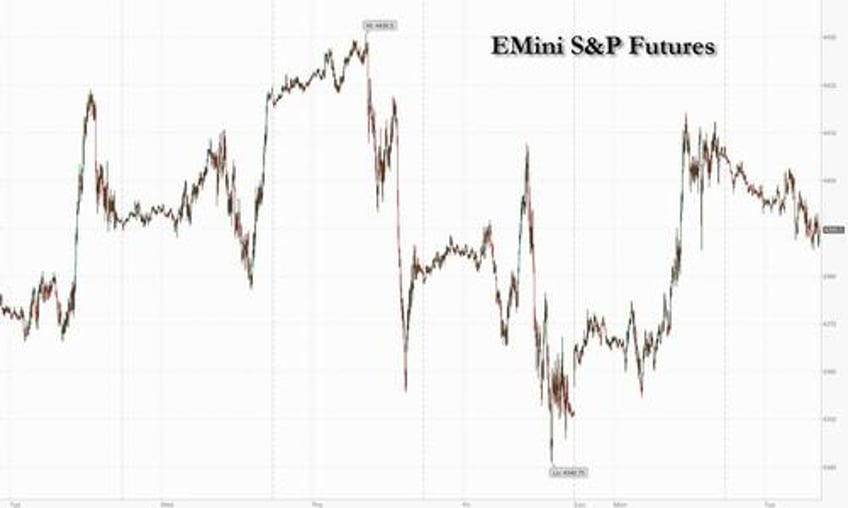

US index futures slid and global markets dropped as yields rose to session highs as complacent investors once again pressed hopes that the Israel-Hamas war could be resolved diplomatically, after Joe Biden said he will travel to Israel to "show his support", which in turn shifted attention back to the untenable US fiscal situation which meant the blowout in yields would continue. At 8:15am S&P futures dropped 0.3% as traders assessed a flurry of major earnings. 10Y TSY yields rose to a high of 4.76%, spiking 20bps in the past two days and undoing much of the "flight to safety" after the Israel war. The dollar steadied, while the pound fell after cooling UK wage growth reduced pressure on the Bank of England to raise interest rates further. Israel’s shekel gained after weakening past 4 against the greenback on Monday. Brent crude oil traded near $90 a barrel.

Today we get the September retail sales and industrial production data before markets open, as well as reports on business inventories and cross-border investment. We also get a slew of Fed speakers including New York Fed President John Williams, Richmond Fed President Tom Barkin, Fed Governor Michelle Bowman and Minneapolis Fed President Neel Kashkari.

In premarket trading, Bank of America gained after its net interest income beat estimates even as its HTM losses soared by $26 billion to a record $132 billion. Goldman Sachs Group Inc. fluctuated as its results showed a beat in trading revenue and a drop in profit. Here are some other premarket movers:

- Johnson & Johnson jumped 1.6% after reporting sales for the third quarter that beat the average analyst estimate.

- Dollar Tree rises 2.6% as Goldman Sachs raises its recommendation on the retailer to buy from neutral, based on its strong earnings growth potential.

- Mondelez International shares rise 0.8%. The company’s lower exposure to the US market is probably a positive, BNP Paribas Exane writes in a note upgrading its rating on the packaged-food company to outperform.

- Viasat rose 5.54% as JPMorgan raised its recommendation to overweight from neutral. The broker said investors should be encouraged by the satellite company’s increased cost discipline.

- NetScout fell 23% as the cybersecurity company cut its adjusted earnings per share guidance for the full year. The guidance also missed the average analyst estimate.

The market mood was largely set by news that JOe Biden is set to travel to Israel Wednesday, aiming to show solidarity with the US’s closest ally in the Middle East and prevent the conflict from engulfing the wider region. He’ll then be in Jordan for talks with King Abdullah II and Egyptian and Palestinian Authority leaders.

“Markets fear a ground offensive by Israel that could ignite a larger and more complicated regional conflict that risks regional supply chains, energy output, economic growth and financial stability,” said Kyle Rodda, senior market analyst at Capital.com. “The presence of President Biden in the region potentially lowers the odds of such an offensive in the coming days, providing markets with some breathing room, if only for a small window.”

Meanwhile, investors are closely assessing the health of this batch of corporate results, after Wall Street strategists warned that the outlook for earnings is weakening. An update is also due Tuesday from United Airlines Holdings Inc. before Netflix Inc. and Tesla Inc. kick off tech-related earnings on Wednesday.

