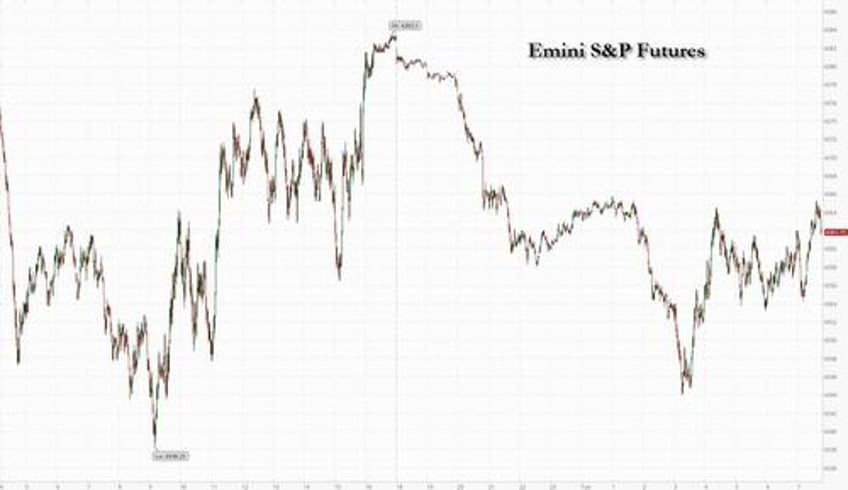

US equity futures are weaker, reversing Monday's modest gains amid a global risk-off tone that has sent European and Asian markets sliding, and which JPM's market intel team says is "a trend that may continue throughout the week." As of 7:30am, S&P futures were down 0.4%, off the worst levels of the session, while Nasdaq 100 futures are down 0.5%. Yields on TSYs and European govvies dropped after hitting decade highs even as the Bloomberg dollar index extended gains following its strongest close since December. Oil retreated as the impact of a rising dollar sapped demand. There is a $48bn auction for 2Y bonds today; this likely requires some concession to be digested and is the first of several auctions this week that are larger than normal size. Today’s macro data focus includes housing prices, new home sales, regional Fed activity surveys, and consumer confidence.

In premarket trading, Tesla shares were 1.5% lower, after Bloomberg reported that during the evidence-gathering that precipitated this month’s surprise announcement of an EU anti-subsidy probe into Chinese EVs, the US carmaker was among the companies found to have likely benefited, according to people familiar with the matter. Coty was down 3.3% after offering 33 million shares as part of a plan by the beauty company to add a Paris stock listing. Thor Industries dropped 2.4% even after the recreation vehicle firm reported net sales that beat estimates, with analysts citing potential slower production and revenue rebound pace as well as a challenging macroeconomic backdrop. Here are some other notable premarket movers:

- DraftKings rises 3.4% after JPMorgan upgrades the online sports-betting company to overweight from neutral, citing sluggish share-price performance since late July, as well as the attractive sector it operates in and industrywide improving expense control.

- Fisker gains 4.7% after saying it has built 5,000 Fisker Ocean SUVs and expects to ramp deliveries of the Ocean to 300 vehicle per day later this year.

- Immunovant jumps 56% after the company announced top-line results from an early-stage trial of its drug for autoimmune diseases. Majority shareholder Roivant Sciences is also up 17% before the market open.

- Omega Therapeutics shares slide 4.3% after it announced preliminary clinical data from a trial of its drug candidate for liver cancer.

- Pliant Therapeutics is up 20% ahead of a call the company set for Tuesday morning to discuss interim mid-stage clinical trial data.

- United Natural Foods falls 13% after issuing a profit outlook for the fiscal year that missed the average analyst estimate. The food wholesaler also added three new members to its board as part of its ongoing customer- and supplier-focused transformation plan.

Overnight, JPM CEO Jamie Dimon warned the world may not be ready for a worst-case scenario of the Fed raising rates to 7% along with stagflation; at the same time Minneapolis Fed chief Neel Kashkari said he expects one more hike this year.

