Stocks were relatively quiet today (relative to recent history and relative to other asset-classes today) as traders await July CPI and Retail Sales data later this week, as well as earnings reports prints from bellwethers including WMT and HD.

Small Caps and The Dow were the day's laggards with Nasdaq and the S&P basically unchanged...

There have been seven 30-handle SPX swings today...

...yet, Goldman's trading desk notes that overall activity levels are down dramatically (-40% vs. the trailing 2 weeks with market volumes down -20% vs the 10dma) with the floor tilting +2% better to buy, with LOs net to buy and HFs net for sale.

HFs are -9% better for sale, this is 95th %-ile over the last 1yr following a week where PB noted single stocks saw the largest net buying in 6 months. They are better for sale in every sector ex-HCare, Tech & REITs. The largest supply is from Macro Products, while Fins, Cons Disc and Mats follow close behind.

LOs are +1% better to buy. Macro Products is at the top, more than 3x better to buy than the next closest sector (HCare). Also buying Staples, Tech & Comms Svcs while selling Cons Disc, Indust, Energy & Fins.

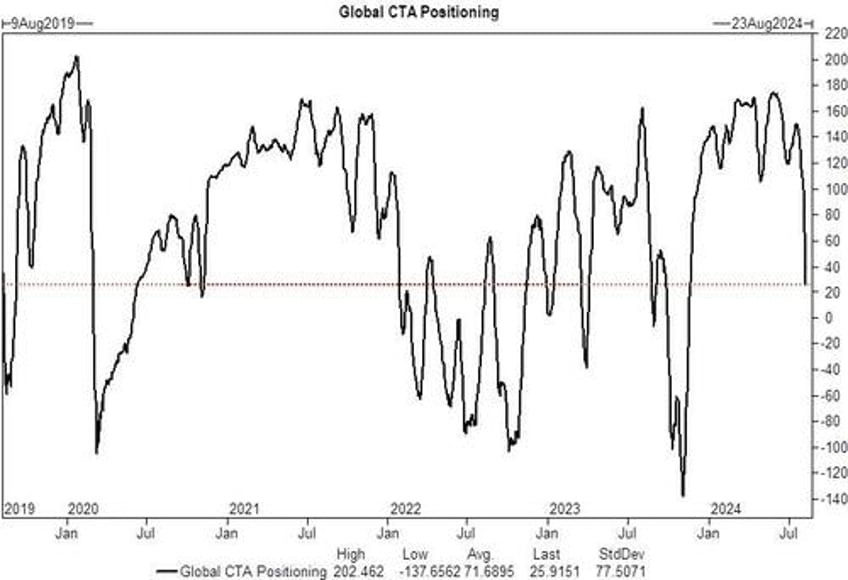

Additionally, Goldman highlights that CTA supply is almost over with $81B out of global equities and $24B out of SPX in the last week...still for sale over the this week, but much more manageable supply...

Source: Goldman Sachs

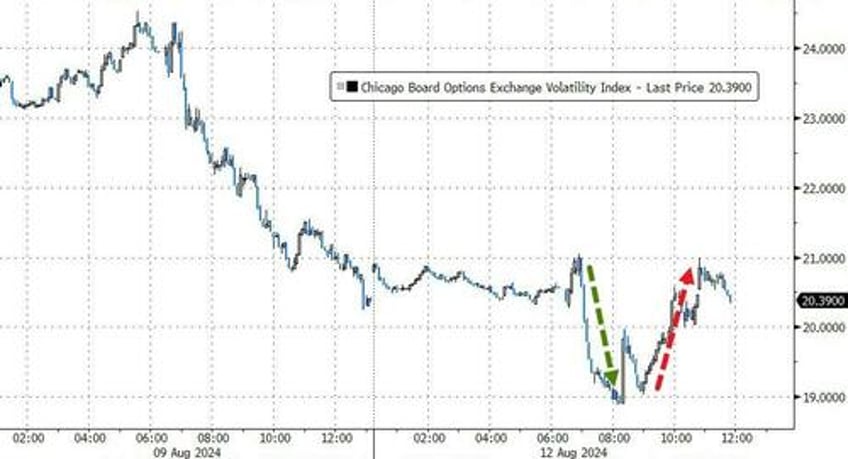

VIX also ended practically unchanged, roundtripping the tumble at the cash open...