On top of geopolitics and earnings, Bloomberg notes that traders are tracking comments from a slew of Federal Reserve speakers this week before a blackout period in the lead-up to the central bank’s November rate-setting meeting. Philadelphia Fed President Patrick Harker on Monday repeated comments he made last week asserting the central bank can hold its benchmark rate steady as long as there is not a sharp turn in the economic data.

Pessimism around the economic outlook is driving investors to cash, according to BofA’s global fund manager survey. The broadest measure of sentiment — based on cash positions, equity allocation and economic predictions — fell in the October poll after showing an improvement in the summer months, BofA strategists led by Michael Hartnett wrote in a note. Cash levels as a percentage of assets under management have climbed above 5%.

A net 50% of investors in the BofA survey expect a weaker global economy over the next 12 months, with more concerned about a hard landing than previously. At the same time, the soft landing of a “Goldilocks” scenario remains the base case. Most surveyed remain convinced the Fed has finished its rate-hiking cycle.

European stocks opened higher but then traded lower as markets awaited President Biden’s arrival in Israel. The Stoxx 600 is down 0.4% after fluctuating during the trading session. Ericsson AB plunged more than 9% after the Swedish 5G-equipment maker warned of persisting weak demand. Rolls Royce Holdings Plc rose after the jet engine maker announced plans to cut jobs and streamline its business. Poland’s stocks and currency extended gains following Sunday’s elections, which gave pro-European Union parties a majority in parliament. Here are some of the most notable European movers:

- Rolls-Royce rises as much as 2.4%, extending this year’s continent-beating rally, as the British engineer announces plans to cut as many as 2,500 jobs

- Umicore jumps as much as 16%, the most in more than a year, after the governments of Canada and its largest province, Ontario, said they would provide the company subsidies to build a large plant

- St James’s Place shares rally, recovering from an initial drop after the UK wealth manager said it sees a hit to underlying cash from its revised charging structure

- Chemring rises as much as 6%, the steepest advance since Aug. 1, after the UK defense company received most of the necessary approvals from the US Department of Defense on certain countermeasure deliveries

- XPS Pensions rises as much as 11%, hitting a record high, after saying it expects to deliver results ahead of previous expectations. Canaccord lifts its EPS estimates and price target following Tuesday’s update

- Unieuro rises as much as 7.2%, the most intraday since June 2022, after the Italian consumer electronics chain agreed to buy Covercare

- EQT falls as much as 7.9% after the Swedish private equity firm reported third-quarter sales and revenues. The group said fundraising is taking longer than before, which Citi flags as a key negative

- Ericsson shares fall as much as 9.5% on Tuesday to the lowest level since 2017, after the telecom equipment maker gave a tepid profitability outlook for the fourth quarter and scrapped its 2024 Ebita margin target

- Lonza Group shares slump as much as 12%, after the Swiss supplier for pharmaceutical and nutrition companies warned on a hit to 2024 earnings

- Munters drops as much as 6.5%, hitting the lowest in three months, as Nordea downgrades its rating on the Swedish industrial ventilation and climate systems group to hold

- Bellway shares fall as much as 4.2% after the housebuilder lowered guidance for housing completions in fiscal 2024, missing estimates

Earlier in the session, Asian stocks advanced, halting a two-day selloff, as technology stocks rallied amid easing concerns over a wider conflict in the Middle East. The MSCI Asia Pacific Index climbed as much as 0.8%, with chipmakers Taiwan Semiconductor and Samsung the biggest boosts. Benchmarks in South Korea, and the Philippines were among the largest gainers amid broad regional gains.

- Stocks climbed in Hong Kong while a key measure of mainland-listed stocks edged higher after China said it would tighten curbs on short-selling activities. Investors await GDP data Wednesday that is expected to show continued weakness in the economy.

- Japan's Nikkei 225 was boosted at the open and briefly climbed above 32,000 although has since pulled back from intraday highs and proceeded to oscillate around the key aforementioned level.

- Australia's ASX 200 was led by outperformance in tech and telecoms, while mining names also benefitted following Rio Tinto’s quarterly update which showed an increase in iron ore shipments despite a decline in output.