The threat of tight policy is undoing some of the market’s biggest gains this year, in high-flying tech stocks. These growth companies are prized for their long-term prospects but hold less appeal when future profits get discounted at higher rates. That’s reflected in growing short positions against the technology-heavy Nasdaq 100 Index. According to Citi, positioning in the Nasdaq 100 is now one-sided net short at $8.1 billion, with all long positions unwound.

“With weak but positive growth holding recession at bay on both sides of the Atlantic, central banks will not be able to ease financial conditions between now and the end of the year,” said Nadège Dufossé, global head of multi asset funds at Candriam. “With positive surprises now largely priced in, there seems to be little room for further appreciation in equity markets, suggesting a degree of caution on risky assets.”

One Fed speaker after another in the past week has delivered emphatic messages that they will keep policy tighter for longer if the economy is stronger than expected. Federal Reserve Bank of Minneapolis President Neel Kashkari said he expects the US central bank will need to raise interest rates one more time this year. Data on US consumer confidence and manufacturing activity expected later Tuesday could provide more clues on the outlook for the economy and monetary policy.

Elsewhere, Bloomberg reported that Senate Republicans and Democrats are closing in on a deal for a short-term spending measure designed to avert a government shutdown. The legislation would extend funding for four to six weeks, a shorter timeframe than Democrats had pushed for, although it may cost speaker Kevin McCarthy his job. Moody’s warned that a government shutdown would be credit-negative.

In the latest development surrounding the Detroit-3 strikes, Joe Biden will visit a UAW picket line in Michigan later today. His trip comes as Ford’s largest labor union blasted it for halting construction on a $3.5 billion battery plant in the state. Adding to labor woes, performers in the video-game industry voted to authorize a strike.

European stocks dropped for a second day, with the Stoxx 600 down 0.4% as China property worries persist and investors process sharply higher bond yields. Technology and consumer shares fall the most while insurance and health care gain. Luxury stocks including Richemont and LVMH drop after Morgan Stanley lowered its earnings estimates on the sector, while Barclays is the Stoxx 600 index’s best performer after an upgrade. Here are the biggest movers on Tuesday:

- Barclays shares rise as much as 3.1%, among top performers in the Stoxx 600 on Tuesday, after Morgan Stanley upgraded the UK bank to overweight, citing a better outlook for revenue and capital efficiency.

- Siltronic shares gain as much as 5.7% after Stifel upgrades the German silicon wafer manufacturer to buy from hold and raises its price target to a Street high, saying the risk/reward profile has turned positive.

- Elekta shares rise as much as 2.5% after SEB raised its recommendation for the Swedish medical technology firm to buy from hold, saying recent share-price weakness is unwarranted and consensus expectations are now favorable.

- Asos shares fall as much as 6.9% after the online fast-fashion retailer reported adjusted like-for-like revenue down 15% in the fourth quarter. The company’s end to the year was “tough,” according to Jefferies.

- TUI shares drop as much as 5.8% in London to the lowest on record amid broader market concern about a protracted period of high interest rates.

- ASM International shares fall as much as 5.8% after giving new guidance for 2025 and beyond. Jefferies says the Dutch chip gear maker’s raised revenue target for 2025 of €3 billion to €3.6 billion is “somewhat underwhelming.”

- Lanxess shares drop as much as 4.7% after analysts at Jefferies cut the price target cut to a Street low, citing weak earnings for the German specialty chemicals company.

- CD Projekt shares decline as much as 5.3% after global release of paid add-on to Cyberpunk 2077 as analysts predict positive player opinions won’t be enough to push company sales above estimates.

- Johnson Matthey shares fall as much a 2.5%, declining for the fourth consecutive day to lowest since August, after Jefferies cuts Ebit estimate for next year and price target, citing lower platinum grade metal prices affecting earnings at UK-based chemicals company.

- Carmat shares plunge as much as 51% after the French developer of an artificial heart says it needs financing to fund its activities after the end of October.

- Close Brothers shares fall as much as 7% after the UK merchant bank reported full-year results. Canaccord analysts say though outlook flagged a good start to FY24, there’s near-term cost pressure weighing on the firm.

