biden discussed with Egypt's Sisi ongoing coordination to deliver humanitarian assistance to Gaza and agreed to work together on encouraging an urgent and robust international response to the UN's humanitarian appeal, while they agreed on the need to preserve stability in the Middle East and prevent escalation of the conflict.

- US President Biden is expected to seek USD 60bln for Ukraine and aid for Israel in an upcoming USD 100bln funding request, according to NBC News.

- Russian Foreign Minister Lavrov says there is a serious risk that the Gaza conflict will become regional, while he added that attempts to blame Iran for the Gaza crisis are provocations, according to IFAX.

- North Korea said Russian Foreign Minister Lavrov's visit will mark a significant occasion in bilateral relations, while Lavrov said his visit will be a chance to reach a practical outcome in implementing the agreement reached at the recent Russia-North Korea summit. Furthermore, Lavrov said Russia totally supports North Korea's push to implement its sovereignty and their ties have a special meaning under the complex global political situation due to US hegemony that seeks world domination, according to KCNA.

- Lebanese Iran-aligned Al Mayadeen reports a drone attack on the Al-Tanf base on the Syrian, Iraqi and Jordanian border. Attack on Conoco site which hosts US troops in Syria; no official confirmation.

- Reports of renewed heavy shelling by Israel on different areas of the Gaza strip, via Al Jazeera and Al Arabiya.

US Event Calendar

- 08:30: Oct. Initial Jobless Claims, est. 210,000, prior 209,000

- Continuing Claims, est. 1.71m, prior 1.7m

- 08:30: Oct. Philadelphia Fed Business Outl, est. -7.0, prior -13.5

- 10:00: Sept. Existing Home Sales MoM, est. -3.7%, prior -0.7%

- 10:00: Sept. Leading Index, est. -0.4%, prior -0.4%

Fed speakers

- 09:00: Fed’s Jefferson Delivers Welcoming Remarks

- 12:00: Fed’s Powell Speaks at the Economic Club of New York

- 13:20: Fed’s Goolsbee Participates in Moderated Q&A

- 13:30: Fed’s Barr Speaks About Stress Testing

- 16:00: Fed’s Bostic Speaks at the New School

- 17:30: Fed’s Harker Speaks on Economic Outlook

- 18:40: Fed’s Logan Speaks in New York

DB's Jim Reid concludes the overnight wrap

The market selloff gathered pace over the last 24 hours, as rising geopolitical risks and a fresh surge in long-term borrowing costs added to the downbeat mood. The main driver were investor fears about an escalation in the Middle East, which drove gold prices (+1.34%) to their highest since the end of July and meant the rebound in oil prices continued, with Brent Crude up a further +1.78% to $91.50/bbl. But the negative sentiment was clear throughout global markets, and the 10yr Treasury yield (+8.1bps) closed at a new post-GFC high of 4.91%, and this morning is up a further +4.7bps to 4.96%, which leaves it within touching distance of 5% for the first time since July 2007. Equities also struggled as well after defying geopolitical gravity in recent days, with the S&P 500 (-1.34%) losing sizeable ground, whilst futures are pointing to a further -0.18% decline for the index this morning following contrasting results for Netflix and Tesla after the bell yesterday. Later today, Fed Chair Powell's remarks at the Economic Club of NY will be very interesting given the recent run up in yields, the stronger data of late and the geopolitical events since we last heard from him.

In terms of the latest developments, yesterday continued to see both sides accuse the other of being behind the explosion at a Gaza hospital, which had already led to a significant risk-off move as the initial reports came through late Tuesday night European time. Oil prices took a further leg higher after Iran’s foreign minister called for an oil embargo against Israel, which saw Brent Crude hit its highs of the day at $93.00/bbl, before falling back in the European afternoon to close at $91.50 (+1.78%). For reference, Israel only plays a small role in the global oil market, but the comments added to fears of a broader escalation, and served as a reminder of the 1973 oil embargo (50 years ago this week) that sent several Western countries into recession and led to a sharp rise in inflation.

Whilst some haven assets benefited from the geopolitical risk premium, sovereign bonds continued to sell off sharply across the world. US Treasuries were at the forefront of that, with yields rising to new cycle highs across the curve. For instance, the 2yr yield was up +1.3bps to 5.22%, the highest since 2006, and the 30yr yield (+7.0bps) closed at 4.995%, the highest since 2007. Interestingly, we also saw inflation expectations reach their highest in months, with the 30yr breakeven (+2.3bps) closing at 2.50%, which is its highest level of 2023 so far. Longer-term yields did fall by nearly 5bps early in the US afternoon following a relatively successful 20yr Treasury auction, but inched higher again later in the session. This morning we’ve seen another rise in yields across the curve, with the 2yr up +2.0bps to 5.24%, and the 30yr up +4.0bps to 5.03% .