- Indian stock rose, snapping a three-day losing streak, after the nation’s largest private lender posted net income that topped estimates. The S&P BSE Sensex closed 0.4% higher to 66,428.09 in Mumbai, while the NSE Nifty 50 Index rose by a similar magnitude. Local shares tracked gains in Asian equities as technology stocks rallied amid easing concerns over a wider conflict in the Middle East.

In FX, the Bloomberg Dollar Spot Index rose 0.3% as markets weighed ongoing diplomatic efforts to contain an escalation in the Israel-Hamas war; the dollar gained against all Group-of-10 peers bar the Australian dollar

- The yen briefly spiked after a report that the Bank of Japan is likely to discuss raising its inflation projections for 2023 and 2024 fiscal years at its policy meeting later this month.

- AUD/USD rose as much as 0.4% to 0.6367 after RBA minutes indicated the central bank considered hiking rates again

- GBP/USD fell as much as 0.6% to 1.2150 after cooling UK wage growth data bolstered the case for the Bank of England to keep rates on hold next month

- NZD/USD slumped as much as 0.6%, leading Group-of-10 declines against the dollar, after New Zealand’s inflation level slowed more than expected in the third quarter

In Rates, treasuries resumed their selloff on Tuesday, with futures near session lows as US trading day begins after sliding during Asia session and London morning. Weakness continues to be led by long-end and intermediates, steepening the curve. US yields are cheaper by more than 6bp at long end, steepening 2s10s, 5s30s curves by ~4bp and ~2bp on the day; 10-year around 4.80% is cheaper by ~10bp vs Monday close with bunds and gilts outperforming by 1bp and 4bp in the sector. Gilts outperform their German counterparts after UK wage growth eased in August. UK two-year yields are down 2bps.

In commodities, Brent futures rise 0.5% to trade near $90.10 and spot gold adds 0.2% to around $1,923.

Bitcoin traded just above $28,000; Israel ordered a freeze on some crypto accounts in a bid to block funding for Hamas with about 100 accounts on Binance closed after appeals for donations appeared on social media, according to FT.

To the day ahead, and today’s data releases include US retail sales, industrial production and capacity utilisation for September, along with the NAHB’s housing market index for October. Elsewhere, we’ll get Canada’s CPI for September and the German ZEW survey for October. From central banks, we’ll hear from the Fed’s Williams, Bowman, Barkin and Kashkari, ECB Vice President de Guindos, the ECB’s Knot, Centeno, Holzmann and Nagel, and the BoE’s Dhingra. Finally, today’s earnings releases include Bank of America, Goldman Sachs, United Airlines, and Johnson & Johnson.

Market Snapshot

- S&P 500 futures little changed at 4,396.75

- MXAP up 0.7% to 156.62

- MXAPJ up 0.5% to 491.64

- Nikkei up 1.2% to 32,040.29

- Topix up 0.8% to 2,292.08

- Hang Seng Index up 0.8% to 17,773.34

- Shanghai Composite up 0.3% to 3,083.50

- Sensex up 0.4% to 66,410.45

- Australia S&P/ASX 200 up 0.4% to 7,056.09

- Kospi up 1.0% to 2,460.17

- STOXX Europe 600 little changed at 450.37

- German 10Y yield little changed at 2.79%

- Euro down 0.2% to $1.0539

- Brent Futures little changed at $89.63/bbl

- Gold spot down 0.0% to $1,919.52

- U.S. Dollar Index up 0.18% to 106.43

Top Overnight News

- The weak outcome of Japan’s 20-year bond auction is pointing to a lack of demand from domestic banks and life insurers. The ¥1.2 trillion ($8 billion) sale of sovereign debt Tuesday indicated poor investor appetite by three major measures, including the bid-cover ratio, amid expectations of higher yields at home and abroad. Japanese major banks and regional lenders have dumped super-long Japanese government bonds for nine straight months through August. BBG

- China has told state-owned banks to roll over existing local government debt with longer-term loans at lower interest rates, two sources with knowledge of the matter said, as part of Beijing's efforts to reduce debt risks in a faltering economy. RTRS

- Chinese civil servants and employees of state-linked enterprises are facing tighter constraints on private travel abroad and scrutiny of their foreign connections, according to official notices and more than a dozen people familiar with the matter, as Beijing wages a campaign against foreign influence. RTRS

- The clock is ticking for Country Garden to avoid its first-ever public dollar-bond default. The Chinese builder missed the original deadline for the $15.4 million coupon on the note last month, and the grace period ends Oct. 17-18. BBG

