By Mish Shedlock of MishTalk

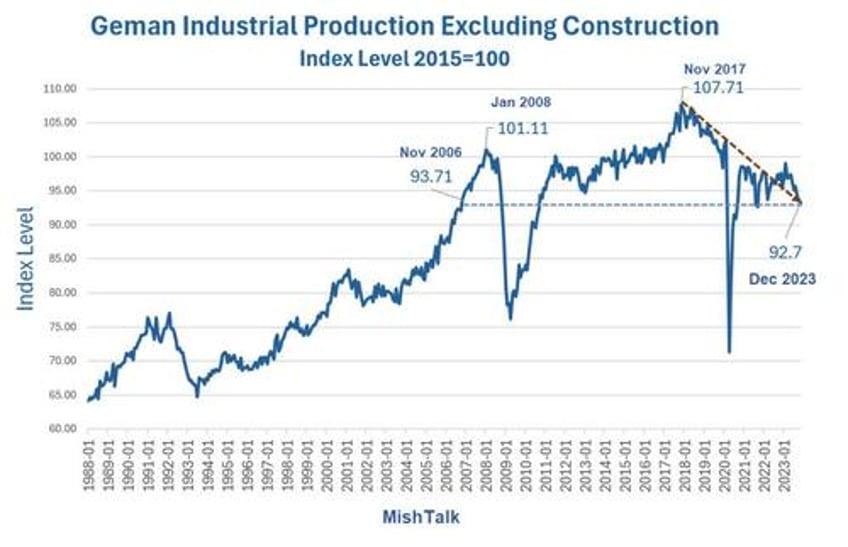

German Industrial production peaked in November of 2017. Germany’s IP has since fallen to a level first seen in 2006.

Bloomberg reports Germany’s Days as an Industrial Superpower Are Coming to an End

In a cavernous production hall in Düsseldorf last fall, the somber tones of a horn player accompanied the final act of a century-old factory.

Amid the flickering of flares and torches, many of the 1,600 people losing their jobs stood stone-faced as the glowing metal of the plant’s last product — a steel pipe — was smoothed to a perfect cylinder on a rolling mill. The ceremony ended a 124-year run that began in the heyday of German industrialization and weathered two world wars, but couldn’t survive the aftermath of the energy crisis.

The underpinnings of Germany’s industrial machine have fallen like dominoes. The US is drifting away from Europe and is seeking to compete with its transatlantic allies for climate investment. China is becoming a bigger rival and is no longer an insatiable buyer of German goods. The final blow for some heavy manufacturers was the end of huge volumes of cheap Russian natural gas.

“The shock was huge,” said Wolfgang Freitag, who worked at the plant since he was a teenager. The 59-year-old’s job now is to disassemble equipment for sale and help his old colleagues find new work.

Fading industrial competitiveness threatens to plunge Germany into a downward spiral, according to Maria Röttger, head of northern Europe for Michelin. The French tiremaker is shutting two of its German plants and downsizing a third by the end of 2025 in a move that will affect more than 1,500 workers. US rival Goodyear has similar plans for two facilities.

“Despite the motivation of our employees, we have arrived at a point where we can’t export truck tires from Germany at competitive prices,” she said in an interview. “If Germany can’t export competitively in the international context, the country loses one of its biggest strengths.”

