The S&P 500 has not had a nine-day win-streak since 2004 and it appears Kamu-nism was enough to stop stocks doing it again today as Harris unveiled her cunning plan, including 28% corporate tax, price-controls, 44.6% capital-gains tax, and last but not least, a tax on unrealized gains.

Small Caps were the ugliest horse in the glue factory today as the algos tried their hardest to maintain the win-streak.

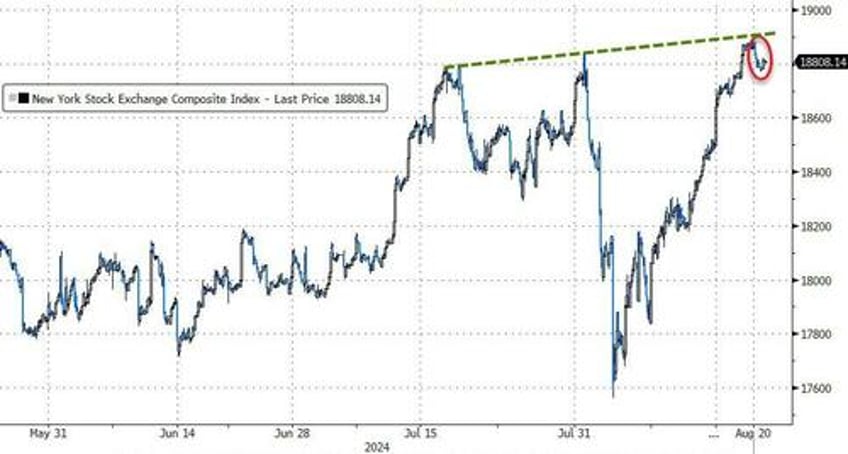

The NYSE Composite Index did make a new record high at this morning's open, but then faded back...

Source: Bloomberg

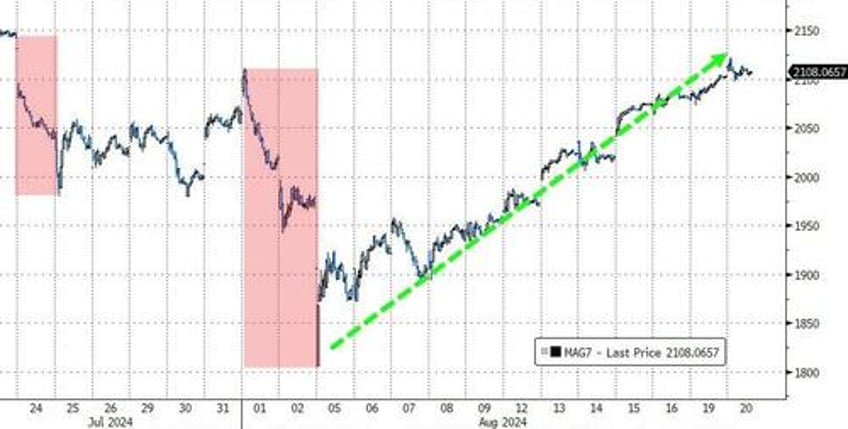

The Mag7 basket managed another day of (marginal) gains (but we do note that it stalled intraday at a key resistance level)...

Source: Bloomberg

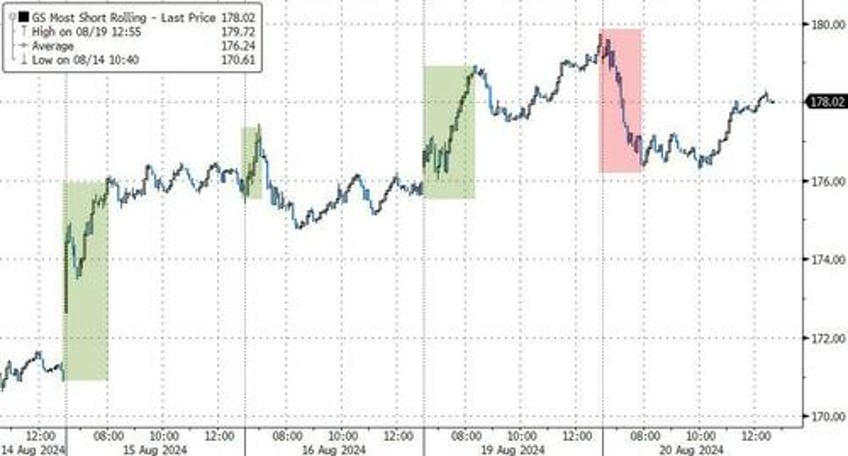

But 'most shorted' stocks were puked out of the gate...

Source: Bloomberg

And this occurred as growth-surprise data slumped back to multi-year lows (not helped by the crash in Philly Fed's survey today)...