- Vladimir Putin arrived in Beijing as China kicks off its Belt and Road Forum. Xi Jinping is set to meet Putin tomorrow just as the US presses China to help it reduce tensions in the Middle East. The ties between the two leaders face heightened scrutiny. BBG

- President Biden is expected to visit Israel on Wednesday as pressure mounted to provide safety and aid to hundreds of thousands of Palestinians in Gaza who have fled their homes before a likely Israeli invasion. Officials have warned a humanitarian crisis there will worsen without immediate help. NYT

- US retail sales probably rose 0.3% in September, half of August’s advance. There’s limited scope for an upside surprise, Bloomberg Economics said. Looking ahead, holiday season spending is expected to grow 14% this year, a Deloitte survey showed, with middle-income consumers impacted by college debt and low wage growth. BBG

- Jim Jordan closed in on the votes he needs to be the next House speaker, but a band of Republican holdouts continues to threaten his bid. The hardline conservative from Ohio plans to proceed with a vote as early as noon today and is prepared for multiple ballots if necessary, a person familiar said. BBG

- The boom in private credit, a fast-growing $1.5 trillion corner of Wall Street born during an era of ultralow interest rates, is starting to show cracks. High borrowing costs, an economic slowdown and contractions in credit markets are testing private credit as never before. Many borrowers paying floating rates that fluctuate with benchmark interest rates are having a difficult time keeping up with rising debt payments, resulting in defaulting loans and, in some cases, bankruptcies. WSJ

- The push by employers to get American workers back into the office appears to be working. Fewer than 26% of US households still have someone working remotely at least one day a week, a sharp decline from the early-2021 peak of 37%, according to the two latest Census Bureau Household Pulse Surveys. Only seven states plus Washington, DC, have a remote-work rate above 33%, the data shows, down from 31 states and DC mid-pandemic. BBG

A more detailed look at global markets courtesy of Newsquawk

APAC stocks were mostly positive following the gains across global counterparts which unwound the recent geopolitical hedging and with President Biden to travel to the Middle East on Wednesday, although the upside was capped as risks of a widening conflict in the Middle East conflict lingered amid threats from Iran. ASX 200 was led by outperformance in tech and telecoms, while mining names also benefitted following Rio Tinto’s uarterly update which showed an increase in iron ore shipments despite a decline in output. Nikkei 225 was boosted at the open and briefly climbed above 32,000 although has since pulled back from intraday highs and proceeded to oscillate around the key aforementioned level. Hang Seng and Shanghai Comp. were both positive although the mainland lagged amid developer debt concerns with Country Garden on the cusp of a default as the grace period for a USD 15mln coupon payment expires today and with an Evergrande unit to seek creditor approval to extend yuan-denominated bonds.

Top Asian News

- RBA Minutes from the October meeting stated the board considered raising rates by 25bps or holding steady and agreed the case for holding steady was the stronger one, while members noted data on inflation, jobs and updated forecasts would be available at the November meeting. RBA Minutes stated members acknowledged upside risks to inflation were a significant concern and said progress in lowering service sector inflation was slow, while the Board had a low tolerance for a slower return of inflation to the target and it stated that further tightening may be required if inflation is more persistent than expected.

- Japan's Rengo (labour organisation) intends to ask for more than a 5% wage hike in the spring 2024 wage discussions, via NHK; is planning to ask for a "more than 3%" base wage hike in Spring 2024 wage discussions.

- PBoC has instructed state banks are to roll over local govt loans with longer term and lower rates; PBoC is to set up an emergency liquidity tool with banks; loans made via tool should be repaid in two years, according to Reuters sources. New interest rates should not be lower than China's Treasury bonds, with terms no longer than 10 years.

- BoJ reportedly mulls raising its FY23 price view closer to 3%; mulls raising FY24 price view to 2% or above; inflation outlook is said to keep FY25 around 1.6%, according to Bloomberg sources.

European bourses are near the unchanged mark with performance mixed as some regions manage to eke out mild gains while others reside slightly in the red as geopolitical tensions continue to dominate newsflow, Euro Stoxx 50 -0.3%. After the cash open, a bout of pressure occurred in proximity to remarks from the Iranian Supreme Leader Khamenei, commentary which aired just prior to the ZEW release which sparked a recovery from the rhetoric-driven session lows in European equity benchmarks. Sectors are mixed with defensively inclined components such as Real Estate, Health Care and Utilities outperforming while Basic Resources is the laggard alongside underlying benchmarks and after Rio Tinto's update.