Over in Europe there was a very similar pattern, with yields on 10yr bunds (+4.3bps), OATs (+5.2bps) and BTPs (+9.5bps) all moving higher. That move meant that yields on I talian BTPs closed at 4.98%, their highest level since 2012, and those on French OATs were at 3.55%, their highest since 2011. Nevertheless, it was UK gilts (+14.6bps) which saw the biggest underperformance, as the latest UK CPI release surprised on the upside at +6.7% in September (vs. +6.6% expected). In turn, that led investors to ramp up their expectations of another hike from the Bank of England, with market pricing for another hike up from 55% the previous day to 75% by the close .

Amidst the rise in long-term borrowing costs, we also got fresh evidence that this increase has been filtering through to the real economy. That came from the Mortgage Bankers Association, with their weekly data showing that the rate on a 30yr fixed mortgage was now at 7.7% in the week ending October 13, the highest it’s been since 2000. In turn, that helped push the overall index of mortgage applications to its lowest level since 1995. In the meantime, investors have continued to price out the chance of rate cuts from the Fed any time soon, with futures for the December 2024 meeting putting the implied rate at a new cycle high this morning of 4.83% .

In part, that followed comments from Fed Governor Waller, who said that he believed “we can wait, watch and see how the economy evolves before making definitive moves” on rates. However, he also pointed out that “if the real economy continues showing underlying strength and inflation appears to stabilize or reaccelerate, more policy tightening is likely needed despite the recent run up in longer term rates”. So little urgency but a clear hawkish bias. Meanwhile, New York Fed President Williams said that “we need to keep this restrictive stance of policy in place for some time” but that he was “not yet convinced” that the neutral rate is higher.

All this proved a tough backdrop for equities, and the S&P 500 (-1.34%) posted a pronounced decline. After the close, we received contrasting Q3 results from Netflix and Tesla. Netflix shares gained as much as 13% in after-hours trading after delivering the strongest quarterly subscriber growth since 2020 and raising prices in some key markets. By contrast, Tesla fell in after-hours trading after missing both sales and earnings estimates. Beforehand, the FANG+ index of megacap tech stocks had underperformed (-2.32%), led by a -4.78% decline for Tesla. Another major underperformer within the S&P were airlines (-5.58%) after United Airlines (-9.67%) lowered its profit guidance due to the suspension of flights to Israel and higher fuel costs. Over in Europe, the STOXX 600 (-1.05%) and other major indices lost ground. However, one exception on both sides of the Atlantic were energy stocks (+0.25% in the STOXX 600 and +0.93% for the S&P 500), which were the biggest outperformers amidst the runup in oil prices.

Overnight in Asia, that risk-off tone has continued and all the major equity indices have seen strong losses. That includes the Hang Seng (-1.95%), the KOSPI (-1.84%), the Nikkei (-1.75%), the CSI 300 (-1.62%) and the Shanghai Comp (-1.21%). Separately, the Australian Dollar has weakened by -0.54% against the US Dollar overnight, following weaker-than-expected employment data, which showed employment up by +6.7k in September (vs. +20k expected).

In US politics, Republican Jim Jordan lost a second vote in his bid to become House Speaker, with the number of Republican representatives opposing his nomination rising from 20 in the first vote to 22. It isn’t clear what will happen from here, but the House is unable to pass any bills without a speaker, and it’s now less than a month until the next government shutdown deadline on 17 November, whilst President Biden said yesterday that he would be asking Congress for an “unprecedented support package for Israel’s defense .” Biden is due to give an Oval Office address tonight at 8pm ET.

Looking at yesterday’s other data, US housing starts recovered to an annualised rate of 1.358m in September (vs. 1.383m expected), moving up from their 3-year low in August. However, building permits fell back to an annualised rate of 1.473m (vs. 1.453m expected).

To the day ahead, and one of the main highlights will be remarks by Fed Chair Powell on the economic outlook. Other Fed speakers include Vice Chair Jefferson, Vice Chair for Supervision Barr, along with Goolsbee, Bostic, Harker and Logan. Data releases include the US weekly initial jobless claims, existing home sales for September, and the Conference Board’s leading index for September. Finally, earnings releases include Union Pacific, AT&T and Blackstone.