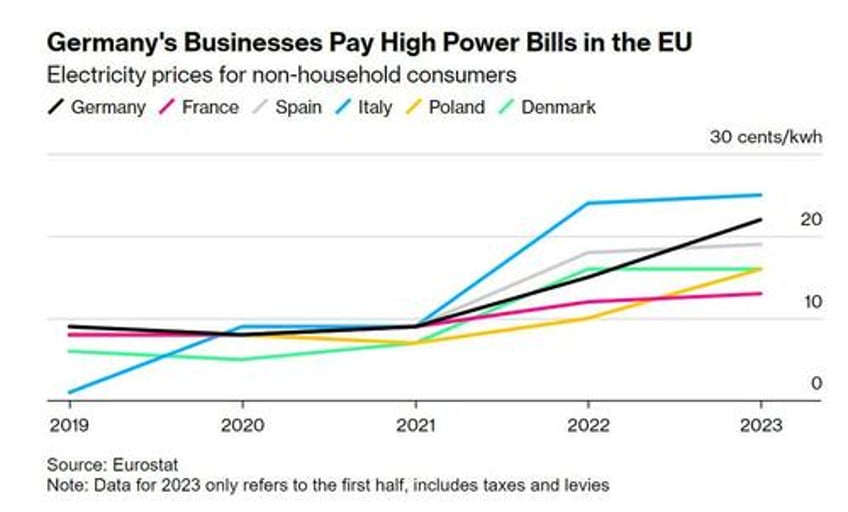

High Power Bills

One of the hardest-hit sectors has been chemicals — a direct result of Germany’s loss of cheap Russian gas. With the transition to clean hydrogen still uncertain, nearly one in 10 companies are planning to permanently halt production processes, according to a recent survey by the VCI industry association. BASF SE, Europe’s biggest chemical producer, is cutting 2,600 jobs and Lanxess AG is reducing staff by 7%.

China is now causing trouble for Germany in a number of ways. On top of its strategic shift into advanced manufacturing, a slowdown of the Asian superpower’s economy is sapping demand for German goods even further. At the same time, cheap competition from China is worrying industries key for Germany’s climate transition — and not just electric cars.

Manufacturers of solar panels are shuttering operations and cutting staff as they struggle to compete with state-supported Chinese rivals. Dresden-based Solarwatt GmbH has already cut 10% of its workforce and may relocate production abroad if the situation doesn’t improve this year, according to CEO Detlef Neuhaus.

“It’s not just energy,” CEO Klaus Geißdörfer said in an interview. “It’s also staff availability in Germany, which is now very tense.” Within a decade, the working-age population will be too small to keep the economy functioning as it does today, he added.

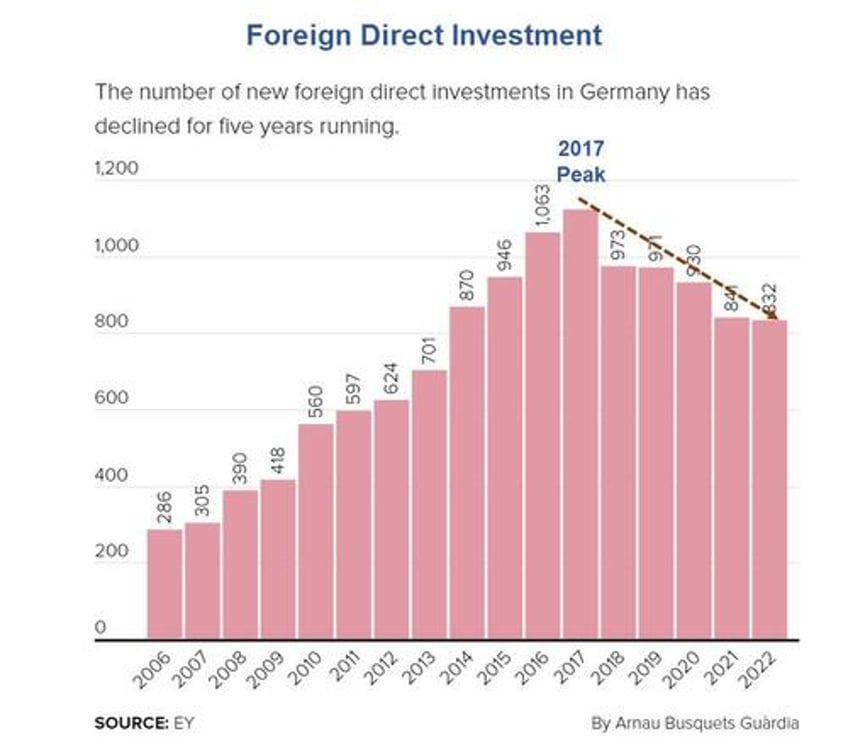

Foreign Direct Investment Plunges

Politico comments on the deindustrialization of Germany in its report Rust on the Rhine.