Source: Bloomberg

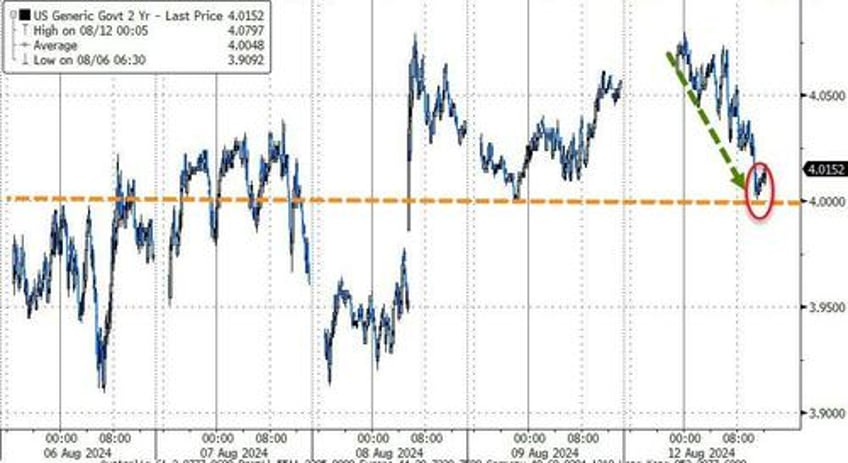

Treasury yields were all lower on the day by around 4bps (30Y underperformed)...

Source: Bloomberg

The 2Y yield fell to 4.00% and found some support on the day...

Source: Bloomberg

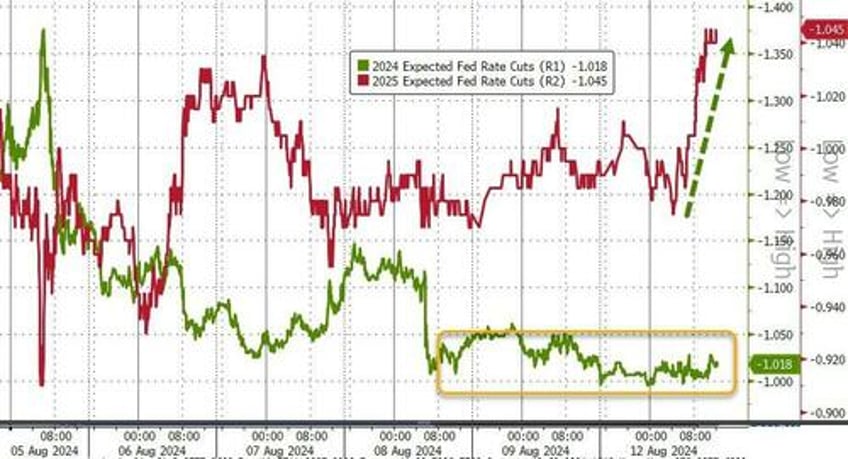

Rate-cut expectations rose today but the dovishness was all pushed into 2025 (with 2024 stuck at four 25bps cuts)...