Top European News

- Poland Election Final Results: PiS 35.38%, Civic Coalition (KO) 30.7%, Third Way 14.4%, New Left 8.6%, far-right Confederation 7.16%. As a reminder, the first exit poll had PiS with 40.36%, Civic Coalition with 26.4%, Third Way 13.6%, Left 8.3% & far-right Confederation 7.4%.

- BoE's Dhingra says average weekly earnings data appear to give a more inflated picture of the wage outlook vs other measures; she expects some letting-up of wage growth. Says the labour market is really loosening and does not see further wage growth momentum. Should see some relenting of domestic inflation pressures.

FX

- Hawkish RBA minutes underpin Aussie as AUD/USD pivots 0.6350 and AUD/NZD approaches 1.0800 from just shy of 1.0700, Kiwi undermined by softer than forecast NZ Q3 CPI metrics, with NZD/USD under 0.5900.

- Pound soft in line with headline UK average earnings vs consensus and BoE's Dhingra chiming with others that the weekly numbers inflate the real picture, Cable tests 1.2150 to the downside from 1.2200+ at one stage.

- Euro supported by 1.0500 expiries and better than expected ZEW survey, Yen initially reliant on 150.00 expiry interest as DXY forms base on 106.000 handle within 106.200-490 range.

- Most recently, USD/JPY has been hit by a BoJ sources piece around the inflation outlook which pushed it down to a brief 148.75 trough, a move which has since partially retraced and as such USD/JPY is currently around 149.40.

- Loonie sits between 1.3650-00 band awaiting Canadian inflation data.

- PBoC set USD/CNY mid-point at 7.1796 vs exp. 7.3038 (prev. 7.1798).

Fixed Income

- Gilts bolstered between 93.91-41 parameters by benign UK wage data, dovish comments from BoE's Dhingra and IFS predicting PSBR undershoot.

- Bunds lag within 128.71-129.14 range after better than forecast German ZEW survey and irrespective of solid Schatz sale.

- T-notes rooted towards base of 106-29/107-08 band ahead of US retail sales, ip and quartet of Fed orators.

Commodities

- Crude benchmarks are modestly firmer on the session but price action has been choppy within relatively tight ranges thus far with geopolitical updates driving action thus far.

- WTI & Brent Dec futures currently post gains of circa. 0.5% on the session, at the top-end of respective USD ~1.00/bbl parameters.

- Spot gold is essentially flat, holding just above the USD 1920/oz figure and as such well within Monday's USD 1908-32 boundaries.

- Base metals are pressured given the cautious mood and as the USD benefits from this, LME Copper towards USD 7.9k/T, pressure perhaps also emanating from the latest Rio Tinto update.

- Commerzbank now sees gold price around USD 1,900/oz at the end of December (prev. USD 2,000/oz); 2024 forecast remains unchanged at USD 2,100/oz.

- Chevron (CVX) Australia spokesperson said they are continuing work to conclude the drafting of proposed enterprise agreements for Gorgon and Wheatstone facilities based on clarification provided by the Fair Work Commission, according to Reuters.

- US State Department said it welcomes the announcement by Maduro representatives and the unitary platform to resume negotiations, while it added the US will continue efforts to unite the international community to support the Venezuelan-led negotiation process.

Geopolitics

- Israeli PM Netanyahu spoke With Russian President Putin and made it clear that Israel will not stop the Gaza operations until Hamas is destroyed, according to Reuters. It was separately reported that Russian President Putin told Israeli PM Netanyahu that Russia is ready to help end the confrontation in the region and resolve it peacefully, according to TASS

- US Secretary of State Blinken confirmed US President Biden will travel to Israel on Wednesday and will reaffirm US solidarity with Israel, while he added that Biden will make it clear that Israel has the right to defend itself and will underscore their message to any actor trying to take advantage of the crisis to attack Israel. Furthermore, Blinken said US and Israel agreed to develop a plan that will allow aid to reach Gaza civilians and noted it is critical that aid begin to flow into Gaza as soon as possible.

- White House's Kirby said US President Biden expects to hear from Israeli officials about what they need, while he added that President Biden will then travel to Amman to meet with Jordan's King Abdullah, Egyptian President El-Sisi and Palestinian Authority President Abbas.