Earlier in the session, Asian stocks declined for a second day as surging Treasury yields and the ongoing property crisis in China dampened risk appetite. The MSCI Asia Pacific Index falls as much as 0.7%, with technology firms among the biggest drags on the gauge amid worries over higher-for-longer interest rates. Chinese stocks extended their slide, with a gauge of property developers slumping by the most in nine months as Evergrande missed a debt payment and former executives were detained. Former executives at the company have also been detained, while there are issues facing other developers like China Oceanwide and Country Garden too. The new turmoil engulfing property developers could jeopardize the latest efforts by authorities in the country to end the housing crisis.

“Ongoing China Evergrande’s debt-restructuring woes suggest that the worst-is-over for China’s property sector is far from being seen,” Yeap Jun Rong, market strategist at IG Asia, wrote in a note. High bond yields and a firmer US dollar “did not provide much conviction for risk-taking for now,” he said.

- Hang Seng and Shanghai Comp declined with sentiment not helped by trade frictions after the US imposed restrictions on additional Chinese and Russian companies related to supplying Russia with components to make drones, although losses in the mainland were stemmed by another substantial liquidity operation and hope that the approaching Mid-Autumn Festival and National Day Golden Week holidays would provide a boost to consumption and economic activity.

- Japan's Nikkei 225 was pressured following the acceleration in Services PPI data and as recent currency moves keep participants on their toes regarding FX intervention.

- Australia's ASX 200 was subdued by underperformance in real estate and tech as domestic yields climbed.

- Korea’s tech-heavy benchmark was the worst performer in the region. The gauge hit its lowest level since May, weighed down by Samsung, SK Hynix and LG Energy Solution.

- Stocks in India dropped on Tuesday, in line with most regional peers, as information technology shares extended slide on worries over interest rates staying higher for longer. The S&P BSE Sensex fell 0.1% to 65,945.47 in Mumbai, while the NSE Nifty 50 Index was little changed at 19,664.70. The benchmark gauge has dropped for five out of six sessions through Tuesday. ICICI Bank contributed the most to the Sensex’s fall, decreasing 0.8%. Infosys and Tech Mahindra were key decliners among software makers as the sectoral gauge fell for a sixth consecutive session, its longest stretch of losses since March 16.

In FX, the Bloomberg Dollar Spot Index rose as much as 0.3% to a nine-month high. USDCHF rose as much as 0.3% to 0.9151, the highest since April; franc’s selloff enters a 11 day, the longest losing streak since 1975. USDJPY little changed at 148.84; it rose earlier to 149.19 and fell sharply after Japanese Finance Minister Shunichi Suzuki’s warnings.

In rates, Treasury futures are higher on the day, unwinding a portion of Monday’s losses and following similar gains in core European rates. Curve has broadly held recent steepening move with 5s30s spread trading at around 4bp, near top of Monday’s range, while 2s10s spread is slightly flatter on the day. US session includes housing market and consumer confidence data, while auctions recommence with 2-year note sale. US yields are richer by 1bp to 3bp across the curve with gains led by 10-year sector, which trades around 4.505%, near day’s low; bunds trail by ~1bp in the sector while gilts trade broadly in line. The US 5s30s spread is steeper by 0.5bp on the day, while 2s10s is flatter by almost 2bp, unwinding portion of Monday’s sharp widening. Treasury auctions resume with $48b 2-year note sale at 1pm, with $49b 5-year and $37b 7-year notes scheduled later this week.

In commodities, crude futures decline with WTI falling 1.1% to trade bear $88.70. Spot gold falls 0.2%.

Looking to the day ahead now, and data releases from the US include the Conference Board’s consumer confidence for September, the Richmond Fed’s manufacturing index for September, new home sales for August, and the FHFA house price index for July. Central bank speakers include the Fed’s Bowman, and the ECB’s Lane, Simkus and Holzmann.