Source: Bloomberg

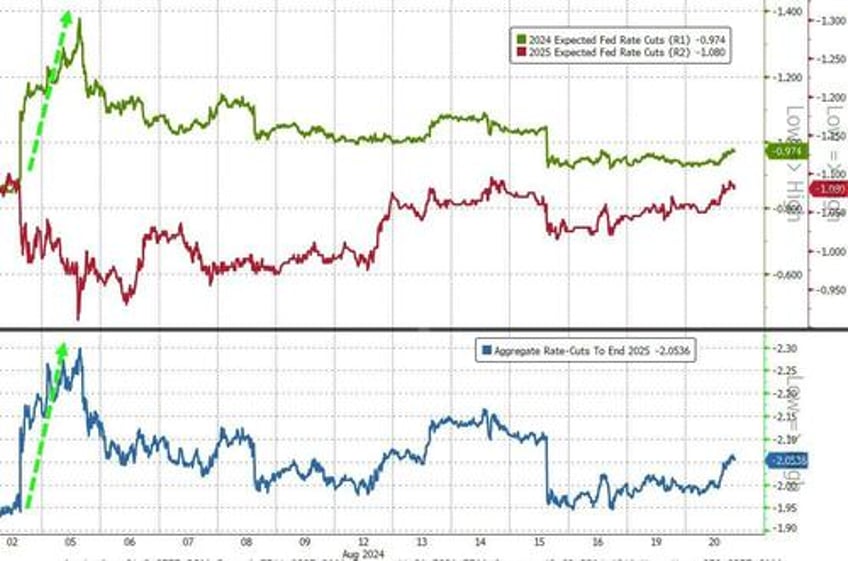

...which lifted rate-cut expectations modestly...

Source: Bloomberg

Are we back in Goldilocks-land - just enough growth-scare to enable the Fed doves support for stocks but not enough growth-scare to terrify investors' guesses at future earnings.

The dollar doesn't care - it's riding the dovish path lower no matter what...

Source: Bloomberg

And despite the best efforts of Benoit and his BIS buddies to tamp down enthusiasm for alternatives, gold surged to a new record high today...

Source: Bloomberg

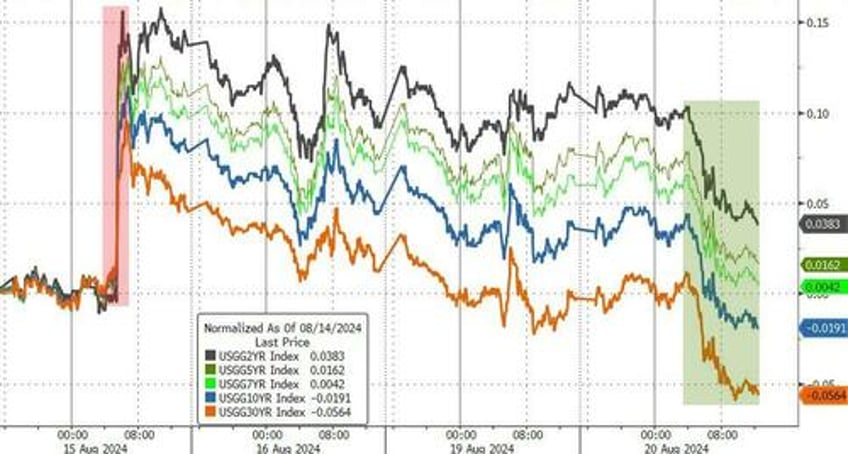

But, we do note that Treasury yields did plunge today (6-7bps across the curve) - a little more growth-scare than equity bulls might have liked to see...

Source: Bloomberg

As the chart above shows, the long-end (10Y and 30Y) has erased all of the CPI-spike from last week.

Most notably, the 2Y yield tumbled back below 4.00% (after CPI sent yields back up to pre-payrolls levels)...

Source: Bloomberg

Oil prices limped lower once again (5th day of the last 6) as growth-scares weighed on commods...

Source: Bloomberg

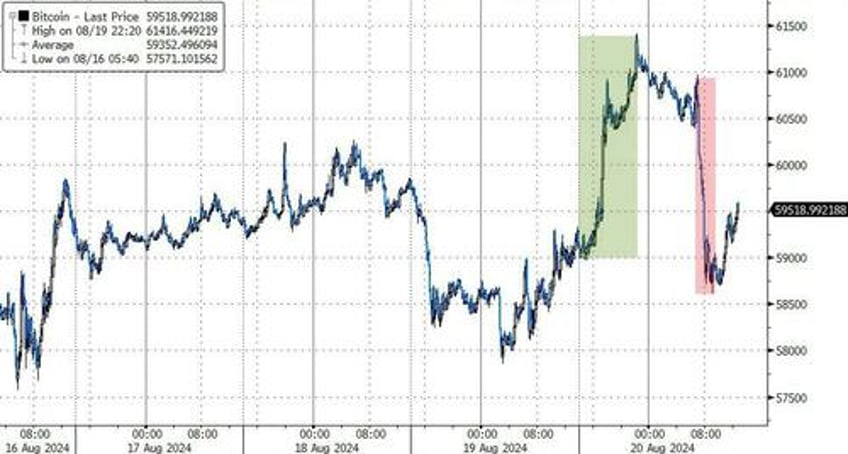

Bitcoin ripped up above $61,000 overnight during the Asia session, then was punched lower during the US session...

