While hedge funds are getting squeezed (as we predicted), and long-onlies are refusing to buy the dip, the late summer volumes remain too anemic for any major market moves. But that may change if Goldman trader John Flood is correct in warning that CTAs are once again relevant in US equity markets after being a non-factor for the last 3+ months.

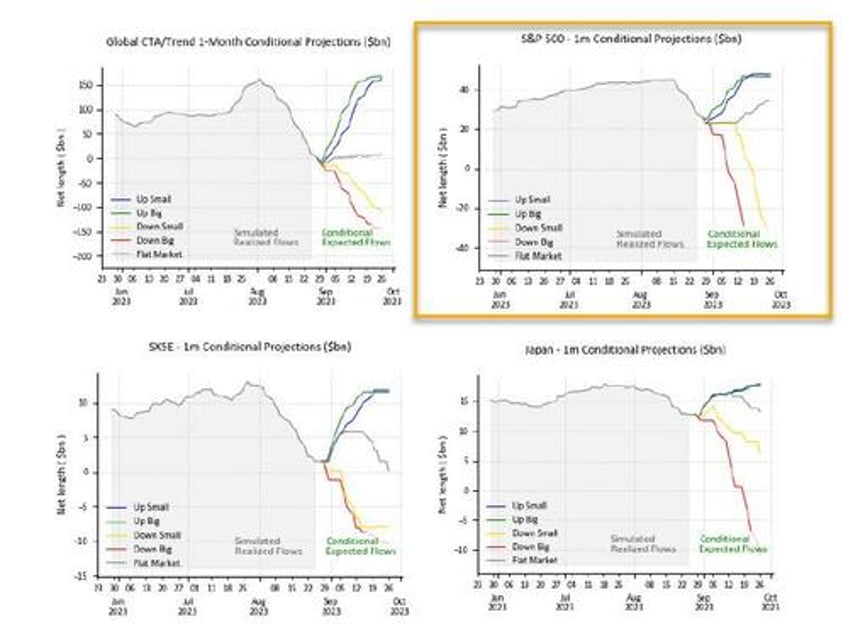

According to Flood, CTAs are now long $28BN S&P (77th percentile in terms of historical length)...