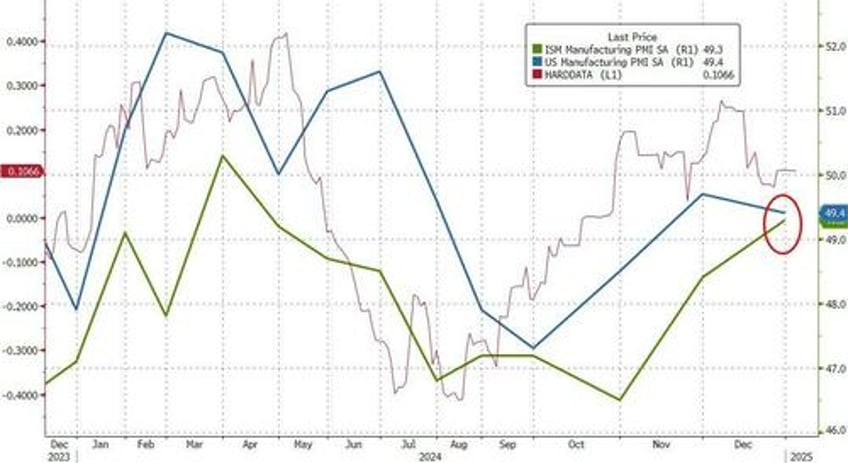

While 'Hard' data has stabilized after its big run up in the second half of 2024, US Manufacturing PMI surveys remain in contractionary territory with S&P Global's PMI limping lower to 49.4 and ISM's PMI rising up to 49.3 to end the year. The ISM print was better than expected (49.3 vs 48.2 exp vs 48.4 prior)...

Source: Bloomberg

Prices Paid and New Orders jumped into year-end but Employment tumbled...

Source: Bloomberg

Chris Williamson, Chief Business Economist at S&P Global Market Intelligence confirms that US factories reported a tough end to 2024, and have scaled back their optimism for growth in the year ahead.

"Production was cut at an increased rate in December amid disappointing inflows of new orders. While November had seen a near-stabilization of order books as uncertainty surrounding the election passed, reviving customer demand, this respite has proved temporary. Factories are reporting an environment of subdued sales and inquiries, notably in terms of exports."

Williamson adds that while businesses were pleased that Trump got re-elected, they are now questioning just how great that new America can be...

“Many firms are generally anticipating that business will pick up in the New Year, with respondents pinning hopes on expectations that the new administration will loosen regulations, reduce tax burdens and boost demand for US-made goods via tariffs. Confidence has consequently risen from a low-point last June, having jumped higher in November on the election result. However, this optimism has been pared back somewhat in December, as firms are now reporting worries over higher input prices, and are concerned that inflation may pick up again, adding to speculation that interest rates will not be cut as much as previously thought likely over the coming year."