Market Snapshot

- S&P 500 futures down 0.4% to 4,361.50

- STOXX Europe 600 down 0.3% to 448.98

- MXAP down 0.8% to 157.87

- MXAPJ down 0.9% to 488.93

- Nikkei down 1.1% to 32,315.05

- Topix down 0.6% to 2,371.94

- Hang Seng Index down 1.5% to 17,466.90

- Shanghai Composite down 0.4% to 3,102.27

- Sensex little changed at 65,979.55

- Australia S&P/ASX 200 down 0.5% to 7,038.19

- Kospi down 1.3% to 2,462.97

- German 10Y yield little changed at 2.78%

- Euro little changed at $1.0597

- Brent Futures down 1.2% to $92.21/bbl

- Gold spot down 0.1% to $1,914.82

- U.S. Dollar Index little changed at 105.97

Top Overnight News

- China says it is willing to play a “constructive” role in the success of the upcoming APEC summit in San Francisco this Nov (markets are hoping Xi attends this event and meets with Biden). CNBC

- The crisis at China Evergrande Group deepened Monday after the company’s mainland unit said it failed to repay an onshore bond, adding a new layer of uncertainty to the developer’s future as a restructuring plan with its offshore creditors teeters. BBG

- Germany slashed the volume of gov’t bond issuance for Q4 by EU31B as support measures designed to shelter people from elevated energy costs begin to wind down. BBG

- Italy’s budget, which is due out on Wed, will be closely scrutinized by markets as Meloni attempts to keep her tax cut promises while reducing the deficit, all in an environment of cooling growth. RTRS

- US gov’t shutdown would delay publication of critical economic data, including the Sept BLS jobs report (due out on 10/6) and the Sept CPI (due out on 10/12). RTRS

- Jamie Dimon repeats prior warnings of a potential worst-case scenario whereby the Fed is forced to hike rates to 7%. BBG

- Global trade volumes slumped at their fastest pace since the pandemic during the month of July, a sign that rising rates are starting to weigh on economic activity. FT

- Tesla will be investigated by the EU as part of its probe into China's state subsidies for electric vehicles, people familiar said. Domestic manufacturers including BYD, SAIC Motor and Nio will also be probed, with the EU taking any necessary countervailing measures to level the playing field for their industry. BBG

- Senate nearing a bipartisan compromise on a short-term continuing resolution (CR) that would keep the gov’t open for 4-6 weeks and once passed, McCarthy would come under pressure to bring it up for a vote. BBG

- Americans outside the wealthiest 20% of the country have run out of extra savings and now have less cash on hand than they did when the pandemic began, according to the latest Federal Reserve study of household finances. For the bottom 80% of households by income, bank deposits and other liquid assets were lower in June this year than they were in March 2020, after adjustment for inflation. BBG

A More detailed look at global markets courtesy of Newsquawk

APAC stocks were mostly lower with headwinds from the rising global yield environment. ASX 200 was subdued by underperformance in real estate and tech as domestic yields climbed. Nikkei 225 was pressured following the acceleration in Services PPI data and as recent currency moves keep participants on their toes regarding FX intervention. Hang Seng and Shanghai Comp declined with sentiment not helped by trade frictions after the US imposed restrictions on additional Chinese and Russian companies related to supplying Russia with components to make drones, although losses in the mainland were stemmed by another substantial liquidity operation and hope that the approaching Mid-Autumn Festival and National Day Golden Week holidays would provide a boost to consumption and economic activity.

Top Asian News

- China's MOFCOM said China and the EU reached agreements on supply chain cooperation in which the agreements also include WTO reform and financial opening, while China urged the EU to exercise prudence in trade remedy.

- Alibaba (BABA), on the proposed spin-off and listing of Cainiao, said HKEX has confirmed that the Co. may proceed with the spin-off, while details have not yet been finalised, and added there is no assurance that the proposed spin-off will take place or when, according to Reuters.

- Some Evergrande (3333 HK) offshore creditors are planning to join the winding-up petition in the event that no new debt restructuring plan is submitted by October 30th, according to Reuters sources.

- China's Auto Industry body CAAM said it hopes the EU will use trade remedy measures prudently, cautiously, and launch countervailing investigation with regards to measures against China's EV products, according to Reuters.