Germany’s biggest companies are ditching the fatherland.

Chemical giant BASF has been a pillar of German business for more than 150 years, underpinning the country’s industrial rise with a steady stream of innovation that helped make “Made in Germany” the envy of the world.

But its latest moonshot — a $10 billion investment in a state-of-the-art complex the company claims will be the gold standard for sustainable production — isn’t going up in Germany. Instead, it’s being erected 9,000 kilometers away in China.

“We are increasingly worried about our home market,” BASF Chief Executive Martin Brudermüller told shareholders in April, noting that the company lost €130 million in Germany last year. “Profitability is no longer anywhere near where it should be.”

The country’s reliance on industry makes it particularly vulnerable. With the exception of software maker SAP, Germany’s tech sector is essentially non-existent. In the financial world, its biggest players are best known for making bad bets (Deutsche Bank) and scandal (Wirecard). Manufacturing accounts for about 27 percent of its economy, compared with 18 percent in the U.S.

A related problem is that Germany’s most important industrial segments — from chemicals to autos to machinery — are rooted in 19th-century technologies. While the country has thrived for decades by optimizing those wares, many of them are either becoming obsolete (the internal combustion engine) or simply too expensive to produce in Germany.

By halting deliveries of natural gas to Germany, the Kremlin effectively removed the linchpin of the country’s business model, which relied on easy access to cheap energy. Though wholesale gas prices have recently stabilized, they’re still roughly triple where they were before the crisis. That has left companies like BASF, whose main German operation alone consumed as much natural gas in 2021 as all of Switzerland, with no choice but to look for alternatives.

The country’s Green transformation, the so-called Energiewende, has only made matters worse. Just as it was losing access to Russian gas, the country switched off all nuclear power. And even after nearly a quarter century of subsidizing the expansion of renewable energy, Germany still doesn’t have nearly enough wind turbines and solar panels to sate demand — leaving Germans paying three times the international average for electricity.

Volkswagen, which has dominated the Chinese auto market for decades, lost its crown as the country’s largest automaker in the first quarter to BYD, a local competitor, amid a surge in EV sales. China is the world’s largest car market, accounting for nearly 40 percent of Volkswagen’s revenue.

Germany Lags in Major Ways

Germany lags the US and China on Artificial Intelligence (AI), EVs, battery development, microchips, phones and even basic internet services.

Liechtenstein has the fastest internet speed in the world in 2023 at 246.76 Mbps according to AtlasAndBoots.

The US is number 10 at 136.48 Mbps. Germany is number 36 at 81.73 Mbps.

A December 2023 Speedtest by Ookla shows similar results.

Ookla has the US in 8th place for fixed broadband and 13th for mobile. Germany is in 51st place for broadband and 45th place for mobile.

One reason is Germany is still reliant on copper lines. While most of the rest of the world turned to fiber, Germany made little investment in its own infrastructure. Germany is still working on the last mile.

Final Blow From the Greens

Not only is Germany seriously lagging on AI, EVs, microchips, phones, and the interment, the Greens came along and demanded Germany scrap nuclear power.

Former chancellor Angela Merkel hopped on the green bandwagon. Instead of investing in infrastructure, Germany invested in silly green projects and scrapped nuclear power for no good reason.

Now, Germany is making foreign direct investment in China, a country still heavily reliant on Coal. Germany gave up on nuclear power and still needs to catch up on basic internet and phone technology. Germany stayed too long on diesel and analog phones.

Greens label this as progress. Farmers are in open revolt. The average German consumer is screwed.

Not only is Germany way behind on basic infrastructure, it lost its export prowess as well. When export dependent countries implode, they are in a world of hurt.