Source: Bloomberg

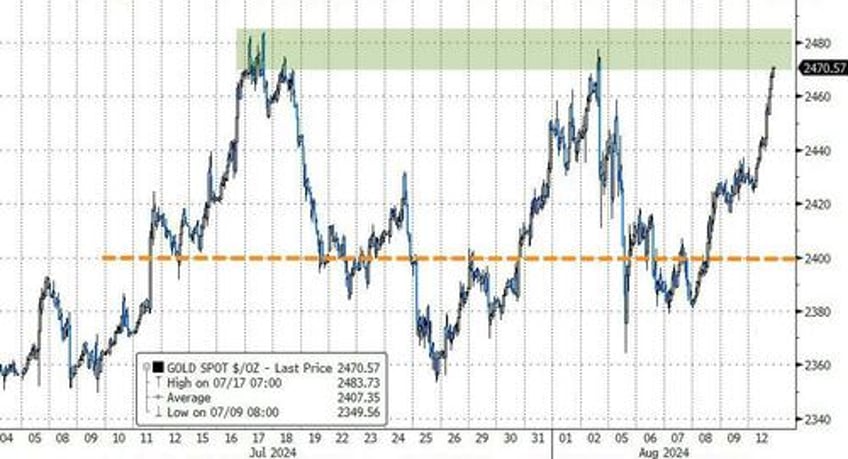

Gold soared up towards record highs once again (a record high close today)...

Source: Bloomberg

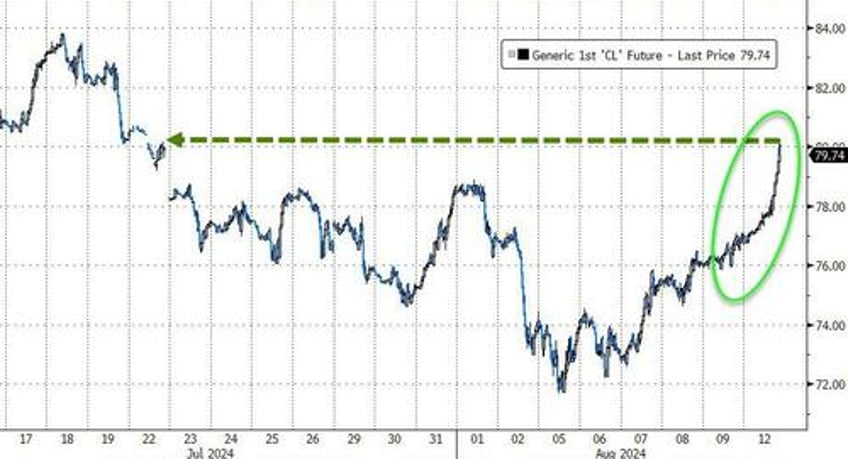

Crude prices also exploded higher today amid geopolitcal tensions with WTI topping $80 for the first time in three weeks)...

