An ugly jobless claims print was the day's early catalyst sending yields significantly lower, stocks, gold, oil, and crypto higher and the dollar down with rate-cut expectations re-ignited...

Source: Bloomberg

A dovish shift supported stocks - which had a "squeezey feel" amid very low liquidity...

Source: Bloomberg

Goldman's trading desk noted that while yesterday was the lightest notional session all year in the US, today is looking to be even slower (tracking down -2% vs. yesterday), which probably helped the liftathon...

The Dow and Small Caps led the way - up almost 1%, and Nasdaq lagged on the day - barely holding on to green...

This was The Dow's seventh straight daily gain - the longest win streak since July 2023.

And both Hedge Funds and Long-Onlys were sellers today (which leaves buybacks - as we predicted - to save the market)...

HFs are -7% for sale and lean better for sale in every sector ex- Cons Disc & Macro Products. Supply is most pronounced in Info Tech & Utes which when combined, make up 2/3 of overall HF net supply.

LOs are -11% for sale with notable supply in Fins & REITs while HCare, Mats, Indust & Info Tech are also net for sale. Demand is modest across Cons Disc, Utes & Macro Products

MAG7 stocks spent a third day going nowhere...

Source: Bloomberg

0-DTE Call-buyers dominated the action today...

Source: SpotGamma

Treasuries were bid across the curve today with very early steepening erased by the close thanks to a strong 30Y auction)...

Source: Bloomberg

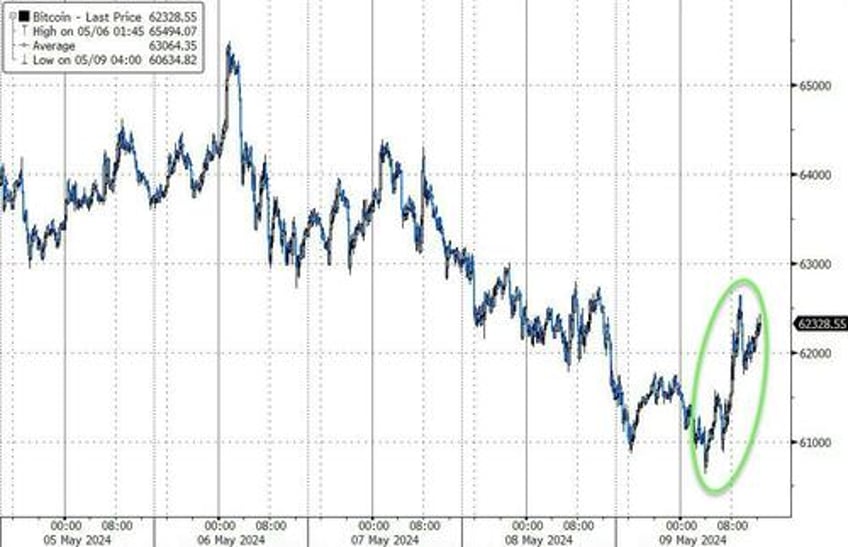

A small net inflow into ETFs yesterday supported bitcoin and as the dollar sank, crypto was bid today too...

Source: Bloomberg

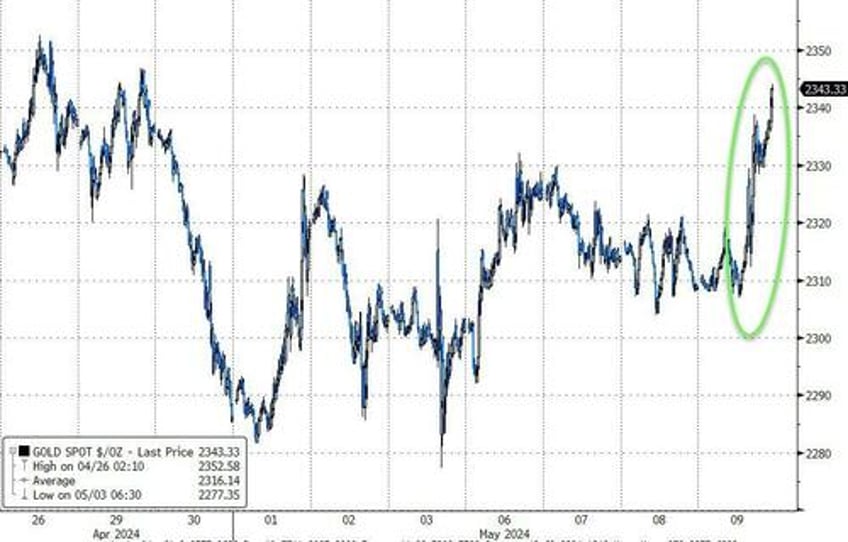

Gold surged back above $2340...