- US Central Command head General Kurilla flew to Israel for talks with military leaders with the visit aiming to ensure Israel has what it needs to defend itself and is focused on avoiding expansion of the conflict.

- Russia's draft UN Security Council resolution on Israel and Gaza failed to receive the minimum nine votes needed, while the Russian UN envoy said the UN Security Council is hostage to Western countries and the UN vote shows who is in favour of a truce in Gaza and delivery of humanitarian aid. Furthermore, the US envoy to the UN accused Russia of giving cover to a terrorist group that brutalises civilians by not condemning Hamas in a draft resolution, according to Reuters.

- US Defense Secretary Austin has put in "be ready to deploy" orders for a select number of American troops should Israel need them, while a separate report stated that about 2,000 troops were told to prepare for deployment.

- The delay in the Israeli ground attack on Gaza is reportedly due to a growing concern that Hezbollah is waiting for the moment that most IDF forces are committed to Gaza to open a full front with the IDF in the north, according to Jerusalem Post sources.

- Russian President Putin said China's proposal for peace talks with Ukraine could become a realistic basis for a peace agreement, according to an interview with Chinese television. However, he also accused Ukraine of not allowing peace negotiations, according to DPA.

- AJA Breaking reports, citing Israeli Radio, that the "Israeli army is intensively bombing many targets in southern Lebanon after bombing the town of Metulla" & "Israeli bombing targets the road between the towns of Kafr Kila and Al-Adisa in the eastern sector of southern Lebanon"

- Iranian Supreme Leader Khamenei says if Israel's crimes continue then no one can stop "Muslims around the world and resistance forces". Gaza bombardments must stop immediately.

- Lebanese Foreign Minister says Israeli attack in south Lebanon pours "oil on fire" and threaten to ignite a front.

- Iran Guard's Deputy Chief says "another shockwave" is on the way if Israel does not end atrocities in Gaza, according to Fars News.

Central Bank speakers

- 08:00: Fed’s Williams Moderates Discussion at Economic Club of NY

- 09:20: Fed’s Bowman Speaks on Innovation in Payments

- 10:45: Fed’s Barkin Speaks on the Economic Outlook

- 17:00: Fed’s Kashkari Participates in a Moderated Discussion

US Event Calendar

- 08:30: Sept. Retail Sales Advance 0.7% MoM, est. 0.3%, prior 0.6%

- 08:30: Sept. Retail Sales Ex Auto 0.6%, est. 0.2%, prior 0.6%

- 08:30: Sept. Retail Sales Ex Auto and Gas 0.6%, est. 0.1%, prior 0.2%

- 08:30: Sept. Retail Sales Control Group 0.6%, est. 0.1%, prior 0.1%

- 09:15: Sept. Industrial Production MoM, est. 0%, prior 0.4%

- 10:00: Aug. Business Inventories, est. 0.3%, prior 0%

- 10:00: Oct. NAHB Housing Market Index, est. 44, prior 45

- 16:00: Aug. Total Net TIC Flows, prior $140.6b

DB's Jim Reid concludes the overnight wrap

Markets seems to be taking the geopolitical risk session by session at the moment, rather than having any strategic sense of where things are heading. It feels like we're in a very dangerous and delicate holding pattern for now, but with no major developments since the Israeli evacuation notice to Gaza residents on Friday, markets have taken off their weekend hedges over the last 24 hours or so.

Headlining this was the +1.06% advance in the S&P 500, which represents the best start to a week since February. Meanwhile the whipsaw in bonds continued with 10yr Treasury yields up +9.4bps on the day to 4.71%, with another +3.8bps move overnight to 4.74%. This time yesterday we highlighted reports that US President Biden was considering a trip to Israel, which was generally taken as a positive sign that the US is working to prevent an escalation, or that one won't happen while he's in the region. But that visit from Biden has since been confirmed by US Secretary of State Blinken overnight, and is set to take place tomorrow. Yesterday’s market moves showed that assets most sensitive to an escalation were reacting in a positive direction. For instance, Brent crude oil prices were down -1.36% to $89.65/bbl, Israel’s TA-35 equity index was up +2.46%, and the US Dollar index weakened by -0.38% as investors took out some of the recent geopolitical risk premium. The exception was Israel’s shekel, which weakened to an 8-year low against the dollar (-0.90%).

