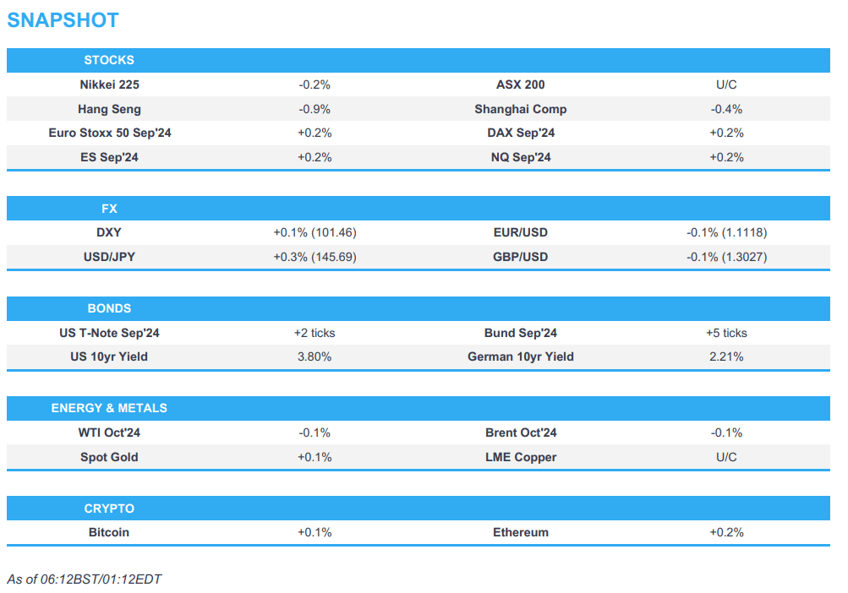

- APAC stocks were subdued following the lacklustre performance stateside where the major indices finished with mild losses.

- European equity futures indicate a marginally positive open with Euro Stoxx 50 future up 0.2% after the cash market finished with losses of 0.2% on Tuesday.

- DXY remains on a 101 handle, JPY is the marginal laggard across the majors, EUR/USD holds onto 1.11 status.

- A deal to bring an end to the fighting in Gaza was said to be on the brink of collapsing, according to Politico.

- Looking ahead, highlights include Canadian Producer Prices, US Payrolls Benchmark Revisions, FOMC Minutes, Democratic Convention, Supply from UK, Germany & US, Earnings from Target, Analog Devices and TJX.

More Newsquawk in 3 steps:

1. Subscribe to the free premarket movers reports

2. Listen to this report in the market open podcast (available on Apple and Spotify)

3. Trial Newsquawk’s premium real-time audio news squawk box for 7 days

US TRADE

EQUITIES

- US stocks traded sideways for most of the session and the major indices finished with mild losses in a day that saw few macro updates and a lack of tier-1 data releases. Furthermore, the latest comments from Fed's Bowman provided very little incrementally as she reiterated her view that rate cuts are appropriate if inflation keeps slowing but noted that she still sees upside risks to inflation, while the attention in the US turns to Wednesday's FOMC Minutes.

- SPX -0.20% at 5,597, NDX -0.24% at 19,720, DJIA -0.15% at 40,835, RUT -1.17% at 2,142.

- Click here for a detailed summary.

NOTABLE HEADLINES

- Fed's Bowman (voter) said they've seen some recent further progress on lowering inflation, but inflation is still uncomfortably above the committee's 2% goal and wage gains remain above the pace consistent with their inflation goal. Bowman said should incoming data show inflation is moving sustainably toward the target, it will become appropriate to gradually lower rates to prevent becoming overly restrictive, while she added they need to be patient and avoid undermining continued progress on lowering inflation by overreacting to any single data point.

APAC TRADE

EQUITIES

- APAC stocks were subdued following the lacklustre performance stateside where the major indices traded sideways and finished with mild losses amid the absence of macro drivers ahead of the FOMC Minutes.

- ASX 200 declined amid a deluge of earnings with underperformance in energy following a retreat in oil prices and with Santos shares pressured after it reported an 18% drop in H1 underlying profit.

- Nikkei 225 slumped at the open amid pressure from recent currency strength but is off worst levels.

- Hang Seng and Shanghai Comp. retreated with the former ragged lower by tech weakness as JD.com suffered a double-digit drop after reports Walmart is seeking to offload its USD 3.5bln stake in the Co. However, the losses in the mainland are limited following the PBoC's firm liquidity effort.

- US equity futures traded steadily with price action contained ahead of upcoming key events.

- European equity futures indicate a marginally positive open with Euro Stoxx 50 future up 0.2% after the cash market finished with losses of 0.2% on Tuesday.

FX

- DXY languished below the 102.00 level with a slight reprieve from the recent selling pressure as attention turns to the FOMC Minutes, while recent comments from Fed's Bowman provided very little fresh insight.

- EUR/USD slightly eased back after climbing to a fresh YTD high above the 1.1100 level.

- GBP/USD held on to the 1.3000 status after the prior day's ascent to a one-year peak.