- Japan maintains its overall view on the economy for September, and said "it is recovering moderately"; raises its view on corporate profits in September for the first time since March 2022, suggesting it is "improving as a whole", according to Reuters.

- Japanese Finance Minister Suzuki said they are closely watching FX moves with a great sense of urgency, according to Reuters.

- Japan is reportedly mulling tapping budget reserves that were originally set aside for COVID inflation countermeasures for upcoming economic package and extra budget, according to Reuters.

- Japanese Cabinet Official said BoJ Governor Ueda told a top economic council meeting that it was important to nurture positive signs of change in corporate behaviour, according to Reuters.

- Ex-BoJ board member Sakurai said the BoJ may hold off on ending negative rates until April, according to Reuters.

- Hyundai Motor (005380 KS) and Kia (000270 KS) are to cut EV prices in South Korea until the end of the year. The Cos plan discounts as government expands subsidies for EV purchases. Cos sees EV sales remaining sluggish in South Korea, according to Bloomberg.

European bourses are on the backfoot but off the worst levels seen at the cash open despite a lack of fresh fundamental headlines, with the UK's FTSE outperforming on a weaker GBP. Sectors in Europe are mostly lower with a slightly more defensive bias vs the cash open, with Healthcare and Utilities towards the top of the bunch while Tech remains the laggard. US futures are pressured amid a generally negative risk tone across the market and a lack of any fresh catalysts.

Top European News

- ECB's Simkus said policy is currently on track for 2% inflation in 2025. He would not rush with an answer when it comes to the timing of rate cuts, according to Bloomberg.

- ECB's Muller said he is not expecting additional rate hikes as things stand, according to Bloomberg.

- UK will sign a trade pact with Washington state aimed at facilitating aerospace deals with the US, according to Bloomberg.

- Germany cut its planned Q4 Federal debt issuance by EUR 31bln. The announced borrowing on the capital market will be reduced by EUR 8bln in Q4 and EUR 23bln less will be raised on the money market, according to the press release.

- Chip-name ASM International (ASM NA) raised its 2025 revenue target and provided 2027 guidance at its Investor Day. Co. sees FY25 Revenue between EUR 3.0-3.6bln (prev. 2.8-3.4bln) while Q3 2023 was guidance reiterated, according to a press release.

FX

- DXY has trimmed earlier upside after initially gaining more ground against the majority of its currency rivals amidst the ongoing rout in debt, and in the run-up to month end in which Citi and Barclays models both point to Dollar buying.

- USD/JPY temporarily rose above 149.00 to a 149.19 high before reversing lower in conjunction with jawboning from Japanese Finance Minister Suzuki.

- GBP/USD is among the laggards under 1.2200 against its US peer against the backdrop of softer UK short-end rates and yields.

- EUR/USD bounced from 1.0570 to test 1.0600 to the upside where EUR 1.7bln option expiries are due to roll off at the NY cut.

- PBoC set USD/CNY mid-point at 7.1727 vs exp. 7.3174 (prev. 7.1727).

- Credit Agricole FX Month-End Rebalancing: month-end portfolio-rebalancing flows are likely to be mild USD buying across the board with the strongest buy signal in the case of the USD vs the CAD.

Fixed Income

- Bonds regained some composure with some aid from Germany’s Q4 issuance remit, which saw the expected reduction confirmed and was overall a positive development, but the bulk of the cut was at the short end.

- Bunds are holding above 129.00 and BTPs defended 110.00 in wake of reasonable German and Italian auctions in relief more than positive response to the results.

- Gilts plunged to 94.82 before rebounding to 95.64, while T-note fell to the edge of 108-00 at 108-05 before trimming losses to trade back towards 108-12+.

- UK sold GBP 3bln 0.875% 2033 Green Gilt: b/c 2.56x (prev. 3.02x), average yield 4.315% (prev. 4.239%) and tail 1.3bps (prev. 0.2bps).

