By Teeuwe Mevissen, senior macro strategist at Rabobank

Sour grapes. According to the Cambridge Dictionary one of the ways to interpret this idiom is: ‘bad behaviour that happens because someone is more successful’. Looking at the current state of affairs in the sector for electric vehicles (EV’s), it is clear that China has been very successful in developing high quality cars that are being offered for very competitive prices. However the German automotive industry is behind in the development of EV’s compared to China and on top of that, faces increasing competition on China’s market from Chinese car makers.

It is in the car industry two of the three of Germany’s previous strategic pillars for foreign policy of the Merkel era have crumbled. Remember that those three major pillars were: i) cheap energy from Russia to stay competitive on the world market for manufactured goods, ii) security guarantees from Washington and iii) a large export market in China. Clearly the first and last pillar are the ones that plague Germany’s car industry. Moreover, it was thought during the Merkel era that Wandel durch Handel (meaning change through trade) would result in China becoming a responsible, democratic, international stakeholder. We all know what actually happened. If any country is forced to change because of its previous (trade) policies it is Germany.

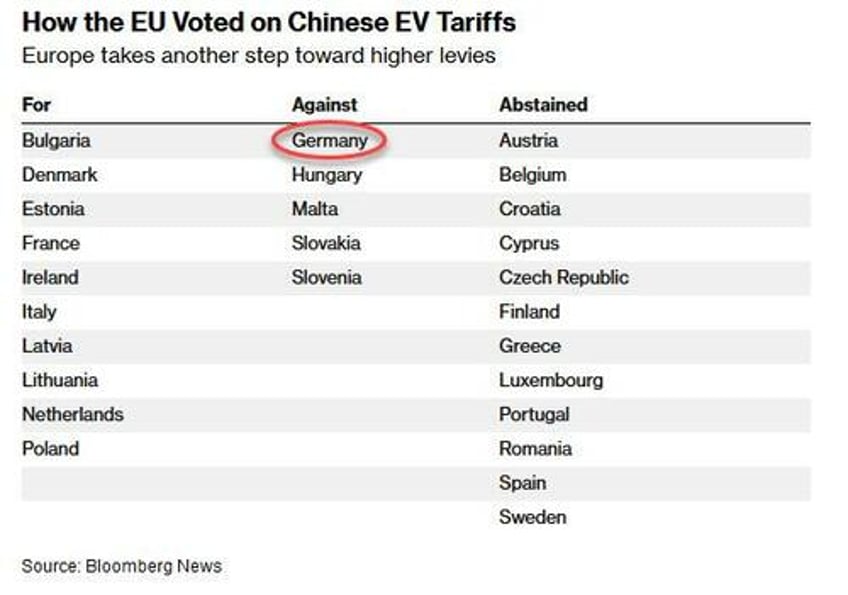

Despite Germany’s grapes being sour, it was Germany that voted against the levy of tariffs on EV’s imported from China. Despite Germany’s opposition to tariffs, China wants to investigate possible tariffs on European large-engine vehicles that are mainly exported by Germany and Slovakia. China will also start collecting levies on brandy. Additionally, China launched several investigations on dairy and pork products, which are mainly exported by Denmark, France, Spain and the Netherlands. All of those countries voted in favor of tariffs except for Spain which abstained from voting.

The most interesting observation regarding the voting behavior of the different member states is that France and Germany are both car producers but that the French car lobby was in favor of tariffs but the German car lobby heavily against. Now obviously we can all make cheesy jokes about nobody wanting to buy French cars anyway, but the truth is that Germany exports way more cars to China than France does.

Additionally, Germany also produces far more cars in China than France. The other truth is that the grapes that France uses for their world class brandy’s are all but sour! While this clearly explains the difference in voting behavior, it still seems that German car manufacturers are likely to face increasingly tough competition in China since China also builds more and more cars in the luxury segment.

So taking into account tariffs, problems with some of their component suppliers and the move towards EV’s, is there still a viable business case to be made for Germany’s car industry in China in the long run? Only time will tell but for now there are plenty of challenges for European car makers. Meanwhile stocks dropped in China after the key policy meeting from the National Development and Reform Committee disappointed investors because no new stimulus measures were announced. And this means a provisional end of the recent frenzy on China’s stock markets. For now, because China’s Finance Minister plans a briefing on Saturday, which investors hope will bring new stimulus measures.

But the real storm the world is watching is of course Hurricane Milton. The hurricane is forecast to make landfall in Tampa, Florida and is going to wreak havoc in more parts of Florida. The damage will likely run in the hundreds of billions and it is feared that Milton could become one of the country’s most damaging and costly hurricanes.

The other storm that markets are awaiting is the current situation in the Middle East. Israel is expected to retaliate for Iran’s recent missile barrage and the stakes seem higher than ever. Given the fact that an explosion was recorded in Aradan county in the Semnan province (Iran) that was followed by an earthquake with a magnitude of 4.6 on October 5, one wonders if Iran tested a nuclear device. Needless to say that an escalation in the Middle East will likely increase oil prices. So for today, brace yourself.