Source: Bloomberg

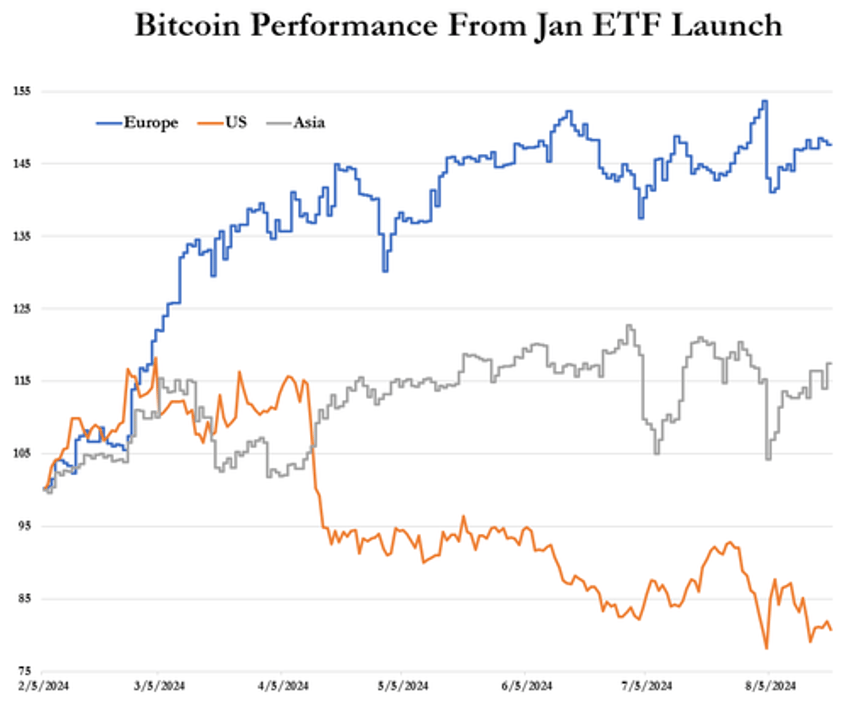

Bear in mind, that pattern of trading should come as no surprise at all...

Finally, while markets have recovered, Deutsche Bank warned this morning in a note to clients that catalysts behind the retreat haven't necessarily evaporated. The firm outlined five key risks that remain that investors should watch:

First, equity valuations are still at historic highs, with the market trading in moderately overweight territory, the bank said. This made some on Wall Street uneasy even before August's sell-off and continues to be a point of anxiety as investments pile in.

Second, economic data remains vulnerable. Part of the reason equities dropped dramatically in August was a softer-than-expected nonfarm payrolls print, which disappointed estimates of 194,000. This was an unwelcome sign of weakness, but not a recessionary reading, DB said. That leaves room for even more disappointing data, which could bring larger consequences to investors if it were to happen.

Third, monetary policy is getting increasingly tight on real terms, with DB noting that the real Fed funds rate recently hit its highest since 2007.

Fourth, September has been a seasonally bad month for stocks over the past few years. The S&P 500 has fallen during the period for four straight years, and in seven of the past 10. DB says it's also been a bad month for fixed income, with the Bloomberg global bond aggregate falling during the past seven Septembers.

Fifth, geopolitical tensions are still high. DB notes that Middle East conflicts contributed to an equity sell-off in April, while oil prices also hit their highs for the year around the same time. More recently, in August, oil saw their biggest single-day spike of the year on reports of further escalation, the firm said.

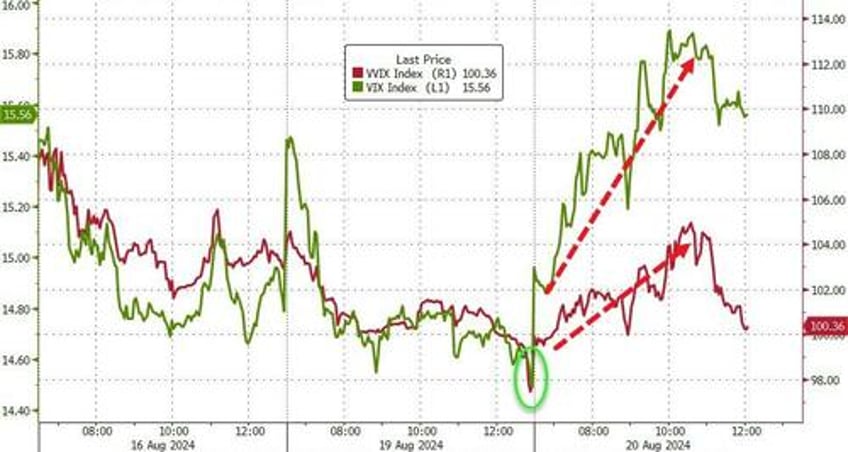

And under the hood, options markets are still pricing in the potential for short-term chaos amid a heavy calendar of risk catalysts including Powell's address at Jackson Hole, NVDA earnings, NFP, CPI, and OpEx...

Source: Bloomberg

As VIX rose notably on the day and VVIX rejected the Maginot Line at 100...

Source: Bloomberg

Was today's dip a sign that the momo-chase is over... for now?