- Germany sold EUR 3.25bln vs exp. EUR 4bln 2.40% 2028 Bobl: b/c 2.0x (prev. 2.1x), average yield 2.76% (prev. 2.56%) & retention 18.75% (prev. 15.15%)

- Italy sold EUR 3bln vs exp. EUR 2.5-3.0bln 3.60% 2025 BTP & EUR 1.75bln vs. Exp. EUR 1.25-1.75bln 1.50% 2029, 2.55% 2041 BTPei.

Commodities

- Crude futures are softer intraday following the choppy price action seen yesterday, while the European morning has seen continued downside across the complex as a result of the risk aversion seen across the broader markets.

- Dutch TTF prices are lower by some 7% at the time of writing following the recent surge, which desks believe is due to the upcoming heating seasons, whilst Norway’s Troll field reportedly saw a delayed startup.

- Spot gold and silver are subdued as the Dollar surged in early European trade, while copper prices are off worst levels and iron ore futures saw another session of losses in the East.

Geopolitics

- South Korean President Yoon warned if North Korea uses nuclear weapons, the overwhelming response by South Korea and the US is to bring its regime to an end, while he added that only a strong military can ensure peace, according to Reuters.

- Chinese Foreign Minister Wang said China opposes 'wanton' expansion of military alliances and squeezing the security space of other countries, according to Reuters.

- China MOFCOM said China firmly opposes the US inclusion of some Chinese companies and individuals in the Iran list, according to Reuters.

- Philippines Coast Guard said four Chinese Coast Guard vessels were nearby prior to the Philippines cutting the barrier at the South China Sea shoal and China removed the remnants of the barrier, while China's Coast Guard was not that aggressive and saw media on board the Philippines vessel, according to Reuters.

US Event Calendar

- 09:00: July S&P CS Composite-20 YoY, est. -0.10%, prior -1.17%

- July S&P/CS 20 City MoM SA, est. 0.70%, prior 0.92%

- July FHFA House Price Index MoM, est. 0.4%, prior 0.3%

- 10:00: Sept. Conf. Board Consumer Confidenc, est. 105.5, prior 106.1

- Sept. Conf. Board Present Situation, prior 144.8

- Sept. Conf. Board Expectations, prior 80.2

- 10:00: Aug. New Home Sales, est. 698,000, prior 714,000

- Aug. New Home Sales MoM, est. -2.2%, prior 4.4%

- 10:00: Sept. Richmond Fed Index, est. -7, prior -7

- 10:30: Sept. Dallas Fed Services Activity, prior -2.7

Central Bank speakers

- 13:30: Fed’s Bowman Delivers Welcoming Remarks

DB's Jim Reid concludes the overnight wrap

Morning from New York where it seems I've taken London type weather with me. It was another stormy day for duration yesterday with fresh milestones reached across several different asset classes. Just to give you a sense of what happened: the 10yr Treasury yields rose +10.0bps and closed comfortably above 4.5% for the first time since 2007; 10yr real yields were near 15yr highs; the 10yr bund yield traded above 2.8% for the first time since 2011; the VIX index of volatility flirted with its highest level since May intra-day; the US dollar index hit a YTD high; and European natural gas prices reached their highest level in almost 6 months. And if that weren’t enough, we remain days away from a potential US government shutdown, unless Congress can agree to pass funding beyond September 30. So a pretty tough backdrop for just about everything. Having said that, the S&P 500 recouped a little of its recent losses to close +0.40% higher, as positive AI demand rhetoric from Amazon and a likely end to the Hollywood writers’ strike boosted tech sentiment.

Of course, the biggest story yesterday was the dramatic rise in sovereign bond yields, which left them at multi-year highs on both sides of the Atlantic. For example, the 10yr US Treasury yield ended the day up +10.0bps at a post-2007 high of 4.53%, and overnight they’re up a further +1.6bps to 4.55%. Meanwhile, the 30yr yield rose +12.8bps to a post-2011 high of 4.65%, and is up +1.6bps overnight to 4.67%. Watch out for the latest 30yr mortgage rates! The recent rise in yields is partly because investors are pricing in that policy rates will remain higher for longer, particularly after the Fed’s dot plot last week. But it’s also been driven by the growing realisation that supply is set to remain elevated given mounting budget deficits, along with a small uptick in longer-term inflation expectations. Indeed, although real rates led the moves in longer-dated yields (10yr +11.7bps to 2.17%), the 30yr inflation breakeven was still up +1.0bps yesterday to 2.39%, which is its highest level in over 6 months. My CoTDs over the last two days have shown that 10yr USTs are now at their 230 plus year average again and that c.86% of time over that period, 10yr rolling inflation has averaged below 4.5%. So after a decade plus of having little value in historical terms, it is finally a competitive asset class again against others such as equities, which raises the question about what return equity investors should demand going forward. See the two here and here.