Source: Bloomberg

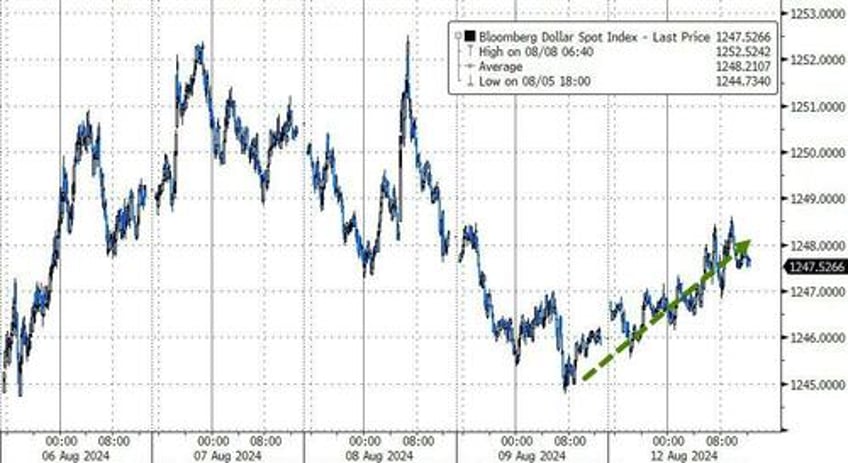

And while commodities were rising, so was the Dollar

Source: Bloomberg

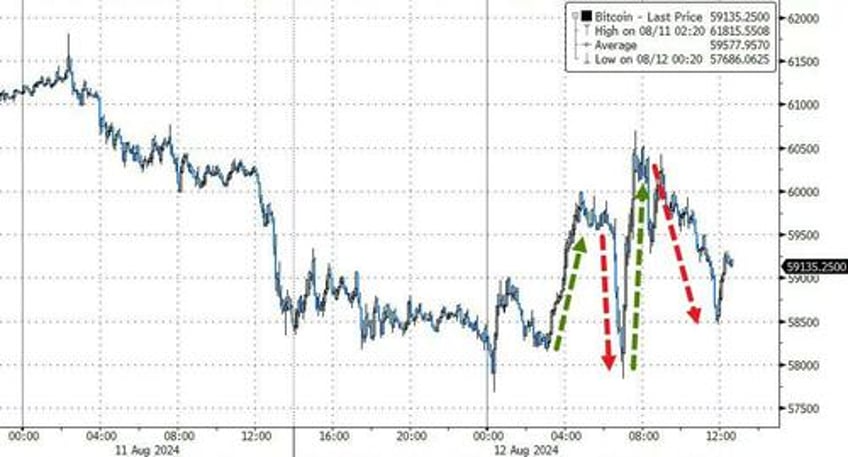

Crypto markets were just as chaotic as stocks today with some serious intraday swings (as BTC whipsawed between $58,000 and $60,000)...

Source: Bloomberg

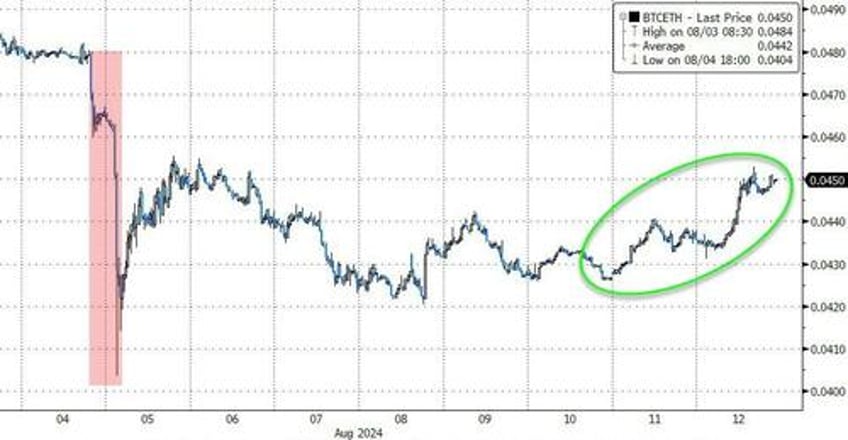

But for a change, ETH outperformed BTC on the day...

Source: Bloomberg

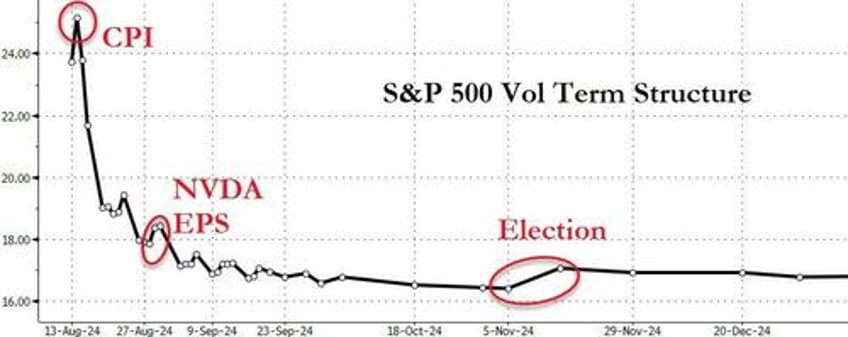

Finally, it's worth noting just how dramatically inverted the S&P 500's vol term structure is...

Source: Bloomberg

With VIX liquidity at or near record lows, and gamma negative, there's still plenty of room for chaotic swings before NVDA's earnings.