Source: Bloomberg

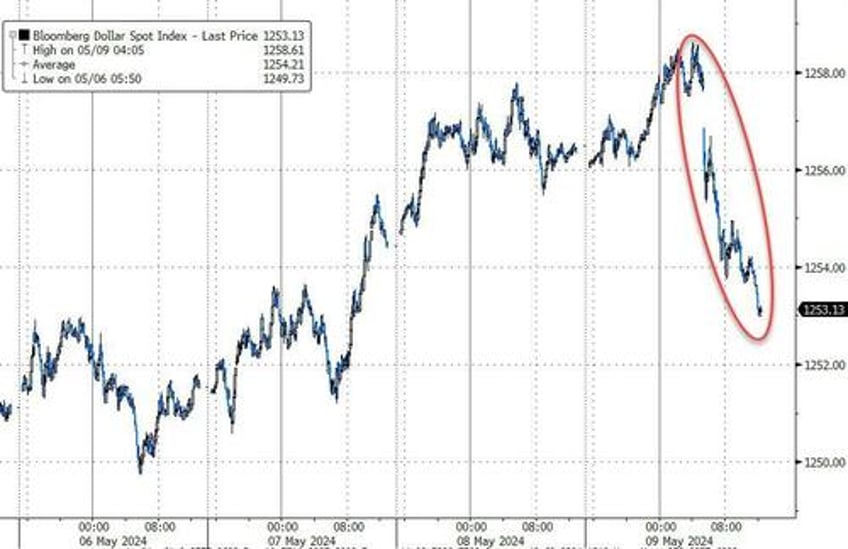

As the dollar dived...

Source: Bloomberg

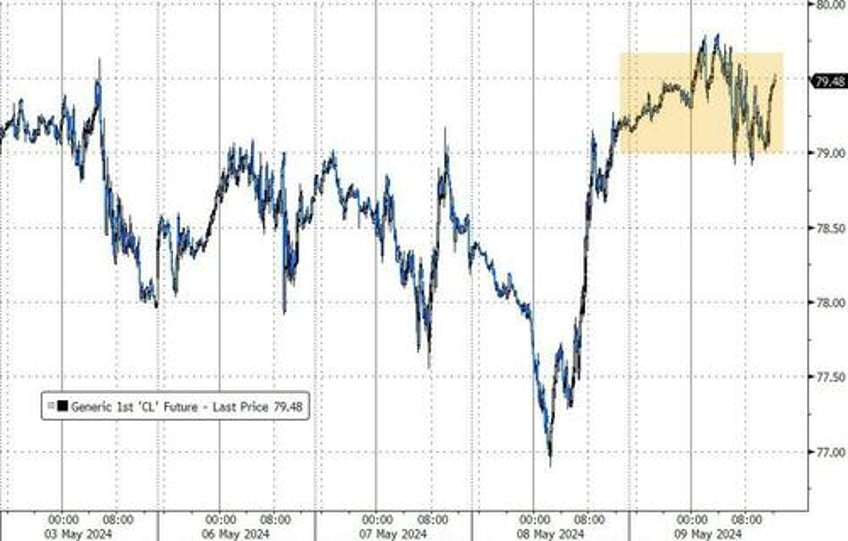

Oil prices ended marginally higher, after chopping around much of the day...

Source: Bloomberg

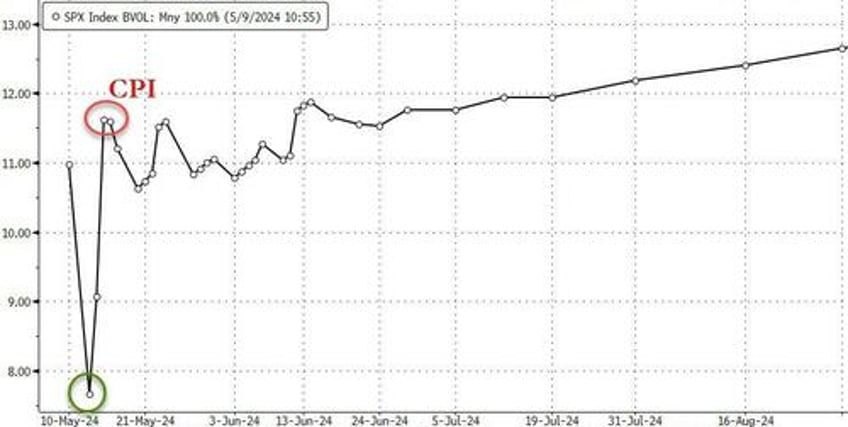

Finally, while fear is gone through Monday, it returns for CPI and vol is pricing in some anxiety next week...

Source: Bloomberg

That '7'-handle vol for Monday looks very cheap.