For European sovereigns it was a similar yield rising story yesterday. Yields on 10yr bunds (+5.6bps) closed at their highest level since 2011, at 2.79%, and those on 10yr OATs (+5.7bps) closed at their highest since 2012, at 3.34%. That said, there was a modest rally at the front end, with 2yr bunds yields down -2.1bps. The moves came with the backdrop of comments by ECB President Lagarde, who said to the European Parliament that rates “will be set at sufficiently restrictive levels for as long as necessary”. This reiterates the language from the ECB press conference back on September 14.

US equities showed resilience to the bond sell off, with the S&P 500 rebounding +0.40% from its 3-month low on Friday, and ending a run of four consecutive declines. Tech mega caps outperformed, with the Magnificent Seven index up +0.87%. Meanwhile, real estate, utilities and consumer staples were the underperformers in the S&P 500 with the higher rates story. As a reminder of the narrow nature of this year’s equity rally, the equal-weighted version of the S&P 500 is up only +1.28% YTD (+0.25% yesterday) compared to +12.97% for the headline S&P 500. Over in Europe, the equity moves were more definitively negative, and the STOXX 600 (-0.62%) fell to a one-month low.

Another important development yesterday was a fresh rise in European natural gas prices, which hit their highest level since April, at €44.44/MWh. Now it’s worth noting that the situation is far better than this time a year ago, when prices were still above €150/MWh, and European gas storage is also more plentiful and secure relative to 12 months ago. But clearly, the latest increase in natural gas prices is an unhelpful development when there’s been other signs that the European economy is slowing. Speaking of which, the Ifo’s business climate indicator from Germany came in at 85.7 in September. That was better than the 85.2 reading expected, but still beneath the revised 85.8 reading from August, which means that the index has fallen for 5 consecutive months now.

Whilst there were growing signs of a slowdown in Europe, the US Dollar continued to strengthen yesterday, with the dollar index (+0.39%) reaching its highest level of 2023 so far, and overnight it’s inched up another +0.02%. Conversely, that pushed the euro beneath the $1.06 mark for the first time since March, whilst sterling also fell to a 6-month low of $1.2212 just as I visit the Apple Store in Manhattan this week. That comes as US real yields have hit their highest in years, and the 30yr real yield (+11.7bps) surpassed its recent peaks in 2010 and 2011 yesterday to close at its highest level since 2009, at 2.27% .

Overnight in Asia we’ve seen more negative sentiment in markets, including losses for all the major equity indices. That includes the KOSPI (-1.22%), the Nikkei (-0.98%), the Hang Seng (-0.84%), the CSI 300 (-0.45%) and the Shanghai Comp (-0.33%). And as it stands, the Hang Seng is currently on track to close at its lowest level since November. We’ve also seen some headlines return about issues in the Chinese property sector, after Evergrande said yesterday that their mainland unit missed an onshore bond payment. Their shares fell by -21.82% yesterday, and overnight they’re down a further -6.98%. Looking ahead, US equity futures are pointing to renewed losses, with those on the S&P 500 down -0.32% this morning.

Looking at yesterday’s other data, the Dallas Fed’s manufacturing index unexpectedly fell to -18.1 in September (vs. -14.0 expected) even if the comments in the press conference were a little more upbeat.

To the day ahead now, and data releases from the US include the Conference Board’s consumer confidence for September, the Richmond Fed’s manufacturing index for September, new home sales for August, and the FHFA house price index for July. Central bank speakers include the Fed’s Bowman, and the ECB’s Lane, Simkus and Holzmann.