- USD/JPY nursed some losses after yesterday's outperformance in havens and with support at 145.00.

- Antipodeans were rangebound with demand sapped by the downbeat mood and quiet calendar.

- PBoC set USD/CNY mid-point at 7.1307 vs exp. 7.1303 (prev. 7.1325).

FIXED INCOME

- 10-year UST futures took a breather after recent bull flattening, while the attention turns to the 20-year auction stateside and FOMC Minutes scheduled later today.

- Bund futures held on to the prior day's gains but with upside capped ahead of a Bund issuance.

- 10-year JGB futures briefly rose above the 145.00 level amid the risk aversion and mixed trade data but later pared the majority of their initial advances.

COMMODITIES

- Crude futures remained subdued after recent declines amid China demand concerns and Gaza ceasefire efforts, while the latest private sector inventory data showed a surprise build in headline crude stockpiles.

- US Private Inventory Data (bbls): Crude +0.3mln (exp. -2.7mln), Distillate -2.2mln (exp. -0.2mln), Gasoline -1.0mln (exp. -0.9mln), Cushing -0.6mln.

- Spot gold traded rangebound after a recent pullback and with support at the USD 2,500/oz level.

- Copper futures lacked conviction with demand contained amid the risk aversion.

CRYPTO

- Bitcoin traded indecisively and ultimately rebounded from an early dip beneath the USD 59,000 level.

NOTABLE ASIA-PAC HEADLINES

- China Automobile Manufacturers Association firmly opposes the EU Commission's final draft on high tariffs on Chinese-made electric vehicles and said the tariff decision brings enormous risks and uncertainty for Chinese firms’ operations and investment in the EU, according to CCTV.

DATA RECAP

- Japanese Trade Balance Total Yen (Jul) -621.8B vs. Exp. -330.7B (Prev. 224.0B)

- Japanese Exports YY (Jul) 10.3% vs. Exp. 11.4% (Prev. 5.4%)

- Japanese Imports YY (Jul) 16.6% vs. Exp. 14.9% (Prev. 3.2%)

GEOPOLITICAL

MIDDLE EAST

- Israeli raids were reported on towns in Baalbek, eastern Lebanon, while Hezbollah said it confronted an Israeli warplane that violated Lebanese airspace in the southern region with a surface-to-air missile, according to Sky News Arabia. Furthermore, Lebanese media reported that 4 people were killed and 10 others wounded in Israeli raids on the Bekaa region.

- Islamic Resistance in Iraq said it attacked a vital target in Eilat, according to Al Jazeera.

- A deal to bring an end to the fighting in Gaza was said to be on the brink of collapsing and there is no clear immediate alternative agreement that could be put forward in its place, according to two US and two Israeli officials cited by POLITICO.

- Israeli PM Netanyahu met with Finance Minister Smotrich over the past two days to convince him to support the hostage deal, according to sources cited by Walla News.

- Hamas refuted US President Biden's claim that it is backing away from a Gaza ceasefire and hostages deal, while it insisted that the US is yielding to Israel's interests in negotiations, according to FT.

- US Secretary of State Blinken said they need to get a ceasefire and hostage release agreement over the finish line now, while he said they will do everything possible over the coming days to get Hamas on board with the bridge proposal.

- UK Foreign Secretary Lammy said he spoke with US Secretary of State Blinken to discuss the ongoing Gaza ceasefire negotiations, while he added that an immediate cessation of fighting in Gaza and release of all hostages is vital.

- Qatari Foreign Minister told US Secretary of State Blinken that Qatar is committed to its mediating role with Egypt and the US to end the war in Gaza.IRGC spokesman justified the delayed response to Israel and said it will come but it will take a long time, according to Al Arabiya. Furthermore, a spokesman said they control the time and Israel must wait, while their response to Israel will be different.

- Iran-backed armed factions in Iraq are ending the truce that was meant to give the Iraqi government time to negotiate the withdrawal of US troops from the country, according to a high-ranking member of one of the groups cited by The National.US Pentagon said it's taking the necessary steps to reduce the possibility of regional escalation by Iran or its agents.

OTHER

- Russian air defences repelled a Ukraine drone attack on Moscow, according to the Moscow Mayor.

- Russia's foreign intelligence agency said, without providing evidence, that Ukraine's incursion into Kursk was prepared with the participation of the US, UK, and Poland, while it added that NATO advisers are providing assistance to Ukraine in its incursion into Kursk, according to TASS.

- US President Biden approved a secret nuclear strategy refocusing on Chinese threat and ordered US forces to prepare for possible coordinated nuclear confrontations with Russia, China and North Korea, according to NYT citing a classified document approved in March.

EU/UK

NOTABLE HEADLINES

- UK Chancellor Reeves plans to increase social housing rents by more than inflation for the next 10 years to boost the building of affordable homes, according to FT.

- France's caretaker government limits 2025 state spending to EUR 492bln which is the same as in 2024, while 2025 spending limits on ministries imply roughly EUR 10bln in savings after inflation.