The bond sell-off was matched by growing anticipation that the Fed might deliver another rate hike in 2023 after all, with pricing for a hike by December up from 32% at the close last week, to 37% yesterday. In turn, yields on 2yr Treasuries were up +4.3bps to 5.10%, whilst the 30yr yield was up +9.7bps to 4.85%. The long-end sell off was shared across real yields and breakevens, with the 10yr real yield up +4.5bps to 2.32%, and the 30yr real yield was up +5.3bps to 2.42%. US retail sales and industrial production today will be a chance for the macro to compete with the geopolitics again for bonds.

It was much the same story in Europe, with yields rising across most of the continent. Those on UK gilts saw the biggest increase, with the 10yr yield up +9.5bps to 4.48%, which followed comments from BoE Chief economist Pill that there was still “some work to do” for the Monetary Policy Committee to achieve their inflation target. Elsewhere in Europe, yields on 10yr bunds (+4.7bps) and OATs (+3.8bps) also moved higher, but BTPs (-1.0bps) were the exception in spite of a government announcement of a new €24bn budget law that includes tax cuts and public sector wage rises. So risk-on offset the fiscal implications.

Whilst bonds were selling off, equities saw a much better performance with all 24 industry groups in the S&P 500 (+1.06%) rising on the day. Small-cap stocks were one of the strongest performers as the Russell 2000 rose +1.59%. Meanwhile in Europe, the STOXX 600 (+0.23%) also recovered from Friday’s losses, and Polish equities saw a major outperformance following the election on Sunday which will likely yield a pro-EU government under the leadership of former Polish PM and European Council President Donald Tusk. That rally included the WIG20 index (+5.31%), which had its best day since February 2022, whilst the Polish Zloty (+1.82%) had its best day against the Euro since March 2022.

In other news, the sharp run-up in European natural gas prices subsided yesterday, with a -12.2% decline to €48.6/MWh. That’s been h elped by the absence of an escalation in the Middle East, as well as the prospect of milder weather after the present colder period passes. European gas storage is now some way above its levels at the same point in recent years, with storage facilities 97.95% full as of Sunday. There was also a decent move lower in US natural gas futures (-3.92%) as well yesterday, which saw their biggest decline in nearly a month.

Overnight in Asia, those gains for equities have continued against the backdrop of ongoing diplomatic efforts. All the major indices have advanced, including the KOSPI (+1.16%), the Nikkei (+1.08%), the Hang Seng (+0.70%), the CSI 300 (+0.46%) and the Shanghai Comp (+0.26%). Overnight, we’ve also seen a selloff among Australian government bonds following the release of the RBA’s minutes from the October meeting. That said they considered raising rates this month, and also that “the board has a low tolerance for a slower return of inflation to target than currently expected.” In light of that, yields on 10yr Australian government bonds are up +9.2bps, and the Australian Dollar is the best-performing G10 currency overnight. Looking forward, US equity futures are slightly lower this morning, with those on the S&P 500 down -0.12% ahead of several earnings releases this week.

There wasn’t much in the way of data releases yesterday, although we did get the Empire State manufacturing survey for October in the US. That fell back into negative territory at -4.6 (vs. -6.0 expected), and the measure of unfilled orders (-19.1) fell to its lowest level since May 2020 during the initial wave of the pandemic. There were also some more positive signals on the inflation side, with the 6-months ahead prices received indicator down to a 3-year low of 16.0.

Looking forward, we could get some more developments on the election of a new Speaker of the US House of Representatives today. The Republicans have nominated Rep. Jim Jordan, and yesterday he appeared to receive the backing of some key Republicans that had been opposed to his nomination. CNN reported yesterday that Jordan said he would force a floor vote at noon today for the speaker election, so that’s one to look out for. Should Jordan be confirmed as Speaker, investors will be watching what this means for fiscal bargaining in Congress ahead of the next government shutdown deadline in mid-November .

To the day ahead, and today’s data releases include US retail sales, industrial production and capacity utilisation for September, along with the NAHB’s housing market index for October. Elsewhere, we’ll get Canada’s CPI for September and the German ZEW survey for October. From central banks, we’ll hear from the Fed’s Williams, Bowman, Barkin and Kashkari, ECB Vice President de Guindos, the ECB’s Knot, Centeno, Holzmann and Nagel, and the BoE’s Dhingra. Finally, today’s earnings releases include Bank of America, Goldman Sachs, United Airlines, and Johnson & Johnson.