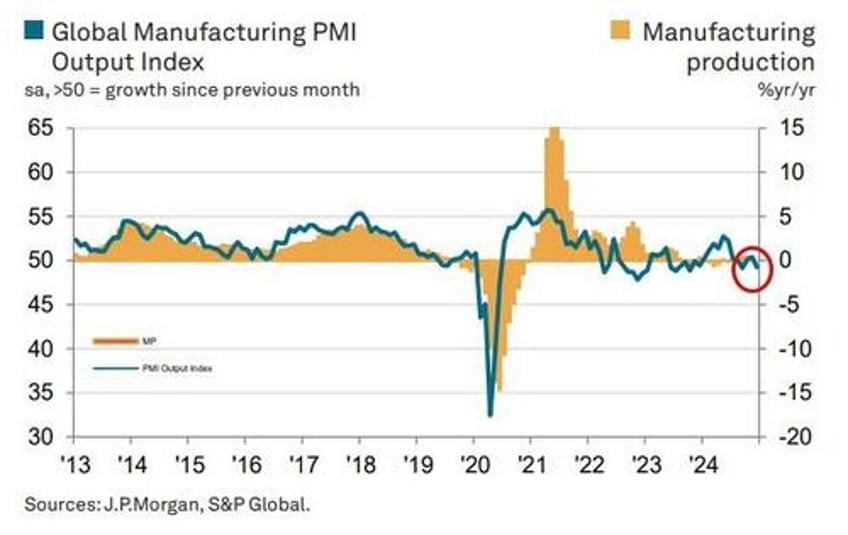

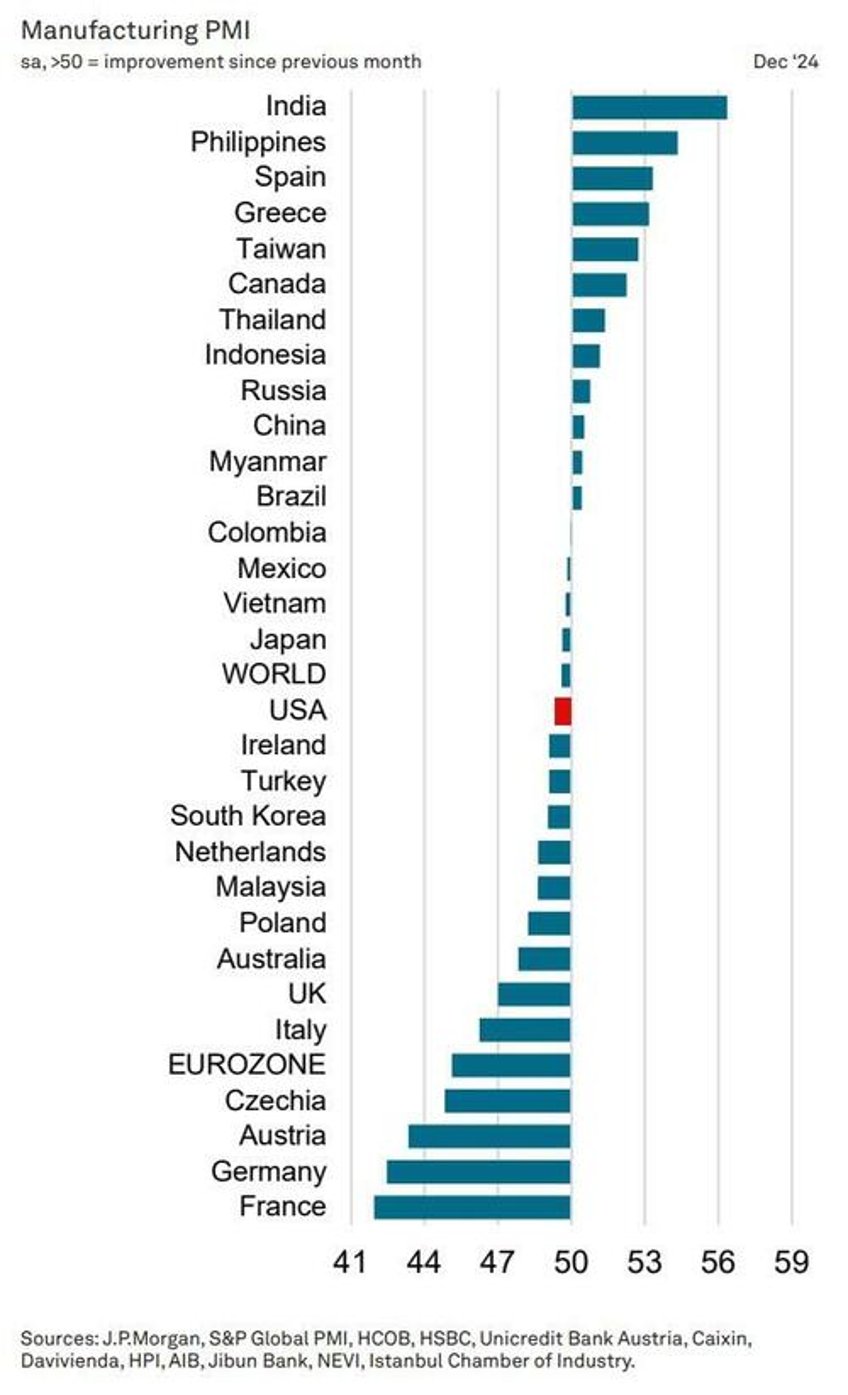

Finally, we note that globally, according to JPMorgan's latest PMI surveys, the global manufacturing sector fell back into contraction at the end of 2024, with output and new orders declining in December following slight increases.

Regional variations were again marked, with business conditions affected by the possibility of US tariffs being imposed in the coming year.

Perhaps most problematically, while input cost inflation accelerated to a four-month high in December, selling price inflation meanwhile eased to a nine-month low - crushing the prospect for corporate margins going forward.